On-chain reinsurance is no longer just a theoretical experiment – it is a proven, high-performance alternative to legacy models. In 2025, protocols like Re have posted a 92% combined ratio and $168.8 million in written premiums, demonstrating not only operational viability but also competitive outperformance versus many traditional reinsurers. As global risk markets contend with climate volatility and rising claims, on-chain models are leveraging blockchain’s transparency and automation to reset expectations for efficiency and capital deployment.

On-Chain Reinsurance: Surpassing Industry Benchmarks in 2025

To appreciate the significance of a 92% combined ratio, consider the broader market context. According to Gallagher’s Reinsurance Market Report, the average combined ratio for traditional global reinsurers hovered around 91.4% at the nine-month stage of 2025. However, this figure masks substantial volatility: major players like PartnerRe reported a staggering 112.7% combined ratio in H1 2025 due to catastrophic events such as California wildfires and reserve strengthening (source). Meanwhile, Swiss Re achieved an exceptional 77.6% for P and C in the first nine months, but such results are outliers rather than norms.

The Re Protocol’s performance sits comfortably within the upper quartile of industry leaders yet stands out for its consistency and resilience in turbulent conditions. With $168.8 million in written premiums, on-chain reinsurance is now managing meaningful risk pools at scale – not just pilot portfolios or sandbox experiments.

The Blockchain Advantage: Efficiency, Transparency, and Speed

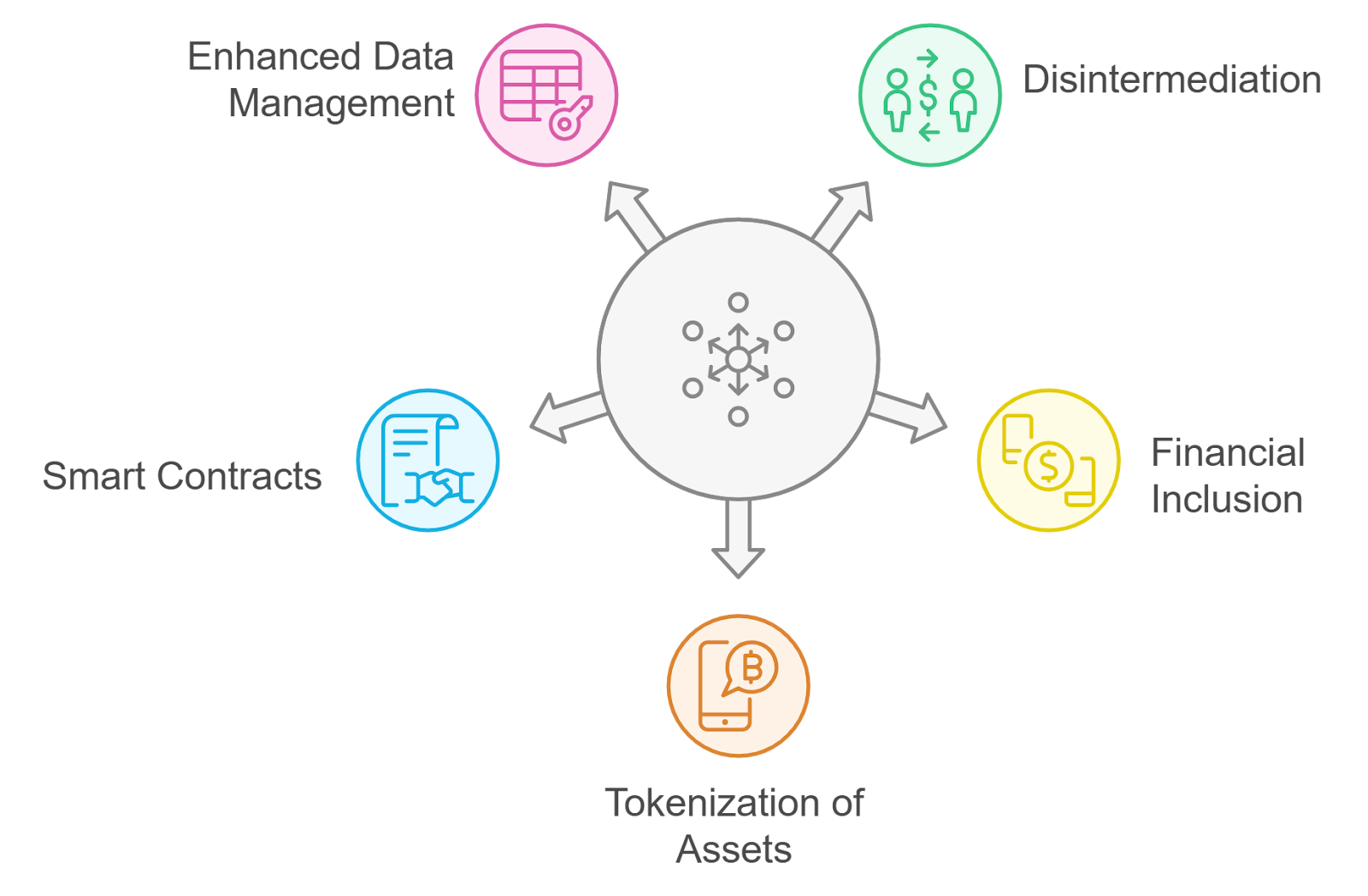

The core drivers behind these results are deeply technological. By deploying smart contracts on decentralized ledgers, on-chain reinsurance eliminates layers of manual processing that encumber traditional models:

- Automated claims handling: Smart contracts execute payouts when predefined triggers are met, reducing delays and disputes.

- Lower administrative costs: Blockchain’s shared ledger removes reconciliation overhead between cedents, brokers, and reinsurers.

- Real-time transparency: All parties can audit reserves, claims status, and premium flows instantly – fostering trust with capital providers.

- Programmable capital allocation: Institutional investors can allocate funds directly into fully collateralized insurance risk pools without intermediaries.

This architecture isn’t just more efficient; it fundamentally realigns incentives by tying returns to real-world premium income rather than opaque financial engineering or speculative bets. Each dollar earned by protocols like Re is actuarially modeled and transparently accounted for on-chain (learn more here).

Pushing Past Traditional Constraints: AI-Powered Pricing and Dynamic Risk Management

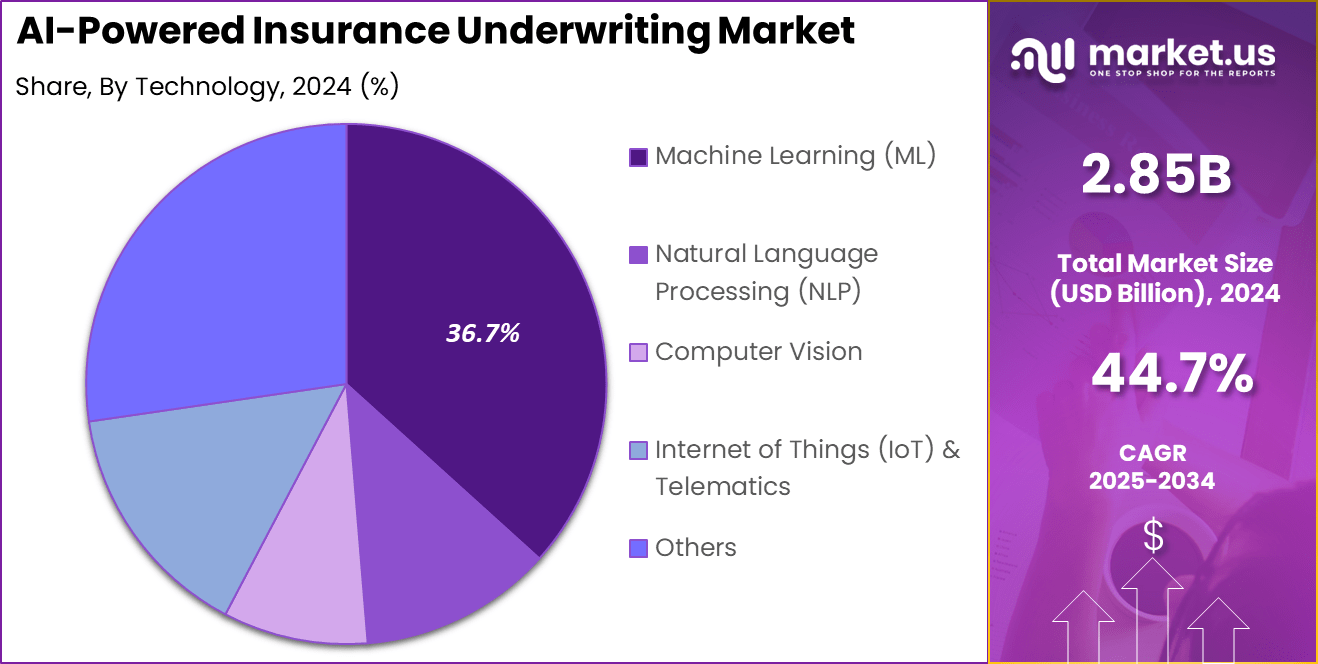

The leap forward isn’t limited to blockchain alone. The integration of artificial intelligence (AI) into treaty pricing has enabled protocols to deliver more accurate quotes while remaining compliant with regulatory standards. Recent research (e. g. , ClauseLens framework) demonstrates how clause-grounded reinforcement learning can optimize treaty terms based on real-time data inputs – a process virtually impossible within legacy systems burdened by static actuarial tables.

This convergence of AI-driven analytics with transparent smart contracts allows for dynamic risk assessment as market conditions evolve – whether that means recalibrating exposure after a natural disaster or adjusting capital buffers as claim frequencies shift mid-year.

Institutional investors are taking note. The ability to participate in on-chain reinsurance pools with full collateralization and on-demand auditing has opened the door for new capital sources previously wary of opacity and counterparty risk. As a result, the market is seeing a virtuous cycle: more capital supports larger and more diverse risk portfolios, which in turn attracts further institutional interest. This contrasts sharply with the traditional reinsurance sector, where legacy systems and regulatory inertia often limit speed to market and innovation.

It is also worth highlighting that on-chain protocols have demonstrated resilience amid the volatility that defined 2025’s catastrophe season. While some traditional reinsurers struggled with outsized losses due to unexpected events, on-chain models rapidly adjusted treaty parameters, rebalanced exposure, and processed claims, all without manual intervention or protracted negotiations. This agility is not only a technological feat but a strategic advantage in today’s fast-moving risk landscape.

Looking Forward: Scaling On-Chain Reinsurance in 2026 and Beyond

With $168.8 million in written premiums already managed through decentralized protocols, on-chain reinsurance has moved beyond proof-of-concept status. The question now shifts from “if” to “how fast” this model can scale across additional lines of business, property-catastrophe, specialty, even life, and geographies where regulatory frameworks are adapting to digital-first risk transfer.

Key Growth Drivers for On-Chain Reinsurance in 2025

-

Increased Institutional Adoption: Major institutional investors and capital providers are actively participating in on-chain reinsurance platforms like Re, driving premium growth to $168.8M in 2025 and contributing to robust performance metrics.

-

Global Regulatory Acceptance: Regulatory bodies in key markets are increasingly recognizing and approving blockchain-based insurance and reinsurance protocols, paving the way for compliant, cross-border operations and greater market trust.

-

AI-Powered Pricing Models: Innovations such as the ClauseLens framework leverage artificial intelligence and reinforcement learning for transparent, data-driven reinsurance pricing, improving risk assessment and treaty accuracy.

-

Real-Time Capital Flows: The use of smart contracts and decentralized ledgers enables instant capital movement and claims settlement, reducing administrative overhead and supporting a 92% combined ratio—outperforming many traditional reinsurers in 2025.

Key challenges remain: onboarding legacy insurers into blockchain ecosystems requires robust education; interoperability between different protocols must be addressed; and ensuring ongoing compliance as regulations evolve will demand continued investment in legal engineering. Yet these hurdles are not insurmountable, and as 2025’s data shows, the upside is substantial for those willing to innovate.

The performance gap between on-chain and traditional models will likely widen as automation deepens and AI-driven analytics become standard practice. For insurance professionals seeking sustainable yield or investors searching for uncorrelated returns backed by real-world premium flows, this new paradigm offers both transparency and efficiency at scale.

To explore how blockchain is transforming the $700 billion reinsurance market, and why protocols like Re are setting new standards for performance, see our detailed analysis here.