Legacy insurance systems have long been the backbone of the global insurance industry, but as blockchain technology gains momentum, the need for seamless integration between these established platforms and modern on-chain reinsurance solutions has never been more urgent. The promise is clear: enhanced efficiency, real-time transparency, and access to new markets. Yet, bridging the gap between legacy infrastructure and blockchain-powered reinsurance models presents a unique set of challenges and opportunities.

Why Integrating Legacy Insurance with Blockchain Matters

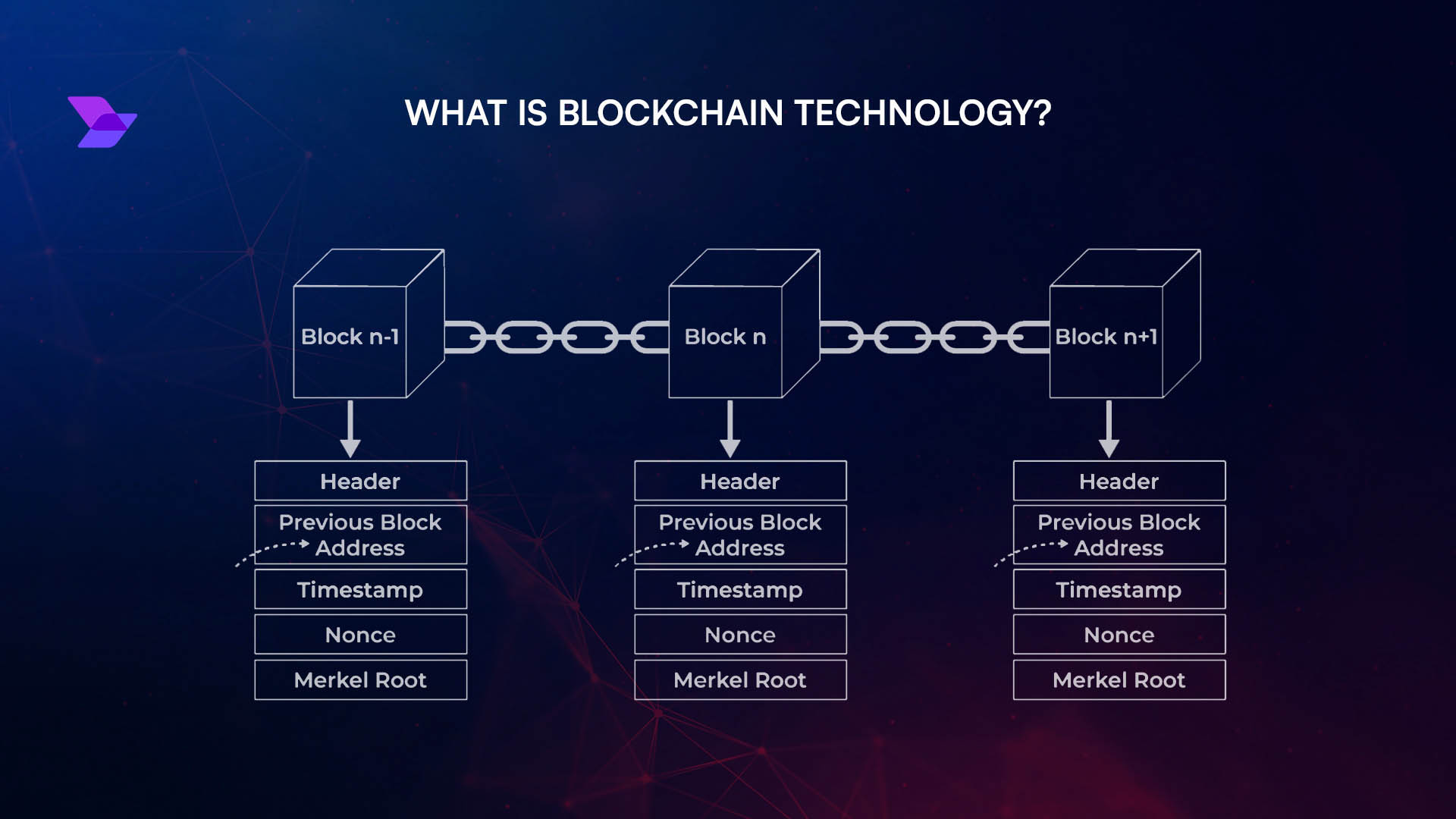

Legacy insurance platforms often operate on decades-old software, designed for stability but not for agility or interoperability. In contrast, on-chain reinsurance systems leverage decentralized ledgers and smart contracts to automate settlements, enhance auditability, and reduce counterparty risk. The synergy between these two worlds could unlock:

- Faster claims processing

- Lower administrative costs

- Improved risk modeling through real-time data sharing

- Access to new capital sources via tokenized risk pools

This integration is not just theoretical. For example, OnRe’s recent launch of its ONe token exemplifies how regulated on-chain reinsurance can provide investors with direct exposure to reinsurance yields, a model only possible through robust blockchain-legacy system integration (source).

The Biggest Challenges in Blockchain-Legacy Integration

Top Challenges in Integrating Legacy Insurance Systems with Blockchain

-

Legacy Infrastructure Constraints: Many insurers still operate on outdated core systems that lack compatibility with modern blockchain platforms, making seamless data exchange and automation difficult.

-

Complexity of Smart Contracts: Translating intricate reinsurance agreements into secure, reliable smart contracts requires advanced technical expertise and rigorous testing.

-

Data Silos and Interoperability Issues: Legacy systems often store data in proprietary formats, complicating integration and real-time data sharing with blockchain solutions.

-

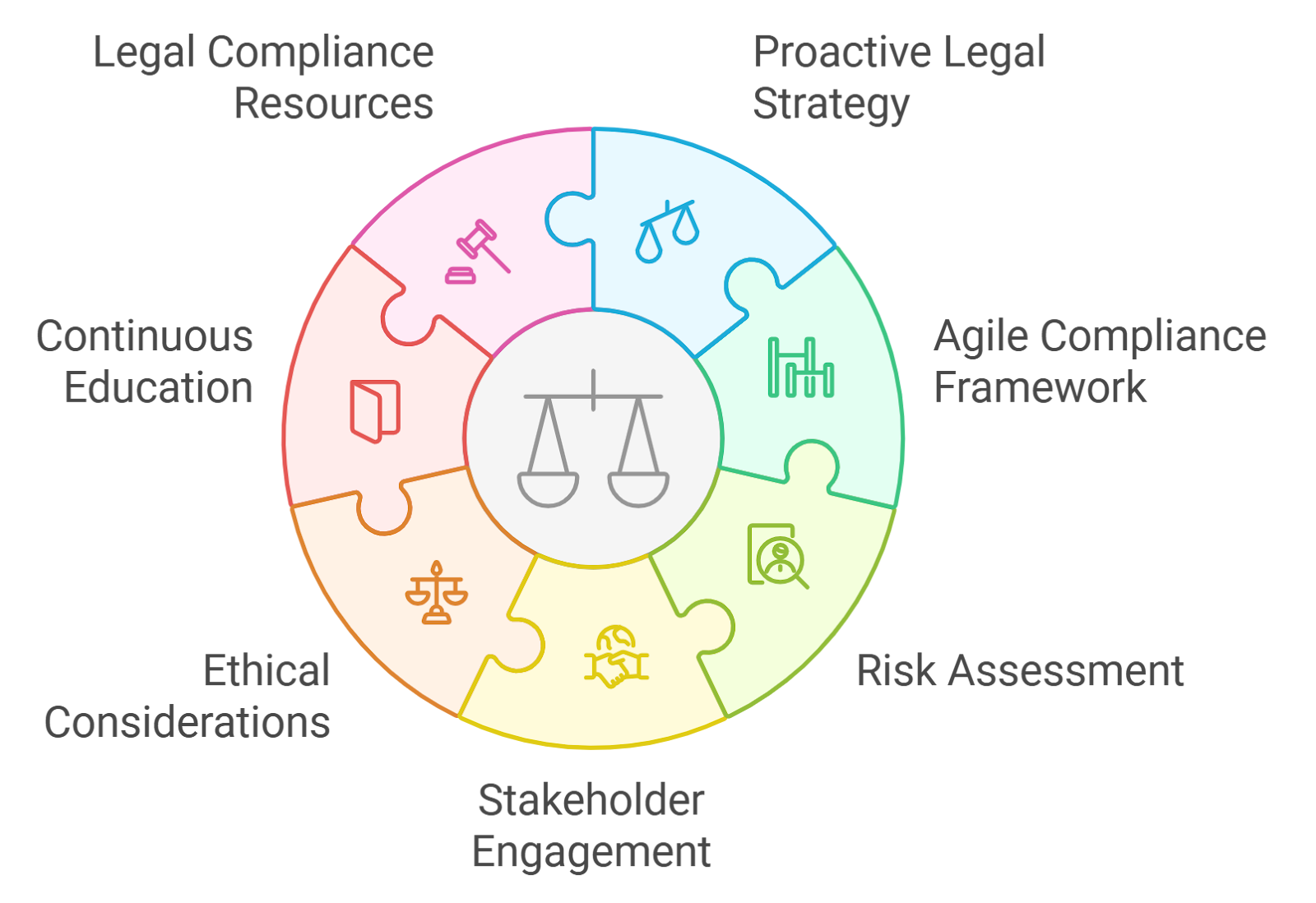

Market Acceptance and Learning Curve: The insurance industry is risk-averse, and stakeholders may be hesitant to adopt blockchain due to unfamiliarity and perceived risks.

-

Regulatory and Compliance Challenges: Navigating evolving regulations for both traditional insurance and blockchain technologies adds complexity to integration efforts.

The reality is that most insurers still rely heavily on legacy IT stacks that are not natively compatible with distributed ledger technology. Here are some major hurdles:

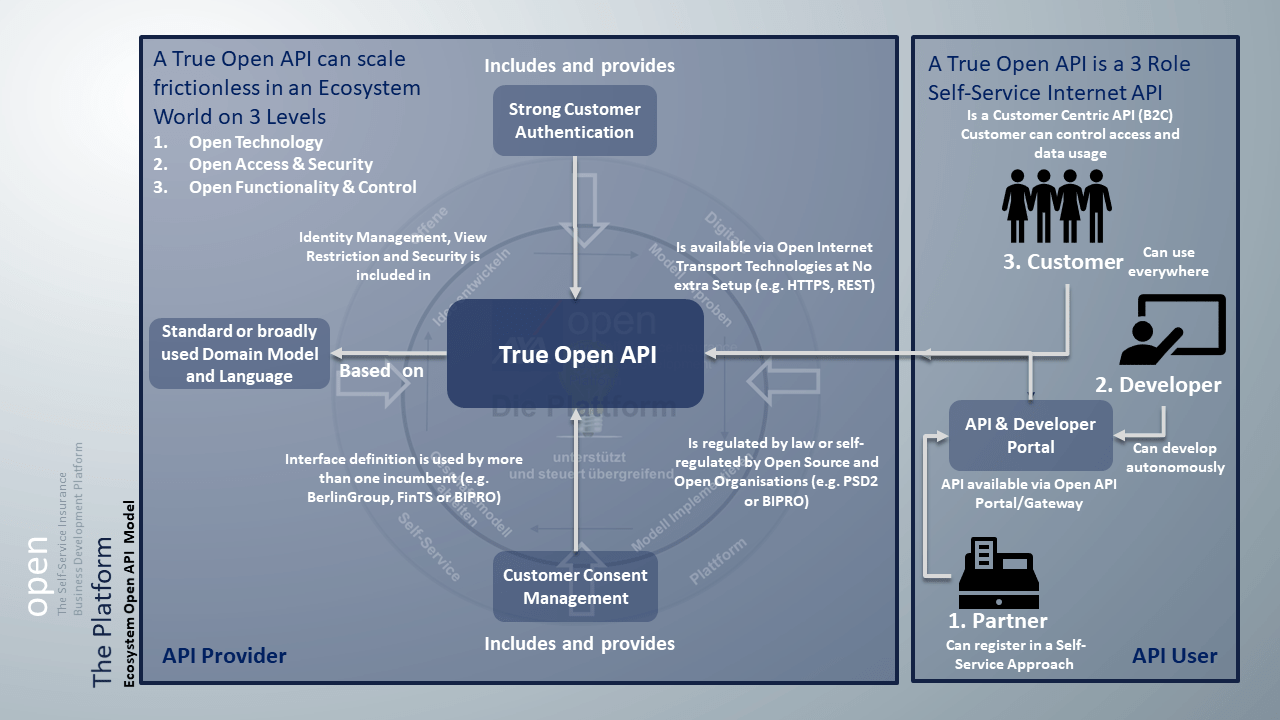

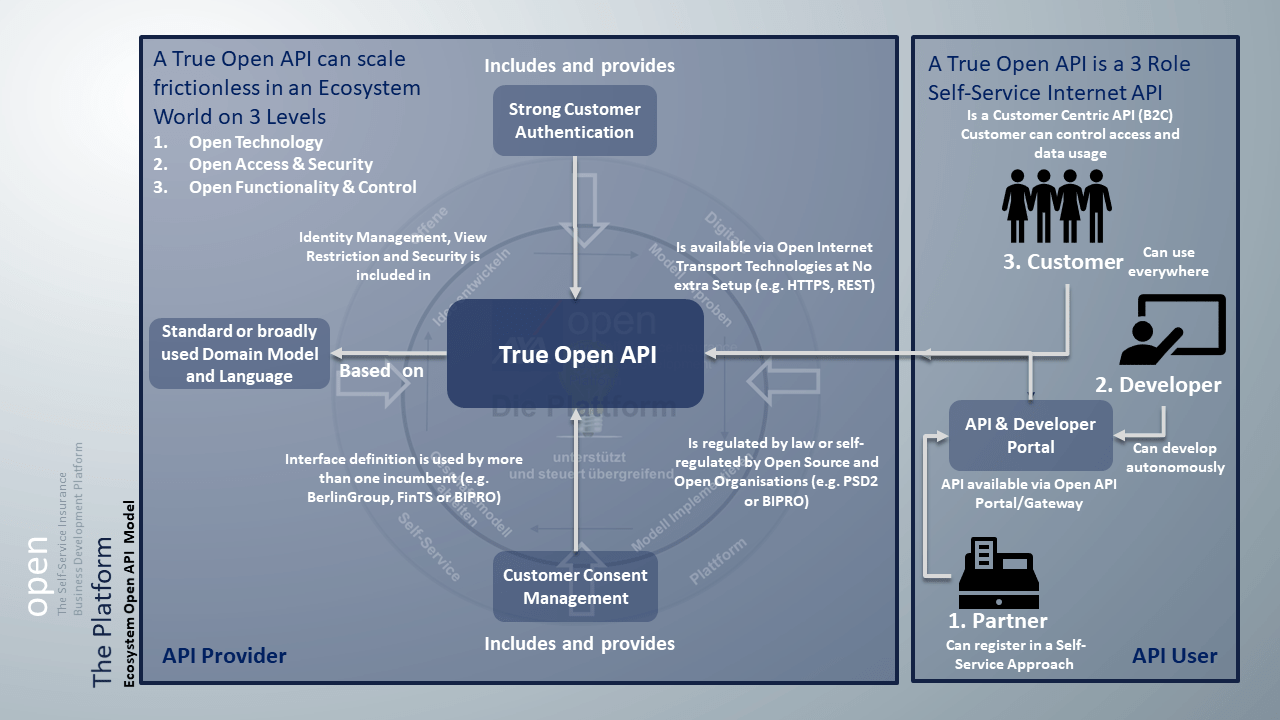

- Legacy Infrastructure Constraints: Outdated core systems may lack APIs or standardized data formats needed for interoperability (source).

- Complexity of Smart Contracts: Reinsurance agreements are nuanced and require smart contracts capable of handling intricate terms without introducing security risks.

- Cultural Resistance: The insurance sector’s risk-averse culture slows adoption as stakeholders require education about both the risks and benefits of moving critical processes onto blockchains.

The good news? These barriers are surmountable, and innovative solutions are emerging rapidly.

Tactical Approaches: Bridging Old and New Systems

No insurer wants a rip-and-replace scenario; instead, most seek incremental modernization. Several practical strategies have proven effective in connecting legacy platforms with on-chain solutions:

Proven Approaches to Integrating Legacy Insurance IT with Blockchain Reinsurance

-

API-Based Communication: Implementing robust APIs enables legacy insurance systems to exchange data with blockchain platforms, ensuring seamless interoperability and real-time information flow. This approach minimizes disruption while enhancing connectivity. (businessdailymedia.com)

-

Middleware Solutions: Leveraging middleware platforms bridges the gap between legacy infrastructure and blockchain networks, allowing insurers to modernize processes without a full system overhaul. Middleware acts as a translator, facilitating smooth data and process integration. (businessdailymedia.com)

-

Cloud Migration: Moving critical data and processes to cloud platforms increases scalability, flexibility, and accessibility. Cloud-based systems integrate more easily with blockchain technologies, supporting rapid innovation and disaster recovery. (businessdailymedia.com)

-

Robotic Process Automation (RPA): Integrating RPA tools with legacy systems automates repetitive tasks, reducing manual intervention and errors. RPA accelerates data handling and can be connected to blockchain workflows for enhanced process efficiency. (businessdailymedia.com)

-

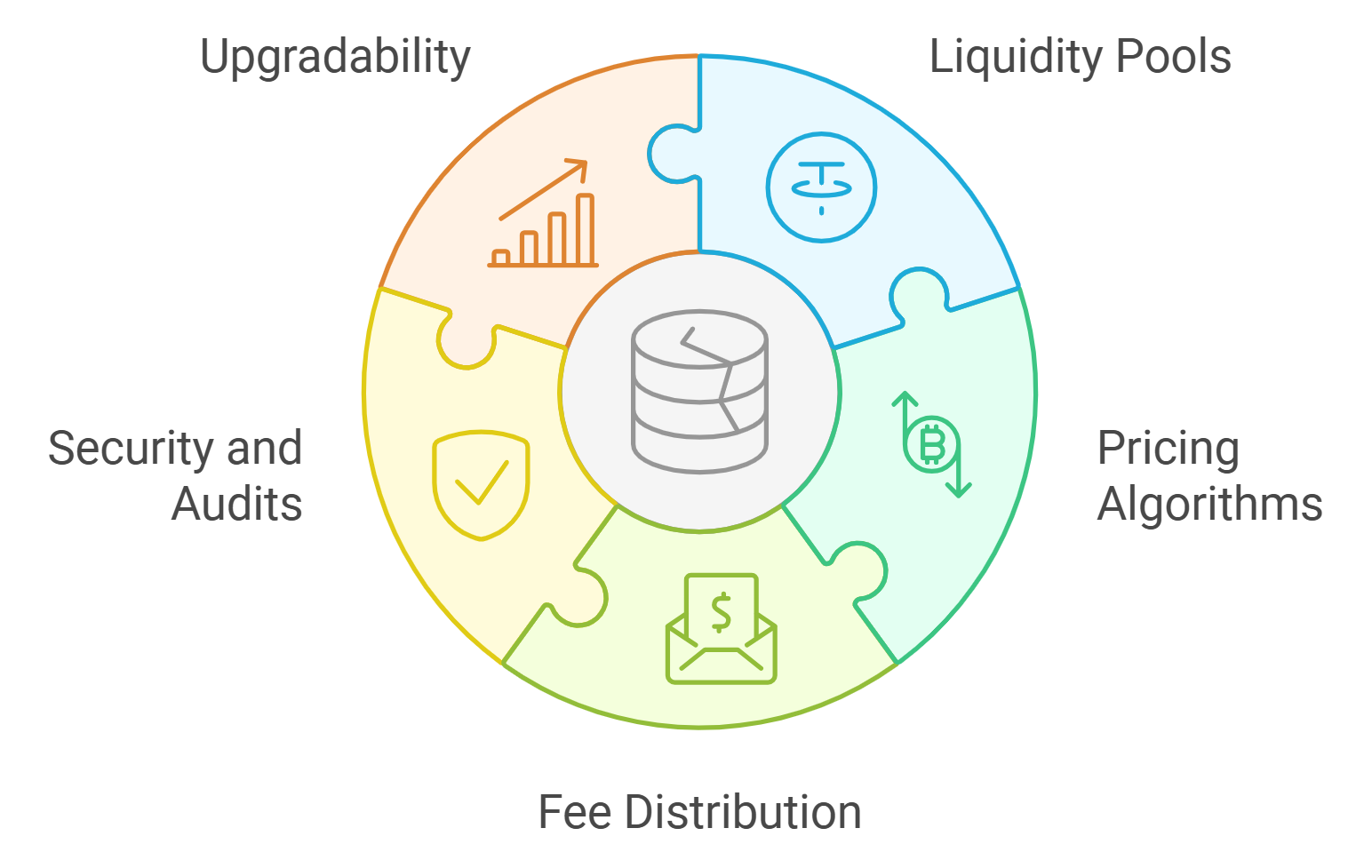

OnRe’s Tokenized Yield Model: OnRe is a regulated on-chain reinsurance platform that launched the ONe token, connecting traditional reinsurance with DeFi. This model provides investors with exposure to reinsurance returns, collateral yield, and token incentives, demonstrating real-world blockchain integration. (insurancebusinessmag.com)

-

Swiss Re and Benekiva Partnership: Swiss Re and Benekiva developed an Integrated Claims Management Platform, combining digital claims administration with automated rules engines. This collaboration exemplifies how established insurers are integrating digital and blockchain-ready solutions to streamline operations. (swissre.com)

-

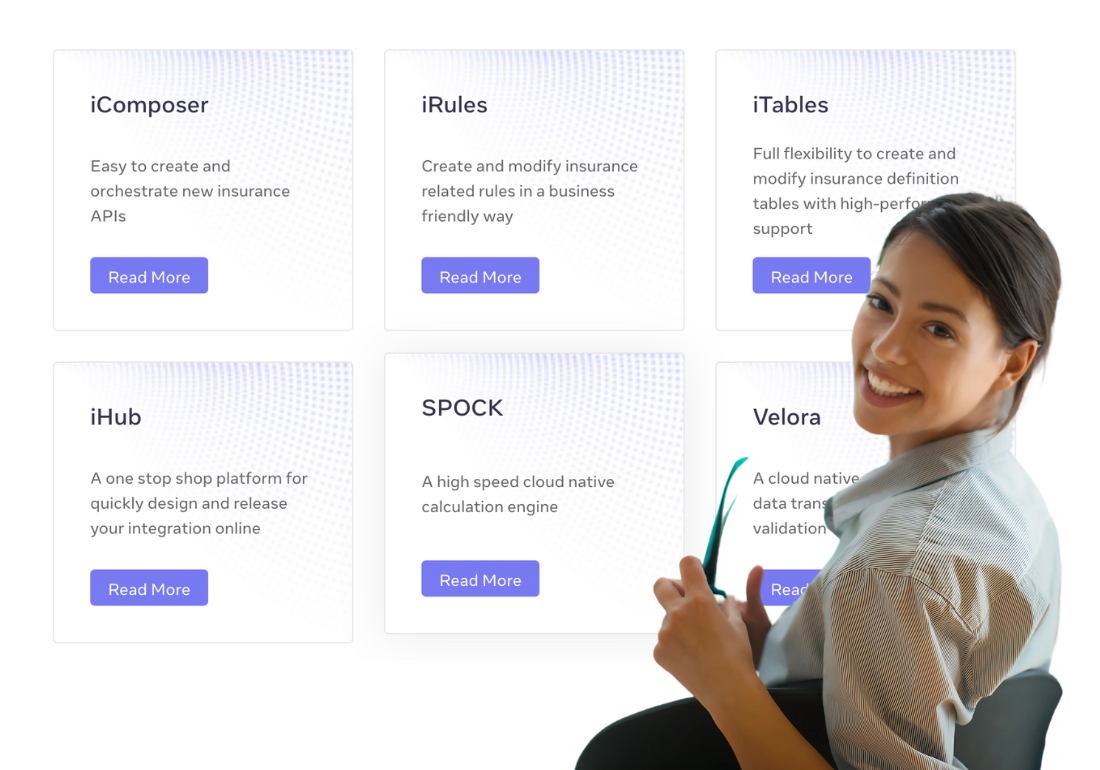

OpenLegacy’s Integration Solutions: OpenLegacy provides tools that connect directly to core insurance systems, generating digital-ready code and deploying it as microservices. This approach enables insurers to modernize legacy assets for blockchain integration without major redevelopment. (openlegacy.com)

- API-Based Communication: Custom APIs allow data exchange between legacy databases and blockchain nodes (source). This approach preserves existing investments while enabling new functionality.

- Middleware Solutions: Middleware acts as a translator between old and new systems, handling data transformation and workflow orchestration without requiring full system replacement.

- Cloud Migration: Moving select processes to cloud-native environments increases scalability and makes it easier to integrate cutting-edge technologies like smart contracts or decentralized identity management.

- Robotic Process Automation (RPA): RPA tools automate repetitive manual tasks within legacy software, freeing up human resources for higher-value work, and can be linked directly to blockchain-based triggers.

This multi-pronged approach allows insurers to modernize at their own pace while positioning themselves competitively in an era where digital trust is paramount.

Adopting a phased integration strategy is proving to be the most sustainable way forward for insurers. By layering new technologies such as blockchain over existing infrastructure, companies can incrementally unlock the benefits of automation, transparency, and improved risk assessment without destabilizing mission-critical operations.

Case Studies: Real-World Successes in Blockchain-Legacy Integration

Several industry leaders are already demonstrating the value of legacy insurance blockchain integration. For instance, Swiss Re’s partnership with Benekiva yielded an end-to-end digital claims management platform that merges legacy claims administration with automated rules engines. This collaboration streamlines workflows and enhances beneficiary experiences, showing how even established giants can evolve through smart integration (source).

Similarly, OpenLegacy offers solutions that connect directly to core insurance systems, automatically generating microservices to bridge the gap between old and new architectures. Their approach enables insurers to leverage digital-ready assets for rapid product launches and continuous innovation (source).

The OnRe tokenized yield model further illustrates the power of on-chain reinsurance systems: by tokenizing reinsurance performance and collateral yields, platforms like OnRe are creating new investment opportunities while fostering greater transparency in risk transfer (source).

Best Practices for Future-Proof Integration

Best Practices for Integrating Legacy Insurance IT with Blockchain

-

Adopt API-Based Communication: Implementing robust APIs enables legacy insurance systems to seamlessly exchange data with blockchain platforms, fostering interoperability and reducing integration friction.

-

Leverage Middleware Solutions: Utilize middleware platforms like OpenLegacy to bridge legacy infrastructure and blockchain networks, allowing modernization without full system replacement.

-

Migrate to Cloud Infrastructure: Transitioning critical processes to cloud platforms enhances scalability and disaster recovery, while providing a flexible foundation for blockchain adoption.

-

Integrate Robotic Process Automation (RPA): Deploy RPA tools to automate repetitive tasks within legacy systems, streamlining workflows and enabling smoother blockchain integration.

-

Design and Test Complex Smart Contracts Thoroughly: Collaborate with blockchain experts to develop smart contracts that accurately reflect reinsurance agreements, ensuring security and reliability through rigorous testing.

-

Engage in Strategic Partnerships: Follow examples like the Swiss Re and Benekiva partnership to combine expertise in claims management and blockchain automation for more efficient operations.

-

Educate and Train Stakeholders: Invest in ongoing education for staff and partners to demystify blockchain technology and foster organizational buy-in, reducing resistance to change.

To maximize success and minimize disruption, organizations should adhere to a few key principles:

- Pilot Projects: Start with limited-scope pilot programs to test integrations before scaling up.

- Stakeholder Alignment: Engage both IT and business teams early to ensure buy-in and shared vision.

- Continuous Education: Invest in ongoing training to bridge knowledge gaps around smart contracts, data privacy, and regulatory compliance.

- Vendor Collaboration: Work closely with InsurTechs and solution providers experienced in hybrid systems.

- Security First: Prioritize robust cybersecurity protocols at every layer of integration.

What’s Next for Insurance IT?

The momentum behind blockchain legacy integration is undeniable. As more insurers witness tangible results from early adopters, resistance is giving way to curiosity, and even enthusiasm. The next wave will likely see deeper automation of underwriting processes, real-time capital allocation via tokenized risk pools, and broader use of decentralized oracles for data validation.

The journey isn’t without its hurdles, regulatory clarity remains a moving target, and interoperability standards are still maturing, but the direction is set. Insurers who invest now in bridging their legacy foundations with agile on-chain reinsurance systems will be best positioned to lead as the industry enters a new era of digital trust.