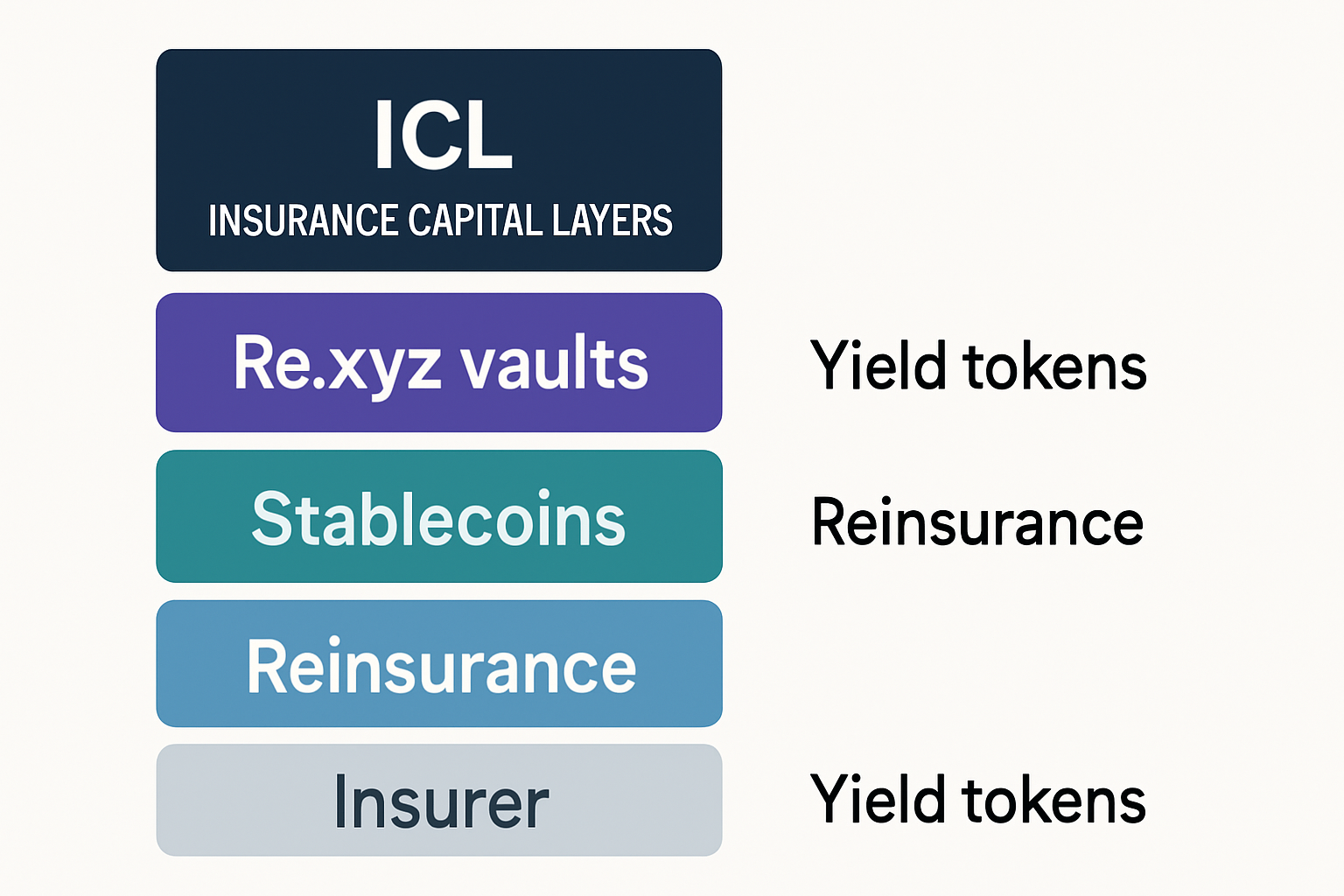

In the evolving landscape of on-chain reinsurance, Insurance Capital Layers (ICLs) stand out as the foundational mechanism bridging decentralized finance with the trillion-dollar reinsurance industry. These on-chain vaults securely hold user deposits, primarily in stablecoins, and strategically allocate capital to back real-world insurance policies. Unlike traditional reinsurance, where access is gated for institutional players, ICLs democratize participation, allowing retail investors to earn yields from premiums while supporting licensed insurers. This fusion of blockchain transparency and actuarial precision is reshaping risk management.

Decoding the Mechanics of Insurance Capital Layers

At their core, ICLs function as protocol-controlled treasuries within platforms like the Re protocol. Each layer corresponds to a distinct ERC-20 yield-bearing token, such as reUSD or reUSDe, tailored to varying risk appetites. User deposits flow into these vaults, where daily sweeps minimize idle capital exposure by routing funds into secure, audited smart contracts. Capital deployment happens only upon signing a Surplus Note with a licensed reinsurer, ensuring every allocation complies with regulatory standards. This process, detailed in Re. xyz documentation, transforms passive holdings into active participants in quota-share reinsurance notes.

Consider the multi-layered reinsurance value chain: primary insurers offload risks to reinsurers, who in turn tap global capital markets. ICLs slot into this chain as on-chain reinsurance pools, providing collateral that’s fully transparent and verifiable. Professional cell managers oversee allocations across diverse portfolios, from housing to auto insurance, as highlighted in industry discussions. This setup not only backs policies but also mitigates counterparty risk through blockchain immutability.

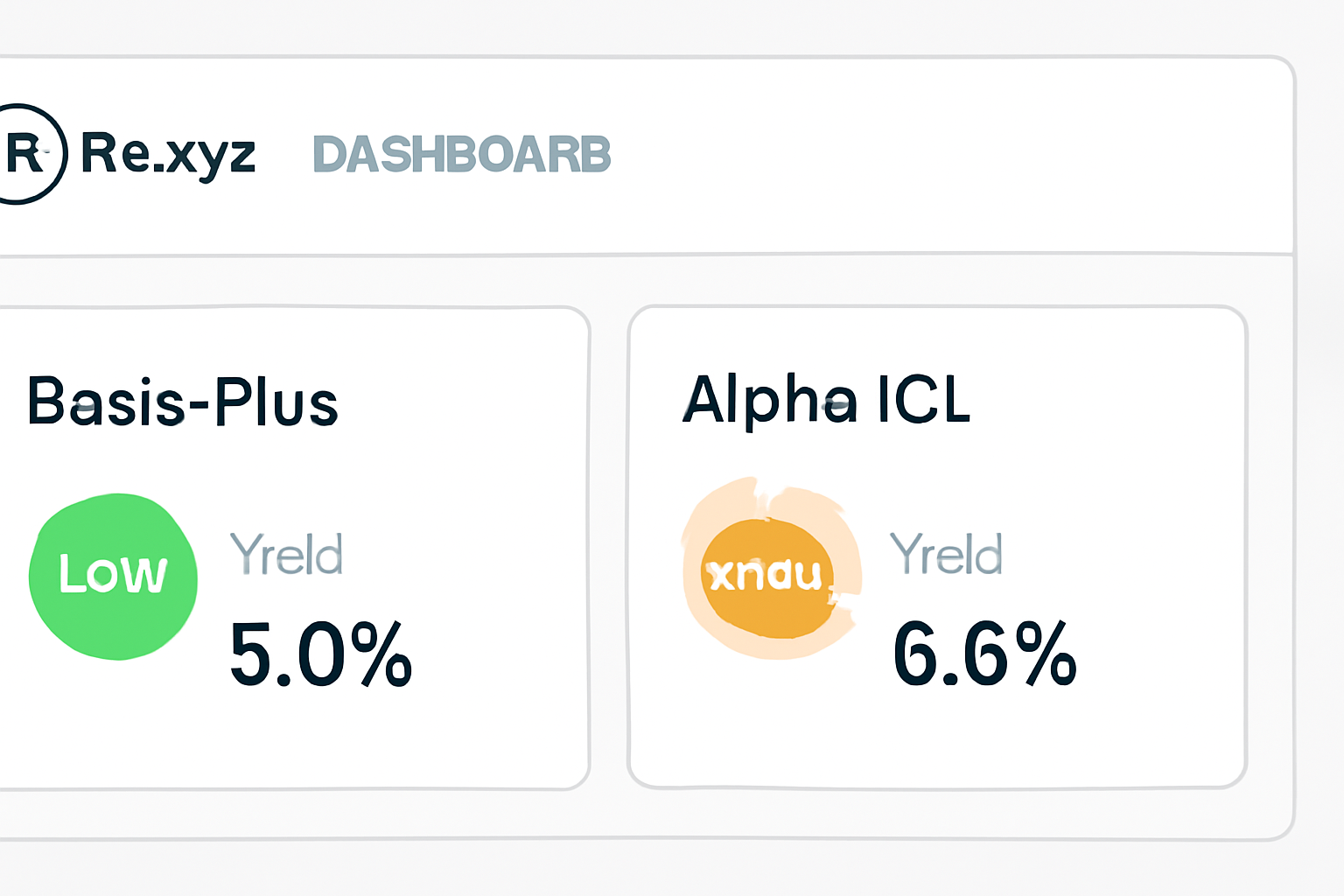

reUSD vs reUSDe: Insurance Capital Layers (ICLs) Comparison

| ICL Name | Risk Profile | Backing | Yield Mechanism | Example Allocation |

|---|---|---|---|---|

| Basis-Plus (reUSD) | Low-risk | Regulatory collateral in trusts | Premiums from stable programs | Avoids first-loss reserves |

| Alpha (reUSDe) | Medium-high risk | First-loss reserves for claims | Higher premiums from volatile lines | Housing/auto risks |

From Deposits to Real Policy Backing

ICLs excel in translating on-chain liquidity into tangible insurance coverage. When a user deposits into an ICL, they receive yield tokens redeemable for principal plus earned premiums, minus any claims. For instance, the Basis-Plus ICL funds regulatory-required collateral in trust accounts, offering a conservative entry point with predictable returns. In contrast, Alpha ICL targets first-loss positions, absorbing initial claims for potentially higher yields. All collateral remains on-chain, participating in reinsurance backed by licensed carriers, as noted in recent market analyses from Finance Magnates and TradingView.

This structure addresses a key pain point in traditional reinsurance: opacity. Blockchain enables real-time auditing of capital flows, from deposit to premium collection. Protocols like Re act as marketplaces connecting these ICLs on-chain reinsurance providers with insurers, unlocking over $134 million in capacity, per Beinsure reports. Investors gain exposure akin to Insurance-Linked Securities (ILS), but with DeFi composability. Yet, pragmatic caution is warranted; while yields stem from real premiums, tail risks from catastrophes demand diversified positioning across ICLs.

Yield Generation in Practice

Earning blockchain reinsurance yield through ICLs hinges on reinsurance economics. Insurers collect premiums upfront, a portion of which funds reserves in ICLs. Unearned premiums generate returns via low-risk instruments until claims arise. Surplus Notes formalize these arrangements, with payouts tied to performance. Re protocol ICLs, for example, offer reUSD holders stable yields from collateralized programs, while reUSDe participants chase alpha from riskier tranches. Historical data from Swiss Re underscores how capitalization levels dictate reinsurance needs, positioning ICLs as efficient capital conduits.

Critically, exits are gated by Surplus Note maturities, preventing premature withdrawals that could destabilize backing. This disciplined approach fosters resilience, much like Munich Re’s vision for ILS in building future-proof portfolios. For traders versed in options and DeFi, ICLs mirror structured products: defined downside with asymmetric upside from premium accretion. As real-world assets tokenize, protocols are poised to capture flowing insurance risks, per Hogan Lovells insights.

Traders familiar with DeFi yields will appreciate how ICLs layer in reinsurance-specific guardrails. Premiums accrue daily, compounded into token value, but claims deduct proportionally from the pool. This quota-share model shares both upside and downside, aligning incentives across the chain. In my view, it’s a masterstroke for longevity: protocols like Re sidestep the pitfalls of over-leveraged lending by tethering returns to actuarial realities, not speculative loops.

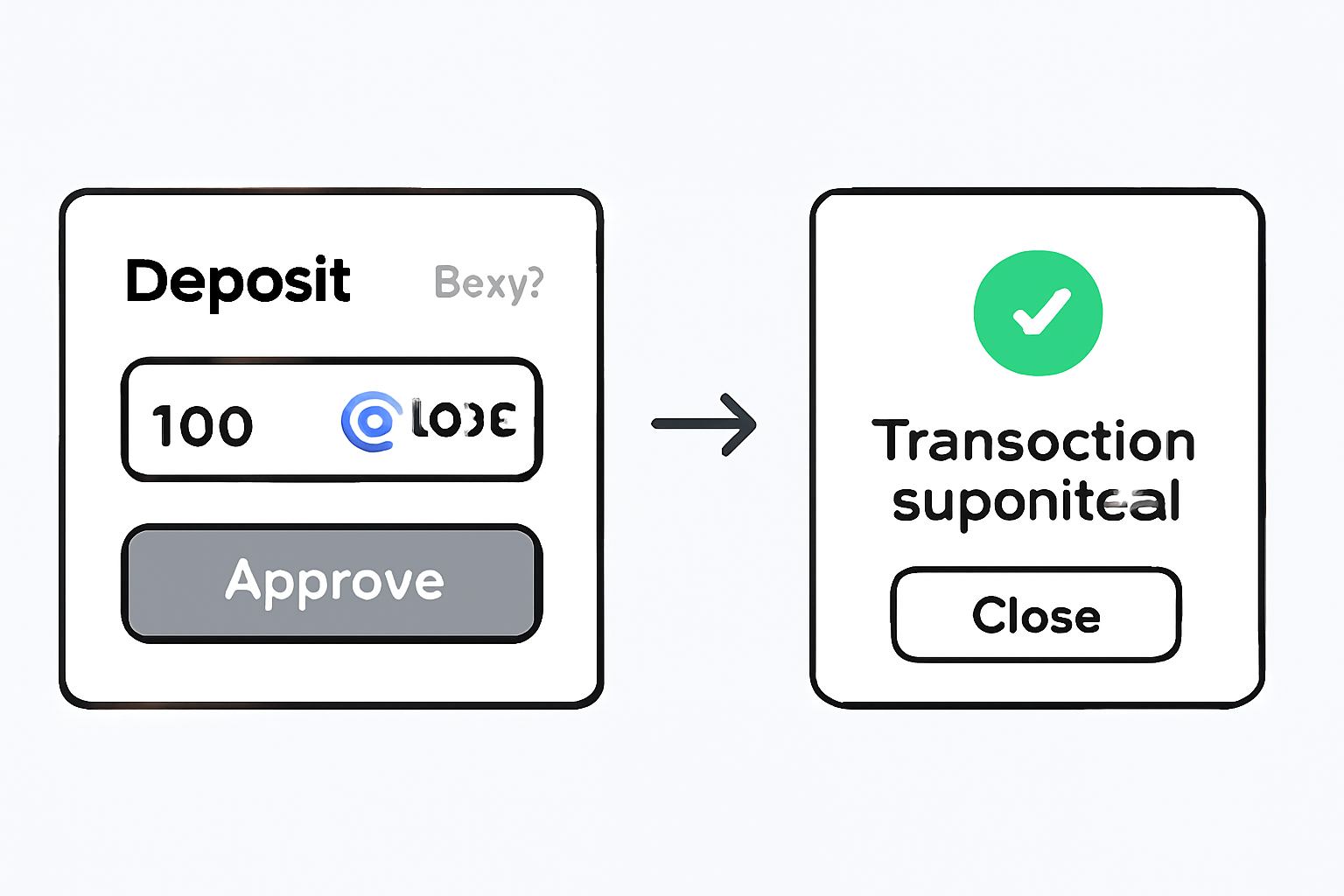

Step-by-Step: Deploying Capital into ICLs

Getting started with Re protocol ICLs is straightforward, yet demands diligence. Begin by connecting a wallet to the Re platform, approving stablecoin transfers, and selecting your ICL based on risk tolerance. Deposits mint yield tokens instantly, with capital swept into vaults for deployment. Track performance via dashboards showing premium inflows, claim ratios, and projected APY. Withdrawals await Surplus Note settlements, typically quarterly, balancing liquidity with commitment.

Here’s a pragmatic walkthrough in action. Deposit $10,000 into Basis-Plus: you receive equivalent reUSD, earning from collateralized premiums at, say, 4-6% annualized, backed by stable lines like commercial property. Alpha might yield 8-12%, funding auto claims reserves, but with volatility from catastrophe events. Diversify across both for a blended profile, much like a strangle in options trading, capping downside while harvesting theta decay from premiums.

Risks and Resilience in On-Chain Reinsurance Pools

No yield comes risk-free, and ICLs on-chain reinsurance is no exception. Primary threats include tail events, hurricanes wiping out housing portfolios, or underwriting mispricing inflating claims. Yet, mitigations abound: diversified allocations via cell managers, on-chain transparency for early warnings, and regulatory Surplus Notes capping exposure. Unlike opaque ILS funds, every transaction is auditable, empowering investors to exit before maturities if red flags emerge.

From a DeFi analyst’s lens, ICLs outshine pure crypto insurance by linking to licensed carriers, reducing smart contract dependency. Umbrex Consulting maps reinsurance as a value chain where capital layers absorb shocks progressively; ICLs occupy the junior tranche smartly, with seniors buffered by reinsurers. Beinsure’s $134 million unlock proves demand, but scale prudently, allocate no more than 5-10% of portfolio initially, stress-testing against Swiss Re’s catastrophe scenarios.

Risk Mitigation Strategies

| Risk Type | ICL Feature | Mitigation Tactic | Example |

|---|---|---|---|

| Catastrophe Claims | First-loss absorption in Alpha | Surplus Note caps and diversification | Housing/auto blend |

| Underwriting Error | Premium modeling | Cell manager oversight | Stable vs volatile lines |

| Smart Contract | Audited vaults | Daily sweeps to secure custody | reUSD collateral trusts |

Regulatory evolution bolsters confidence. As Hogan Lovells notes, on-chain risks will migrate naturally with tokenized assets, positioning ICLs as first-movers. Munich Re’s ILS advocacy aligns here: these layers foster resilience by pooling global crypto capital into proven models.

Why ICLs Redefine Yield for Crypto Traders

For options strategists like myself, blockchain reinsurance yield via ICLs evokes covered calls on steroids, collect premiums upfront, define max loss, and compound indefinitely. Retail access to trillion-dollar markets, once a pipe dream, now thrives through tokenized quota-shares. Protocols bridge TradFi underwriting with DeFi composability, enabling strategies like leveraging reUSD as collateral elsewhere while earning passively.

Looking forward, expect ICL proliferation: more tokens for niche risks, AI-driven allocations, and integrations with RWAs. Re. xyz’s model sets the benchmark, proving on-chain reinsurance isn’t hype, it’s infrastructure. Savvy traders will stack ICLs alongside vaults and perps, crafting hybrid portfolios resilient to crypto winters. Dive in informed, position for the long haul, and let reinsurance premiums fuel your edge. For deeper mechanics on protocol flows, explore how these systems deliver yields.