Picture this: you’re parking your stablecoins in a vault that’s not just earning yield from dusty T-bills, but tapping straight into the trillion-dollar reinsurance beast. Right now, as of January 29,2026, Re Protocol’s reUSD is humming along at $1.058, up a tidy 0.00095% in the last 24 hours with a high of $1.061 and low of $1.055. That’s your ticket to low-drama, principal-protected returns in the wild world of on-chain reinsurance yields. But hold up – enter reUSDe, the alpha chaser built for those ready to shoulder first-loss risks for juicy 16-25% APYs. Today, we’re slicing deep into Re Protocol reUSD vs reUSDe, unpacking how these bad boys layer up in Insurance Capital Layers (ICLs) to supercharge your DeFi bag with real insurance premiums.

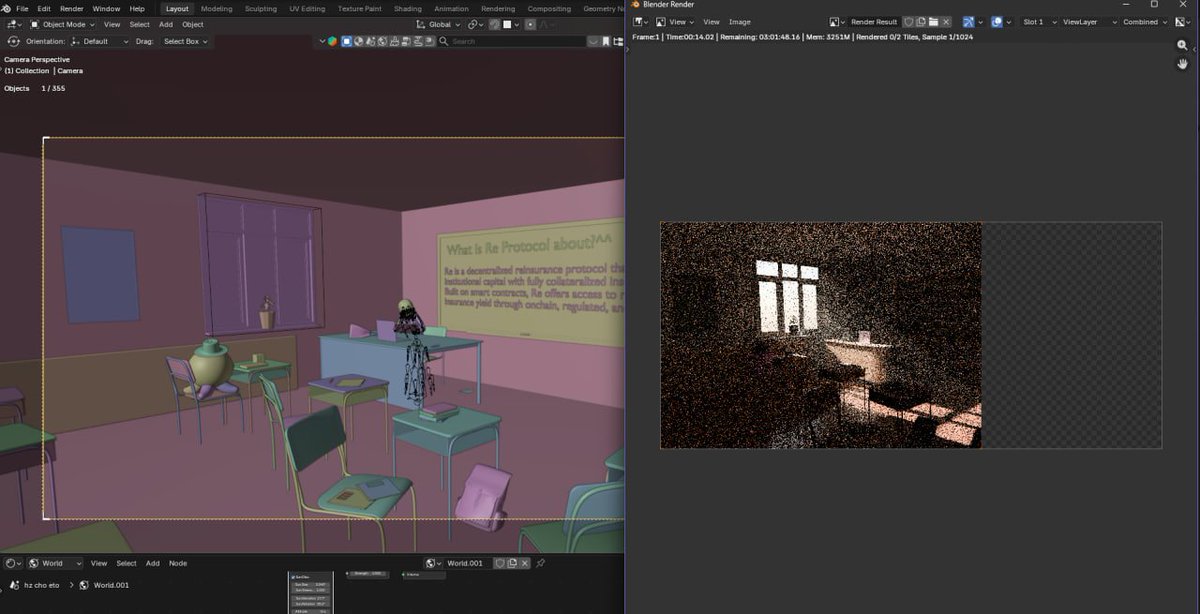

Re Protocol isn’t messing around. Managed by the Resilience Foundation, it’s the decentralized bridge hurling on-chain capital into flesh-and-blood reinsurance treaties. Think transparent blockchain workflows custodying your deposits in ICLs – those core vaults that slice and dice capital for real-world policies on homeowners, auto, and workers’ comp. No black boxes here; everything from collateral to premiums is on-chain verifiable. Retail players are piling in, blending DeFi liquidity with underwriting muscle, and scoring yields that smoke traditional stables.

Re Protocol’s ICLs: The Engine Powering Tokenized Reinsurance

At the heart of Re Protocol ICLs are these smart custody layers. Users deposit stables, get minted reUSD or reUSDe, and boom – your capital fuels regulated reinsurance while you sip yields. Audited by Hacken, the protocol’s network ensures efficient allocation, no middlemen skimming. It’s tactical gold: deploy into U. S. insurance lines with full collateral backing, all while Avalanche powers the low-fee magic. I’ve been watching this space for years, and Re’s setup screams opportunity in a market starved for real yield.

Diving tactical, reUSD is your conservative powerhouse. Locked at principal protection, it targets 6-10% annually by parking idle funds in delta-neutral ETH basis trades or short U. S. Treasuries, topped with protocol overlays. No underwriting jitters – just steady compounding for stablecoin maxis dodging vol. If you’re building a fortress portfolio, reUSD at $1.058 is screaming buy for that predictable edge.

reUSD Deep Dive: Low-Vol Yields Backed by Regulatory Muscle

reUSD steps up as regulatory backing for the reinsurance ops, meaning it’s the stable anchor insurers lean on. Holders earn without touching loss payouts, keeping things serene. Current price action? That $1.058 mark reflects tight management, with daily compounds smoothing the ride. Pair it with Re’s points program, and you’re stacking extras on Avalanche. Tactical play: ladder in during dips below $1.055 for max entry.

reUSD Price Prediction 2027-2032

Long-term forecasts based on current $1.06 price trend, reinsurance yields (6-10%), on-chain adoption, and market cycles

| Year | Minimum Price | Average Price | Maximum Price | Est. YoY % Change (Avg) |

|---|---|---|---|---|

| 2027 | $0.98 | $1.10 | $1.25 | +3.8% |

| 2028 | $1.00 | $1.20 | $1.40 | +9.1% |

| 2029 | $1.05 | $1.35 | $1.65 | +12.5% |

| 2030 | $1.10 | $1.50 | $1.85 | +11.1% |

| 2031 | $1.15 | $1.70 | $2.10 | +13.3% |

| 2032 | $1.25 | $1.95 | $2.45 | +14.7% |

Price Prediction Summary

reUSD, as a principal-protected yield-bearing token in Re Protocol’s reinsurance ecosystem, is forecasted to show progressive appreciation amid growing DeFi insurance adoption. Average prices could climb from $1.10 in 2027 to nearly $2.00 by 2032 (CAGR ~10.5% from current $1.06), with mins reflecting bearish depegs or regulatory hurdles, maxes capturing bull runs and yield compounding. Short-term (7-90 days): stable around $1.05-$1.10 barring market shocks.

Key Factors Affecting reUSD Price

- Rising demand for on-chain reinsurance yields via Insurance Capital Layers (ICLs)

- Regulatory clarity boosting tokenized insurance products

- Competition and innovation in yield-bearing stablecoins

- Crypto market cycles impacting Avalanche-based DeFi TVL

- Technological enhancements in transparency and risk underwriting

- Macro trends in real-world reinsurance market integration

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Flip the script to reUSDe, aka Insurance Alpha, and volatility turns into your best friend. This token eats first-loss across the portfolio, sharing underwriting profits for those 16-25% historical hauls. Fully collateralized reserves back U. S. lines, with quarterly tNAV resets and redemptions tied to actuarial surplus. Price compounds daily, but expect swings – it’s built for yield hogs chasing blockchain reinsurance capital layers.

reUSDe: First-Loss Firepower for High-Yield Hunters

reUSDe holders are in the trenches, absorbing hits but feasting on premiums when claims stay low. It’s tokenized reinsurance risks dialed to 11, letting you play institutional grades on-chain. With Re channeling capital transparently, you’re not just speculating – you’re underwriting like the big boys. At today’s market pulse, pairing reUSDe exposure with reUSD ballast creates a killer ICL stack for diversified DeFi reinsurance investment. Watch those quarterly releases; they can rocket value if surplus pops.

Stacking these layers smartly is where the real alpha hides. Blend reUSD’s stability with reUSDe’s punch, and you’ve got a portfolio that’s battle-tested against crypto winters while harvesting insurance gold. But let’s get granular – how do they stack in practice?

Head-to-Head: reUSD vs reUSDe Risk-Reward Breakdown

reUSD vs reUSDe Comparison

| Product | Yield Target | Risk Profile | Current Price | Backing Assets | Ideal For |

|---|---|---|---|---|---|

| reUSD | 6-10% | ✅ Principal Protected, Low-Vol | $1.058 | Delta-neutral ETH basis strategies, short-duration U.S. Treasury bills | Stablecoin holders seeking steady income without underwriting risks |

| reUSDe | 16-25% | First-Loss (Insurance Alpha) | tNAV-based (daily compounding, quarterly redemption) | Fully collateralized U.S. insurance lines (homeowners, auto, workers’ comp) | Investors aiming for higher yields with reinsurance exposure |

That table lays it bare: reUSD at $1.058 is your set-it-and-forget-it play, dodging the drama of claims while clipping steady premiums. reUSDe? It’s the swing-for-the-fences option, where low claim quarters mean fat profit shares. I’ve traded enough DeFi trenches to know – diversification across ICLs crushes single-token bets. Allocate 70% reUSD for ballast, 30% reUSDe for juice, and rebalance quarterly post-tNAV. With Avalanche’s speed, transactions barely dent your gains.

Risks? Yeah, they’re real, but managed tight. reUSD sidesteps underwriting hits entirely, but opportunity cost bites if reinsurance booms. reUSDe faces first-loss pain during catastrophe seasons – think hurricanes spiking homeowners claims. Yet, full on-chain collateral and Hacken audits keep it legit. Protocol’s tied to regulated U. S. carriers, so no rogue exposures. Tactical hedge: monitor actuarial reports on Re. xyz for surplus signals before redemptions.

Yield mechanics seal the deal. reUSD juices idle capital via ETH basis trades – sell spot ETH, long perps for delta-neutral carry – plus T-bills for that risk-free floor. reUSDe layers reinsurance alpha atop, with premiums flowing direct from policies. No inflationary tokenomics here; yields accrue real from trillion-dollar markets. As Re protocol ICLs scale, expect TVL to explode, tightening spreads and lifting both tokens.

Tactical Plays: Deploying Capital in On-Chain Reinsurance Layers

Ready to execute? Bridge USDC to Avalanche, hit Re’s app, deposit into ICLs, and mint your flavor. Start small – test reUSD at $1.058 for the low entry, scale reUSDe post-dry seasons. Pair with points farming for airdrop gravy. I’ve seen traders ladder buys on intraday dips like today’s $1.055 low, compounding edges. For tokenized reinsurance risks, this beats CeFi yields hands down – transparent, programmable, unstoppable.

Zoom out: Re Protocol’s cracking open reinsurance for retail, fusing on-chain reinsurance yields with DeFi composability. LPs can lend reUSD, options protocols collateralize reUSDe – the flywheels spin wild. With reUSD holding firm at $1.058 amid stablecoin flights, now’s prime for positioning before institutional inflows hit.

Bottom line, Re’s duo turns stablecoin parking into a yield machine. Whether you’re fortifying with reUSD or charging with reUSDe, blockchain reinsurance capital layers deliver the goods. Dive in, stack those layers, and let reinsurance volatility work for you.