For DeFi traders in 2025, the landscape of risk management is evolving at a breakneck pace. As regulatory scrutiny intensifies and market volatility remains a constant, on-chain reinsurance has emerged as a cornerstone for safeguarding capital and optimizing yield strategies in decentralized finance. Leveraging blockchain’s transparency, automation, and real-time data, on-chain reinsurance is not just reshaping how risks are transferred but redefining what’s possible for crypto-native investors seeking both protection and performance.

Tokenization of Reinsurance Assets: A New Layer of Diversification

The introduction of tokenized reinsurance assets is one of the most significant advances in crypto risk management for DeFi traders. Platforms such as OnRe have led the way by creating tokens like ONyc and sUSDe, which represent fractional ownership in regulated reinsurance pools. These digital assets are engineered to be uncorrelated with mainstream crypto markets, offering a rare hedge against systemic volatility.

This innovation enables DeFi users to diversify beyond traditional stablecoins or blue-chip tokens. By holding tokenized reinsurance assets within liquidity pools or staking contracts, traders can access steady yields derived from real-world insurance premiums, yields historically reserved for institutional giants. The democratization of access means even modest portfolios can now benefit from exposure to the $750 billion global reinsurance market, projected to reach $2 trillion within the next decade.

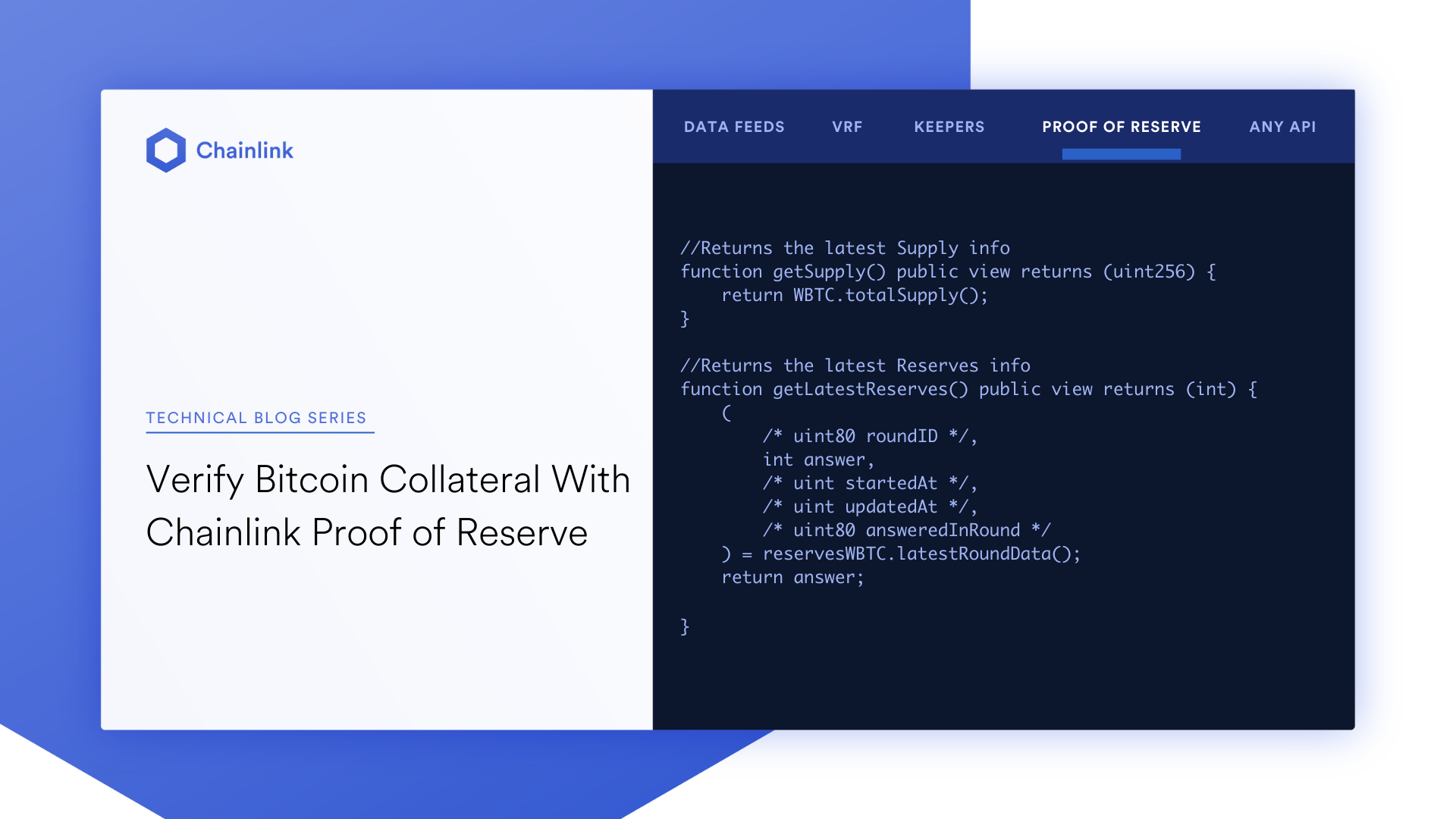

Transparency and Real-Time Verification: Building Trust through Proof-of-Reserve

Trust is non-negotiable in DeFi, especially when it comes to risk transfer mechanisms. In 2025, platforms like Re have integrated Chainlink’s Proof of Reserve technology to deliver unprecedented transparency in on-chain reinsurance contracts. This integration allows any participant to independently verify that off-chain collateral is fully backing every issued policy or pool share, directly on-chain and in real time.

This level of transparency addresses a critical pain point: counterparty risk. By ensuring that every claimable event is collateralized and verifiable via immutable smart contracts, DeFi traders can confidently allocate capital without fear of hidden liabilities or under-collateralization, a problem that has undermined trust in legacy insurance models.

Automated Collateral Management: Efficiency Meets Security

Manual processes are anathema to scalable DeFi operations. On-chain reinsurance leverages smart contracts for end-to-end automation, including premium collection, claims assessment, fund disbursement, and collateral adjustments. Every transaction is cryptographically validated and timestamped on public blockchains.

This automation delivers two key benefits: operational efficiency (lowering administrative costs) and enhanced security (minimizing human error or fraud). For active traders managing complex portfolios across multiple protocols, automated collateral management ensures that coverage remains robust even during periods of extreme market stress, when speed and accuracy are paramount.

Accessing Uncorrelated Yield Opportunities

The appeal doesn’t stop at risk mitigation; tokenized reinsurance introduces new sources of yield with low correlation to core crypto assets. As underwriting profits flow into these pools, backed by real-world insurance contracts, DeFi participants gain access to income streams previously walled off by high minimums or regulatory barriers. This stable yield acts as a buffer against sharp drawdowns typical in crypto markets while providing an avenue for sustainable portfolio growth.

The convergence of these innovations positions on-chain reinsurance as an indispensable tool for forward-thinking DeFi traders navigating the complexities of 2025’s digital asset ecosystem. For deeper technical insights into how these mechanisms work under the hood, explore our analysis at this dedicated resource.

Democratizing Risk Management: Lowering Barriers for All DeFi Traders

Historically, reinsurance was the exclusive domain of large institutions with deep capital reserves and privileged access. In 2025, on-chain reinsurance protocols have fundamentally changed this paradigm. By fractionalizing reinsurance pools into blockchain tokens, platforms enable participation from a much broader spectrum of investors. Now, anyone with a Web3 wallet can allocate as little or as much capital as they wish, gaining exposure to a risk-managed yield source that is structurally distinct from typical DeFi lending or staking products.

This democratization isn’t just about inclusivity, it’s about building systemic resilience. As more diverse capital flows into on-chain reinsurance pools, these structures become better capitalized and less susceptible to single-point failures or liquidity crises. Moreover, with transparent smart contracts governing every aspect of premium collection and claims payout, smaller participants enjoy the same protections and auditability as institutional whales.

Key Benefits of On-Chain Reinsurance for DeFi Traders

-

Tokenization of Reinsurance Assets: Platforms like OnRe have pioneered the creation of tokens such as ONyc and sUSDe, representing shares in reinsurance pools. This enables DeFi traders to diversify portfolios with traditionally uncorrelated assets, mitigating crypto market risk.

-

Enhanced Transparency with Real-Time Data: Integration of Chainlink Proof of Reserve by platforms like Re allows real-time, on-chain verification of collateral backing reinsurance contracts. Traders can independently verify that agreements are fully collateralized, boosting trust and transparency.

-

Automated Collateral Management: Smart contracts automate premium collection, claims triggers, and fund distribution. This reduces administrative overhead and minimizes human error or fraud, ensuring secure, efficient transactions for DeFi traders.

-

Access to Uncorrelated Yield Opportunities: The global reinsurance market, valued at over $750 billion and projected to reach $2 trillion, offers stable, uncorrelated income streams. Tokenized reinsurance pools enable DeFi traders to access these yield opportunities as a hedge against crypto volatility.

-

Democratization of Investment Access: Tokenization lowers entry barriers, allowing even small investors to buy fractional stakes in reinsurance pools. This democratizes access to reinsurance yields, opening up a traditionally exclusive asset class to a broader range of DeFi participants.

Navigating the Regulatory Crosswinds

As digital asset regulation intensifies in 2025, compliance is no longer optional. On-chain reinsurance platforms are responding by incorporating robust KYC/AML modules and collaborating with licensed entities to bridge regulatory gaps between traditional insurance law and decentralized protocols. This proactive approach not only future-proofs these solutions but also provides institutional DeFi users with the confidence that their capital is protected within compliant frameworks.

Regulatory clarity also opens doors for cross-border capital flows and insurance innovation. As noted by industry analysts, tokenized reinsurance is now a core pillar in real-world asset (RWA) expansion strategies for both crypto-native projects and traditional insurers seeking new growth vectors.

The Outlook: On-Chain Reinsurance as Core Crypto Infrastructure

The synthesis of transparency, automation, diversified yield streams, and regulatory readiness positions on-chain reinsurance not just as an optional add-on but as a foundational layer for crypto risk management in 2025 and beyond. As DeFi continues to attract institutional flows and mainstream adoption accelerates, robust risk transfer mechanisms will be essential for sustaining growth without sacrificing security or trust.

The data-driven reality is clear: integrating tokenized reinsurance into portfolio construction offers measurable improvements in drawdown protection and yield stability, outcomes that any serious crypto trader or investor should prioritize in today’s unpredictable landscape.