In 2025, the landscape of on-chain reinsurance is being fundamentally reshaped by the integration of Chainlink Proof of Reserve (PoR). As institutional capital flows into decentralized insurance protocols, market participants are demanding not just robust security, but also real-time, verifiable transparency around collateral that backs reinsurance contracts. Gone are the days of opaque quarterly reports and trust-based systems – today’s protocols need cryptographic proof that collateral exists, is sufficient, and is accessible at all times.

Why Collateral Transparency Is Non-Negotiable in On-Chain Reinsurance

Traditional reinsurance relies on centralized audits and delayed disclosures. This model leaves investors and cedents exposed to hidden risks – from undercollateralization to outright fraud. In DeFi, where capital moves at internet speed and risk can be instantly repriced, such latency is unacceptable. Real-time on-chain collateral verification has become a baseline expectation for both institutional and retail participants.

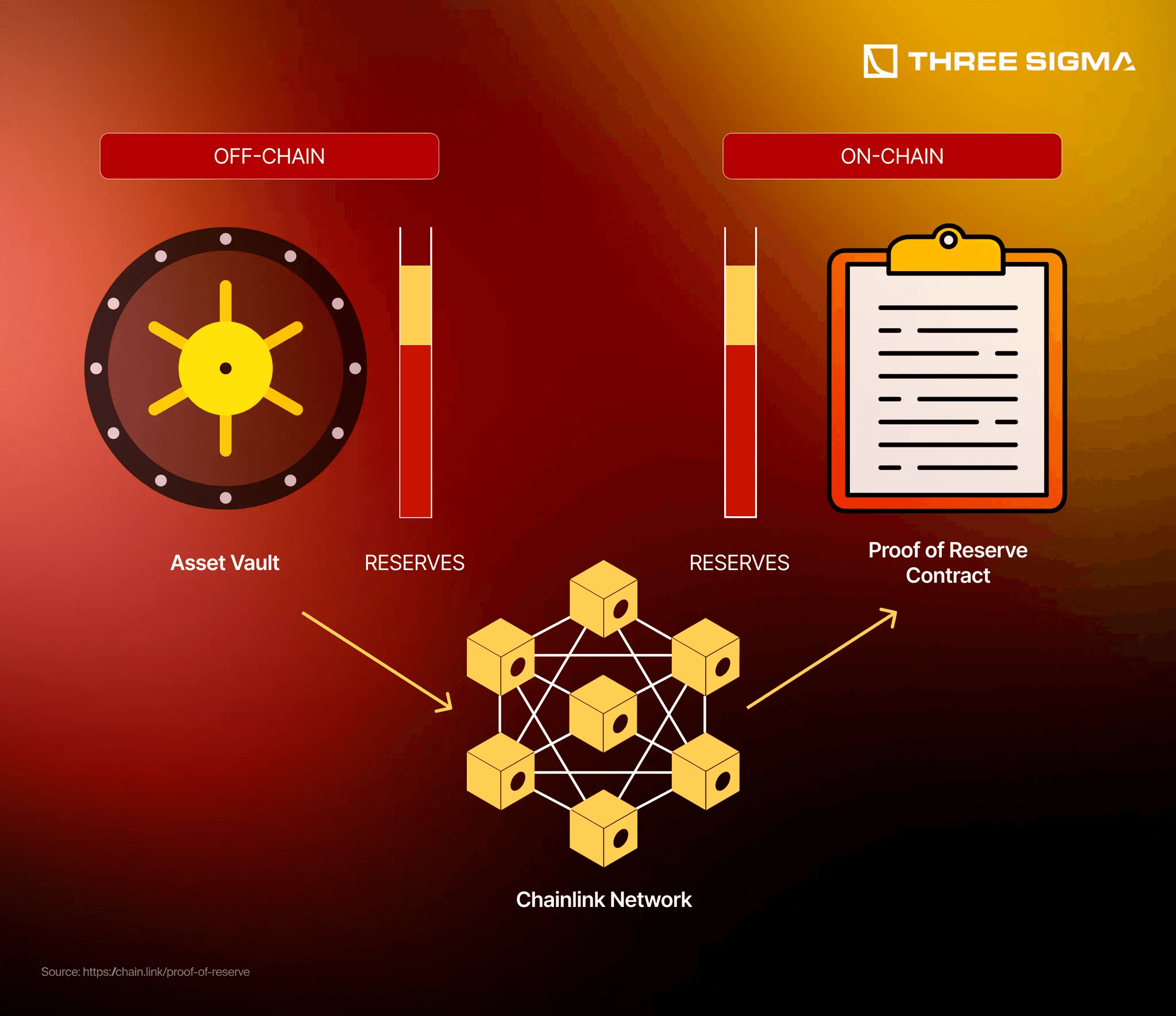

This is where Chainlink PoR comes in. By leveraging a decentralized oracle network, Chainlink PoR enables protocols like Re to continuously verify that off-chain assets backing reinsurance contracts are fully accounted for. The result? No more blind trust – only mathematically enforced assurance.

The Mechanics: How Chainlink Proof of Reserve Works for Reinsurance Protocols

Chainlink PoR operates as a bridge between off-chain reserves (such as fiat or securities held by custodians) and on-chain smart contracts. Here’s how it secures the new generation of blockchain reinsurance:

- Data Sources: Chainlink nodes fetch reserve data directly from trusted custodians or financial institutions holding the collateral.

- Decentralized Validation: Multiple independent oracles cross-verify reported balances to minimize single points of failure or manipulation.

- On-Chain Publishing: The validated reserve data is written directly onto the blockchain, making it accessible to anyone in real time.

- Automated Responses: Smart contracts can be programmed to react instantly if collateral falls below required thresholds – pausing policies or triggering claims as needed.

This system has been adopted by leading decentralized reinsurance platforms like Re, which integrated Chainlink PoR to provide continuous proof that all their on-chain contracts are fully backed by real-world assets. This leap forward not only boosts confidence among capital providers but also sets a new industry standard for transparency and auditability.

The Market Impact: $13.99 LINK Price Underscores Growing Demand

The adoption of Chainlink PoR across financial products has had ripple effects throughout the crypto markets. As of November 16,2025, Chainlink (LINK) trades at $13.99, reflecting steady demand amid its expanding utility in DeFi insurance and beyond. This price stability underscores investor confidence in Chainlink’s infrastructure as critical middleware for secure blockchain applications.

The significance goes beyond price charts: with every integration – from Crypto Finance’s ETP custody verification to Re’s decentralized reinsurance pools – more capital can confidently enter DeFi insurance markets knowing that reserves are visible and verifiable at all times. For a deeper look into how this technology powers transparent on-chain reinsurance collateral, see our dedicated guide: How Chainlink Proof of Reserve Powers Transparent On-Chain Reinsurance Collateral.

The End of Opaque Trust Accounts: Automation Meets Assurance

Pioneers like Re are moving away from periodic trust account statements toward a future where every stakeholder – from insurers to policyholders to regulators – can independently verify collateralization status with a few clicks or API calls. This shift isn’t just technical; it’s philosophical. It aligns with the core ethos of decentralized finance: replacing subjective trust with objective truth enforced by code and cryptography.

Automated collateral verification, powered by Chainlink PoR, means reinsurance protocols can offer continuous assurance without human bottlenecks. Smart contracts instantly react to any deviation in reserve levels, enforcing risk controls that are both transparent and tamper-proof. This is a seismic upgrade from legacy systems, where delayed reporting could mask insolvency or mismanagement for months.

The implications for risk management are profound. With real-time data feeds, capital providers can set programmatic exposure limits that automatically adjust based on the latest reserve status. Insurers and cedents gain confidence that claims will be honored even during market volatility, while regulators can audit collateralization without waiting for end-of-quarter disclosures.

Programmatic Risk Management: How DeFi Insurance Benefits

The programmability of on-chain reinsurance unlocks new possibilities for both product design and compliance. For example:

- Dynamic Premiums: Insurance pools can adjust premiums in real time based on up-to-the-minute collateral ratios.

- Instant Claims: Claims processing is automated, if reserves are sufficient, payouts happen instantly with no manual intervention.

- Transparent Audits: Anyone can independently verify reserve status at any time, improving trust across the value chain.

This level of automation and transparency is only possible because of decentralized oracle solutions like Chainlink PoR. The result is a more resilient insurance sector that’s open to global participants, not just those with access to privileged information or legacy infrastructure.

Looking Ahead: A New Standard for Blockchain Reinsurance Security in 2025

The integration of Chainlink Proof of Reserve into leading protocols such as Re signals a paradigm shift in how reinsurance markets operate. By combining the security guarantees of blockchain with automated, real-time collateral verification, the industry is moving toward a future where decentralized insurance transparency is the norm rather than the exception.

This evolution isn’t just theoretical, it’s operational today. As more platforms adopt PoR-based models and as the price of LINK remains robust at $13.99, expect further institutional adoption and cross-market integrations. For those interested in exploring technical details or implementation strategies, our comprehensive resources cover every aspect of this transformation: How On-Chain Collateral Transparency Is Transforming Reinsurance With Chainlink Proof of Reserve.

The bottom line? In 2025 and beyond, trust will be built not on reputation but on verifiable code and cryptographic proof. As on-chain reinsurance matures, Chainlink Proof of Reserve stands out as an indispensable pillar securing both capital efficiency and market integrity for the next generation of decentralized risk transfer.