On-chain risk assessment is rapidly moving from a theoretical promise to a practical reality in the reinsurance sector. Blockchain oracles now serve as the vital bridge between smart contracts and real-world data, enabling a new level of pricing accuracy, transparency, and efficiency for reinsurance contracts. With platforms like Re. xyz and Arbol automating parametric reinsurance triggers using smart contracts, the industry is witnessing a profound shift toward data-driven, automated risk transfer mechanisms.

How Blockchain Oracles Power On-Chain Reinsurance Pricing

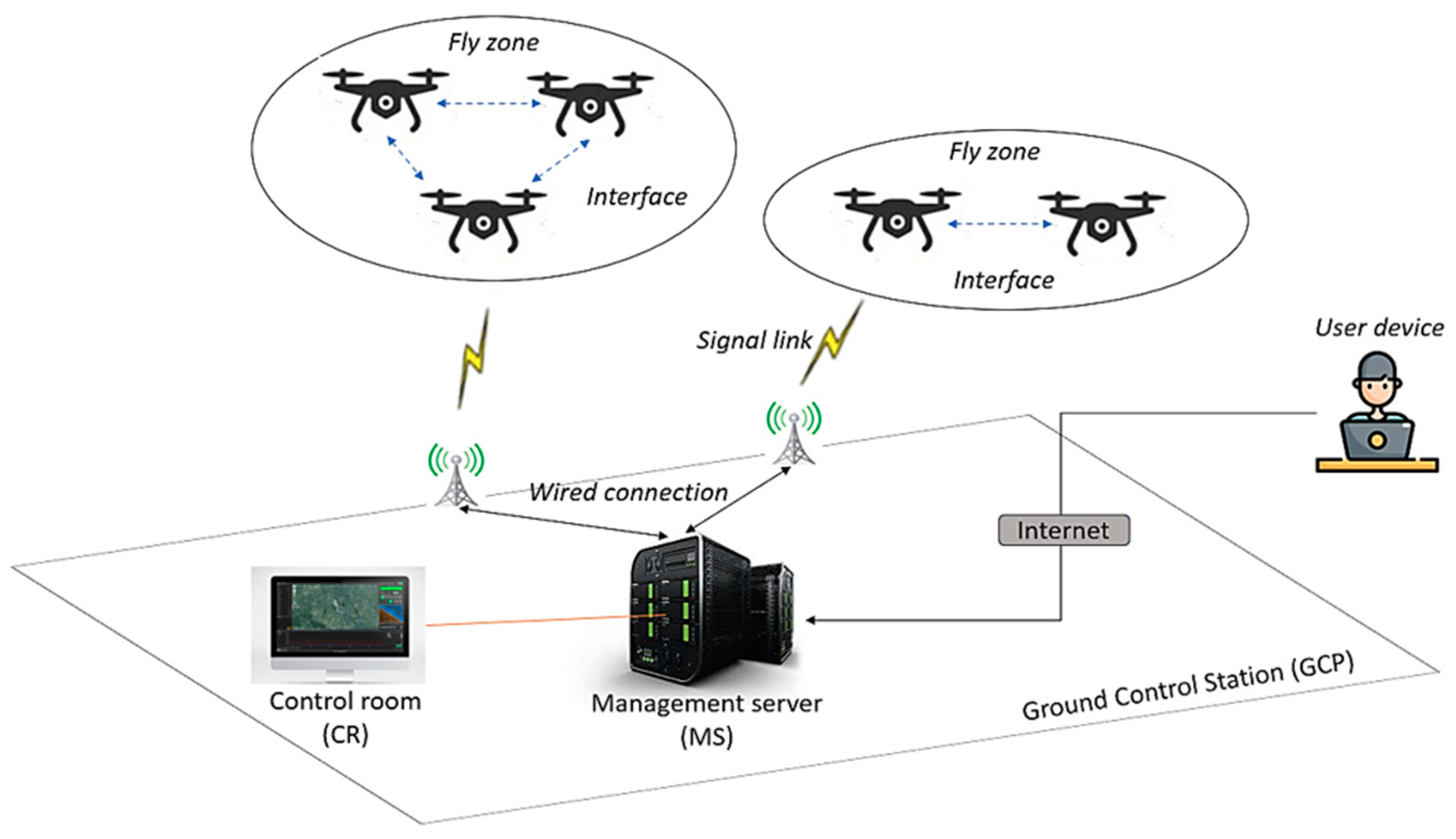

In traditional reinsurance, pricing often relies on periodic reports and delayed data feeds. This can lead to mismatched premiums, slow response times, and costly manual reconciliations. Blockchain oracles disrupt this paradigm by providing real-time access to external data, such as weather indices, catastrophe event parameters, or even market volatility measures. These oracles feed live information directly into smart contracts on blockchain platforms like Avalanche or Ethereum.

For example, Arbol leverages blockchain-based parametric triggers to automate loss calculations for severe storm catastrophe transactions. This is made possible because oracles stream verified meteorological data directly onto the chain, allowing payouts and premium adjustments to occur without human intervention. The result? Efficient and transparent parametric loss calculations that minimize disputes and administrative overhead (Artemis.bm).

The Rise of Dynamic Insurance Pricing: Real-World Examples

The integration of blockchain oracles has enabled reinsurers to move beyond static pricing models. For instance, Re. xyz’s decentralized protocol allows alternative capital providers to invest in baskets of insurance policies that are continually monitored for risk exposure. When new risks emerge – say, an approaching hurricane or a spike in crypto market volatility – the platform’s oracle system retrieves updated external data and automatically recalibrates pricing for affected policies.

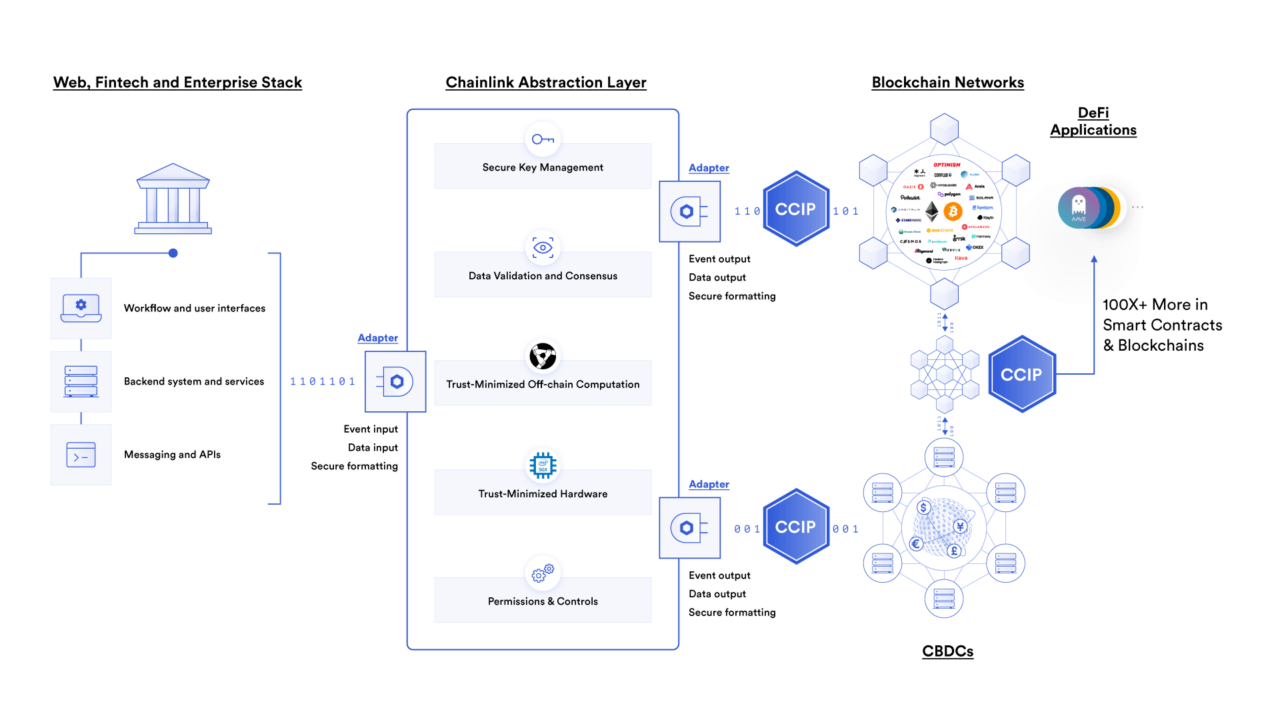

A notable case is inSure DeFi’s use of Chainlink’s historical price data oracles. By pulling in up-to-the-minute market prices, their protocol can dynamically adjust premiums for crypto-insurance products based on current volatility levels (insureteam.medium.com). This approach ensures that coverage remains relevant and actuarially sound even as markets fluctuate wildly.

Key Benefits of Blockchain Oracles in Insurance Pricing

-

Enhanced Transparency: Blockchain oracles enable real-time, verifiable data feeds directly into smart contracts, making reinsurance pricing processes more transparent. Platforms like Re use decentralized protocols to allow all stakeholders to view how premiums are calculated and distributed.

-

Dynamic, Real-Time Pricing: By integrating oracles such as Chainlink, insurers can adjust premiums based on live external data, such as weather events or market volatility. For example, inSure DeFi uses Chainlink’s historical price data to dynamically update crypto-insurance rates.

-

Increased Efficiency and Automation: Smart contract-based systems, like those used by Arbol, automate parametric reinsurance triggers, enabling faster and more accurate loss calculations for catastrophe events. This reduces administrative overhead and speeds up claims settlements.

-

Improved Risk Assessment: By continuously monitoring risk factors through oracles, platforms like Gate.com enhance the accuracy of reinsurance pricing. Access to up-to-date external data supports more precise underwriting and risk modeling.

Navigating Oracle Risks: Data Quality and Manipulation Concerns

Despite their promise, blockchain oracles introduce their own set of challenges – chief among them are data quality assurance and resistance to manipulation. Oracles act as intermediaries between blockchains and off-chain sources; a single faulty feed can propagate errors throughout an entire portfolio of smart contracts.

This risk isn’t hypothetical. If an oracle delivers inaccurate weather readings during a catastrophe event or provides manipulated asset prices during extreme market swings, smart contracts could execute erroneous payouts or fail to trigger when needed. According to S and P Global’s analysis (spglobal.com), robust verification mechanisms – including multi-source aggregation and reputation scoring – are essential safeguards against such vulnerabilities.

The future points toward hybrid oracle solutions that combine on-chain consensus with trusted off-chain computation partners to further bolster reliability.

As on-chain risk assessment matures, the reinsurance industry is developing new best practices to address these oracle-related risks. Leading protocols employ redundancy by aggregating data from multiple independent oracles, using cryptographic proofs and cross-verification to ensure only accurate, consensus-driven data triggers smart contract actions. This approach not only reduces single-point-of-failure risk but also increases confidence for both capital providers and policyholders.

Practical Steps for Robust Oracle Integration

For reinsurers and insurance innovators embracing blockchain technology, integrating oracles requires a nuanced strategy. Here are some practical steps:

Steps for Secure Oracle Integration in Reinsurance

-

Assess and Select a Reputable Oracle Provider: Choose established oracle networks such as Chainlink or Band Protocol, known for reliability and robust security. Evaluate their track record in insurance and DeFi sectors, focusing on transparency and data integrity.

-

Implement Permissioned Blockchain Infrastructure: Utilize permissioned blockchains, like those supported by Swiss Re or RiskStream Collaborative, to ensure strong identity management and restricted access for participants, enhancing data privacy and compliance.

-

Establish Data Verification Mechanisms: Integrate multi-source data feeds and consensus-based validation to mitigate the risk of inaccurate or manipulated data. Platforms such as Arbol automate parametric triggers using smart contracts and verified weather data, setting a precedent for robust verification.

-

Continuously Monitor and Audit Oracle Performance: Use platforms like Re that offer real-time monitoring of risk and data flow, enabling timely detection of anomalies or data discrepancies. Regular audits help maintain system integrity and trust.

-

Integrate Automated Pricing Adjustments: Leverage oracles to feed real-time data into smart contracts for dynamic premium calculations, as demonstrated by inSure DeFi, which uses Chainlink’s historical price data oracles for crypto-insurance pricing.

-

Develop Incident Response Protocols: Prepare for potential oracle failures or data breaches by establishing clear procedures for incident detection, response, and communication. Reference guidelines from S&P Global on blockchain oracle risk management.

First, selection of reputable oracle providers is crucial. Look for those with established track records in mission-critical DeFi ecosystems and transparent operational methodologies. Second, design smart contracts with built-in fail-safes, such as time delays, multi-sig approvals, or fallback data sources, to further mitigate the impact of anomalous feeds.

Additionally, ongoing monitoring of oracle performance is essential. Platforms like Re. xyz exemplify this by continuously tracking risk parameters and updating pricing models as new data arrives (reinsurancene.ws). This dynamic approach allows for responsive adjustments and helps maintain actuarial soundness even in volatile conditions.

Unlocking New Opportunities in On-Chain Reinsurance

The successful deployment of blockchain oracles is already fostering innovative reinsurance models that were previously unattainable. Parametric products, where payouts are triggered by objective external events rather than lengthy claims processes, are becoming more accessible to a broader range of risks and geographies. For example, catastrophe bonds can now be tokenized and managed on-chain with real-time event verification via trusted oracles, streamlining the entire risk transfer process.

Moreover, the increased transparency afforded by blockchain insurance pricing is attracting alternative capital providers who demand clear audit trails and instant settlement capabilities. As reported by ScienceSoft, these benefits extend beyond efficiency, they also help build trust among stakeholders who might have previously been wary of opaque legacy systems.

Looking Ahead: The Evolution Continues

The next wave of on-chain reinsurance will likely feature more sophisticated oracle networks leveraging AI-driven anomaly detection, decentralized governance over data feeds, and interoperability between multiple blockchains. As this ecosystem evolves, expect to see even tighter integration between actuarial science and programmable finance, offering reinsurers tools that are not just faster but fundamentally smarter.

Ultimately, leveraging blockchain oracles in reinsurance pricing isn’t just about technical innovation, it’s about equipping the industry with tools for greater resilience in an increasingly complex risk landscape. Insurers who embrace these technologies today will be best positioned to lead tomorrow’s transparent, efficient, and responsive markets.