For decades, reinsurance has operated as a gated market, its $1 trillion in annual premiums largely the domain of major institutions with the capital and regulatory muscle to participate. But blockchain technology is fundamentally changing this equation. By leveraging smart contracts, tokenization, and decentralized protocols, innovators are dismantling long-standing barriers and democratizing access to reinsurance yields for a broader spectrum of investors.

From Closed Club to Open Protocols: The Shift in Reinsurance Access

The traditional reinsurance market is characterized by high entry thresholds and opaque processes. Capital providers must navigate complex legal structures, endure lengthy settlement cycles, and accept limited transparency into underlying risks. This has historically limited participation to a handful of global reinsurers and institutional asset managers.

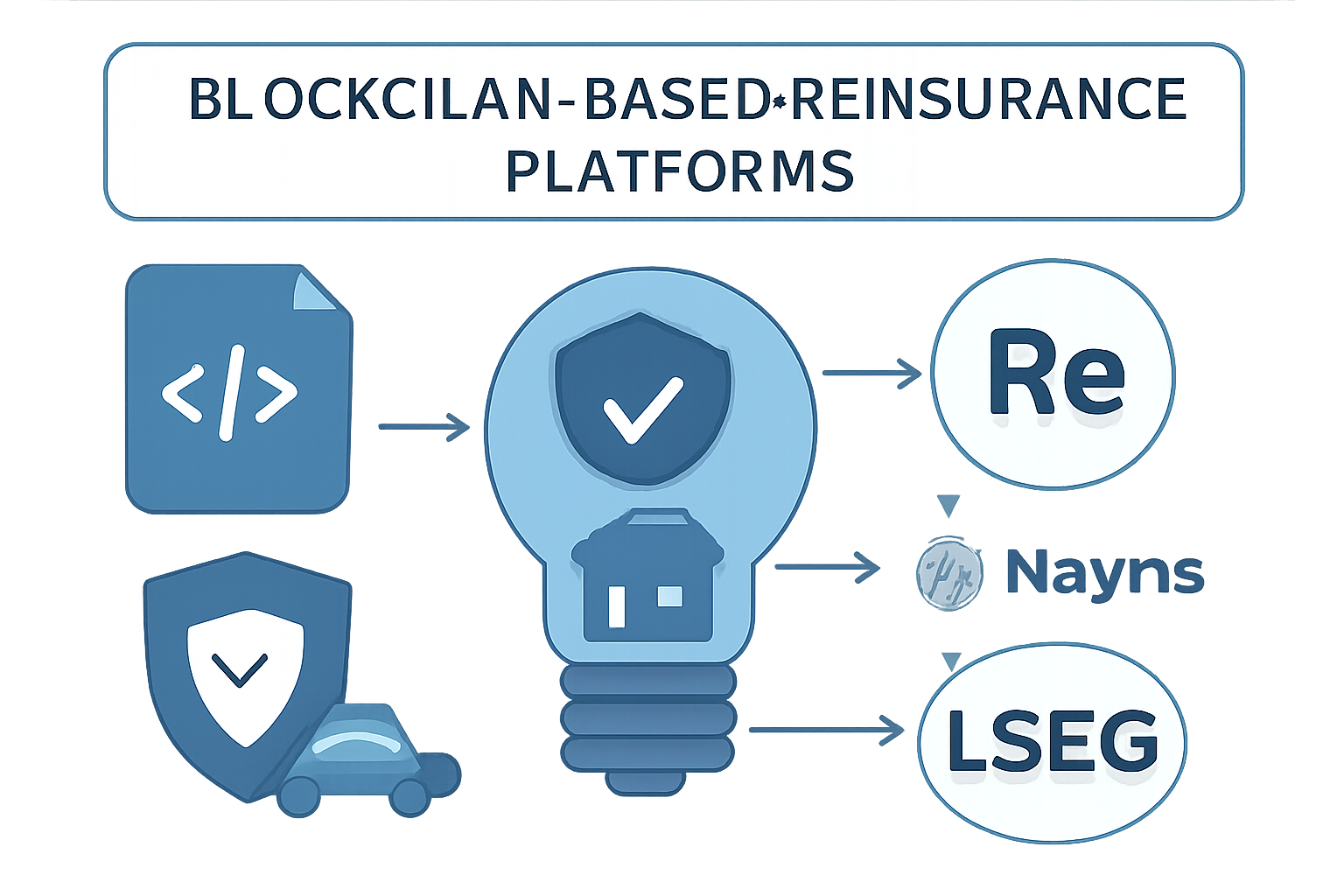

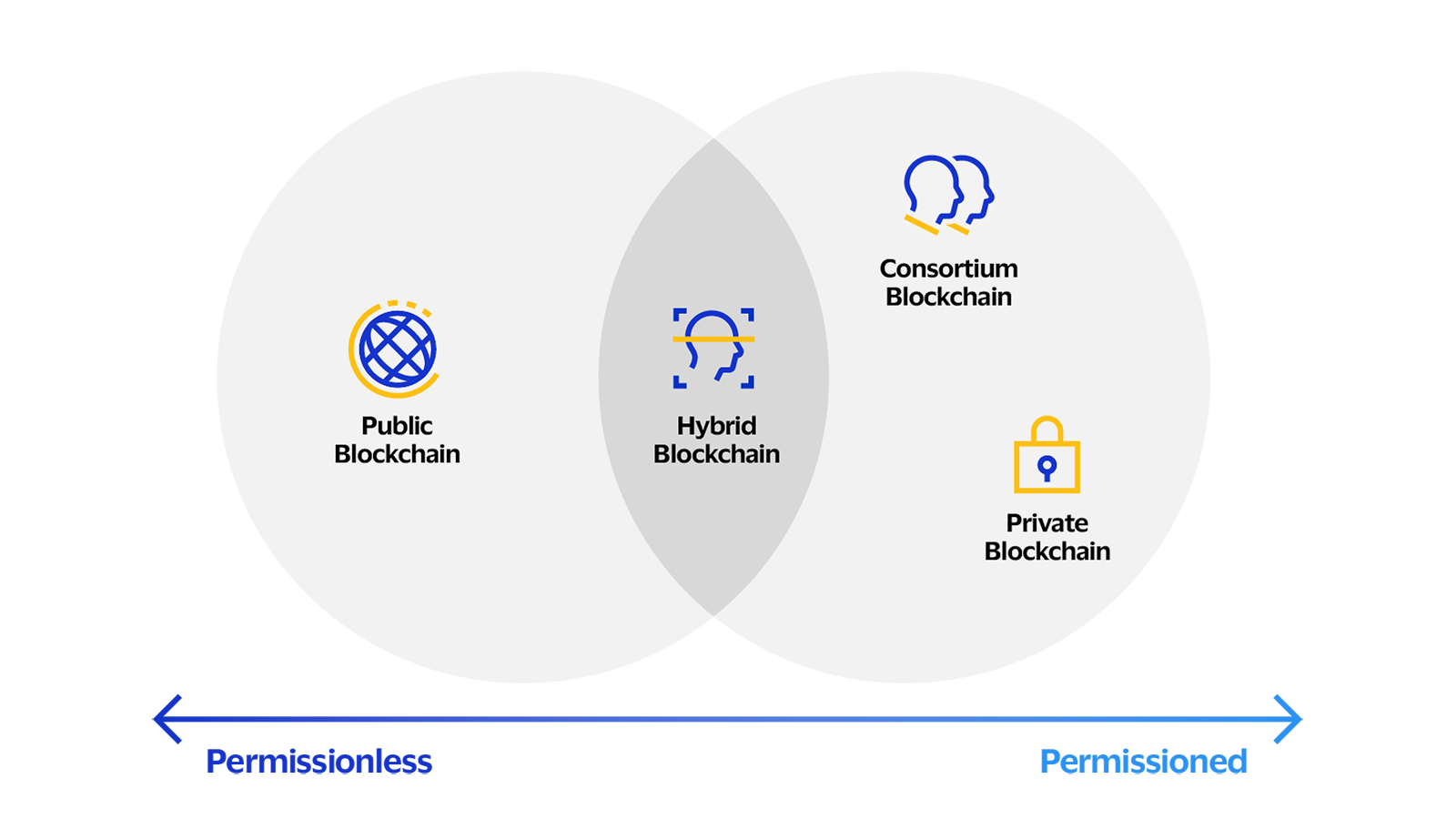

Blockchain-powered platforms are upending this status quo. By embedding insurance contracts directly onto public ledgers, platforms like Re are enabling real-time access to insurance premiums as an alternative yield source. These on-chain structures automate claims processing, collateral management, and premium flow through smart contracts – reducing operational friction while boosting transparency for all participants.

The Rise of Decentralized Reinsurance Protocols

Several pioneering protocols are reshaping the landscape:

- Re Protocol: Built on Avalanche, Re bridges DeFi capital with global reinsurance demand via transparent, collateral-backed structures. It gives both crypto-native and traditional investors direct exposure to insurance risk through tokenized contracts.

- Nayms: By introducing the NAYM token for decentralized governance and staking, Nayms enables participants of all sizes to join insurance syndicates previously reserved for large institutions. Their focus on real-world asset (RWA) tokenization aligns with the growing appetite for uncorrelated yield in DeFi portfolios.

- LSEG Digital Markets: The London Stock Exchange Group’s recent adoption of blockchain-based infrastructure allows asset managers like MembersCap to raise capital efficiently for private reinsurance funds – a pivotal step toward mainstream acceptance of decentralized finance in insurance-linked securities.

This wave of innovation is not just theoretical; it’s already being deployed at scale. For example, Re’s platform currently supports approximately $168 million across low-volatility US lines (source). This demonstrates both institutional buy-in and real-world traction for blockchain-enabled reinsurance models.

The New Value Proposition: Transparency, Efficiency, and Real Yield

The strategic advantages of on-chain reinsurance extend far beyond improved access:

- Transparency: Every transaction is immutably recorded on-chain, providing full auditability for regulators, investors, and counterparties alike.

- Operational Efficiency: Smart contracts automate policy lifecycle events – from premium collection to claims payout – slashing administrative costs compared to legacy systems.

- Diversified Yield Streams: Tokenized exposure to insurance premiums offers uncorrelated returns that are especially attractive during periods of market volatility or low interest rates elsewhere.

This shift also helps insurers themselves by broadening their capital base and enhancing risk resilience. With more participants able to provide collateral via DeFi rails or regulated digital asset accounts (such as Bermuda-segregated structures), the entire ecosystem becomes more robust against systemic shocks.

Institutional acceptance is accelerating as more regulated, blockchain-native products come to market. The recent launch of Re’s on-chain yield products on Avalanche, for example, gives institutional investors a direct route to participate in fully collateralized, low-volatility insurance programs. These offerings are not just theoretical; they are structured to deliver potential returns of up to 36.5%, derived from real-world insurance premiums, an attractive proposition in a landscape where traditional yields are increasingly compressed.

Meanwhile, the use of Bermuda-regulated segregated account structures enables compliant participation for global investors. This regulatory clarity is crucial as it ensures that on-chain reinsurance protocols can scale without running afoul of cross-border legal constraints. The London Stock Exchange Group’s (LSEG) blockchain-based infrastructure further validates the trend: its adoption by MembersCap to raise capital for reinsurance funds demonstrates that even legacy institutions see the benefits of tokenized risk transfer and instant settlement cycles (source).

“Blockchain-based reinsurance is not just about access, it’s about aligning incentives and reducing systemic risk through radical transparency. “

What Comes Next: Scaling On-Chain Reinsurance Globally

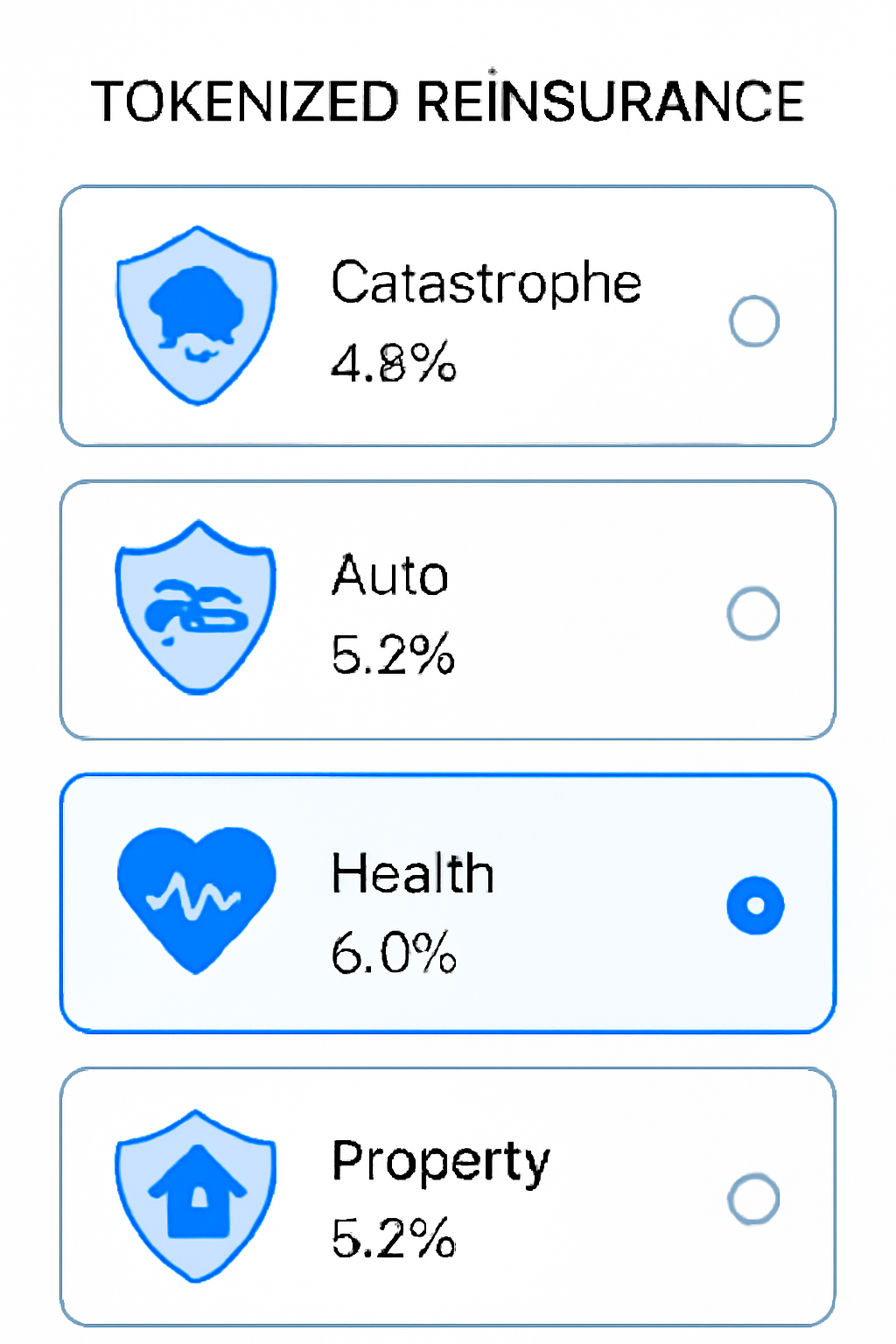

As platforms like Re Protocol and Nayms mature, expect rapid scaling in both deal volume and diversity of supported insurance lines. Tokenized reinsurance arrangements are already showing traction in catastrophe-light U. S. segments, but the long-term vision is much broader: global coverage across property, casualty, specialty lines, and even ESG-linked risks.

The next phase will likely see deeper integration with DeFi primitives, think permissionless liquidity pools backing insurance contracts or automated risk tranching via smart contracts. With growing appetite for real yield in crypto and traditional markets alike, tokenized reinsurance stands out as a rare source of uncorrelated returns backed by tangible economic activity.

For investors seeking diversification beyond equities or bonds, the blockchain reinsurance market offers exposure to a $1 trillion pool previously locked behind institutional gates. As more protocols achieve regulatory compliance and enhance transparency through public ledgers, expect further inflows from both crypto-native funds and traditional allocators searching for stable yield.

Strategic Considerations for Market Participants

The democratization of access does not eliminate risk, instead it demands greater diligence from all parties involved. Investors must assess protocol security, collateralization standards, claims automation mechanisms, and underlying portfolio quality before allocating capital to on-chain structures.

- Due Diligence: Scrutinize smart contract audits and regulatory status.

- Diversification: Spread exposure across multiple protocols or insurance lines.

- Liquidity: Understand lock-up periods and secondary market options for tokenized positions.

The most successful participants will be those who combine rigorous risk management with an appetite for innovation, leveraging data-rich blockchains to make smarter allocation decisions in real time.

The bottom line: Blockchain is no longer simply a tool for speculation, it’s rapidly becoming a foundational layer for real-world financial infrastructure. In the context of on-chain reinsurance, this means unlocking new sources of yield while driving greater efficiency and resilience across the entire insurance value chain. The future belongs to those who can navigate this convergence of DeFi technology and legacy finance, and capitalize on the opportunities it creates.