In a landmark move signaling the maturation of blockchain in insurance, Re has authorized $134M in reinsurance capital for the upcoming January 2026 renewal season. This deployment spans key lines like commercial auto, general liability, property, and workers’ compensation, showcasing how on-chain reinsurance is stepping up to meet real-world risk transfer needs. As someone who’s tracked both traditional and decentralized markets for years, I see this as more than a capital raise; it’s validation that transparent, programmable reinsurance can compete head-on with legacy players.

Breaking Down Re’s $134M Reinsurance Authorization

Re, launched in 2022, isn’t your average reinsurer. By tokenizing capital on blockchain, it enables seamless deployment without the paperwork nightmares of traditional treaties. This $134M authorization targets the busiest renewal period, when insurers scramble to lock in coverage for the year ahead. Picture this: on-chain capital instantly backing policies, with smart contracts automating claims and payouts. No more waiting on wire transfers or trust-based collateral calls.

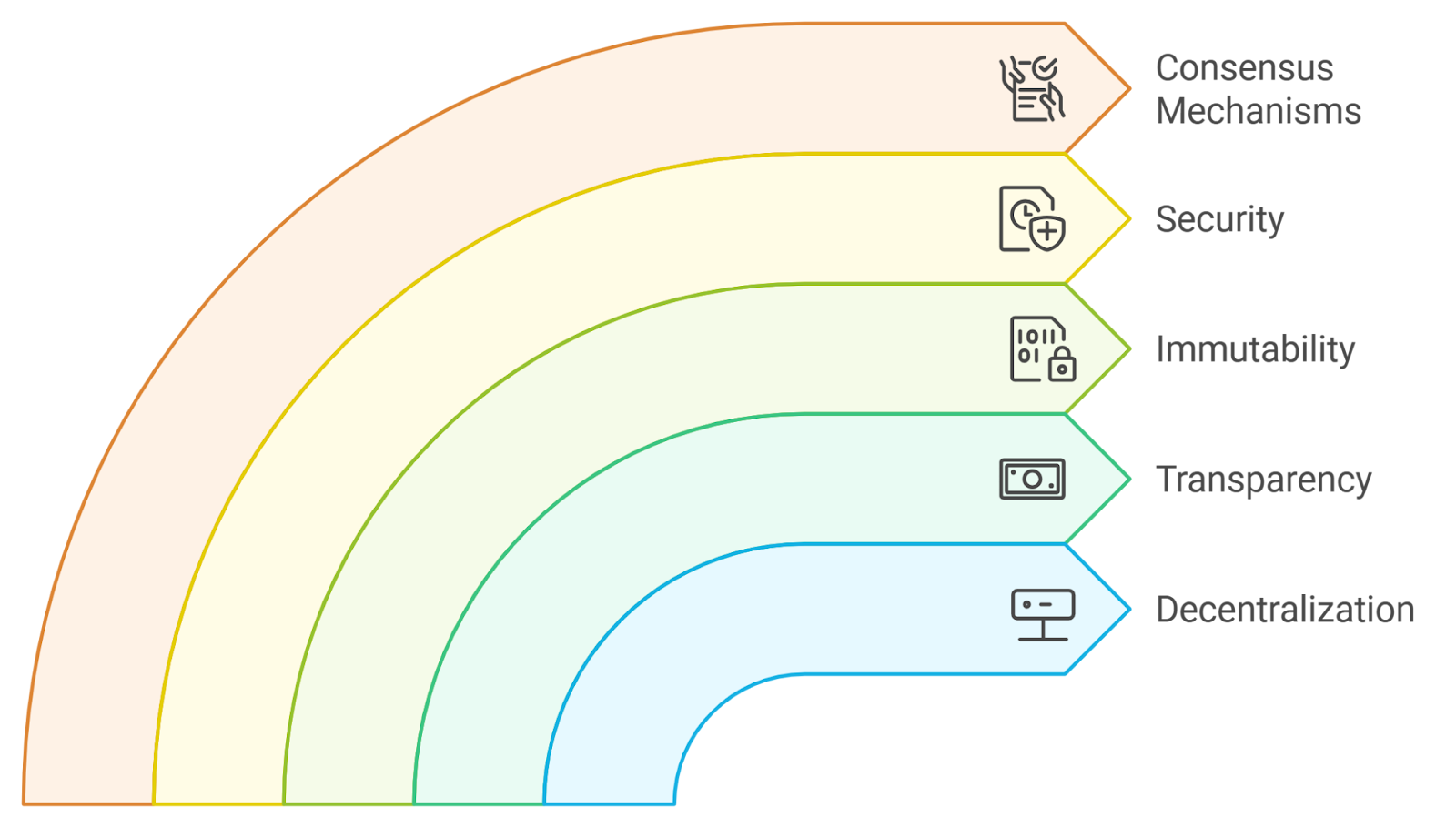

From commercial auto fleets navigating urban chaos to general liability shields for businesses, this capital injection addresses pressing exposures. Property risks, ever vulnerable to climate shifts, and workers’ compensation for labor-intensive sectors round out the portfolio. Early buzz from industry watchers underscores the momentum. Cliff White noted how the infrastructure is ‘working, ‘ with onchain funds effortlessly supporting these lines.

What’s particularly insightful is Re’s yield potential. Investors in on-chain reinsurance can earn attractive returns while providing liquidity to primary insurers. This isn’t speculative DeFi; it’s actuarial-grade risk pooling on public ledgers, where every transaction is verifiable.

A Buyer’s Market Bolsters On-Chain Reinsurance 2025 Momentum

The timing couldn’t be better. Aon’s latest report paints a picture of robust global reinsurance capital at a record $735 billion as of June 30,2025. Retained earnings and redeployed alternative capital have flooded the market, creating leverage for buyers. Insurers are negotiating sharper pricing and broader terms, a shift from the hardening cycles of recent years.

Layer on the insurance-linked securities boom: catastrophe bond issuance hit over $17.3 billion by mid-August 2025, eclipsing 2024’s full-year total. This influx of ILS diversifies risk away from traditional reinsurers, pressuring everyone to innovate. In this environment, Re’s blockchain reinsurance capital stands out. It offers not just capacity, but programmable efficiency – think real-time collateral adjustments tied to loss data feeds.

For insurance pros eyeing the reinsurance renewal season 2025, this means more options. Traditional towers might suffice for catastrophe layers, but on-chain solutions excel in mid-tier, frequent-loss lines where speed matters. Re’s model reduces friction, potentially squeezing out those nagging expense ratios that plague incumbents.

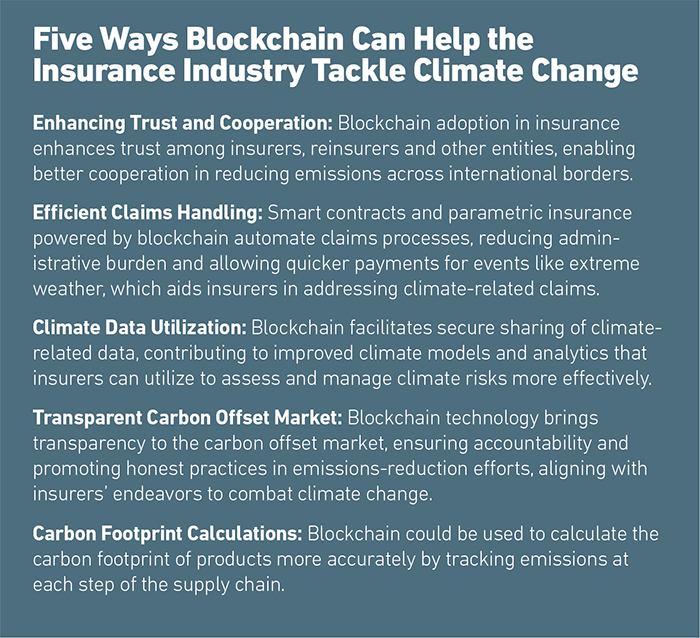

Blockchain’s Edge in the Reinsurance Evolution

I’ve long argued that transparency is risk management’s north star, and Re embodies this. Unlike opaque collateral trusts, every dollar of that $134M reinsurance authorization is trackable on-chain. Investors see exact deployments, performance metrics, and yield accrual in real time. This builds trust, drawing in crypto-savvy institutions wary of black-box reinsurance.

Consider the yield angle: onchain reinsurance yield often outpaces bonds or money markets, backed by diversified premium streams. For 2025, with capacity abundant, Re positions itself to capture premium growth without diluting returns. It’s a win for cedents seeking stability and backers chasing uncorrelated alpha. As we approach renewals, watch how this capital flows – it could set precedents for hybrid models blending TradFi and DeFi.

That hybrid potential is where things get exciting. Primary insurers could layer Re’s on-chain capacity atop traditional excess towers, creating resilient programs that adapt to loss trends via oracles. It’s not pie-in-the-sky; pilots are already proving the tech stack holds up under pressure.

Opportunities and Risks in On-Chain Reinsurance 2025

Zooming into investor appeal, this $134M reinsurance authorization opens doors for those hunting yields beyond crypto volatility. Backers deploy stablecoins or tokenized treasuries, earning from premiums net of losses – all auditable on-ledger. Picture combined ratios dipping below industry averages through automated underwriting, much like how on-chain models have historically outperformed with tighter expense controls. For a deeper dive into those numbers, check out our analysis on superior performance metrics.

Re’s Blockchain Advantages

-

Instant Collateral Deployment: On-chain capital deploys immediately to back risks like commercial auto and GL, powering Re’s $134M authorization for 2026 renewals.

-

Real-Time Transparency: Blockchain ledger provides stakeholders instant visibility into capital flows and exposures in a $735B market.

-

Automated Claims: Smart contracts handle payouts swiftly, minimizing delays in lines like property and workers’ comp.

-

Higher Yields: Efficient risk pooling optimizes returns amid surging ILS growth past $17.3B in cat bonds.

-

Legacy Integration: Seamlessly bridges traditional systems, easing adoption for global reinsurers.

Insurers benefit too. In a buyer’s market with $735 billion in total capital, cedents can cherry-pick on-chain layers for speed. Commercial auto, prone to frequent claims, thrives on instant payouts; property lines gain from parametric triggers tied to weather data. Workers’ comp and GL round it out, covering the bread-and-butter risks that keep balance sheets balanced.

Of course, no evolution skips hurdles. Smart contract bugs or oracle failures loom as risks, though Re’s battle-tested infrastructure – vetted by actuarial pros – mitigates much of that. Regulatory clarity is evolving, with jurisdictions like Bermuda greenlighting blockchain reinsurers. My take: these teething issues pale against the gains in efficiency and trust.

Reinsurance Market Snapshot 2025

| Metric | Value |

|---|---|

| Global Capital | $735B |

| Cat Bond Issuance | $17.3B |

| Re’s Deployment | $134M |

| Key Lines | Auto/GL/Property/WC |

| Buyer Leverage | High |

Strategic Implications for the Renewal Season

As January 2026 nears, Re’s move injects fresh momentum into on-chain reinsurance 2025 discussions. This isn’t isolated; it’s part of a broader shift where blockchain reinsurance capital scales to match TradFi giants. Expect more authorizations as protocols refine risk models with AI-driven loss forecasting.

From my vantage in actuarial science, the real game-changer is composability. Re’s pools can nest within DeFi vaults or ILS structures, unlocking trillions in sidelined capital. Insurers facing hardening nat-cat rates might pivot here for affordable excess cover, while investors diversify beyond equities into insurance beta.

Stakeholders should monitor deployment dashboards closely. How much flows to property amid hurricane season tailwinds? Will yields hold above 10% as capacity floods in? Early indicators point yes, with Re’s track record of low loss ratios.

Ultimately, this $134M reinsurance authorization cements blockchain’s foothold in reinsurance renewal season 2025. It bridges crypto innovation with insurance pragmatism, promising a more fluid, verifiable market. For pros and pioneers alike, it’s a call to experiment – the tools are ready, the capital committed, and the yields waiting.