For decades, reinsurance sidecars have operated quietly as a bridge between insurers and capital markets, allowing risk to be shared with third-party investors through specialized vehicles. In the blockchain era, these structures are rapidly evolving, unlocking new efficiencies and transparency that were previously out of reach. The convergence of blockchain and sidecars is not just a technical upgrade – it signals a fundamental shift in how risk capital is sourced and deployed in global insurance markets.

What Are Reinsurance Sidecars?

At their core, reinsurance sidecars are financial entities created by insurers or reinsurers to transfer a portion of their risk to outside investors for a limited period. Investors provide capital to the sidecar, which then assumes some of the insurer’s risk on a defined book of business – typically property catastrophe or life and annuity portfolios. For insurers, this boosts underwriting capacity without the need to raise equity; for investors, it offers access to insurance-linked returns uncorrelated with traditional asset classes.

Traditionally, these vehicles have been established as off-balance-sheet special purpose vehicles (SPVs), often domiciled in insurance hubs like Bermuda or the Cayman Islands. According to recent data, ceded reserves to sidecars tripled from 2021-2023, reaching nearly $55 billion as insurers sought capital relief amid rising premium volumes (insurancebusinessmag.com). This surge underscores the growing appetite for flexible reinsurance solutions in both property/casualty and life/annuity sectors.

The Blockchain Advantage in Reinsurance Sidecars

Blockchain technology is tailor-made for the complex world of reinsurance. By leveraging distributed ledger systems, all parties involved in a sidecar – ceding insurer, investors, managers – gain real-time access to shared data with unprecedented visibility. Smart contracts automate premium flows and claims settlements according to pre-agreed rules coded directly on-chain. This reduces administrative friction and expedites processes that once took weeks or months.

A landmark example came in April 2022 when Allianz and Swiss Re executed a legally binding catastrophe excess-of-loss contract using blockchain (insuranceinsider. com). This milestone demonstrated that even highly regulated reinsurance agreements can be managed securely on-chain. For sidecars specifically, blockchain enables more granular risk assessment and transparent reporting throughout the investment lifecycle – qualities highly valued by institutional allocators.

Key Benefits: Why Investors and Insurers Are Embracing On-Chain Sidecars

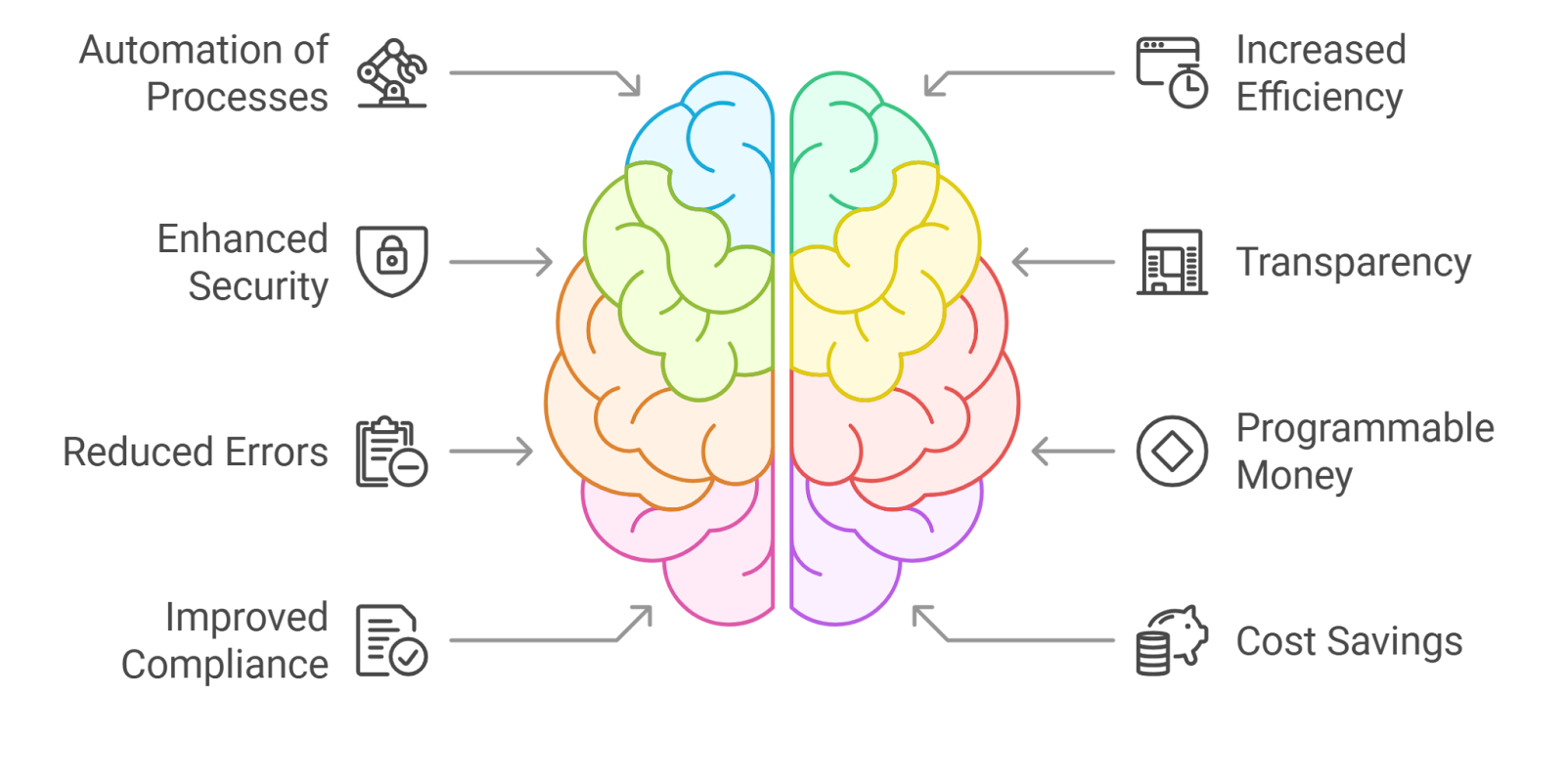

Top 5 Benefits of Blockchain-Powered Reinsurance Sidecars

-

Enhanced Transparency and Trust: Blockchain’s decentralized ledger enables real-time, immutable record-keeping of all transactions and risk transfers. This transparency builds trust among insurers, investors, and regulators, reducing disputes and audit complexities.

-

Faster and More Efficient Settlement: Smart contracts on blockchain automate premium payments, claims processing, and capital deployment. This reduces administrative overhead and accelerates settlements, as demonstrated by the 2022 Allianz-Swiss Re blockchain contract.

-

Improved Capital Efficiency: Blockchain-powered sidecars streamline capital flows, allowing third-party investors to deploy funds with greater confidence and speed. This leads to optimized risk-sharing and increased underwriting capacity without the need for insurers to raise additional capital.

-

Stronger Security and Data Integrity: The cryptographic security inherent in blockchain technology protects sensitive insurance data from tampering or unauthorized access. This ensures data integrity across multi-party agreements and reduces the risk of fraud.

-

Broader Market Access for Investors: By lowering operational barriers and providing transparent risk assessment, blockchain sidecars open up reinsurance participation to a wider pool of global investors, including those interested in tokenized reinsurance securities like those offered by Oxbridge Re.

The integration of blockchain into reinsurance capital structures delivers several strategic advantages:

- Transparency: Immutable transaction records provide all parties with confidence in reported results.

- Efficiency: Automated smart contracts streamline premium collection and claims payments.

- Security: Decentralized ledgers reduce counterparty risk by eliminating single points of failure.

- Accessibility: Tokenized participation lowers barriers for accredited investors seeking exposure to insurance-linked returns.

- Regulatory Innovation: On-chain compliance tools can support evolving regulatory requirements without added manual overhead.

This combination is already transforming how both traditional reinsurers and crypto-native platforms approach capital formation. For example, tokenized reinsurance securities now act as direct funding mechanisms for collateralized insurance investments (artemis.bm). As adoption accelerates, we expect new models of on-chain insurance investment to emerge across geographies and product lines.

As blockchain reinsurance sidecars gain traction, the industry is witnessing a profound shift in capital dynamics and operational workflows. Insurers are no longer limited to traditional investor pools or slow-moving capital allocation processes. Instead, on-chain platforms enable near-instant capital deployment and real-time risk monitoring, empowering both insurers and investors with an agile response to market developments.

Real-World Impact: Enhanced Capital Efficiency and Risk Management

The practical benefits of blockchain-powered sidecars are already evident. For instance, the surge in ceded reserves to sidecars, tripling to $55 billion between 2021 and 2023: demonstrates how these vehicles are meeting the demand for scalable, flexible risk transfer (insurancebusinessmag.com). On-chain infrastructure further amplifies this by allowing seamless coordination among multiple parties. With smart contracts handling everything from premium allocation to loss settlements, operational bottlenecks are minimized.

Moreover, decentralized ledgers provide a single source of truth accessible by all stakeholders. This is particularly valuable in complex multi-party agreements typical of sidecar structures. Investors benefit from transparent performance data and immutable audit trails, while insurers can demonstrate robust governance, a key consideration for regulators and rating agencies alike.

Emerging Trends: Tokenization and Global Market Access

Tokenization is rapidly becoming the next frontier for on-chain insurance investment. By issuing digital tokens that represent shares in a reinsurance sidecar, platforms can fractionalize access to insurance-linked returns. This not only democratizes participation for accredited investors but also enhances liquidity, an area where traditional sidecars have historically lagged.

Innovators like Oxbridge Re have already issued tokenized securities as funding mechanisms for collateralized reinsurance vehicles (artemis.bm). Such approaches could pave the way for secondary trading markets, enabling dynamic portfolio management strategies previously unavailable in insurance-linked securities (ILS).

“Blockchain is made for reinsurance, ” as PwC notes, offering cost savings up to $10 billion annually by reducing administrative overheads associated with legacy systems.

Challenges Ahead: Regulation and Standardization

No transformation comes without hurdles. Regulatory clarity remains a work in progress as authorities adapt existing frameworks to accommodate on-chain products. Questions around investor eligibility, data privacy, and cross-border compliance must be addressed through collaboration between industry groups and regulators. However, early pilots like Allianz-Swiss Re’s legally binding contract provide a blueprint for scalable adoption within current legal constructs (insuranceinsider. com).

Looking Forward: The Future of Blockchain Reinsurance Sidecars

The convergence of blockchain technology with reinsurance sidecars signals more than just efficiency gains, it heralds an era where transparency, automation, and global access redefine risk capital markets. As insurers continue to seek agile solutions amid rising premiums and evolving risks, blockchain-enabled structures will likely become foundational tools in their strategic arsenal.

The next wave of innovation will focus on interoperability between blockchains, standardization of smart contract templates for insurance applications, and expanded investor participation through regulated tokenized offerings. For forward-looking professionals navigating this space today, understanding these trends is not just advantageous, it’s essential for shaping tomorrow’s resilient insurance ecosystem.