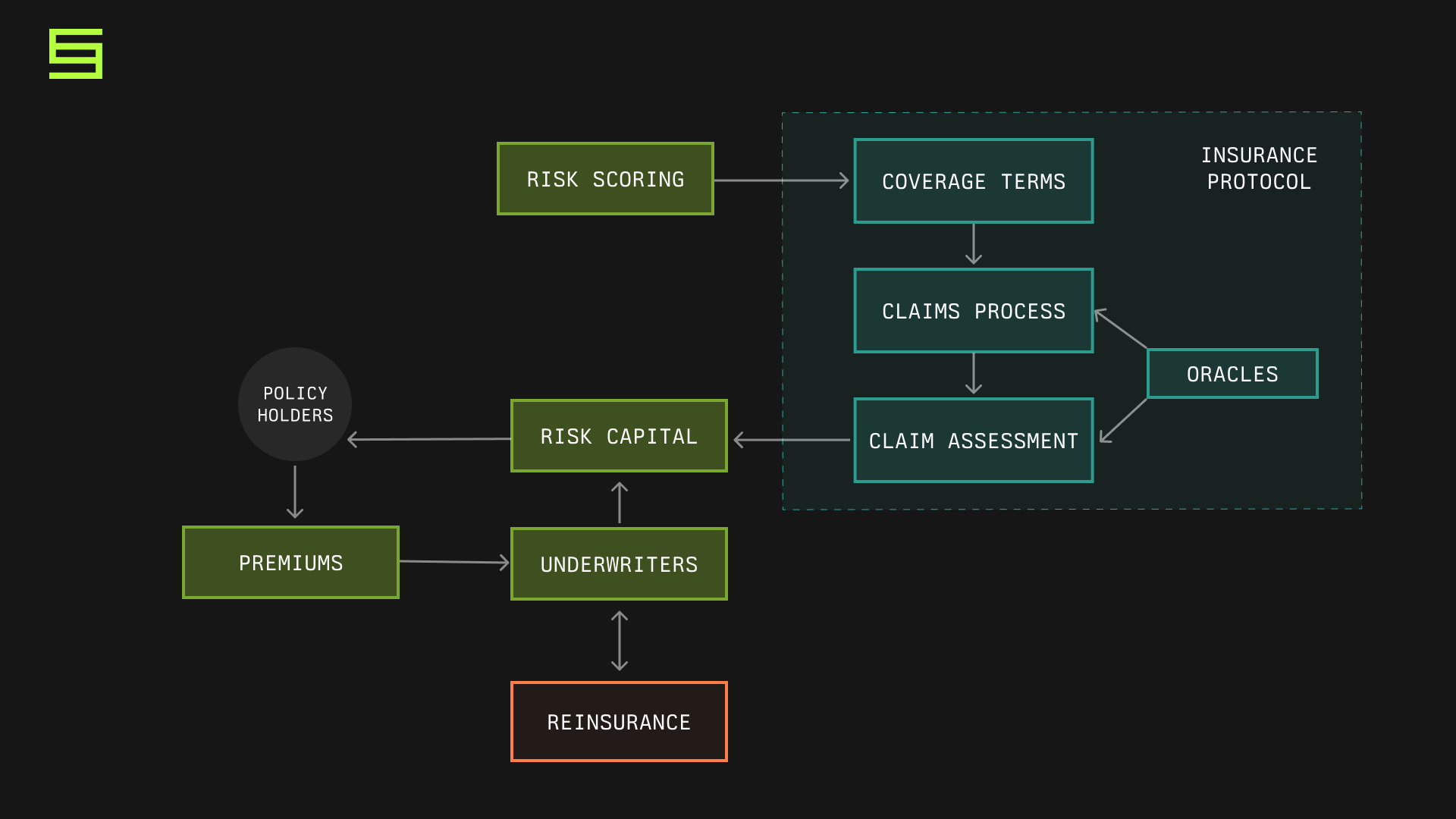

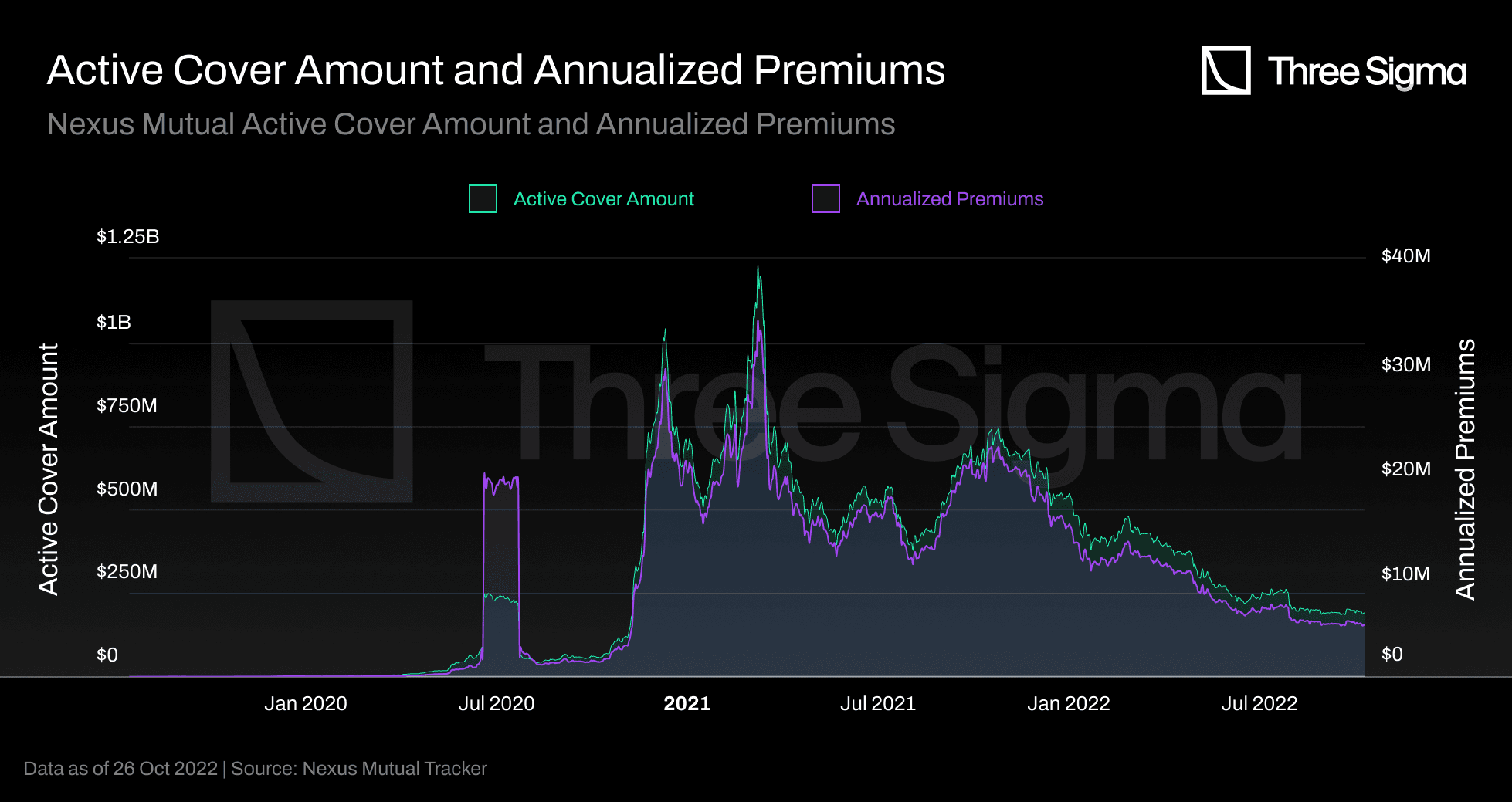

In the rapidly evolving landscape of real-world assets (RWAs), on-chain reinsurance stands out as a bridge between traditional insurance markets and decentralized finance. Platforms like Re Protocol have already channeled $191M in reinsurance premiums and $100M in on-chain capital into real-world treaties, proving that blockchain can handle the scale and scrutiny of a $784 billion industry projected to double in the coming decade. Yet, success hinges on mastering custody compliance and deposit structures. These elements ensure DeFi capital flows securely into RWAs without compromising regulatory trust or operational efficiency.

At the heart of on-chain reinsurance fundamentals lie three core pillars: regulated structures, Tier-1 custody, and transparent deposit mechanisms. These aren’t just technical checkboxes; they form the foundation for institutional adoption, allowing protocols to underwrite risks with the precision of legacy markets while embracing blockchain’s transparency. Re Protocol exemplifies this by sitting beneath existing reinsurers, channeling capital through blockchain-native workflows secured by industry-leading safeguards.

Regulated Structures: Building Trust in a Hybrid World

Traditional reinsurance relies on collateral locked in off-chain trust accounts, often opaque and slow to audit. On-chain models flip this script with regulated structures that embed compliance directly into smart contracts. Think multi-signature approvals and automated KYC checks that align with global standards like those from Bermuda or Cayman regulators, where many RWA projects domicile.

Re Protocol’s approach, as detailed on their site, channels on-chain capital into real-world treaties without reinventing the wheel. It partners with established reinsurers, using regulated special purpose vehicles (SPVs) to wrap treaties in compliant wrappers. This hybrid setup means deposits from retail or institutional investors meet solvency requirements upfront, reducing counterparty risk. In my experience analyzing both legacy and DeFi insurance, this structure is crucial for scaling; it reassures LPs that their funds aren’t exposed to unregulated wild-west scenarios.

Core Pillars for Secure DeFi-RWA Integration

-

Regulated Structures for compliance alignment: Platforms like Re Protocol and OnRe use collateralized reinsurance treaties with smart contracts, ensuring regulatory compliance while channeling on-chain capital into real-world risks, as seen in Re’s $191M in premiums.

-

Tier-1 Custody for asset security: Secured by Fireblocks multisig in Re Protocol’s ICL vault and multi-signature wallets on OnRe, providing institutional-grade protection with multi-party approvals for collateral releases.

-

Transparent Deposit Mechanisms for real-time visibility: Blockchain-native workflows enable on-chain vaults for deposits, offering full transparency, active collateral management, and verifiable settlements via dashboards like Re’s transparency dashboard.

Without robust regulated structures, even the most innovative protocols falter under regulatory scrutiny. Platforms like OnRe demonstrate this by tokenizing collateralized reinsurance, where smart contracts enforce treaty terms visible to all parties. The result? Faster settlements and verifiable solvency, drawing in yield-hungry investors to a trillion-dollar market previously off-limits.

Tier-1 Custody: The Vaults Protecting Reinsurance Capital

RWA reinsurance custody demands more than basic wallets; it requires Tier-1 custody solutions proven at institutional scale. Re Protocol’s Insurance Custody Layer (ICL) is a prime example: a dedicated on-chain vault secured by Fireblocks multisig. This setup coordinates settlement, collateral management, and payments across chains, addressing the real challenges of running capital markets on-chain, as noted by Anchorage Digital.

Fireblocks, with its MPC technology and insurance backing, ensures funds are only released via multi-party computation, thwarting single points of failure. Investors depositing into these core custody vaults earn yield from reinsurance contracts, blending stablecoin returns with underwriting profits. This Tier-1 standard not only complies with blockchain reinsurance compliance but also enables real-time transparency, letting users track every dollar from deposit to payout.

For insurance professionals eyeing DeFi, Tier-1 custody demystifies the ‘where are my assets?’ question plaguing RWA products. With $100M already on-chain via Re, these vaults prove resilient, handling volatility while maintaining 100% collateralization. It’s a far cry from legacy trusts, where audits lag months behind.

Transparent Deposit Mechanisms: Fueling Efficient Capital Flows

Deposits are the lifeblood of reinsurance deposit structures, and transparency turns them into a competitive edge. On-chain reinsurance RWAs thrive on mechanisms that let users stake assets into permissionless yet auditable pools. Re Protocol’s workflow shines here: users deposit into ICL vaults, where smart contracts allocate capital to treaties with full on-chain verifiability.

This setup, as Blockworks reports, positions Re as one of the most scaled on-chain reinsurers. Dashboards reveal live positions, premium flows, and collateral health, empowering retail investors to tap reinsurance yields previously reserved for institutions. Transparent mechanisms also facilitate secondary markets, where tokenized positions trade seamlessly, unlocking liquidity in an illiquid asset class.

Imagine depositing stablecoins into a vault where every allocation to a catastrophe bond or property treaty is trackable in real time. That’s the power of transparent deposit mechanisms. Unlike traditional setups with quarterly reports, on-chain dashboards from protocols like Re provide granular visibility: premium inflows, loss reserves, and yield accruals. This not only builds investor confidence but also enables dynamic rebalancing, where excess capital shifts to higher-yield treaties automatically via oracles.

For DeFi users, these mechanisms lower barriers to entry. Retail investors, as Finance Magnates notes, can now stake into core custody vaults and earn from reinsurance contracts, generating yields uncorrelated to crypto markets. OnRe takes it further with active collateral management, where tokenized structures allow secondary trading of positions. The outcome? Liquidity in a sector historically dominated by locked-up capital, fostering broader participation.

Synergizing the Pillars: Re Protocol’s Blueprint for Scale

Regulated structures, Tier-1 custody, and transparent deposit mechanisms don’t operate in silos; their interplay defines viable on-chain reinsurance RWAs. Re Protocol masters this synergy through its ICL, where deposits flow into Fireblocks-secured vaults under compliant SPVs. The result speaks volumes: $191M in reinsurance premiums backed by $100M in on-chain capital, as shared on LinkedIn. This isn’t hype; it’s a transparency dashboard-verified milestone positioning Re as a scaled leader, per Blockworks.

Consider a real-world treaty: capital deposits via transparent mechanisms hit Tier-1 custody, then regulated structures route it to reinsurers. Smart contracts enforce payouts only on verified claims, with multisig gates preventing premature releases. For institutional investors wary of DeFi, this hybrid model offers the best of both worlds: blockchain efficiency meets actuarial rigor. My analysis of similar setups shows loss ratios mirroring legacy peers, around 60-70%, while yields beat treasuries by 200-300 basis points.

Challenges persist, of course. Oracle reliability for off-chain claims and cross-chain bridging add layers of complexity. Yet, protocols addressing these, like Re with its blockchain-native workflows, pave the way. Reddit discussions in r/defi highlight the ICL’s role in underwriting markets, underscoring community trust in these fundamentals.

Looking ahead, as RWAs mature in 2026, these pillars will underpin tokenized reinsurance pools yielding across cycles. Platforms blending stablecoins with underwriting profits, compatible with DeFi composability, could capture slices of the $2 trillion market projection. OnRe’s collateralized structures already hint at this, with real-time transparency and secondary markets.

Insurance pros and crypto natives alike should prioritize these fundamentals when evaluating protocols. They transform reinsurance from a opaque backstop into an accessible, yield-bearing RWA. By nailing custody compliance and deposit structures, on-chain reinsurance isn’t just viable; it’s poised to redefine risk transfer in the blockchain era.