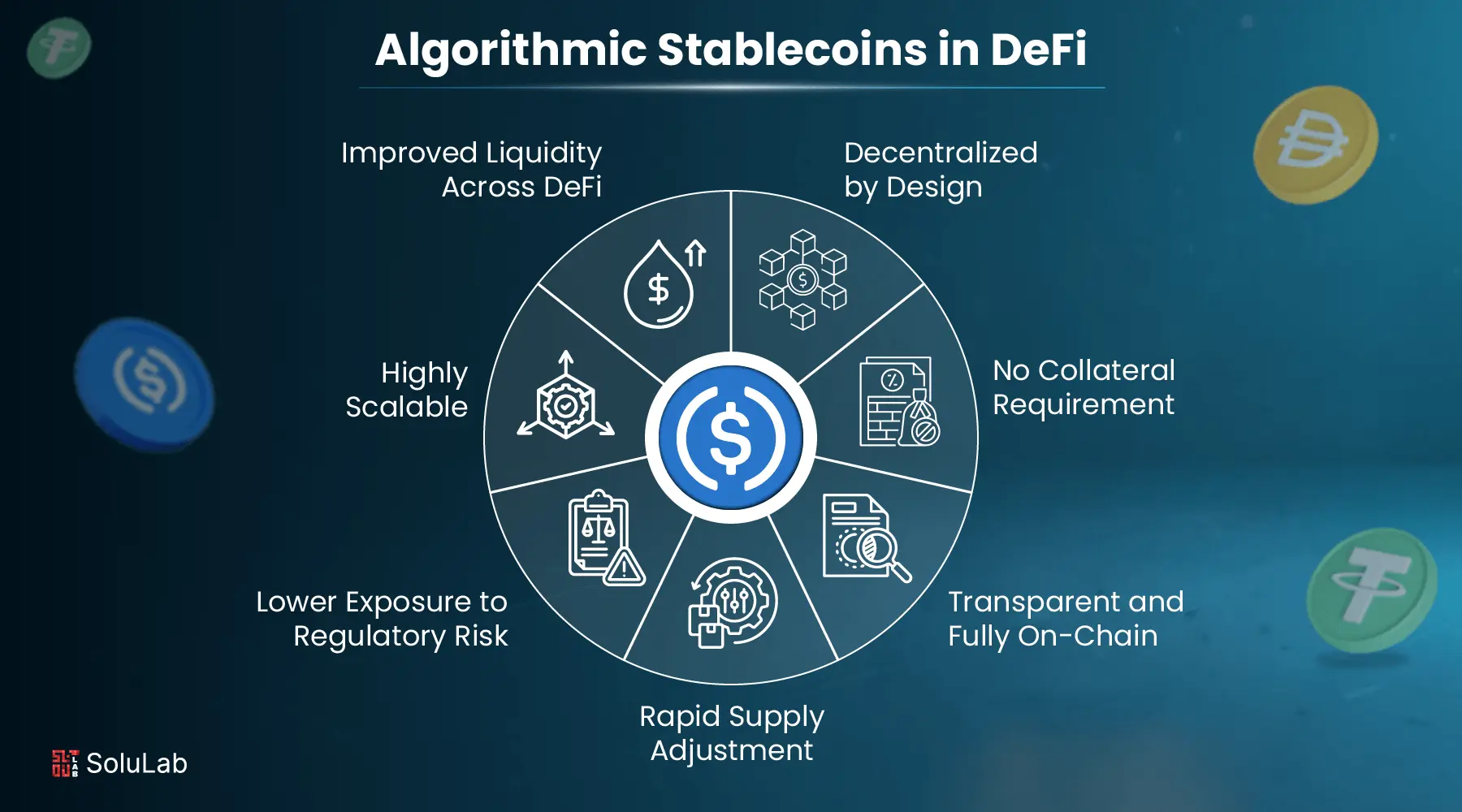

Stablecoins and blockchain technology are rapidly transforming the insurance sector, but few innovations are as disruptive as on-chain reinsurance protocols like Re. These platforms are pioneering a new paradigm, where stablecoins such as USDC can be directly staked into smart contracts that underwrite real-world insurance risk. The result? A seamless bridge between decentralized capital and traditional insurance premiums, with full transparency and on-chain auditability.

How On-Chain Reinsurance Connects Crypto to Real-World Insurance Premiums

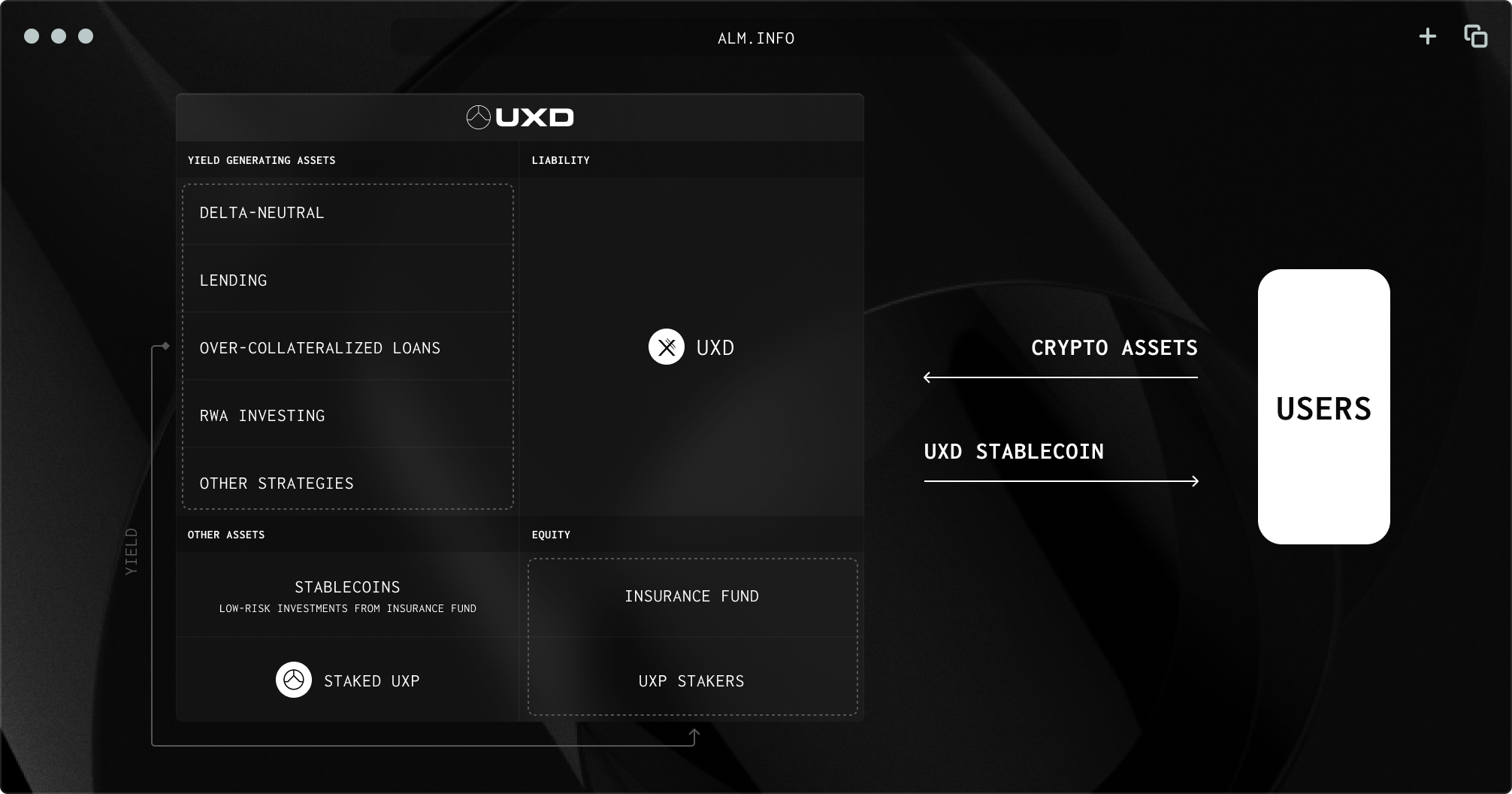

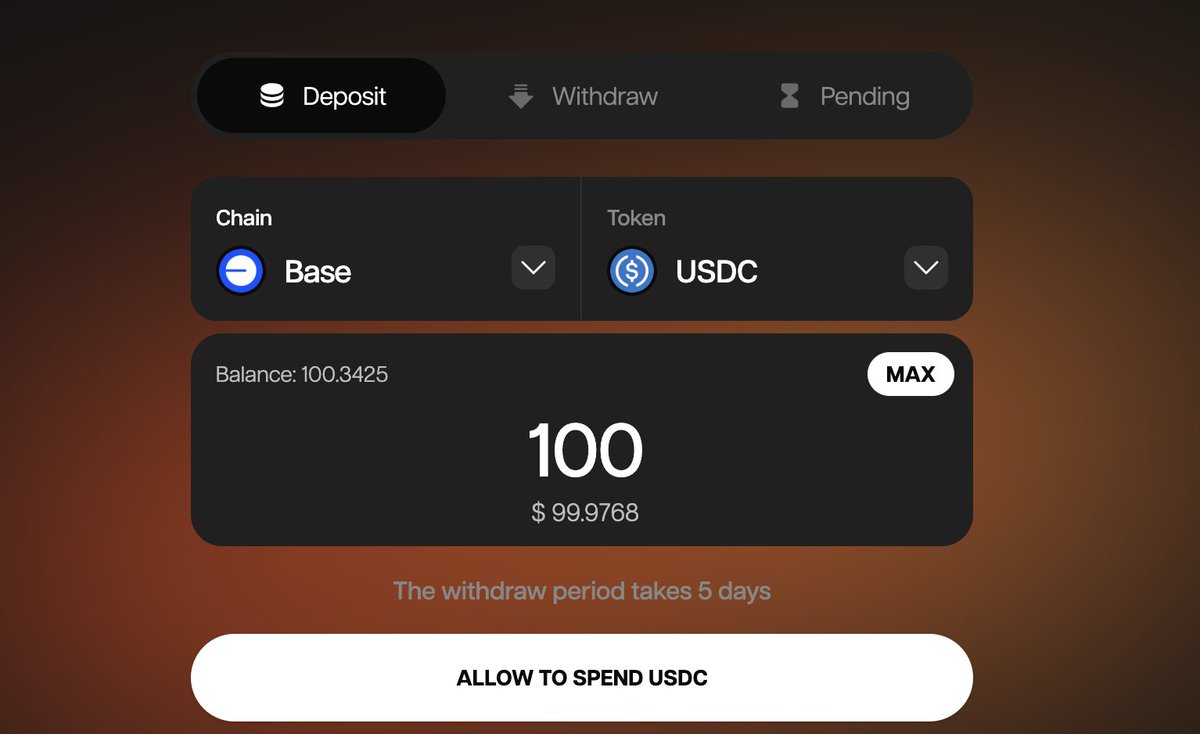

At the heart of this revolution is the ability to channel crypto liquidity into tangible, off-chain use cases. Re’s protocol, for example, allows users to deposit stablecoins into its Insurance Capital Layer (ICL) smart contracts. Once deposited, these assets mint tokens like reUSD and reUSDe, which represent ownership of the underlying capital pool. This pool is then deployed across a diversified portfolio of reinsurance agreements – from health and property coverage to catastrophe risk – with yields generated by actual insurance premium flows.

This structure offers two crucial advantages:

- Yield generation from non-correlated assets: Unlike lending or staking in DeFi protocols that depend on crypto market cycles, reinsurance premium yields are tied to global insurance activity – providing diversification for digital asset holders.

- On-chain transparency: Every dollar of collateral and every premium payment is visible on-chain. Investors can track capital flows in real time, ensuring trust and regulatory compliance.

The Mechanics: From Stablecoin Staking to Insurance Premium Yield

The process begins when users deposit stablecoins (such as USDC or $USDe) into Re’s ICL smart contracts. In return, they receive tokenized receipts (reUSD/reUSDe) that entitle them to a proportional share of future reinsurance premium yield. The smart contract infrastructure ensures that all transactions – from deposits and withdrawals to premium distributions – are recorded immutably on the blockchain.

This model has attracted both institutional capital and DeFi-native investors seeking uncorrelated returns. Recent partnerships illustrate this momentum: Ethena Labs now allows holders of its $sUSDe and $USDe stablecoins to lock them as reserve capital supporting global insurers via Re’s protocol. Not only do participants earn a share of premium-derived yield, but they also receive up to 5x rewards on their locked $sUSDe tokens – amplifying incentives for long-term participation (source).

Top Benefits of Using Re Protocol for Decentralized Insurance

-

Direct Access to Real-World Insurance Yields: Re enables stablecoin holders to earn yields from actual reinsurance premiums, offering returns that are typically uncorrelated with traditional crypto and equity markets.

-

Transparent, On-Chain Operations: Every transaction, premium payment, and collateral deposit is recorded on the blockchain, ensuring real-time auditability and building trust among participants.

-

Diversified Reinsurance Exposure: Users can deploy stablecoins into portfolios covering diverse insurance sectors—including health, property, and catastrophe—spreading risk and enhancing portfolio resilience.

-

Institutional-Grade Partnerships: Collaborations with platforms like Ethena Labs allow stablecoin holders to lock assets such as $sUSDe and $USDe as reserve capital, earning additional rewards and supporting global insurance providers.

-

Bridging DeFi and Real-World Finance: By channeling crypto capital into essential insurance services, Re helps bridge the gap between decentralized finance and traditional markets, expanding the utility of stablecoins beyond speculation.

Pushing Blockchain Reinsurance Toward Mainstream Adoption

The implications go far beyond yield farming or passive income strategies. By connecting decentralized capital pools with regulated, real-world insurance markets through transparent smart contracts, protocols like Re are setting new standards for both risk management and investor participation.

This approach not only unlocks new sources of funding for insurers but also gives crypto holders an avenue to participate in the trillion-dollar global insurance industry without leaving the blockchain ecosystem. It’s a powerful demonstration of how tokenized assets can support essential financial infrastructure while delivering robust returns uncorrelated with traditional equities or fixed income.

As on-chain reinsurance platforms mature, they are rapidly evolving to serve a broader range of institutional and retail participants. The integration of stablecoins into insurance capital layers is not just a technical feat, it’s a strategic shift that makes insurance premium yield accessible, auditable, and programmable for anyone with access to DeFi tools.

Regulatory clarity is also improving, with protocols like Re operating under transparent frameworks that allow traditional insurers to tap into decentralized capital. This opens the door for major insurance carriers and alternative asset managers to allocate capital on-chain, diversifying their exposure while maintaining compliance and visibility into every transaction. The transparency inherent in blockchain reinsurance means that every dollar staked and every premium paid can be independently verified by both investors and regulators, ushering in an era of unprecedented trust.

Real-World Impact: Stablecoins Powering Insurance at Scale

The partnership between Ethena Labs and Re is a prime example of how these protocols are moving from proof-of-concept to large-scale deployment. By enabling $sUSDe holders to lock their assets as reserve capital for global insurers, and rewarding them with up to 5x yield multipliers, the collaboration demonstrates how crypto liquidity can directly support essential real-world services (source).

This model isn’t just about higher returns; it’s about resilience. Insurance premium yields are traditionally less volatile than crypto lending or staking rewards, making them attractive during periods of market uncertainty. As more protocols tokenize real-world assets (RWAs) such as insurance contracts, stablecoin holders gain access to diversified income streams while helping insurers manage risk more efficiently than ever before.

Five Ways On-Chain Reinsurance Transforms Stablecoin Utility

-

1. Direct Access to Real-World Insurance Yields: On-chain reinsurance protocols like Re allow stablecoin holders to earn yields sourced from actual insurance premiums, rather than relying solely on crypto-native lending or staking. This provides exposure to insurance markets traditionally reserved for institutional players.

-

2. Enhanced Transparency and Auditability: Every transaction, collateral deposit, and premium payment is recorded on-chain, enabling real-time, public auditability of insurance capital flows and reserves. This level of transparency is a significant leap over legacy reinsurance systems.

-

3. Diversification with Non-Correlated Returns: By connecting stablecoins to diversified reinsurance portfolios—covering risks like health, property, and catastrophe—protocols such as Re offer returns that are typically uncorrelated with crypto or traditional financial markets, helping users diversify their portfolios.

-

4. Real-World Impact Through Crypto Capital: Partnerships like Ethena Labs and Re enable stablecoin holders to allocate capital directly to support global insurance providers, bridging DeFi with essential real-world services and expanding the utility of stablecoins beyond speculation.

-

5. Incentivized Participation and Reward Multipliers: Protocols are introducing reward multipliers for stablecoin holders who lock their tokens as reinsurance capital. For example, Ethena users can receive up to 5x rewards for locking $sUSDe, boosting engagement and stablecoin demand.

For investors, this means:

- Access to new yield sources: Premium flows from health, property, and catastrophe insurance diversify portfolio risk.

- Enhanced transparency: Real-time auditability ensures confidence in capital allocation.

- Regulatory alignment: Protocols are building bridges with legacy finance rather than bypassing it.

The future trajectory is clear: as more institutional players enter the space and regulatory guardrails solidify, on-chain reinsurance will become a mainstay of both DeFi portfolios and traditional insurance balance sheets. Expect continued innovation around multi-collateral models (like OnRe’s ONyc), dynamic risk pricing, and automated claims handling, all powered by the programmability of smart contracts.

Takeaway for Insurance Professionals and Crypto Investors

If you’re an insurer seeking new sources of capital or a crypto investor looking for stable yields uncorrelated with broader markets, the emergence of on-chain reinsurance protocols like Re represents a watershed moment. By leveraging blockchain’s transparency and efficiency, these platforms are democratizing access to one of finance’s most conservative yet essential industries, while offering robust returns anchored in real-world economic activity.