Reinsurance is the backbone of global risk transfer, yet for decades its settlements have been slowed by manual processes, opaque records, and costly administrative overhead. Today, blockchain technology is rewriting this narrative. With smart contracts at the core, blockchain reinsurance settlements are becoming faster, more transparent, and more trustworthy than ever before.

Automating the Heart of Reinsurance Settlements

At its essence, a smart contract is code that self-executes when pre-set conditions are met. In reinsurance, this means treaty terms – from premium payments to claim apportionments – can be enforced automatically without human intervention. This automation slashes both time and error rates. According to recent analysis from Lenderdock, smart contracts can ensure coverage conditions and premium flows are maintained precisely as agreed, 24/7.

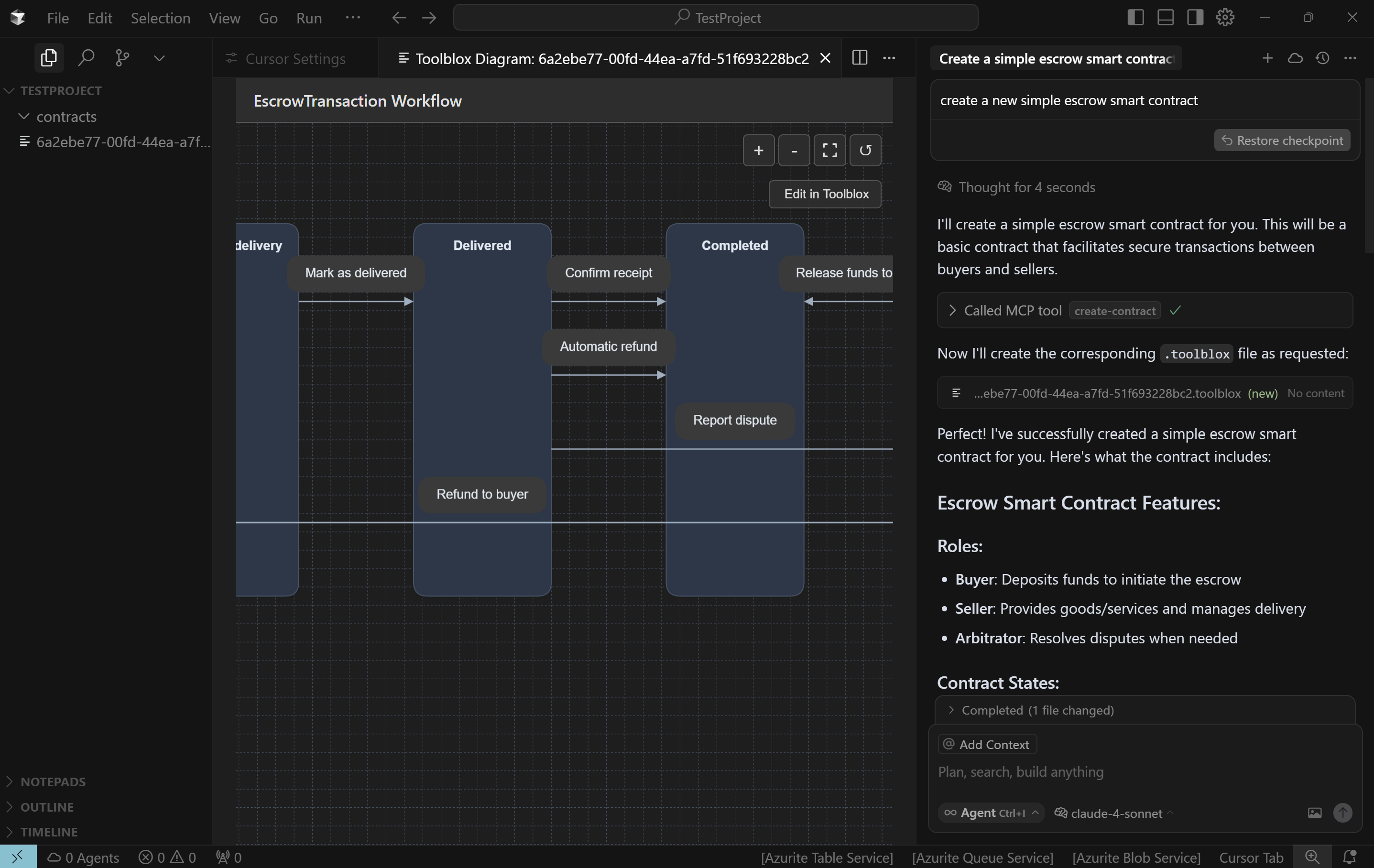

The Model Context Protocol (MCP) Reinsurance Framework is a standout example: it leverages smart contracts to automate complex treaty management processes. This leads to dramatically reduced administrative work and operational friction for all parties involved (source). The result? Quicker settlements and a streamlined experience for both insurers and reinsurers.

Transparency: The Blockchain Advantage

One of blockchain’s greatest strengths in reinsurance is its ability to create a single, immutable ledger accessible by all stakeholders. This shared source of truth minimizes disputes over claims or premium calculations since every transaction is visible in real time. As highlighted by SettleMint, embedding payout logic directly into smart contracts allows reinsurers and cedents to monitor portfolio exposures instantly – an impossible feat with legacy systems.

This transparency not only accelerates settlements but also builds trust among insurers, reinsurers, brokers, and clients. Disagreements that once took weeks or months to resolve can now be addressed in hours thanks to the clarity provided by blockchain records.

Top Benefits of Blockchain for Reinsurance Professionals

-

Automated Settlements with Smart Contracts: Blockchain smart contracts enable automatic execution of reinsurance agreements, streamlining premium calculations, claim apportionments, and settlements. This reduces manual intervention and administrative overhead, as demonstrated by the Model Context Protocol (MCP) Reinsurance Framework.

-

Enhanced Transparency and Trust: Blockchain’s decentralized ledger provides a single, immutable record of transactions accessible to all parties, minimizing disputes and fostering trust between insurers and reinsurers. Real-time visibility into exposures and liabilities is a key benefit, as highlighted by SettleMint’s blockchain use cases.

-

Faster Claims Processing and Payouts: Smart contracts can automate claims processing, enabling instant or near-instant payouts. For example, Lemonade’s blockchain-based crop protection insurance delivers rapid settlements and affordable premiums for policyholders.

-

Legally Binding Digital Contracts: Major reinsurance players like Allianz and Swiss Re have successfully executed legally binding reinsurance contracts on blockchain, marking a significant milestone in industry adoption and regulatory acceptance.

-

Reduced Fraud and Operational Risk: Blockchain’s shared, tamper-proof ledger helps minimize fraud and operational errors by ensuring all contract terms and transactions are transparent and verifiable by all stakeholders.

Real-World Adoption: From Pilot Projects to Global Impact

The industry isn’t just theorizing about these benefits – it’s already putting them into practice. In 2022, Allianz and Swiss Re executed the world’s first legally binding reinsurance contract on a distributed ledger (details here). This milestone proved that even the most complex treaty agreements can be digitized and settled with unprecedented speed and certainty.

Lemonade’s blockchain-based crop protection insurance program further demonstrates how automated claims processing can deliver instant payouts while keeping premiums affordable (source). These pioneering projects show how automated reinsurance claims are moving from proof-of-concept into daily operations across multiple lines of business.

While the momentum behind blockchain reinsurance settlements continues to build, it’s important to recognize the nuanced landscape that insurers and reinsurers must navigate. The rapid automation of treaty execution and claims settlement is not without its challenges. Most notably, the inherent complexity of many reinsurance agreements can make full automation difficult. These contracts often require subjective interpretation or involve unique, event-driven triggers that are tough to encode in deterministic logic.

Industry experts at Solidum Partners point out that while smart contracts excel at automating straightforward processes, they are less suited for clauses that depend on human judgment or evolving regulatory guidance (see analysis). For this reason, smart contracts are emerging as a powerful complement to traditional workflows rather than a replacement. Hybrid models allow organizations to harness the efficiency and transparency of blockchain while retaining flexibility for complex or bespoke arrangements.

The Road Ahead: Integrating Blockchain Insurance Solutions

The next phase for smart contracts in reinsurance is all about integration and scalability. As more platforms adopt open standards like the MCP Reinsurance Framework, interoperability between different insurers and reinsurers will become easier. This paves the way for a global ecosystem where risk is transferred seamlessly across borders, and settlements occur in near real time.

Key to this evolution is education and collaboration across the insurance value chain. Underwriters, brokers, cedents, and regulators must develop a shared understanding of how automated reinsurance claims work within a blockchain environment. Industry consortia such as B3i continue to play a vital role by piloting new solutions and setting best practices for data governance, privacy, and compliance.

The Benefits in Practice

What does this look like day-to-day? Consider these real-world improvements:

Real-World Examples of Automated Reinsurance Claims

-

Model Context Protocol (MCP) Reinsurance Framework: MCP leverages smart contracts to automate complex treaty management and claims settlements, significantly reducing administrative overhead and minimizing manual errors in reinsurance processes.

-

B3i (Blockchain Insurance Industry Initiative): In 2022, Allianz and Swiss Re placed a legally binding reinsurance contract on blockchain via B3i, enabling near-instant, error-resistant settlements and real-time visibility for all parties involved.

-

Lemonade’s Blockchain-Based Crop Protection: Lemonade uses smart contracts for its crop insurance program, automating claims processing and delivering instant payouts to policyholders, which streamlines reinsurance settlements and reduces potential for human error.

-

SettleMint Blockchain Platform: SettleMint provides blockchain infrastructure that enables insurers and reinsurers to automate claims settlements through smart contracts, improving transparency and reducing settlement times across the reinsurance value chain.

For institutional investors and risk managers, these enhancements translate into improved liquidity management and reduced counterparty risk. For cedents, it means fewer disputes over recoveries or premium flows – freeing up resources to focus on core underwriting decisions rather than reconciliation headaches.

“The transparency provided by shared ledgers is fundamentally reshaping trust between market participants, “ notes one senior reinsurance executive. “We’re seeing relationships evolve from transactional to collaborative partnerships. “

Balancing Innovation with Practicality

No technology transformation comes without growing pains. As blockchain insurance solutions mature, organizations must balance innovation with regulatory requirements and legacy systems integration. Early adopters recommend starting with pilot projects focused on high-volume but low-complexity treaties before expanding automation across broader portfolios.

The future of reinsurance settlements will likely be defined by hybrid models – leveraging both code-based automation where possible while preserving expert oversight for exceptional scenarios. This pragmatic approach allows the industry to reap immediate benefits from blockchain while building toward more sophisticated applications as standards evolve.