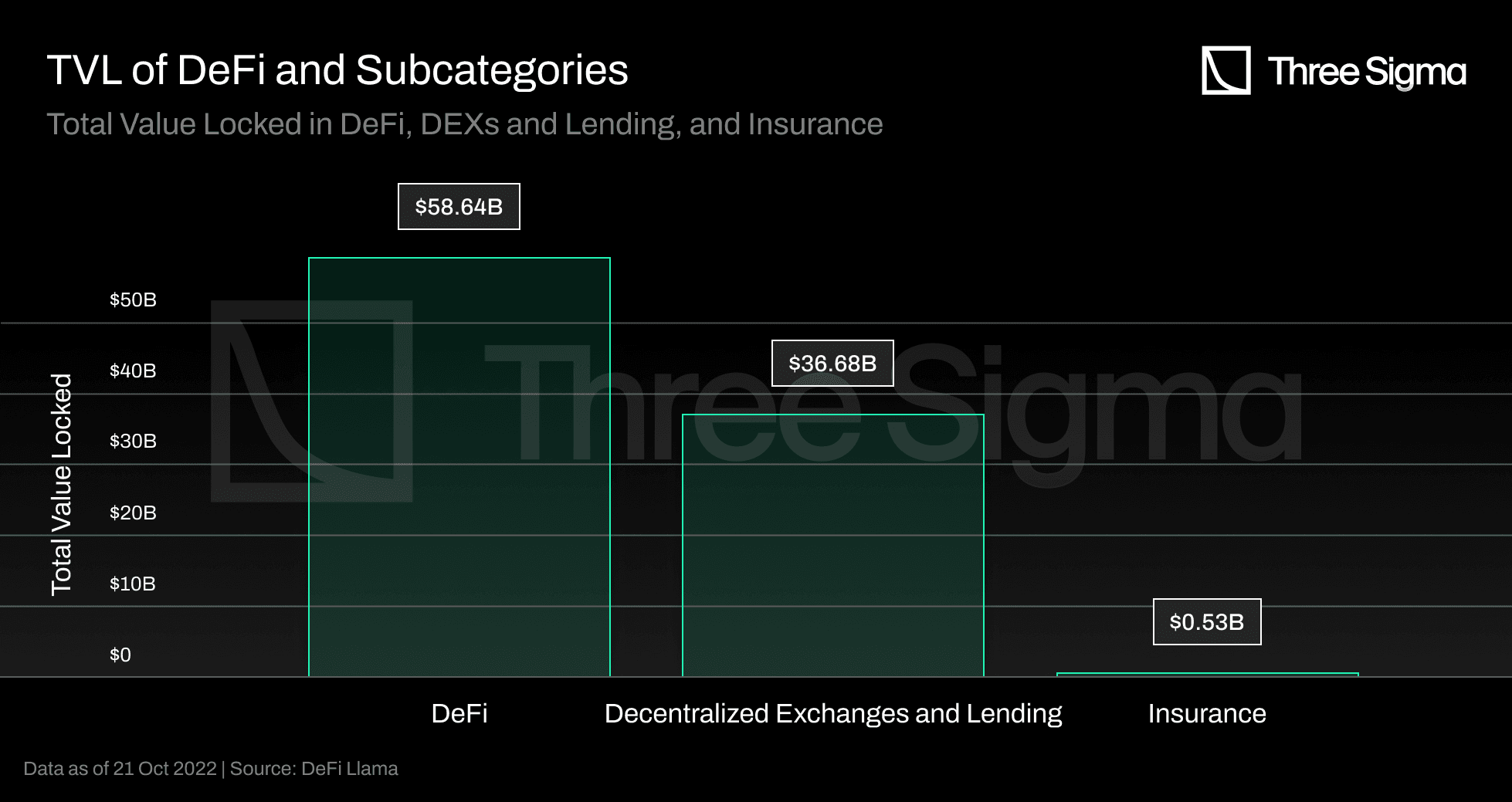

Decentralized Finance (DeFi) is quietly upending the centuries-old reinsurance paradigm. At the heart of this transformation are reinsurance liquidity pools: decentralized, blockchain-driven capital reserves that enable a new form of on-chain risk sharing. These pools allow participants to collectively underwrite insurance risks, automate claims, and earn yield – all without relying on traditional intermediaries.

How Reinsurance Liquidity Pools Power On-Chain Risk Sharing

In traditional reinsurance, insurers transfer portions of their risk portfolios to external parties to balance exposure. DeFi insurance pools mimic this mechanism but replace the institutional gatekeepers with transparent smart contracts and open capital markets. Here’s how it works:

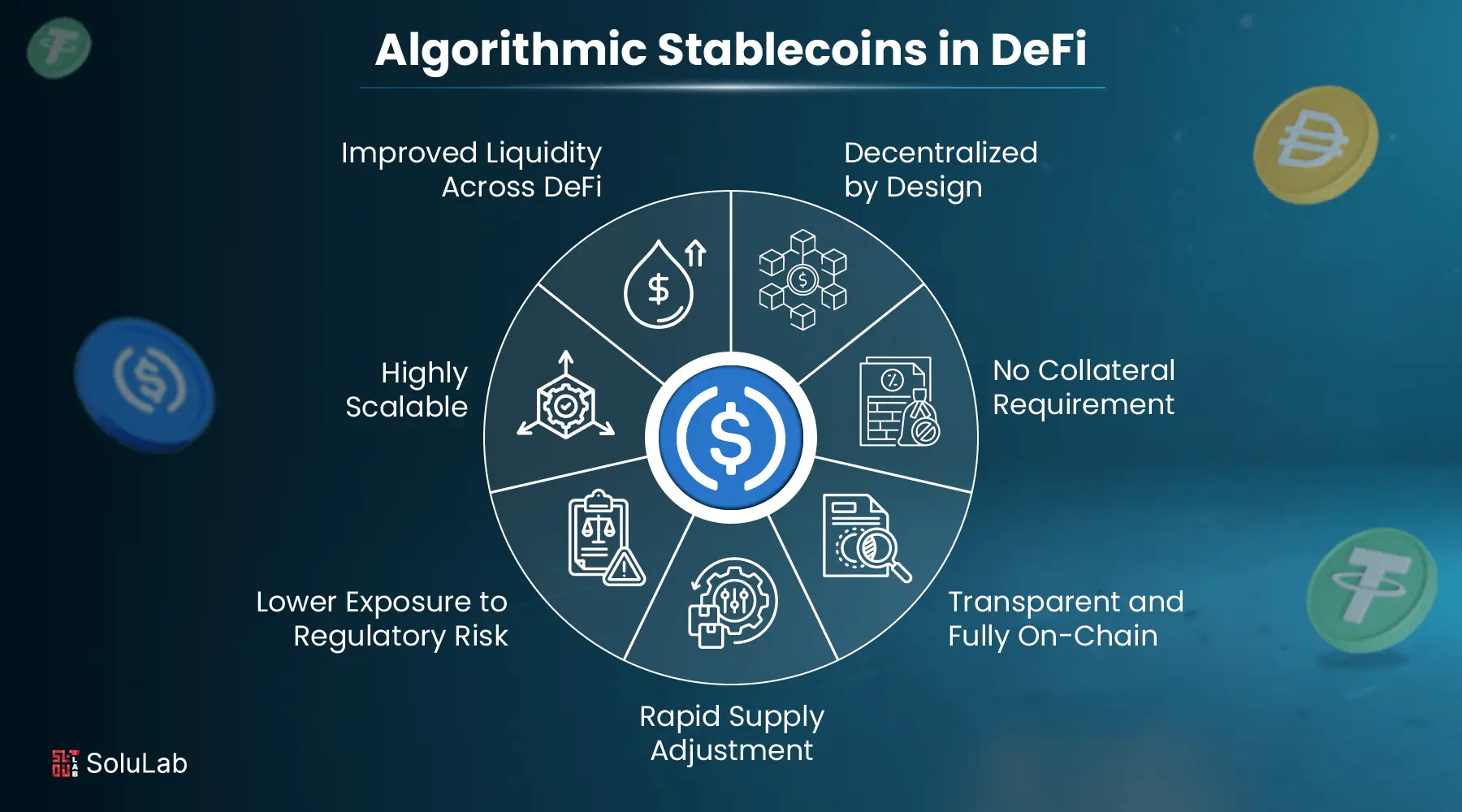

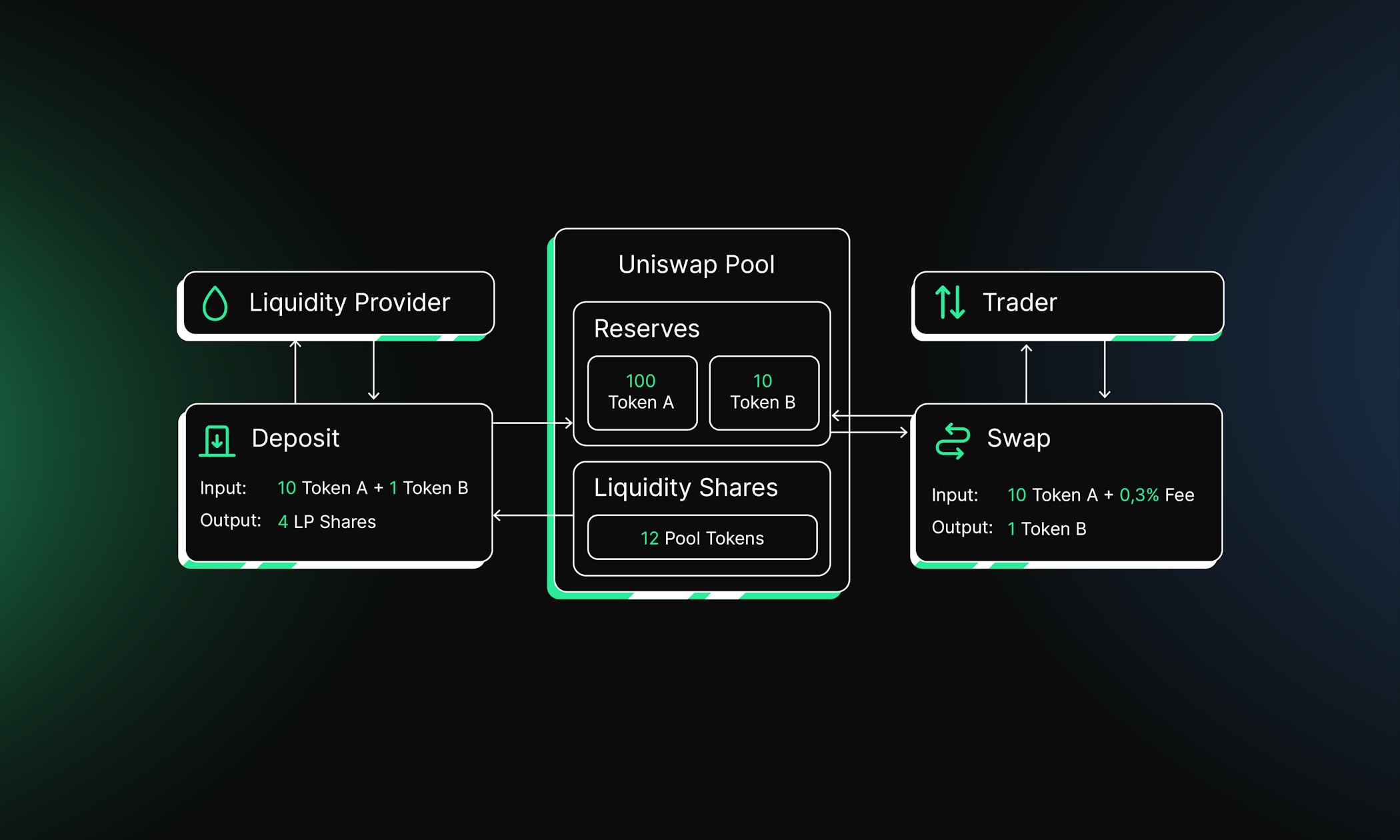

- Pooling Capital: Users deposit cryptoassets (often ETH, BTC, or stablecoins) into a smart contract, creating a reserve that backs insurance policies for specific risks, such as protocol exploits or smart contract failures.

- Automated Coverage: When a claim event occurs and meets predefined criteria, the smart contract automatically pays out from the pool – no claims adjuster or legal wrangling required.

- Earning Yield: Contributors receive premiums paid by policyholders, plus additional yield if their deposited assets are staked or lent out via DeFi protocols.

This model not only democratizes access to reinsurance investment but also unlocks 24/7 liquidity and automated price discovery – features impossible in legacy markets. As noted by AuditOne and Hacken, these pools aggregate capital from multiple sources to ensure sufficient funds for claims while offering passive income opportunities for liquidity providers.

The Mechanics: DeFi Platforms Leading the Charge

Pioneers like Bridge Mutual have elevated the concept with internal reinsurance pools that act as protocol-owned coverage providers. These specialized vaults use only protocol-owned funds (not retail leverage), lowering risk profiles for both policyholders and investors. Yield generated by third-party protocols is funneled back into these pools, improving capital efficiency and making coverage more affordable. For an in-depth breakdown of this structure, see Bridge Mutual’s documentation.

The result? A system where risk is distributed among many rather than concentrated in a few hands – with every transaction visible on-chain for maximum transparency.

Key Benefits of DeFi Reinsurance Liquidity Pools

-

Enhanced Capital Efficiency: Automated smart contracts and protocol-owned vaults, like those on Bridge Mutual, ensure that capital is allocated optimally, maximizing returns for liquidity providers and reducing the cost of coverage for insurers.

-

Risk Diversification: By aggregating liquidity from a wide range of participants, DeFi reinsurance pools spread risk across multiple contributors, reducing the impact of individual losses and enhancing overall pool resilience.

-

Transparency and Trust: All transactions and claims are recorded on public blockchains, providing immutable and transparent records that foster trust among investors and insurers alike.

-

24/7 Accessibility and Global Participation: DeFi platforms operate without geographic or time restrictions, enabling investors and insurers worldwide to participate and access coverage at any time.

-

Yield Generation Opportunities: Liquidity providers can earn passive income through premiums and on-chain yields from assets like ETH, BTC, or stablecoins, which are often staked or lent within the pools.

-

Reduced Reliance on Intermediaries: By leveraging decentralized protocols, reinsurance liquidity pools eliminate the need for traditional brokers or reinsurers, streamlining processes and reducing administrative costs.

Risk Management in a Decentralized World

The decentralized nature of these pools brings distinct advantages but also new challenges. On the upside:

- Diversification: Pooling resources from global participants spreads out risk exposure far more efficiently than bilateral treaties.

- Transparency: Every deposit, withdrawal, claim approval, and payout is recorded immutably on-chain – fostering trust even among pseudonymous actors.

- Capital Efficiency: Automated market makers (AMMs) dynamically allocate funds based on real-time market conditions and claim probabilities.

However, these innovations come with caveats:

- Smart Contract Vulnerabilities: Bugs or exploits can drain entire pools if not properly audited.

- Market Volatility: The underlying assets may fluctuate wildly in value during black swan events.

- Regulatory Uncertainty: Jurisdictional clarity around decentralized insurance remains elusive in most regions.

These risks highlight the importance of robust auditing, diversified asset strategies, and adaptive governance. Leading DeFi insurance protocols are investing heavily in third-party code audits and bug bounties, while also experimenting with multi-asset pools to buffer against single-token shocks. Community-driven governance frameworks allow participants to vote on risk parameters, asset allocations, and claims processes, keeping the system agile as new threats emerge.

What’s Next for Blockchain Reinsurance Investment?

The evolution of reinsurance liquidity pools is unlocking entirely new frontiers for both institutional and retail investors. As on-chain risk sharing matures, we’re seeing:

Top Trends in DeFi Reinsurance Liquidity Pools

-

Protocol-Owned Reinsurance Pools: Platforms like Bridge Mutual are pioneering internal reinsurance pools that use only protocol-owned funds, reducing risk exposure and improving capital efficiency.

-

Automated Capital Allocation via Smart Contracts: The use of automated market makers (AMMs) and smart contracts enables efficient, transparent capital allocation and instant claims processing, minimizing manual intervention.

-

Yield Generation from Third-Party Protocols: Reinsurance pools are increasingly integrating with external DeFi protocols to generate additional yield, which is then recycled into the capital pool to offer more competitive coverage options.

-

Enhanced Risk Diversification Through Aggregated Liquidity: By aggregating liquidity from a diverse set of participants, these pools distribute risk more broadly, reducing the impact of individual losses and promoting systemic resilience.

-

Focus on Transparency and Trust via Blockchain: All transactions and pool operations are recorded on-chain, ensuring transparency and building trust among participants—a key differentiator from traditional reinsurance models.

-

Addressing Smart Contract and Market Risks: Leading platforms are prioritizing robust audits, bug bounties, and risk assessment frameworks to mitigate vulnerabilities and manage market volatility within reinsurance pools.

-

Evolution Toward Regulatory Compliance: As the regulatory landscape evolves, DeFi reinsurance pools are exploring compliance solutions, such as on-chain KYC and risk disclosures, to adapt to global standards.

For sophisticated investors, these pools offer a unique blend of yield generation and exposure to insurance-linked risks, previously reserved for global reinsurers or hedge funds. For insurers and protocols seeking coverage, DeFi insurance pools provide rapid capital deployment and flexible terms that adapt as markets shift.

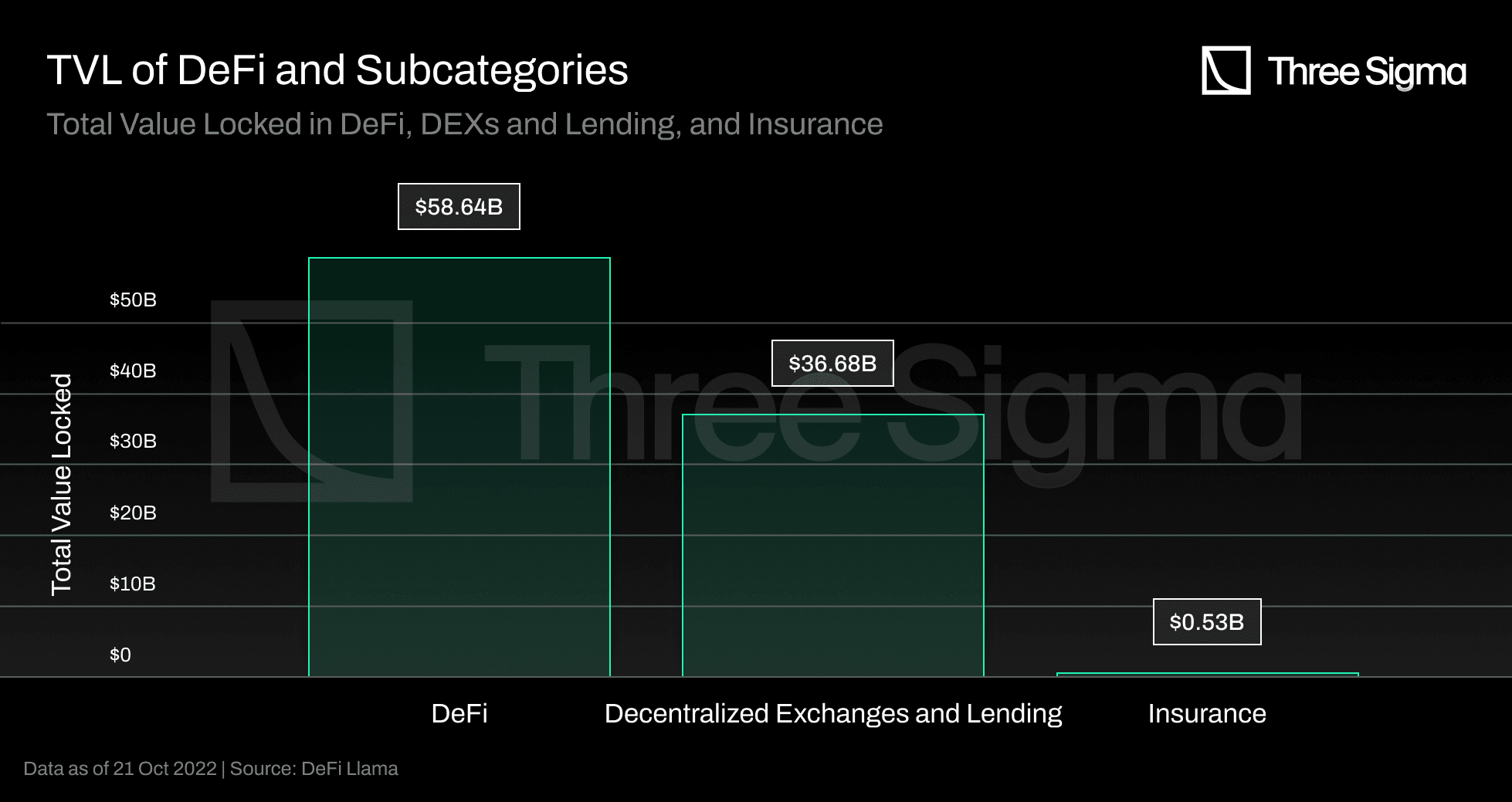

Yet the path forward is not without hurdles. Regulatory frameworks remain in flux; some jurisdictions are beginning to recognize on-chain insurance entities but most have yet to provide clarity. In parallel, the composability of DeFi means that reinsurance pools are increasingly interconnected with lending protocols, DEXs, and stablecoin systems, amplifying both opportunity and systemic risk.

Forward-looking operators will need to balance innovation with prudent risk management as this market grows. The winners will be those who can combine transparency, automation, and diversified capital bases without sacrificing security or compliance.

Frequently Asked Questions

The real promise of on-chain reinsurance lies in its ability to create programmable risk markets, where anyone can participate as a capital provider or policyholder with just a wallet address. As more protocols embrace modular design and open standards, expect cross-chain coverage products and AI-assisted underwriting models to emerge by 2026.

The journey is just beginning. Whether you’re an insurer exploring new capital sources or an investor seeking uncorrelated returns in the crypto era, now is the time to learn how DeFi insurance is reshaping risk sharing at a global scale.