For decades, reinsurance has operated behind closed doors. Complex contracts, opaque risk pools, and a reliance on intermediaries have made it challenging for investors and cedents alike to truly understand where their capital is going or how claims are managed. But the rise of on-chain reinsurance protocols is rapidly changing this landscape. Platforms like Re are leveraging blockchain’s transparency and programmability to bring unprecedented clarity, accessibility, and efficiency to the world of insurance risk transfer.

How On-Chain Reinsurance Protocols Like Re Work

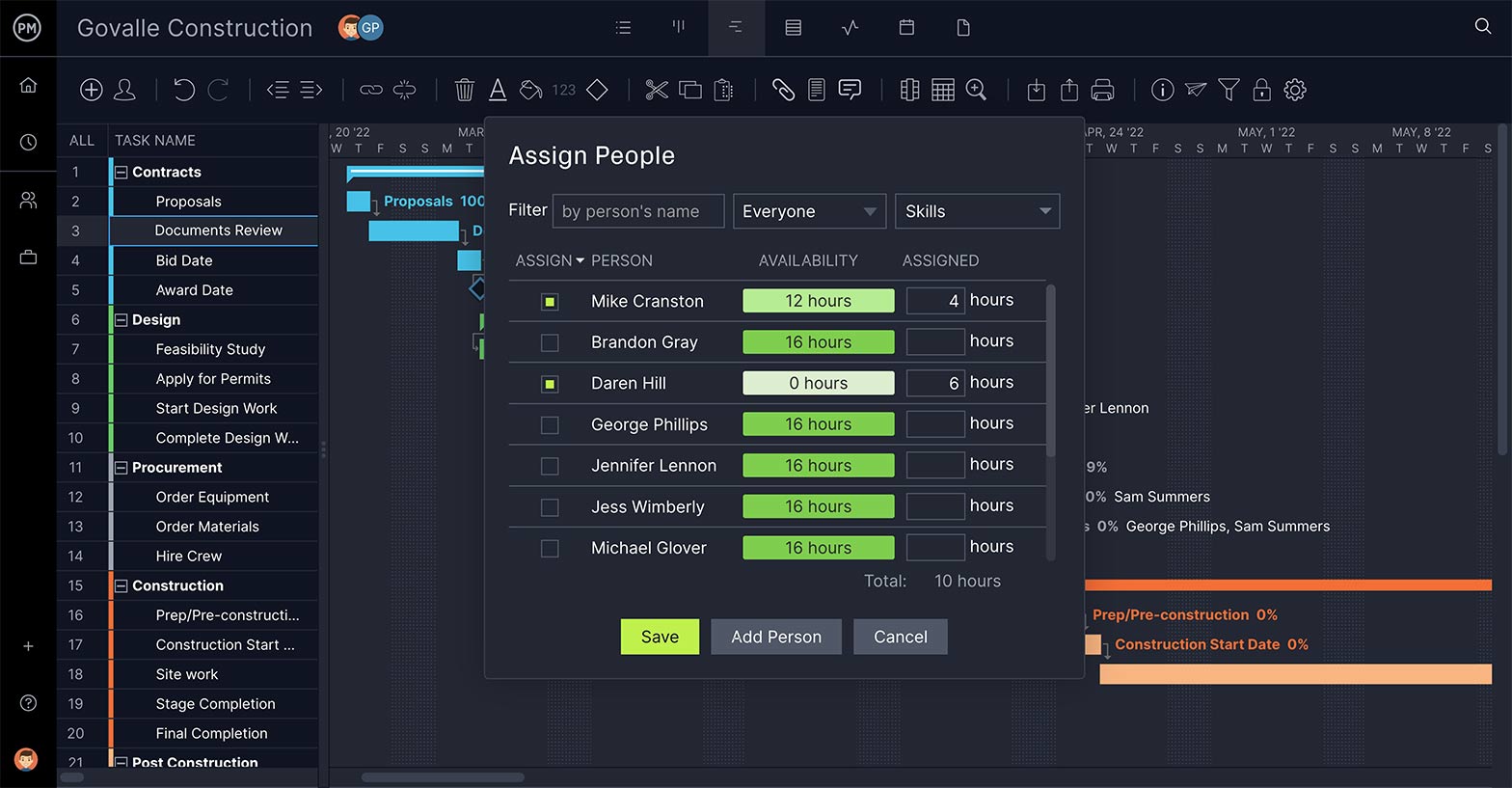

The core innovation behind Re lies in its use of smart contracts to connect capital directly to insurance programs. Rather than routing funds through layers of brokers and retrocessionaires, participants can stake stablecoins directly into Re’s Insurance Capital Layer (ICL) contracts. In return, they receive tokenized representations of their investment:

- reUSD: A principal-protected, low-volatility token designed for those seeking stable DeFi reinsurance yield.

- reUSDe: A profit-sharing, first-loss token that offers higher upside potential in exchange for taking on more risk.

This structure democratizes access to an asset class that was previously reserved for large institutional players. Now, anyone with stablecoins can gain exposure to real-world insurance yield – all while enjoying the benefits of blockchain insurance transparency.

The Transparency Revolution: Blockchain as a Trust Engine

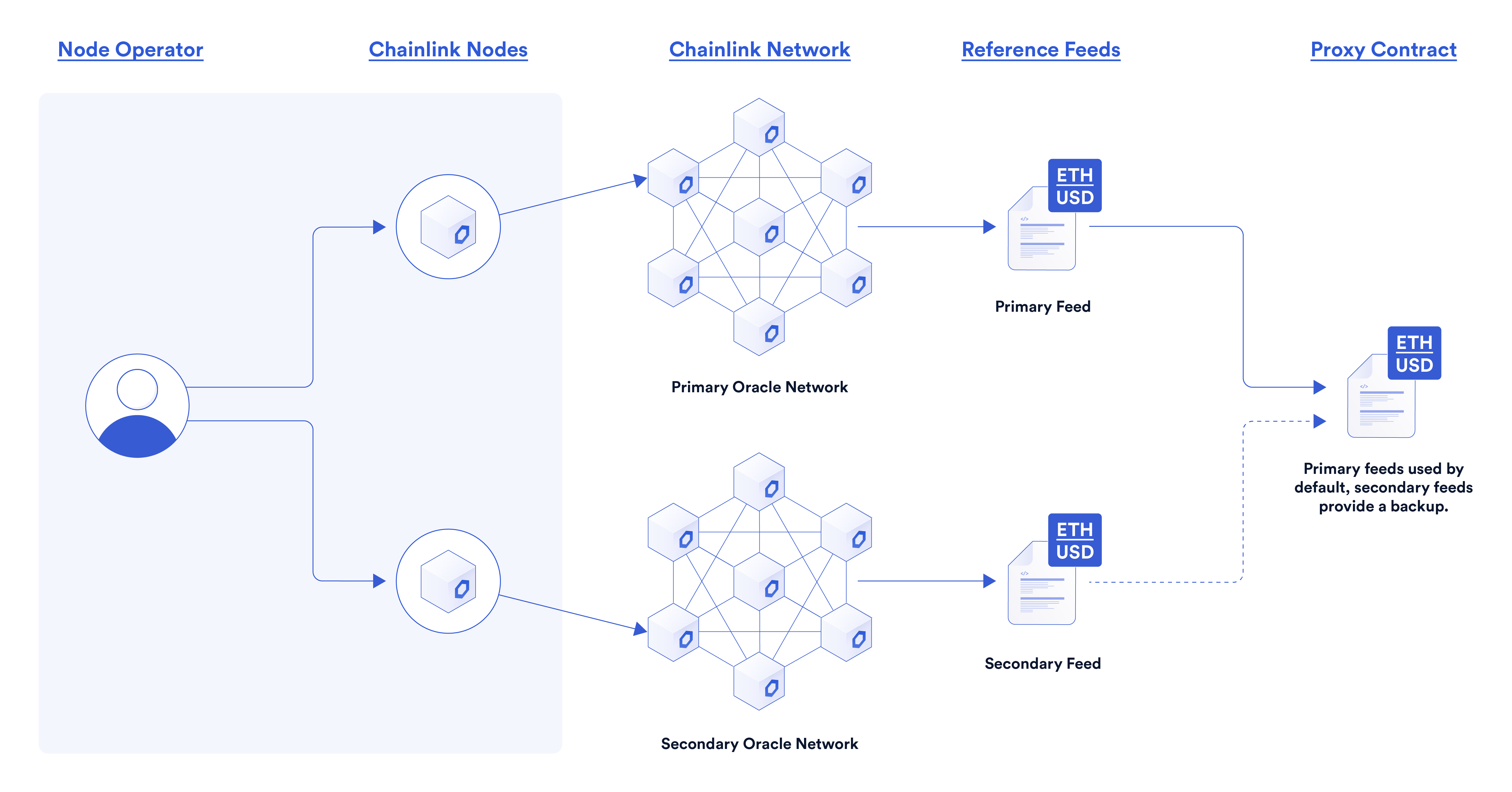

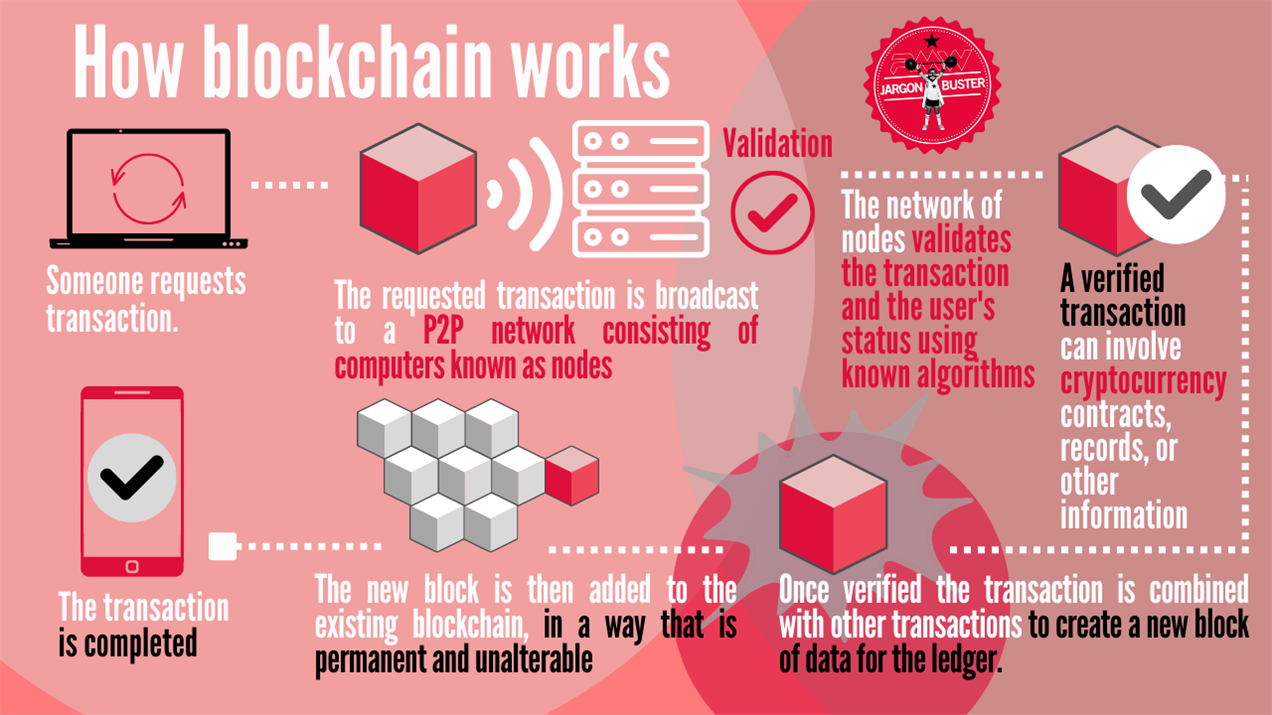

The true game-changer is not just tokenization but the radical transparency embedded at every step. Every transaction – from capital deployment under surplus notes to premium inflows and claim outflows – is recorded on-chain and made publicly auditable. This data is hashed and pushed to Chainlink oracles, ensuring 24/7 proof-of-funds for all participants.

This approach eliminates blind spots that have historically plagued traditional reinsurance markets. Investors can monitor trust account balances in real time, while insurers benefit from more efficient collateral management. For regulators and auditors, immutable records mean greater oversight with less manual reconciliation.

Key Features of Re’s On-Chain Reinsurance Protocol

-

Capital Staking & Tokenization: Users can stake stablecoins into Re’s Insurance Capital Layer (ICL) smart contracts and receive yield-bearing tokens like reUSD (principal-protected) and reUSDe (profit-sharing, first-loss), providing direct exposure to reinsurance-backed contracts.

-

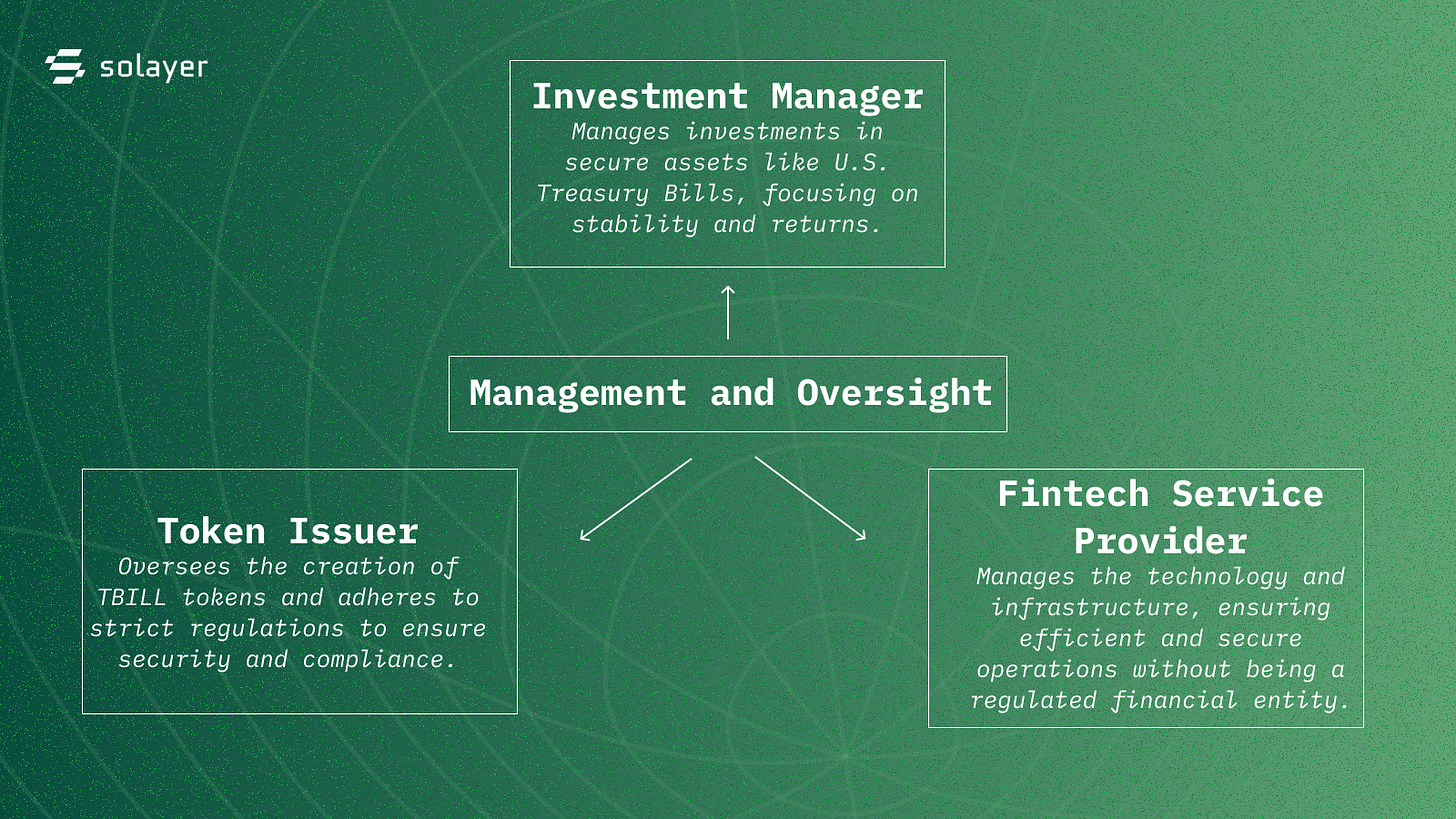

Intelligent Deployment via Surplus Notes: Staked capital is deployed through legally binding Surplus Notes to vetted reinsurers, with funds held in U.S.-domiciled trust accounts. Trust balances and fund flows are hashed and published on-chain for transparency.

-

Liquidity & Redemption Logic: reUSD offers instant liquidity up to a set NAV percentage, while reUSDe features quarterly redemption windows. Redemption requests auto-roll and continue to earn yield until fulfilled.

-

Transparency & Risk Management: Chainlink Oracles publish real-time data on trust balances, price feeds, and redemption queues. Regular third-party audits and multi-signature wallets enhance security and operational integrity.

-

Participant Benefits: Access to institutional-grade reinsurance yields, flexible token options for different risk profiles, token composability for DeFi collateral, and real-time on-chain monitoring of balances and collateral.

Liquidity Meets Security: Redemption Logic in Action

On-chain protocols like Re are also tackling one of the thorniest issues in insurance finance: liquidity management. For example, reUSD holders enjoy instant liquidity up to an actuarially-set threshold based on Net Asset Value (NAV), with scheduled windows for larger redemptions. Meanwhile, reUSDe investors participate in quarterly redemption cycles where actuaries release surplus after careful review.

If redemption requests exceed available liquidity during a window, they automatically roll over to the next period – continuing to earn yield until settled. This system balances investor flexibility with the need for prudent risk management within fully collateralized trust structures.

Unpacking the Benefits: Access, Composability and Real-Time Oversight

The implications go far beyond just efficiency gains or cost savings. By integrating blockchain technology into the heart of reinsurance operations:

- Breadth of Access: Tokenized insurance products open doors for both retail users and institutions previously sidelined by high entry barriers.

- Composability: These tokens can be used as collateral across various DeFi venues – multiplying their utility within a broader Web3 ecosystem.

- Real-Time Monitoring: Participants can track portfolio balances and collateral status live on-chain rather than waiting weeks for statements or audits.

This new paradigm marks a dramatic shift from legacy systems where information asymmetry often led to mispricing or mismanagement of risk. Instead, platforms like Re are placing transparency at the center of every transaction – ushering in an era where trust is built not by reputation alone but by cryptographic proof visible to all stakeholders.

As the on-chain reinsurance ecosystem matures, protocols like Re are not only reshaping how risk is transferred but also redefining what it means to participate in insurance markets. The convergence of smart contracts, oracles, and real-time data feeds empowers both capital providers and insurance program managers to operate with a level of confidence and agility previously unattainable.

Institutional-Grade Innovation: Yield, Security, and Regulatory Alignment

Recent developments have seen Re expand its offerings for institutional investors, launching new yield products such as reUSD (Basis-Plus) and reUSDe. These tokens are backed by fully collateralized insurance programs, providing access to uncorrelated yield that is distinct from broader crypto market volatility. The use of U. S. -domiciled trust accounts for collateral ensures regulatory compliance and enhances security for all participants.

Integration with Chainlink further strengthens this value proposition by powering on-chain Net Asset Value (NAV) calculations. This enables transparent, tamper-proof monitoring of fund health, a critical requirement for both institutional due diligence and retail user confidence.

Top Reasons Institutions Adopt On-Chain Reinsurance Protocols

-

Unprecedented Transparency via Blockchain: On-chain reinsurance protocols like Re record every transaction and fund movement on public blockchains. This allows institutions to audit capital flows, premium payments, and claims in real time, reducing information asymmetry and building trust.

-

Direct Access to Real-World Insurance Yield: Platforms such as Re enable institutional investors to participate in reinsurance markets by staking stablecoins and receiving yield-bearing tokens like reUSD and reUSDe. This provides exposure to uncorrelated, low-volatility returns previously reserved for specialized reinsurers.

-

Efficient, Automated Operations with Smart Contracts: Smart contracts automate key processes—capital deployment, premium collection, claim payouts, and redemptions—minimizing manual intervention and operational risk. This leads to faster settlements and lower administrative costs.

-

Robust Risk Management and Security: Protocols like Re utilize Chainlink oracles for real-time data feeds, multi-signature wallets for critical actions, and regular third-party audits. These features enhance security, transparency, and operational integrity for institutional participants.

-

Flexible Liquidity and Redemption Options: Institutional investors benefit from instant liquidity (up to actuarially-set NAV percentages) with reUSD and scheduled redemptions for reUSDe. This flexibility allows for tailored risk management and portfolio optimization.

-

Composability and Integration with DeFi Ecosystems: Yield-bearing tokens from on-chain reinsurance protocols can be used as collateral in decentralized finance (DeFi) venues, unlocking further utility and yield opportunities for institutions.

Challenges and Forward Momentum: What’s Next for On-Chain Reinsurance?

No transformation comes without hurdles. While platforms like Re have made significant strides in bridging blockchain technology with traditional insurance infrastructure, some challenges remain:

- Education Gap: Many insurance professionals are still learning how smart contracts and tokenized insurance products function in practice.

- Regulatory Evolution: As adoption grows, regulators will need to evolve frameworks to account for the transparency, and unique risks, of DeFi-based reinsurance models.

- Ecosystem Maturity: Interoperability between different protocols and blockchains will be crucial for scaling liquidity and risk capacity globally.

The pace of innovation is rapid. With initiatives like OnRe integrating Chainlink oracles for NAV transparency (OnRe Finance) and Falcon Finance launching multi-million dollar on-chain insurance funds, the foundation is being laid for a more open, efficient, and resilient risk transfer marketplace.

Why Blockchain Insurance Transparency Matters Now

The legacy reinsurance industry’s opacity has long been a barrier to efficiency and trust. By contrast, on-chain platforms make every capital flow traceable, from initial staking through surplus note deployment to claims settlement, all visible on public ledgers. This isn’t just a technical upgrade; it’s a philosophical one that aligns incentives across cedents, reinsurers, investors, and regulators alike.

The result? Lower operational costs due to automation. More accurate pricing thanks to real-time data feeds. And most importantly, a level playing field where anyone can verify the integrity of the system at any time.

The future of risk transfer is being written in open code rather than closed boardrooms. As protocols like Re continue to refine their models, prioritizing transparency through smart contracts, oracles, audits, and robust redemption logic, the global insurance sector stands poised for its most profound transformation in generations.