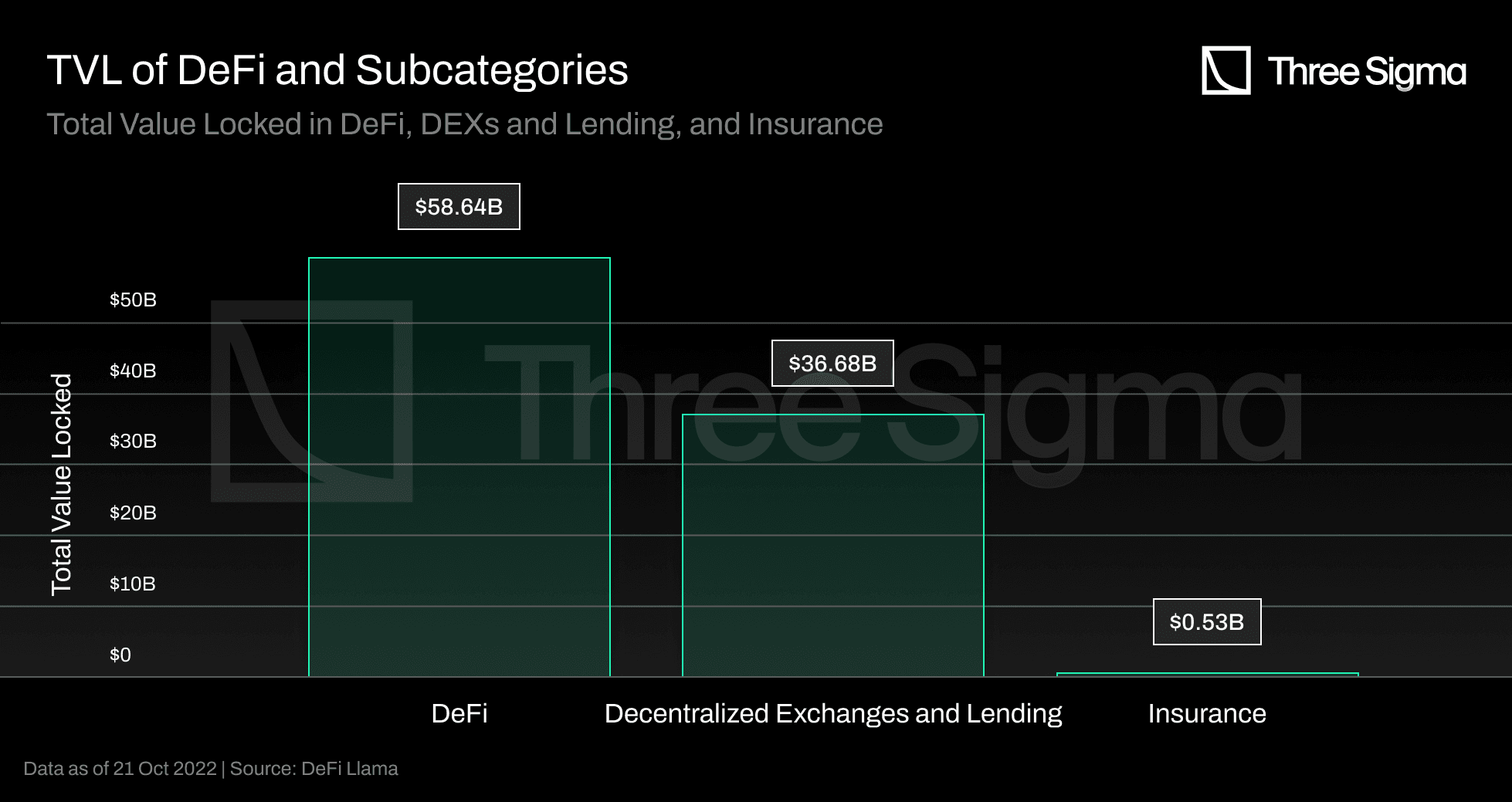

On-chain reinsurance protocols are rapidly redefining the DeFi yield landscape by injecting genuine, uncorrelated returns from real-world insurance assets into blockchain-native products. Unlike speculative yield farming or circular tokenomics, these platforms, led by innovators like OnRe and Re, anchor their yields in the time-tested cash flows of global reinsurance markets, a sector valued at $750 billion. For DeFi users seeking stability and sustainability, this represents a paradigm shift: yields that are both transparent and fundamentally linked to real economic activity.

Yield Generation: From Stablecoins to Real-World Insurance Returns

At the core of these protocols is a simple but powerful mechanism: users deposit stablecoins (such as sUSDe) into smart contract-based capital pools on blockchains like Solana or Avalanche. These pools act as decentralized underwriting vehicles, allocating capital across a diversified book of reinsurance contracts underwritten by actuarial teams with decades of experience.

OnRe’s ONe token, for example, offers projected returns of up to 40.35%: a figure derived from three sources:

- Reinsurance performance: Premiums paid by traditional insurers for risk transfer.

- Collateral yield: Conservative investment income from capital held in secure vaults.

- Token incentives: Protocol rewards for providing liquidity and participating in governance.

This approach stands in stark contrast to most DeFi yield products, which often rely on volatile native token emissions or unsustainable leverage loops. Instead, the underlying collateral is deployed into regulated insurance markets, generating cash flows that are largely uncorrelated with crypto market cycles or macroeconomic shocks.

The Institutional Playbook: Re Protocol’s Permissioned Structure

If OnRe is focused on democratizing access to reinsurance yields for retail and professional investors alike, Re Protocol takes an institutional-first approach. Its flagship tokens, reUSD (Basis-Plus) and reUSDe (Insurance Alpha): are minted via permissioned smart contracts known as Insurance Capital Layers (ICLs). Here’s how it works:

How Users Earn DeFi Yields with Re Protocol

-

Deposit Stablecoins into the Protocol: Users begin by depositing stablecoins such as sUSDe (for OnRe) or USDC (for Re) into the protocol’s smart contracts on supported blockchains like Solana or Avalanche. These deposits form the capital base for underwriting real-world insurance risk.

-

Receive Yield-Bearing Tokens: Upon deposit, users are issued protocol-native tokens—ONe (OnRe), reUSD, or reUSDe (Re Protocol)—which represent their share of the reinsurance pool and entitle them to future yields.

-

Capital Allocated to Real-World Reinsurance Contracts: The protocol’s underwriting and actuarial teams allocate pooled capital across a diversified portfolio of regulated reinsurance contracts, such as homeowners, auto, and workers’ compensation insurance, generating yields uncorrelated with crypto markets.

-

Yield Generation and Accrual: Yields are generated from a combination of reinsurance underwriting profits, collateral yield, and protocol incentives. For example, OnRe projects returns up to 40.35%, while Re’s products combine T-bill yields and delta-neutral ETH strategies with insurance returns.

-

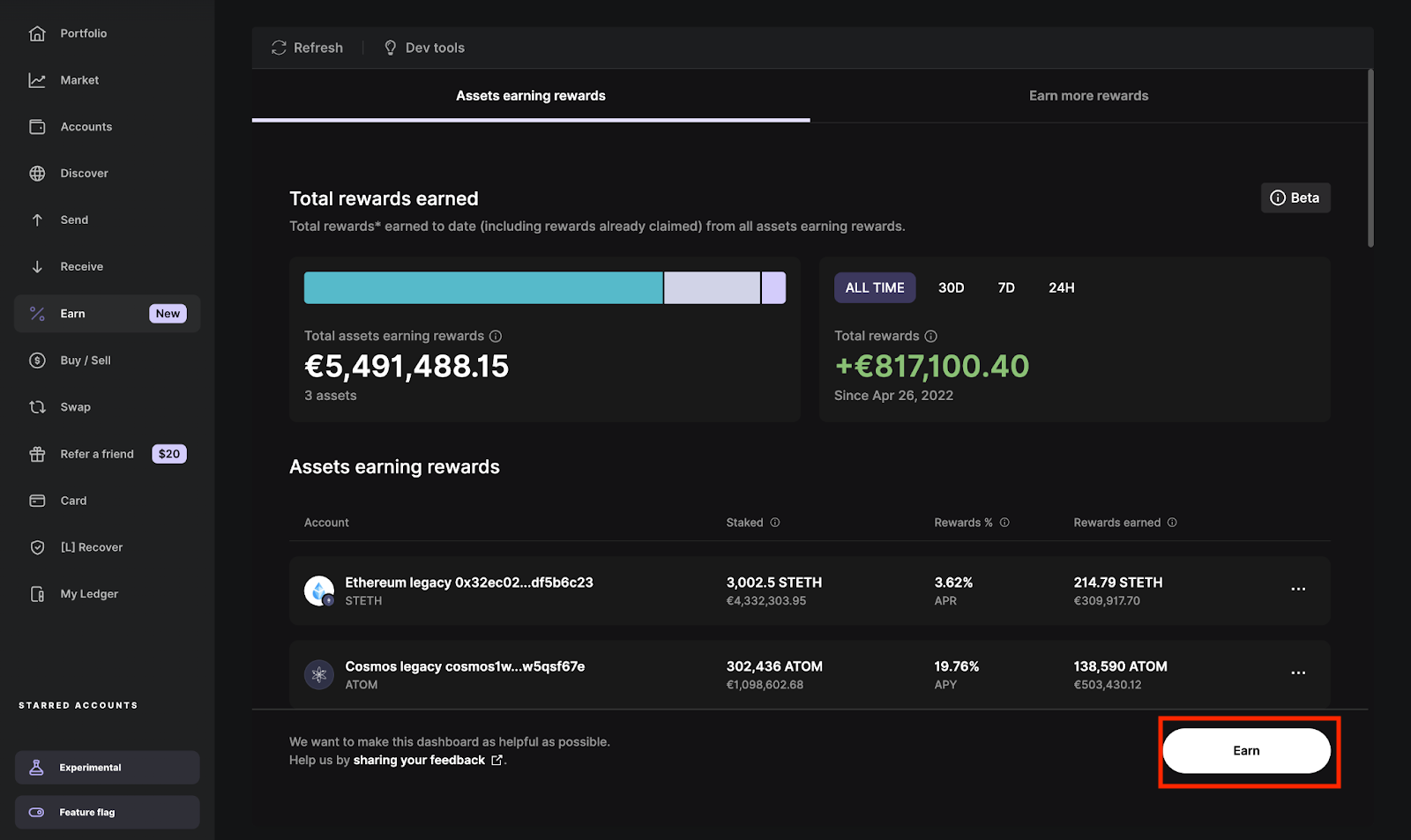

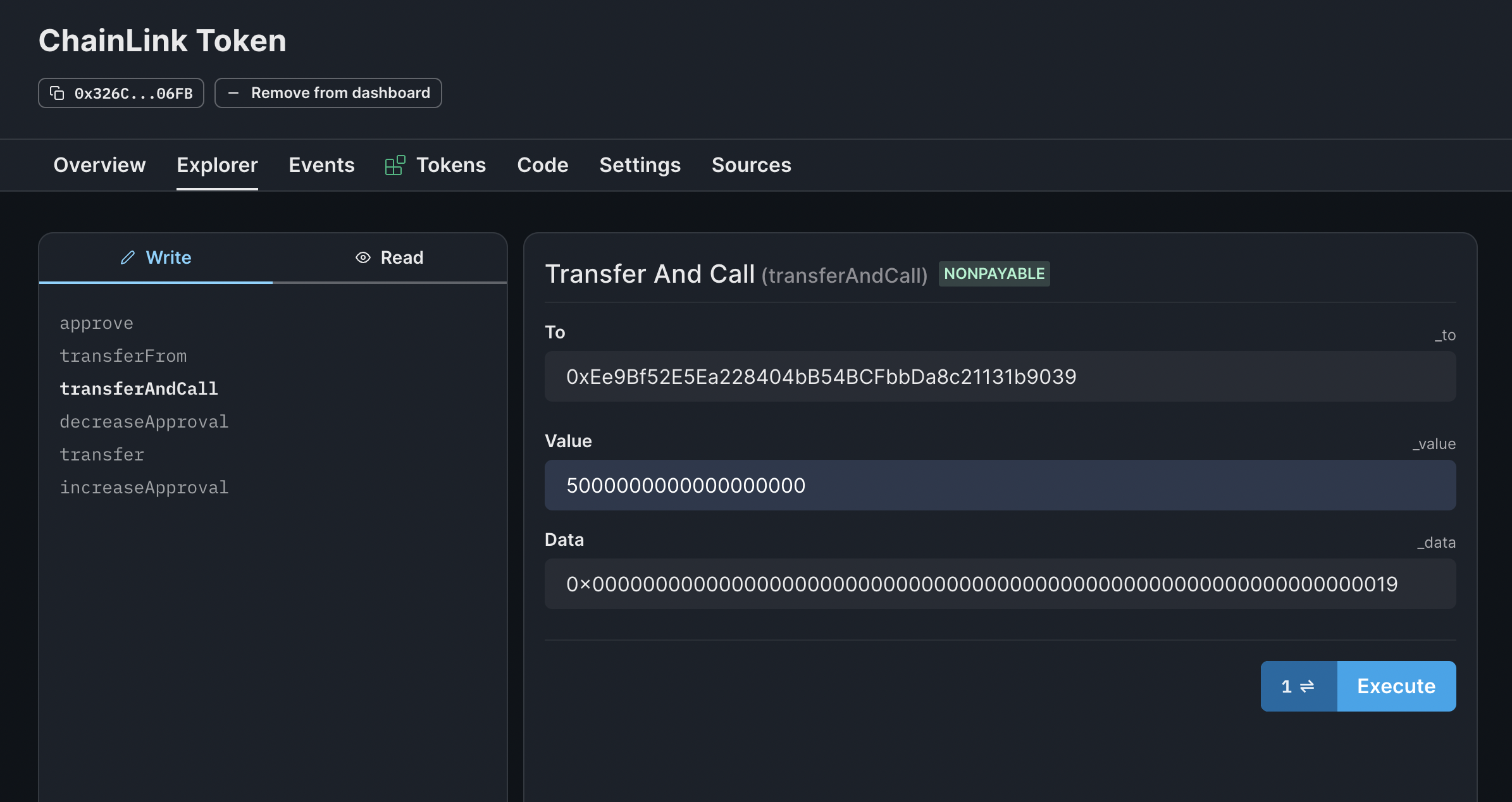

Transparency and On-Chain Verification: Protocols publish daily vault balances and contract performance data to Chainlink oracles or similar services, enabling users to independently verify collateralization and yield accrual in real time.

-

Redeem or Compound Earnings: Users can redeem their yield-bearing tokens for stablecoins or compound their earnings by reinvesting, leveraging on-chain composability and integration with other DeFi protocols for further yield strategies.

The protocol routes user deposits into U. S. -regulated insurance lines such as homeowners, auto, and workers’ compensation. Idle funds are held in secure vaults; balances are published to Chainlink oracles daily for full transparency and auditability (source). This ensures that every dollar backing reUSD or reUSDe can be independently verified on-chain, a critical requirement for institutional adoption.

Diversification and Yield Stability in Volatile Markets

The most compelling feature of on-chain reinsurance protocols is their ability to deliver sustainable yield streams that are decoupled from crypto market volatility. During periods when traditional DeFi yields collapse due to price drawdowns or liquidity crunches, insurance-backed returns tend to remain steady, reflecting the predictable nature of premium payments and loss ratios in diversified risk portfolios.

This dynamic has not gone unnoticed by sophisticated allocators. As noted in recent coverage (prnewswire.com), OnRe’s partnership with Ethena allows users to deploy sUSDe stablecoins directly into a Solana-based pool underwriting multiple reinsurance treaties, a structure designed specifically for portfolio diversification and downside protection.

Risk mitigation and transparency are not just marketing buzzwords in this sector, they are structural features. By leveraging blockchain’s immutable ledger, both OnRe and Re Protocol ensure that all capital inflows, outflows, and claim events are publicly auditable. This real-time verifiability is a significant leap forward from the opaque balance sheets of legacy reinsurers or the black-box risk models of many DeFi projects.

Moreover, the permissioned design of Re Protocol’s Insurance Capital Layers (ICLs) establishes a robust compliance framework. Only verified counterparties can participate in underwriting pools, which aligns on-chain operations with stringent KYC/AML requirements and insurance regulations. This hybrid model balances DeFi’s efficiency with the oversight demanded by institutional allocators.

Key Advantages: Why Insurance-Backed DeFi Yields Stand Out

Top 5 Reasons On-Chain Reinsurance Delivers Sustainable, Uncorrelated DeFi Returns

-

1. Real-World Asset Backing: On-chain reinsurance protocols like OnRe and Re generate yields directly from regulated reinsurance contracts, providing exposure to a $750 billion global market. These yields are derived from actual insurance premiums and claims performance, not speculative DeFi activity, ensuring reliable, sustainable returns.

-

2. Market Uncorrelated Yield Streams: Returns from reinsurance are historically uncorrelated with traditional financial markets and crypto volatility. For example, OnRe’s ONe token and Re’s reUSDe are backed by diversified insurance portfolios such as homeowners and auto, offering DeFi investors a rare source of yield that is insulated from macroeconomic shocks.

-

3. Institutional-Grade Compliance and Transparency: Platforms like Re operate within permissioned, regulated frameworks and publish daily vault balances to Chainlink oracles. This transparency, combined with institutional compliance standards, reduces counterparty risk and increases investor confidence in yield legitimacy.

-

4. Diversified, Actuarially Underwritten Portfolios: On-chain protocols allocate capital across multiple insurance lines and geographies, managed by professional underwriting teams. OnRe, for instance, leverages actuarial expertise to structure portfolios that minimize risk and maximize long-term yield stability.

-

5. Blockchain-Native Efficiency and Accessibility: By leveraging smart contracts on networks like Solana and Avalanche, these protocols enable instant settlement, composability with DeFi strategies, and global access to insurance yields. This blockchain-native approach removes traditional barriers and inefficiencies found in legacy reinsurance markets.

For yield-seeking investors, several advantages stand out:

- Low correlation to crypto markets: Returns are driven by insurance premium flows, not token speculation or leverage cycles.

- Regulatory alignment: Both OnRe and Re Protocol operate within established insurance frameworks, reducing legal and counterparty risks.

- Transparency: Daily balance attestations via Chainlink oracles ensure full visibility into collateral reserves.

- Capital efficiency: Idle funds generate conservative yield (e. g. , T-bills), while deployed capital earns insurance premiums.

- Diversification: Exposure to multiple non-catastrophic insurance lines smooths out returns over time.

This multifaceted approach is attracting not just crypto-native users but also traditional asset managers searching for yield in a low-rate environment. The ability to earn up to 40.35%, as projected by OnRe’s ONe token, is particularly compelling given that these yields are rooted in real-world economic activity rather than speculative trading (source).

The composability of these protocols further enhances their utility across the broader DeFi ecosystem. For example, Onchain Yield Coin (ONyc) can be integrated into advanced strategies on platforms like Exponent, enabling users to split or leverage their real-world reinsurance yield exposure (prnewswire.com). Meanwhile, Re Protocol’s tokens are natively compatible with Avalanche-based lending and liquidity protocols, creating new avenues for risk-adjusted returns without sacrificing compliance or transparency.

The Road Ahead: Scaling Insurance Yields on Blockchain

The fusion of blockchain infrastructure with reinsurance economics is still in its early innings. Yet the traction seen by OnRe and Re demonstrates that sustainable DeFi yields backed by regulated insurance assets are not merely theoretical, they’re already reshaping how capital moves between traditional finance and crypto markets.

If adoption continues at its current pace, we can expect an expansion beyond core insurance lines into more complex risk pools, cyber liability, climate risk tranches, even parametric catastrophe bonds, all accessible via transparent smart contracts. As protocols refine their actuarial models and deepen partnerships with established insurers, the opportunity set for both retail and institutional investors will only grow richer.

The bottom line: on-chain reinsurance platforms aren’t just another yield farm, they represent a new financial primitive where trust is built on math, transparency is default, and returns are anchored in real-world value creation. For those seeking sustainable alpha in an uncertain macro environment, this may be one of the most compelling frontiers yet in decentralized finance.