Decentralized Autonomous Organizations (DAOs) are rapidly moving from crypto-native experiments to real contenders in legacy industries, and reinsurance is right at the epicenter of this disruption. Picture a world where risk pooling, premium pricing, and claims management aren’t dictated by a handful of executives behind closed doors, but instead handled transparently on-chain and governed by the very stakeholders who stand to gain or lose. That’s the promise of DAO reinsurance, and it’s already attracting serious attention from both blockchain insurance governance advocates and institutional risk managers.

![]()

DAO Reinsurance: What Makes It Game-Changing?

The traditional reinsurance market is notorious for its opacity, slow-moving processes, and high barriers to entry. DAOs break these shackles by leveraging smart contracts to automate everything from capital contributions to claim payouts. Every decision and transaction is immutably recorded on-chain, creating an unprecedented level of transparency that builds trust between participants.

But it’s not just about transparency. DAOs also introduce operational efficiency that legacy players can only dream about. By removing layers of middlemen and automating workflows via code, decentralized reinsurance platforms slash administrative costs and accelerate contract execution. This isn’t theoretical, projects are already using DAOs to let policyholders vote on risk assessment models and premium adjustments in real time (source).

Key Opportunities DAOs Unlock in Decentralized Reinsurance

-

Radical Transparency: DAOs record every transaction and governance decision on an immutable blockchain ledger, making all actions verifiable and fostering trust between reinsurers, cedents, and investors.

-

Automated Claims & Contracts: Smart contracts on platforms like Ethereum automate claims processing and contract execution, reducing administrative overhead and speeding up settlements.

-

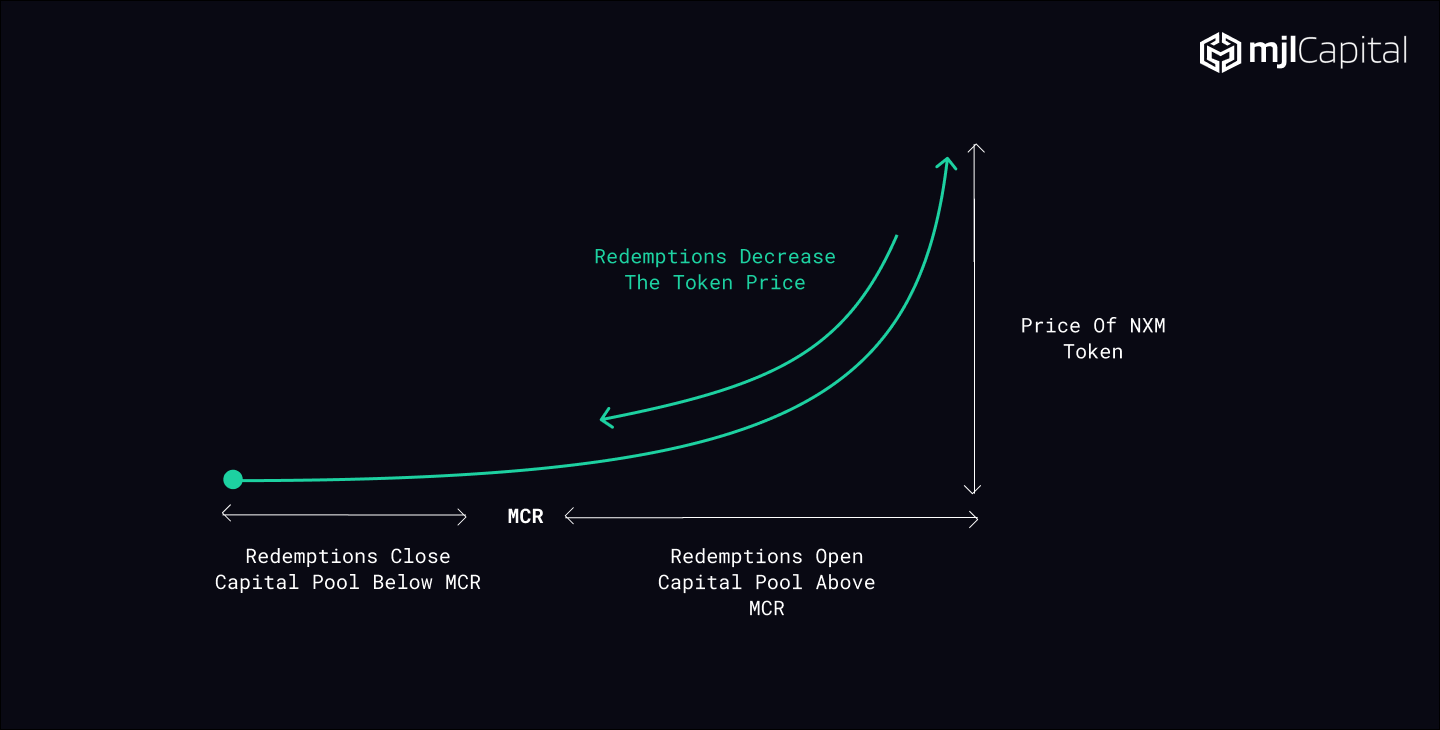

Inclusive, Token-Based Governance: DAOs such as Nexus Mutual empower policyholders and investors to vote directly on risk assessments, premium pricing, and claims—leading to more balanced and representative outcomes.

-

Global Access to Capital: Tokenized reinsurance contracts allow DAOs to attract worldwide investors, increasing capital pools and potentially lowering reinsurance costs through platforms like Etherisc.

-

24/7, Borderless Operations: DAOs operate continuously and without geographical constraints, enabling real-time risk sharing and coverage across global markets.

How On-Chain Governance Works in Decentralized Reinsurance

At the heart of every successful DAO is robust governance, without it, you’re just running code with no direction. In decentralized reinsurance, token holders (which can include policyholders, investors, or even third-party underwriters) collectively make decisions through proposals and votes embedded in smart contracts. This democratizes risk management:

- Policyholder Participation: Those actually exposed to risk help shape how it’s managed.

- Transparent Premium Setting: Voting mechanisms allow for dynamic adjustment based on real-time data.

- Claims Processing: Automated triggers execute payouts instantly when conditions are met, cutting out human error or bias.

This participatory approach not only aligns incentives but also opens the door for global capital inflows. Tokenizing reinsurance contracts means anyone, from a London hedge fund to a farmer in Kenya, can provide liquidity or hedge exposure on equal footing (source). It’s borderless capital meets borderless risk.

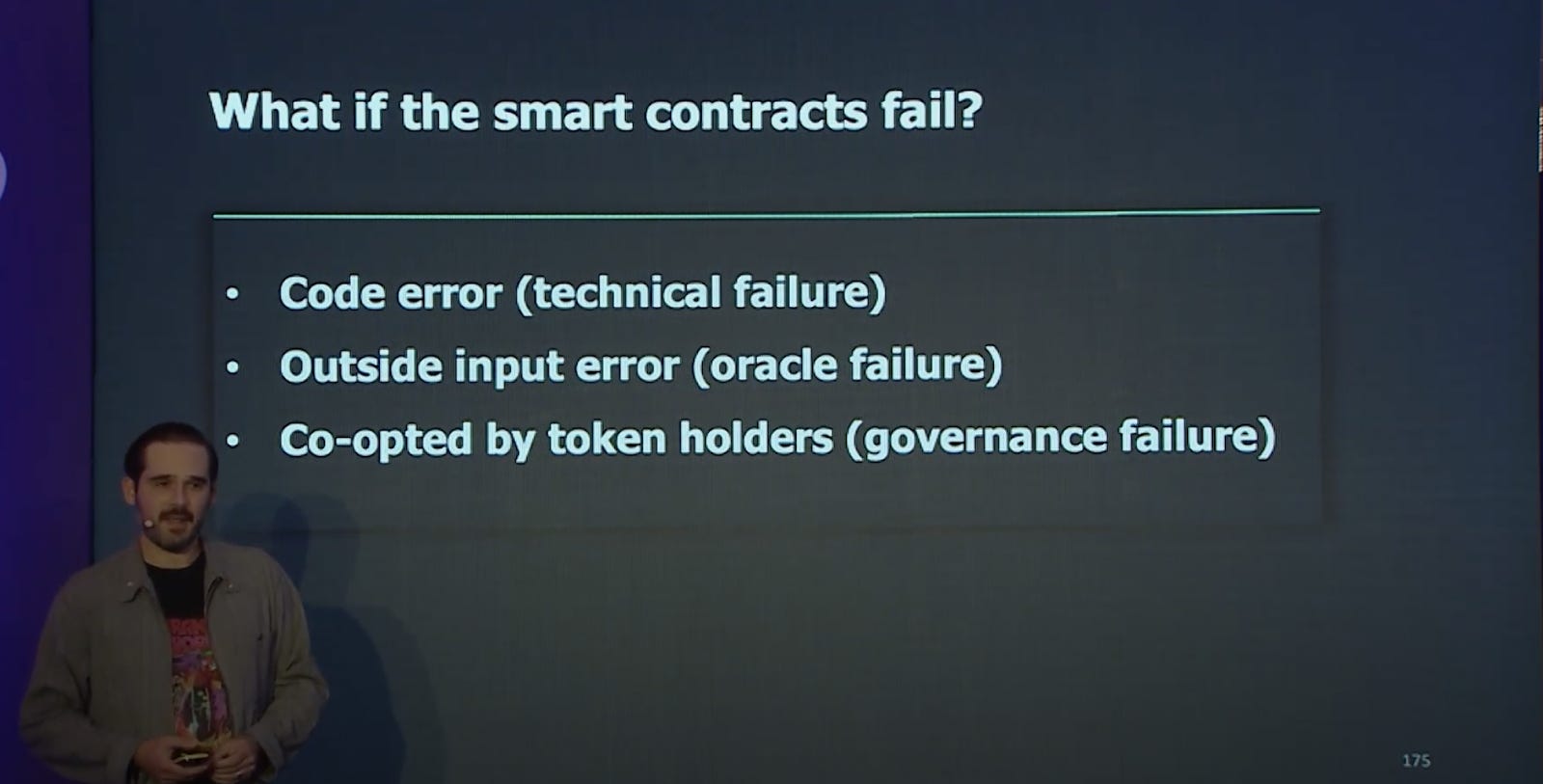

The Double-Edged Sword: Risks Lurking Beneath the Surface

No revolution comes without its growing pains. As appealing as decentralized reinsurance sounds, there are significant risks that demand tactical navigation:

- Regulatory Uncertainty: Most jurisdictions still don’t know what to make of DAOs, which can leave participants exposed if something goes wrong (source). Wyoming may have granted legal status, but elsewhere you’re often operating in a gray zone.

- Smart Contract Vulnerabilities: The infamous 2016 DAO hack is a cautionary tale; poorly audited code can lead to catastrophic losses overnight.

- Governance Capture: If voting power concentrates among whales or insiders, you end up swapping one opaque elite for another, hardly the spirit of decentralization.

- Scalability Bottlenecks: As participation grows, so do gas fees and decision-making delays, especially on congested networks like Ethereum mainnet.

The bottom line? For every opportunity unlocked by on-chain risk pooling and decentralized governance, there’s an equally potent challenge waiting around the corner. But as we’ll see next, some projects are already charting tactical paths through this minefield, turning volatility into opportunity for those bold enough to get involved.

Mitigating DAO Risks: Tactical Playbooks for Decentralized Reinsurance

Forward-thinking DAO reinsurance projects aren’t just crossing their fingers and hoping for the best, they’re deploying sophisticated strategies to manage the risks unique to blockchain insurance governance. Security is being treated as a non-negotiable foundation. Top protocols are investing in continuous code audits, bug bounty programs, and even decentralized insurance backstops that pay out in the event of smart contract exploits. This proactive approach is directly informed by hard lessons like the 2016 DAO hack, driving a culture of transparency and resilience from day one.

On the governance front, projects are experimenting with quadratic voting and time-weighted staking to prevent whales from dominating decisions. These mechanisms reward active participation while diluting the influence of passive large holders, keeping power distributed and responsive. Active community engagement isn’t optional, it’s essential for DAOs to avoid stagnation or capture.

Regulatory uncertainty remains a wild card, but some DAOs are tackling it head-on by incorporating in jurisdictions like Wyoming or using legal wrappers that give them recognized status without sacrificing decentralization. This hybrid approach helps attract institutional capital that would otherwise sit on the sidelines due to compliance concerns (source). Meanwhile, scalability is being addressed through Layer 2 solutions, modular blockchains, and off-chain voting frameworks that keep transaction costs low and throughput high, even during periods of heavy network congestion.

Tactical Solutions DAOs Use to Mitigate Key Risks

-

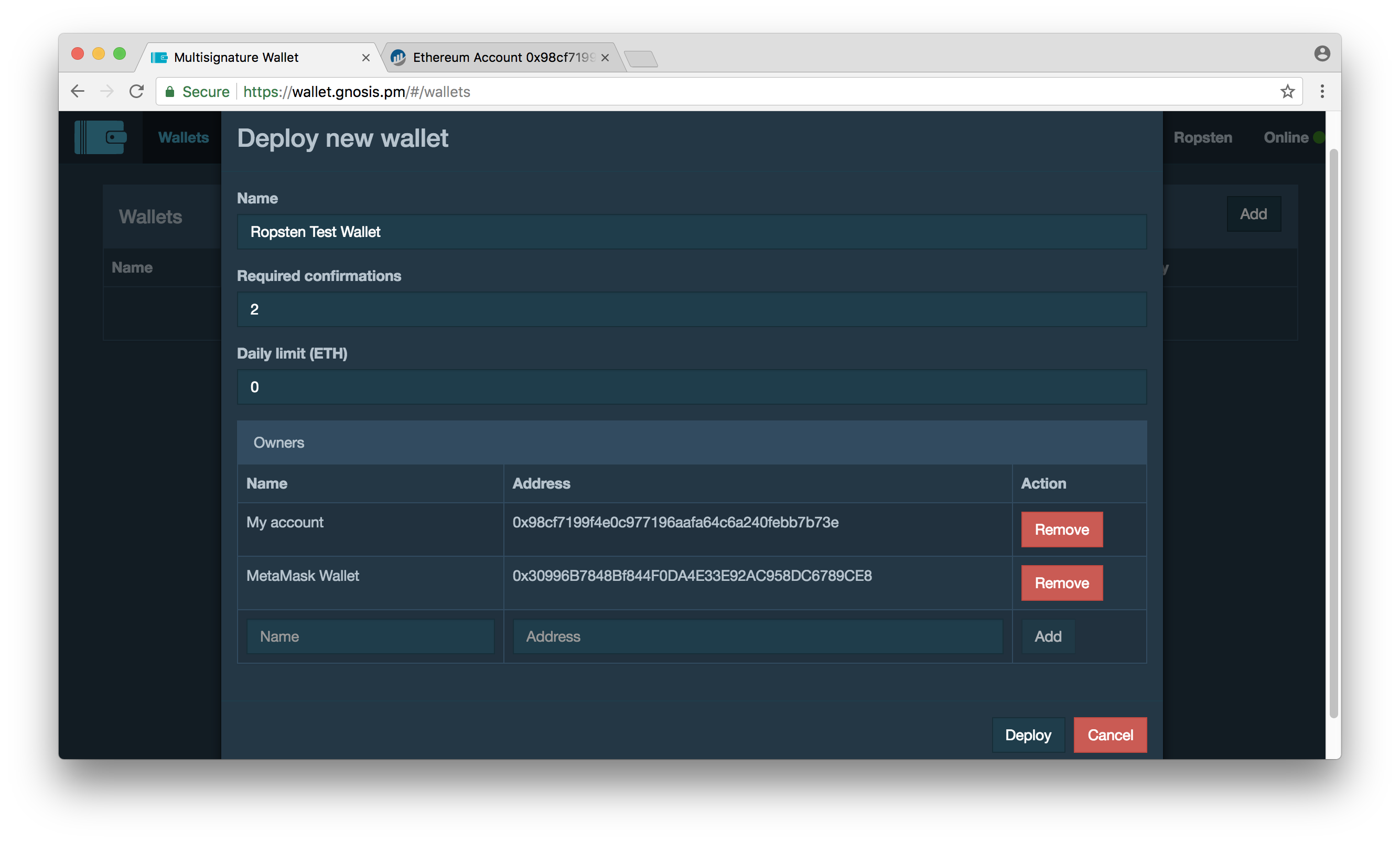

Multi-Signature Wallets (e.g., Gnosis Safe): Require multiple approvals for transactions, reducing the risk of unilateral fund transfers and adding a crucial layer of security against hacks and internal fraud.

-

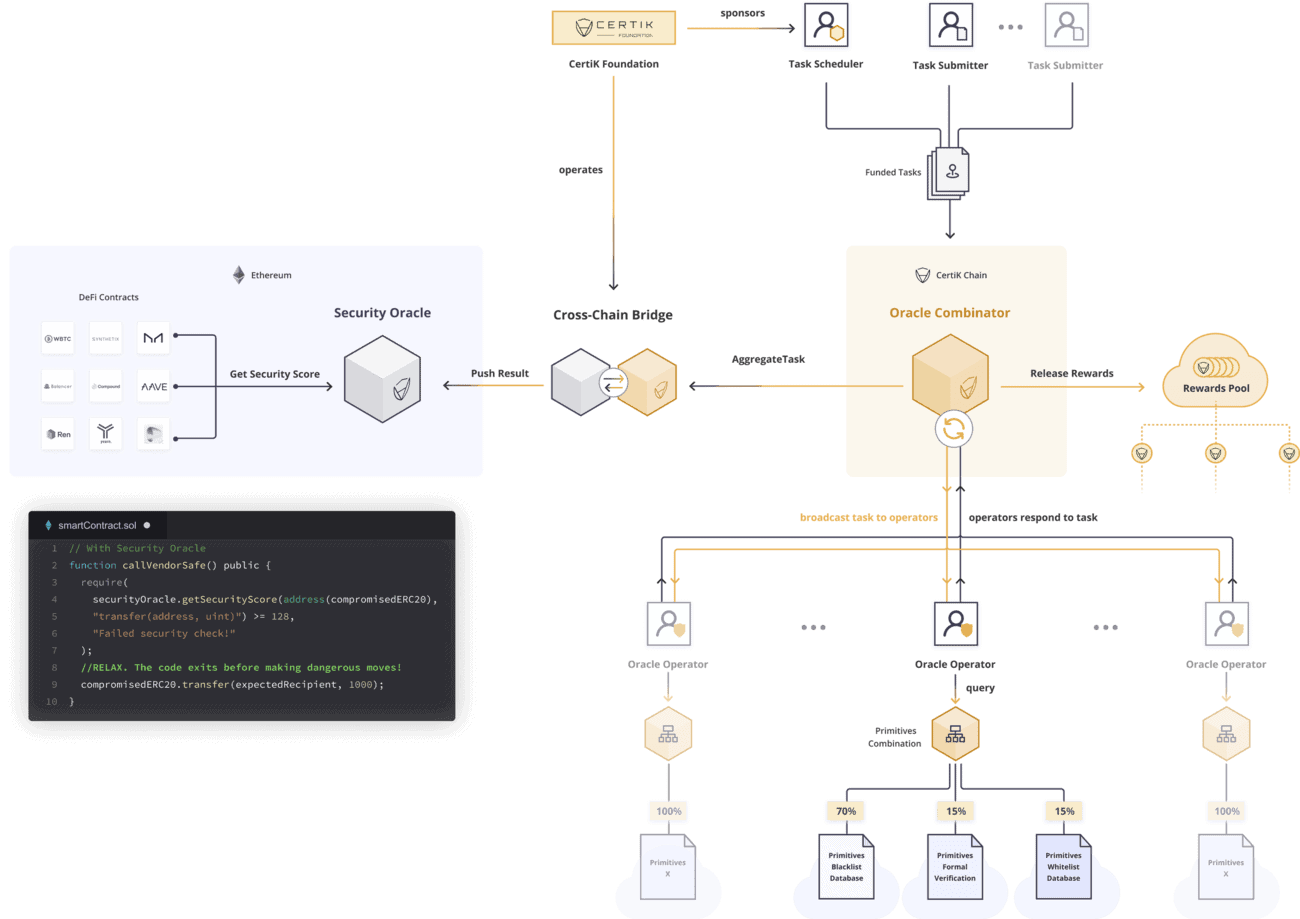

Smart Contract Audits by Leading Firms (e.g., CertiK, OpenZeppelin): Engage reputable security auditors to rigorously review and test smart contracts, minimizing vulnerabilities and preventing exploits like the 2016 DAO hack.

-

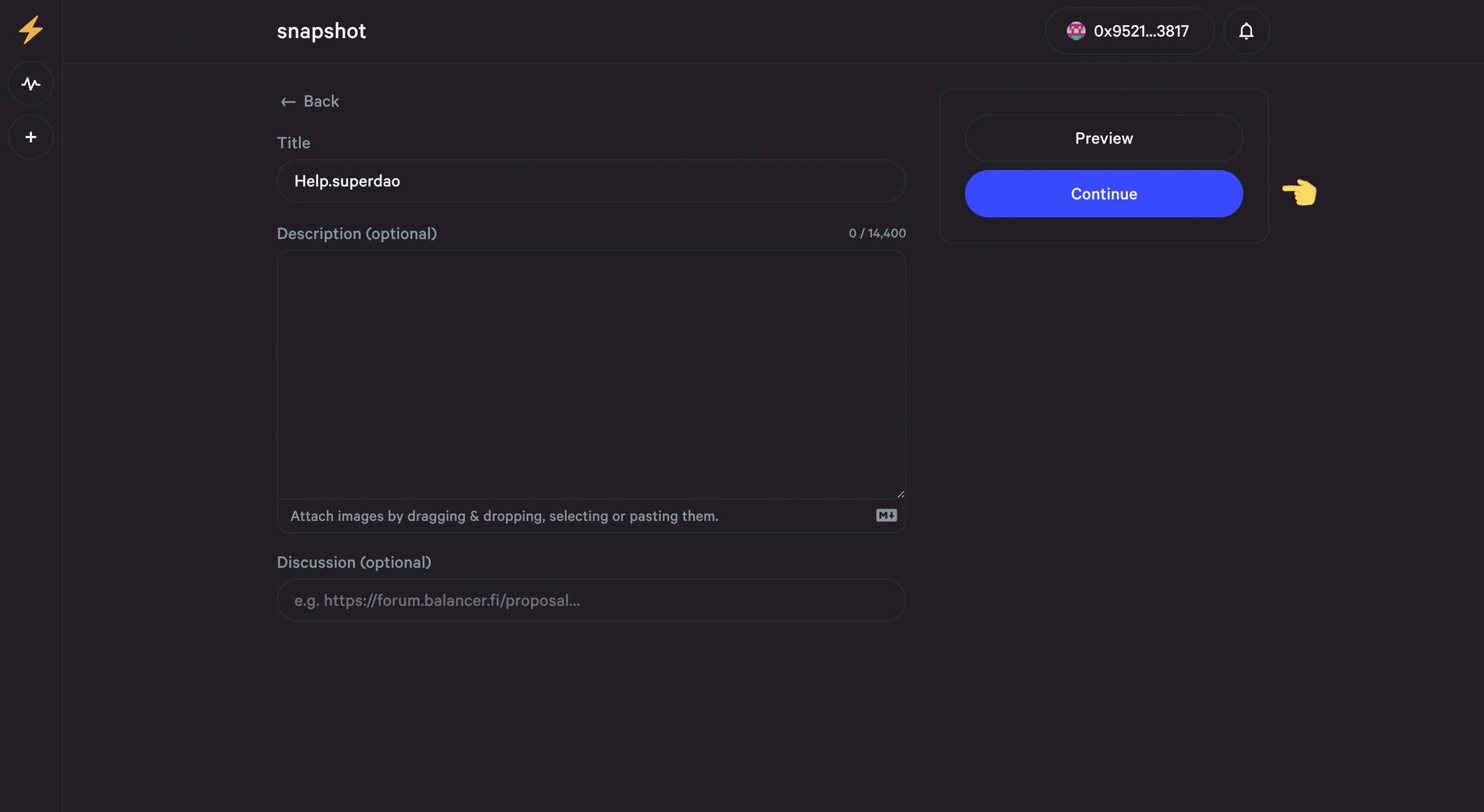

Decentralized Governance Platforms (e.g., Snapshot, Aragon): Use open, transparent voting systems to encourage broad participation and prevent governance capture by a small group of token holders.

-

Layer 2 Scaling Solutions (e.g., Optimism, Arbitrum): Deploy smart contracts and voting mechanisms on Layer 2 networks to lower transaction fees and increase throughput, ensuring scalability as the DAO grows.

-

Legal Entity Formation in Crypto-Friendly Jurisdictions (e.g., Wyoming DAO LLC): Register as legal entities where possible to gain regulatory clarity, limit liability, and facilitate compliance with local laws.

-

Insurance Protocols for Smart Contract Risk (e.g., Nexus Mutual): Purchase decentralized insurance coverage to protect DAO treasury funds against losses from smart contract failures or exploits.

The Future of On-Chain Risk Pooling: What Comes Next?

The momentum behind decentralized reinsurance isn’t slowing down, in fact, it’s compounding as more capital flows into on-chain risk pools and traditional players begin experimenting with DAO structures themselves. We’re seeing new models emerge where parametric insurance payouts are triggered automatically by real-world data feeds (oracles), cutting claim settlement times from weeks to minutes. Cross-border syndicates are forming via tokenized pools that let anyone participate in global risk-sharing without legacy friction.

This isn’t just theory, real-world adoption is accelerating as both retail participants and institutional investors recognize the efficiency gains. The result? Lower premiums for policyholders, faster liquidity for underwriters, and radically improved transparency across every layer of the value chain.

Would you trust a decentralized reinsurance DAO with your risk capital?

DAOs in reinsurance promise transparency, efficiency, and global access, but also face regulatory, security, and governance risks. Where do you stand?

Key Takeaways for Insurance Innovators

- Don’t wait for perfect clarity: The early movers in DAO reinsurance are already shaping industry standards, and capturing outsized rewards.

- Pilot small: Start with limited-scope experiments (like parametric products or regional pools) before going all-in on full-stack decentralization.

- Prioritize security: Invest heavily in audits and community-driven bug bounties; one exploit can erase years of progress overnight.

- Stay agile on regulation: Monitor developments in key jurisdictions like Wyoming, what’s gray today could be green-lit tomorrow.

The bottom line? If volatility is opportunity, then decentralized reinsurance DAOs are built for this moment. The next wave of winners will be those who blend technical rigor with tactical flexibility, turning smart contracts into smart strategies while staying laser-focused on both innovation and risk management.