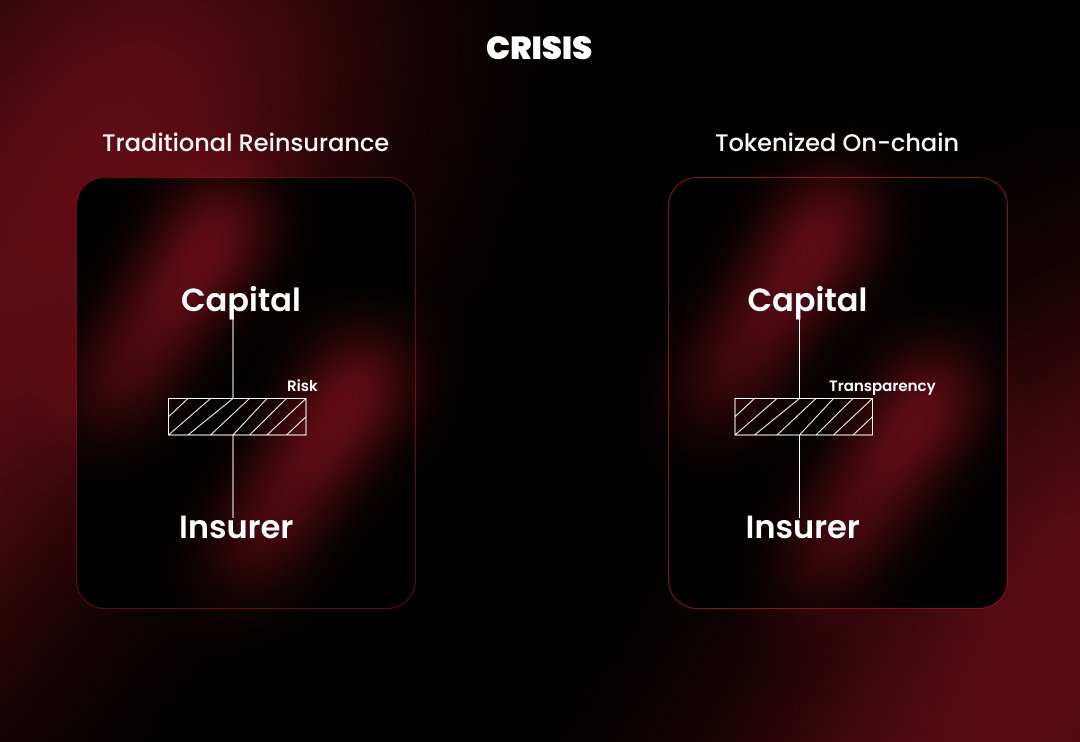

Blockchain tokenization is rapidly redefining access to reinsurance markets, introducing a new era of liquidity, transparency, and investor inclusivity. Historically, reinsurance has been a domain reserved for large institutions, hindered by high capital thresholds and opaque processes. Today, on-chain reinsurance protocols are lowering the drawbridge, enabling both insurers and a broader spectrum of investors to participate in risk transfer with unprecedented efficiency.

Unlocking Liquidity Through Fractional Reinsurance Investment

Traditional reinsurance contracts are illiquid, often requiring multi-year commitments and significant upfront capital. Blockchain tokenization solves these pain points by converting reinsurance contracts into digital tokens that can be fractionally owned and traded. This shift enables investors to buy or sell portions of risk pools on secondary markets, dramatically improving liquidity and making reinsurance an accessible asset class. The impact is profound: not only does this broaden participation beyond institutional giants, but it also provides insurers with faster access to diversified capital.

For example, platforms like Re and SurancePlus have launched tokenized reinsurance funds on public blockchains, allowing investors to hold digital shares that represent real insurance portfolio exposures. This model directly links returns to actual premium flows and claim outcomes, aligning incentives across all participants. As a result, both primary insurers and investors benefit from more dynamic risk-sharing arrangements.

Lower Barriers and Diversified Opportunities for Investors

One of the most significant advances brought by blockchain reinsurance tokenization is the reduction of entry barriers. Previously, the minimum investment size in reinsurance was prohibitive for all but the largest players. Tokenization divides these exposures into smaller units, enabling accredited investors to participate with far less capital while still gaining exposure to insurance risk premiums.

Key Benefits of Fractional Reinsurance Investment

-

Enhanced Liquidity and Market Accessibility: Tokenization enables fractional ownership of reinsurance contracts, allowing investors to buy and sell portions of reinsurance assets more freely. This increased liquidity democratizes access, making reinsurance investments available to a broader range of participants beyond traditional institutional investors.

-

Lower Barriers to Entry for Investors: By dividing reinsurance contracts into smaller, more affordable digital tokens, tokenization reduces the capital requirements for participation. This opens up reinsurance as an asset class to accredited investors who previously could not meet the high minimums of traditional reinsurance deals.

-

Improved Transparency and Operational Efficiency: Blockchain technology ensures all transactions are recorded on an immutable ledger, providing real-time visibility into contract performance. Smart contracts automate premium collection, claims payouts, and profit distribution, reducing administrative overhead and error rates.

-

Diversified Investment Opportunities: Tokenized reinsurance offers exposure to a new asset class that is uncorrelated with traditional financial markets. Investors can select tokens with different risk-return profiles, enhancing portfolio diversification and resilience against market volatility.

-

Broader Capital Access for Insurers: By tapping into a global pool of accredited investors through tokenization, insurers can expand their capital base more efficiently. This can improve risk-sharing and enable more competitive pricing for end policyholders.

-

Industry Adoption by Leading Platforms: Established players such as SurancePlus (Oxbridge Re Holdings) and Zoniqx, Re (on Avalanche), and Schroders Capital with Hannover Re have launched real-world tokenized reinsurance initiatives, demonstrating the viability and growing acceptance of this model in the market.

This democratization supports portfolio diversification strategies. Tokenized insurance risk is largely uncorrelated with traditional asset classes such as equities or bonds, providing a potential hedge against broader market volatility. Investors can now select from a spectrum of risk-return profiles, ranging from low-volatility tokens backed by stable portfolios to higher-yield opportunities that assume greater underwriting risk.

Transparency and Efficiency: Transforming Trust in Reinsurance

Transparency has long been a challenge in legacy reinsurance markets. Blockchain’s immutable ledger architecture ensures every transaction – from premium payments to claim settlements – is recorded in real time and accessible to all permissioned stakeholders. Smart contracts further automate key processes such as premium collection, claims adjudication, and profit distribution.

“Tokenization isn’t just about digitizing assets, it’s about fundamentally changing how we trust and transact in insurance markets. “

The operational efficiency gains are substantial: reduced administrative overheads mean lower costs for insurers and faster payouts for policyholders. This transparency also builds trust among investors who can independently verify contract performance without relying solely on intermediaries or opaque reporting structures.

Pioneering Case Studies in On-Chain Reinsurance

The real-world impact of blockchain-enabled reinsurance is already visible through several industry partnerships and pilots:

- SurancePlus and Zoniqx: Jointly deploying tokenized contracts to revolutionize capital access for primary insurers.

- Re’s Avalanche Fund: Creating decentralized alternatives to legacy syndicates by pooling investor capital directly into blockchain-backed risk pools.

- Schroders Capital and Hannover Re: Piloting digital ILS management systems that streamline secondary trading and settlement.

This wave of innovation signals that tokenized reinsurance is not merely theoretical; it’s actively reshaping how risk is financed and managed globally. For a deeper technical dive into implementation strategies, see our detailed guide at Tokenization of Reinsurance Contracts: Benefits and Implementation Strategies.

Despite the clear advantages, the transition to on-chain reinsurance isn’t without hurdles. Regulatory uncertainty remains a top concern, with global jurisdictions struggling to keep pace with the innovation in insurance risk tokenization. Compliance with KYC/AML requirements, investor accreditation, and securities laws varies markedly between regions, adding complexity to cross-border participation. To address these challenges, leading platforms are investing in robust governance frameworks and third-party smart contract audits to ensure both security and compliance standards are met.

Risk Management, Security, and Institutional Confidence

Security is paramount in decentralized reinsurance pools. The integrity of smart contracts and the underlying blockchain infrastructure must be uncompromising, as any vulnerability could undermine trust and expose participants to losses. Regular code audits, transparent governance, and insurance against smart contract failure are becoming industry best practices. Notably, some protocols have begun to offer on-chain proof of reserves and real-time solvency metrics, allowing investors to verify the health of risk pools at any moment.

For insurers, the ability to tap into a global pool of capital via on-chain protocols can dramatically improve solvency ratios and risk-adjusted capital efficiency. Tokenization also allows for more precise risk segmentation, enabling insurers to structure bespoke reinsurance layers that align with their unique exposures. This granular approach to risk transfer is simply not feasible in the traditional market structure.

Strategic Implications for Market Participants

The strategic calculus for both investors and insurers is shifting. For investors, fractional reinsurance investment offers an attractive source of yield that is largely insulated from macroeconomic shocks affecting equities or fixed income. For insurers, on-chain reinsurance protocols provide a flexible, transparent alternative to traditional treaty arrangements, supporting faster capital deployment and more responsive risk management.

“On-chain reinsurance is not a replacement for legacy markets, it’s a parallel system that brings unprecedented optionality, efficiency, and transparency to risk transfer. “

As adoption accelerates, expect the emergence of new secondary markets for trading tokenized reinsurance exposures, further enhancing liquidity and price discovery. The convergence of DeFi infrastructure with insurance risk will likely attract a new breed of quantitative investors, algorithmic trading strategies, and even retail capital, provided regulatory clarity continues to improve.

Ultimately, the winners in this new landscape will be those who embrace rigorous risk management, leverage transparent on-chain data, and remain adaptable to evolving regulatory standards. The maturation of on-chain reinsurance protocols marks a pivotal shift for both the insurance industry and the broader capital markets, one that rewards innovation grounded in robust governance and measurable results.