The reinsurance sector is experiencing a fundamental shift in how collateral is verified and disclosed, thanks to the integration of Chainlink Proof of Reserve (PoR). As of November 2025, decentralized reinsurance protocol Re has adopted Chainlink’s PoR, setting a new benchmark for transparency and real-time verification in on-chain reinsurance. This move comes at a pivotal moment, with institutional investors and DeFi participants demanding more robust assurances that insurance contracts are fully collateralized and verifiable on-chain.

Why Transparency Matters in On-Chain Reinsurance

Traditional reinsurance markets have long struggled with opaque reporting cycles, periodic audits, and reliance on trusted intermediaries. These legacy systems often obscure the true state of reserves backing insurance contracts, a critical issue when billions in risk capital are at stake. By contrast, on-chain reinsurance transparency is not just a regulatory checkbox but an operational imperative for trust and capital efficiency.

The integration of Chainlink PoR into platforms like Re enables continuous, automated verification of off-chain collateral. Instead of quarterly or annual reserve attestations, stakeholders can now access real-time data about the assets backing their risk exposures. This level of transparency significantly reduces counterparty risk and aligns the interests of insurers, reinsurers, and capital providers.

How Chainlink Proof of Reserve Works for Reinsurance Collateral

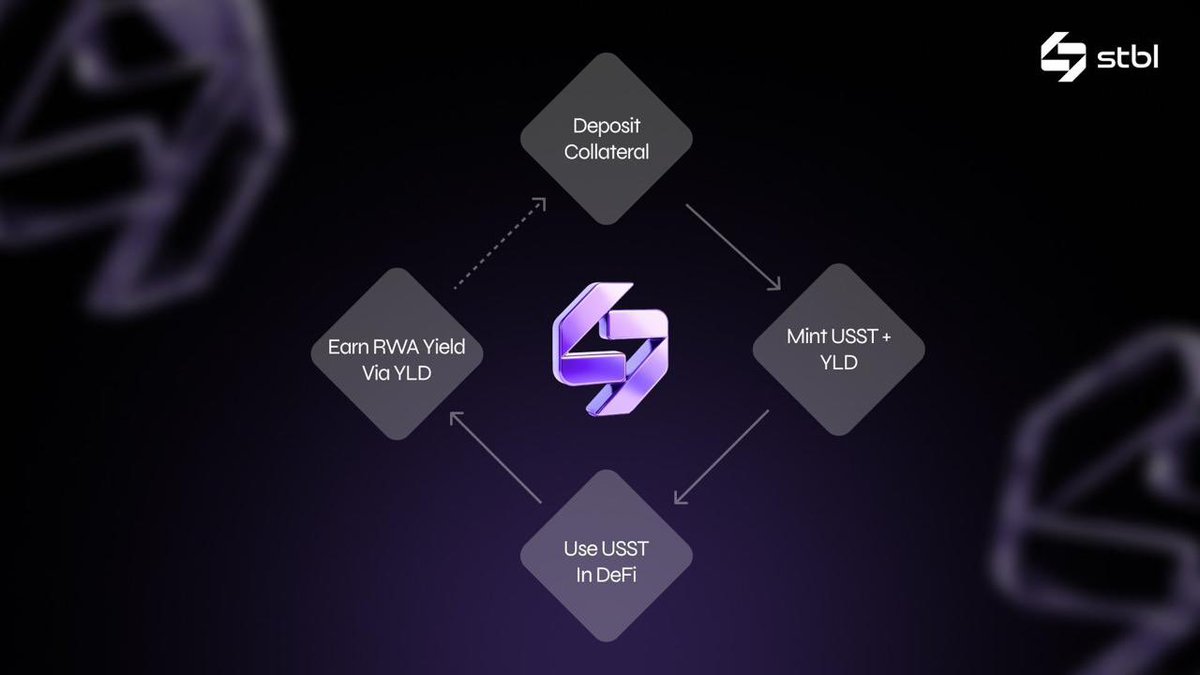

Chainlink’s decentralized oracle network acts as an impartial bridge between traditional finance infrastructure and blockchain-based smart contracts. When Re integrated PoR in October 2025, it unlocked the ability to verify that every reinsurance contract was backed by actual reserves, whether those are fiat deposits, tokenized securities, or other digital assets, without relying on any single party’s word.

The process works as follows:

- Off-chain collateral (such as bank-held funds or tokenized assets) is monitored by independent data providers.

- Chainlink oracles fetch this reserve data at predefined intervals or upon specific triggers.

- The verified reserve status is published directly to the blockchain where anyone can audit it instantly.

This model removes much of the friction that has historically plagued cross-border insurance arrangements. It also provides a strong foundation for regulatory compliance by delivering tamper-proof evidence that all liabilities are fully backed at any given moment. For a deeper dive into how this system operates in practice, see our analysis: How Chainlink Proof of Reserve Secures On-Chain Reinsurance in 2025.

Market Impact: Building Trust with Institutional Capital

The adoption of decentralized proof-of-reserves protocols like Chainlink PoR marks a watershed moment for both DeFi insurance innovators and established financial players. Recent integrations, such as Crypto Finance (part of Deutsche Börse Group) going live with PoR, demonstrate growing institutional appetite for blockchain insurance collateral verification solutions.

This trend is accelerating capital inflows into on-chain reinsurance pools by providing investors with real-time assurance that their funds are protected against under-collateralization or fraudulent reporting. For example, Virtune’s use of Chainlink PoR to monitor over $450 million in digital asset reserves underscores how these tools are closing trust gaps across multiple asset classes.

Chainlink (LINK) Price Prediction 2026-2031

Professional price outlook for LINK based on November 2025 market data, ongoing Proof of Reserve integrations, and evolving DeFi use cases.

| Year | Minimum Price | Average Price | Maximum Price | Year-over-Year Change (Avg) | Key Market Scenario |

|---|---|---|---|---|---|

| 2026 | $10.80 | $15.20 | $22.50 | +14.3% | PoR adoption grows; moderate DeFi growth |

| 2027 | $13.00 | $18.80 | $29.00 | +23.7% | Institutional PoR integration accelerates |

| 2028 | $15.50 | $23.60 | $36.00 | +25.5% | DeFi/TradFi convergence; increased regulation |

| 2029 | $17.20 | $27.40 | $45.00 | +16.1% | Chainlink oracles dominate on-chain data |

| 2030 | $16.50 | $31.00 | $52.00 | +13.1% | Major financial institutions adopt PoR |

| 2031 | $19.00 | $36.50 | $61.00 | +17.7% | LINK consolidates as core DeFi utility token |

Price Prediction Summary

Chainlink’s price outlook from 2026 to 2031 is broadly bullish, driven by growing Proof of Reserve adoption, institutional partnerships, and Chainlink’s critical role in decentralized finance infrastructure. While short-term volatility remains, long-term trends point to steady growth as Chainlink cements its position as the leading oracle and data verification network, especially in reinsurance and on-chain asset verification. Min/max ranges reflect both potential regulatory headwinds and upside from mass adoption.

Key Factors Affecting Chainlink Price

- Rapid adoption of Chainlink Proof of Reserve by financial institutions and DeFi protocols

- Expansion of on-chain reinsurance and insurance markets

- Technological upgrades to Chainlink’s oracle network (scalability, security)

- General crypto market cycles and sentiment

- Regulatory developments around DeFi and real-world asset tokenization

- Competition from other oracle and data verification providers

- Integration into mainstream financial products and infrastructure

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Real-Time Collateral Verification: The End of Opaque Trust Models?

The shift toward automated reserve monitoring isn’t just about meeting regulatory expectations, it fundamentally changes how risk is managed across global insurance markets. With LINK currently trading at $13.30, market participants can track both asset prices and reserve adequacy without waiting for outdated reports or third-party audits.

This dynamic approach to proof-of-reserves means that systemic risks can be identified earlier and addressed proactively. As more protocols adopt these standards, including both DeFi-native players like Re and TradFi stalwarts, the industry moves closer to a future where trust is algorithmic rather than anecdotal.

For reinsurers, cedents, and capital providers, the ability to independently verify collateral in real time is more than a technological upgrade, it’s a strategic advantage. Automated on-chain verification streamlines claims processing, reduces operational overhead, and enables faster capital deployment. This not only benefits direct participants but also strengthens the entire risk transfer ecosystem by making it more resilient to shocks and less prone to cascading failures caused by information asymmetry.

Operational Efficiency: Reducing Friction and Fraud

The move to blockchain insurance collateral verification via Chainlink PoR doesn’t just enhance transparency, it also drives down costs associated with manual audits, periodic attestation fees, and slow reconciliation cycles. Smart contracts can be programmed to automatically trigger payouts or adjust risk parameters based on live reserve data, minimizing the window for human error or malicious manipulation.

Moreover, this approach democratizes access to reinsurance markets. Smaller insurers and innovative DeFi protocols can now tap into global capital pools without facing steep barriers imposed by legacy trust models. By removing intermediaries and providing a single source of verifiable truth, Chainlink PoR levels the playing field while maintaining robust security guarantees.

Looking Ahead: The Future of Decentralized Reinsurance Proof of Reserves

As adoption accelerates, we’re likely to see further standardization of proof-of-reserves mechanisms across both crypto-native and traditional insurance products. Regulatory bodies are already taking note, real-time collateralization data is poised to become a baseline expectation rather than an optional add-on.

Protocols like Re are at the forefront of this transition, offering a blueprint for others seeking to blend compliance with innovation. For those interested in deeper technical details or practical implementation guides, explore our resource on how Chainlink Proof of Reserve enables real-time collateral verification in on-chain reinsurance.

Ultimately, the integration of decentralized proof-of-reserves solutions such as Chainlink PoR is transforming how trust is established in insurance markets. With transparent reserve data available on demand, and with LINK trading at $13.30 as of November 2025, stakeholders can make informed decisions based on verifiable facts rather than opaque reports.