As tokenized real-world assets (RWAs) approach $20 billion in market size across treasuries, private credit, and public equities, on-chain reinsurance stands at a pivotal crossroads. Fund managers and institutional investors are pouring into RWA reinsurance transparency, but one truth remains ironclad: without ironclad on-chain reinsurance custody, the entire edifice crumbles. In 2026, custody compliance isn’t a luxury; it’s the gateway to scalable, trustless reinsurance models that bridge traditional insurance risks with blockchain efficiency.

Custodians like BitGo and Anchorage Digital Bank have evolved from mere storage providers into indispensable architects of this new paradigm. They offer segregated wallets for tokenized private equity and commodities, complete with hack insurance and multi-jurisdictional compliance. Picture this: a reinsurance pool backed by physical assets, verifiable on-chain via cryptographic proofs, yet shielded by regulated off-chain vaults. This hybrid model mitigates the irreversibility of blockchain transactions, where a single exploit could wipe out millions in premiums. Recent data underscores the stakes-$191 million in reinsurance premiums alongside $100 million in on-chain deposits-demand clarity on exactly where those assets reside.

Custody as the Bedrock of RWA Reinsurance Security

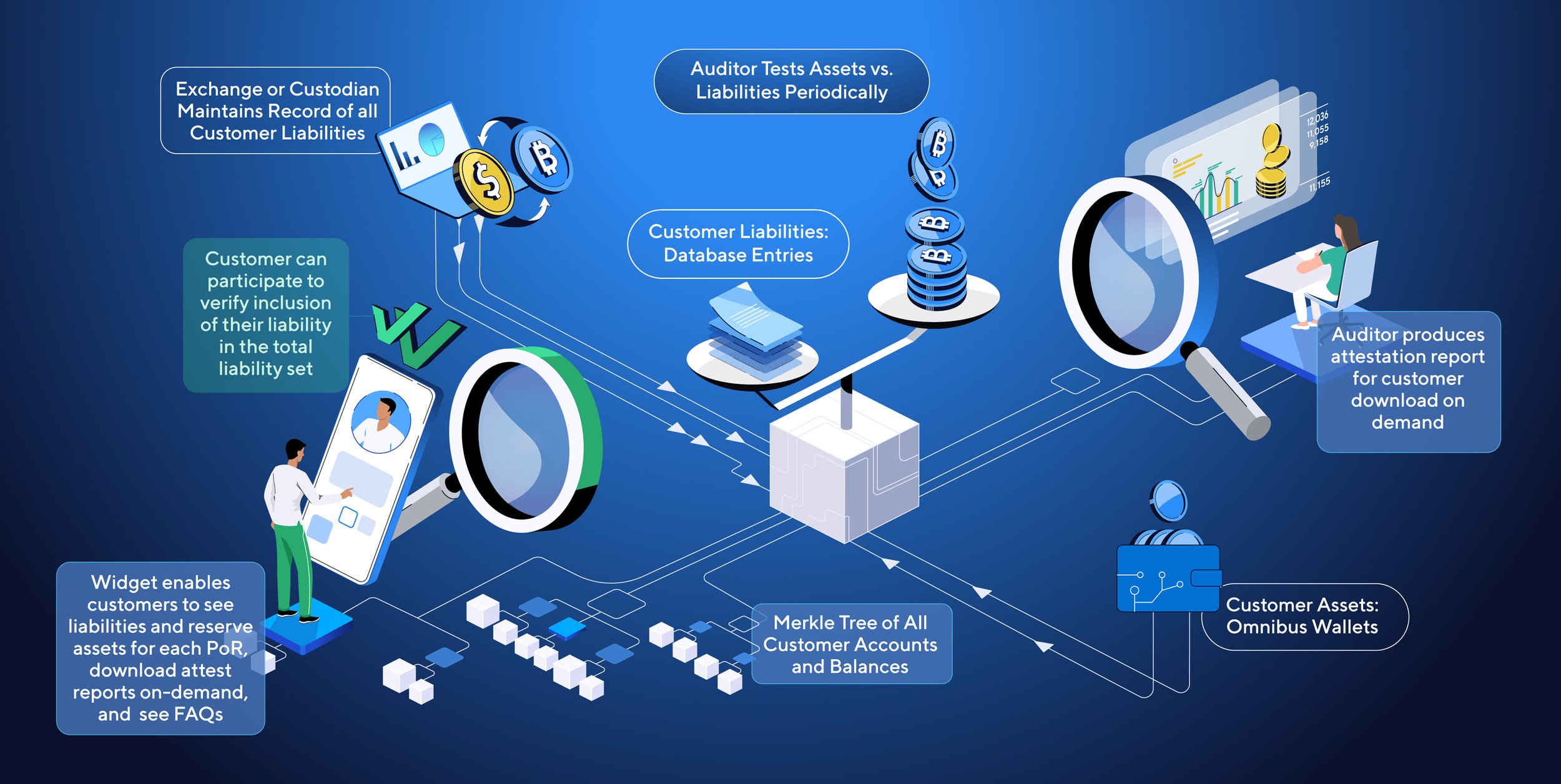

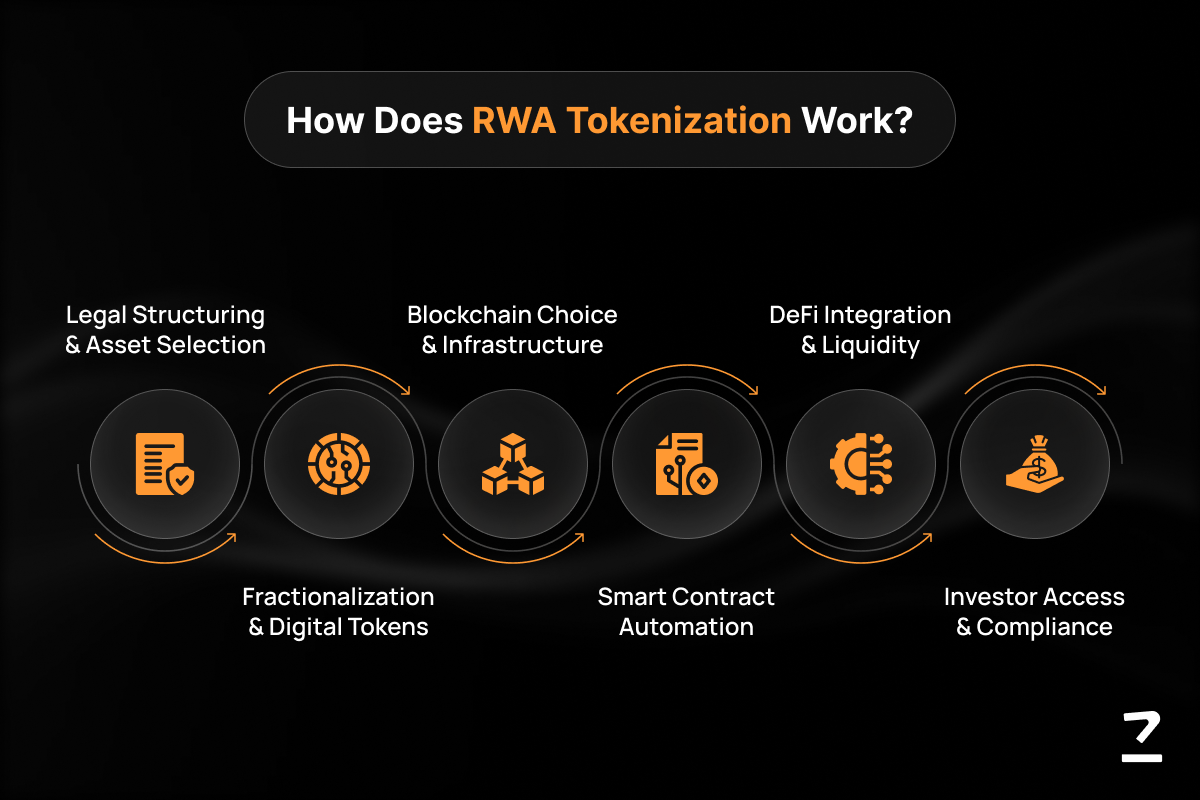

In the rush to tokenize reinsurance contracts as RWAs, custody emerges as the first line of defense. Licensed custodians enforce security protocols that detect anomalies early, from unusual on-chain payments to off-chain discrepancies. Without them, protocols risk the pitfalls seen in earlier DeFi mishaps. I argue that reinsurance compliance blockchain integration demands more than smart contracts; it requires custodians who bridge TradFi diligence with DeFi speed. Firms now provide custodial APIs, letting token issuers plug into auditors and insurance networks seamlessly. This reduces issuance friction while upholding standards like proof of reserves and NAV transparency.

Take OnRe finance’s recent moves: deploying USD* backing into RWA reinsurance protocols. Independent audits confirm asset integrity, but it’s the custodial layer that instills confidence. Users scrutinize trust signals-custody arrangements, legal wrappers, redemption processes-before depositing. In my view, skimping here invites regulatory scrutiny and capital flight.

Top 10 Trust Signals for RWA Deposits

-

Regulated Custody: Licensed providers like BitGo and Anchorage Digital Bank offer segregated wallets and multi-jurisdictional compliance for tokenized RWAs.

-

Third-Party Audits: Independent reports, like OnRe’s asset audits, verify protocol security and backing assets.

-

Proof-of-Reserves Attestations: Cryptographic proofs match on-chain deposits to real reserves, enhancing transparency.

-

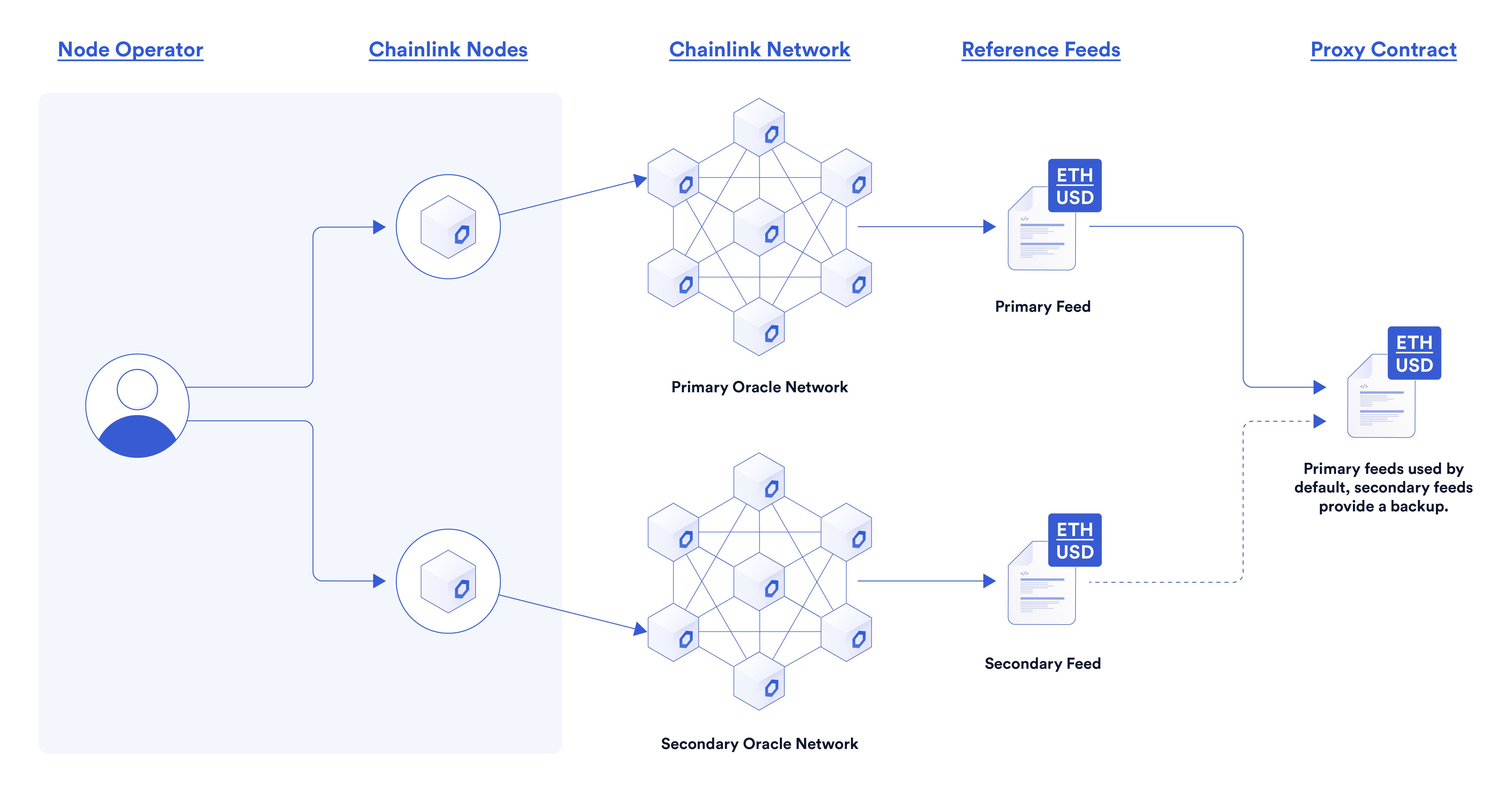

NAV Real-Time Updates: Continuous calculations via oracles provide live asset valuation transparency.

-

Seamless Redemptions: Instant liquidity without lockups, supported by robust custody infrastructure.

-

KYC/AML Compliance: Investor checks aligned with eIDAS, SEC, and global standards from the start.

-

Oracle-Verified Data Feeds: Secure feeds from Chainlink and Pyth ensure accurate real-world data.

-

Hack Insurance Coverage: Custodians provide coverage against exploits and operational risks.

-

Legal Wrappers: Structures compliant with SEC securities laws and tokenized deposit rules.

-

Cross-Chain Liquidity Proofs: Verified via bridges like LayerZero and Wormhole for seamless transfers.

Decoding 2026 Blockchain Reinsurance Regulations

Regulatory evolution is accelerating to match RWA growth. In the US, the SEC mandates that tokenized securities adhere to federal laws, compelling RIAs to enforce custody and reporting for on-chain reinsurance deposits. Meanwhile, the CFTC eyes tokenized collateral pilots, potentially unlocking stablecoin reinsurance wrappers. Across the Atlantic, the EU’s eIDAS framework extends to public blockchains, linking smart contracts to qualified electronic seals for machine-verifiable Know Your Contract checks. No new intermediaries-just pure, cryptographic compliance.

This isn’t bureaucratic overreach; it’s a maturation signal. Global landscapes demand legal validity for on-chain assets, from Bermuda’s custody-oracle integrations to tokenized deposit insurances matching traditional FDIC coverage. For reinsurance, this means protocols must embed KYC/AML from inception, with licensed custodians safeguarding pools. I’ve spoken at fintech conferences where managers confess: without these guardrails, institutional inflows stall.

Transparency Engines Powering RWA Reinsurance Trust

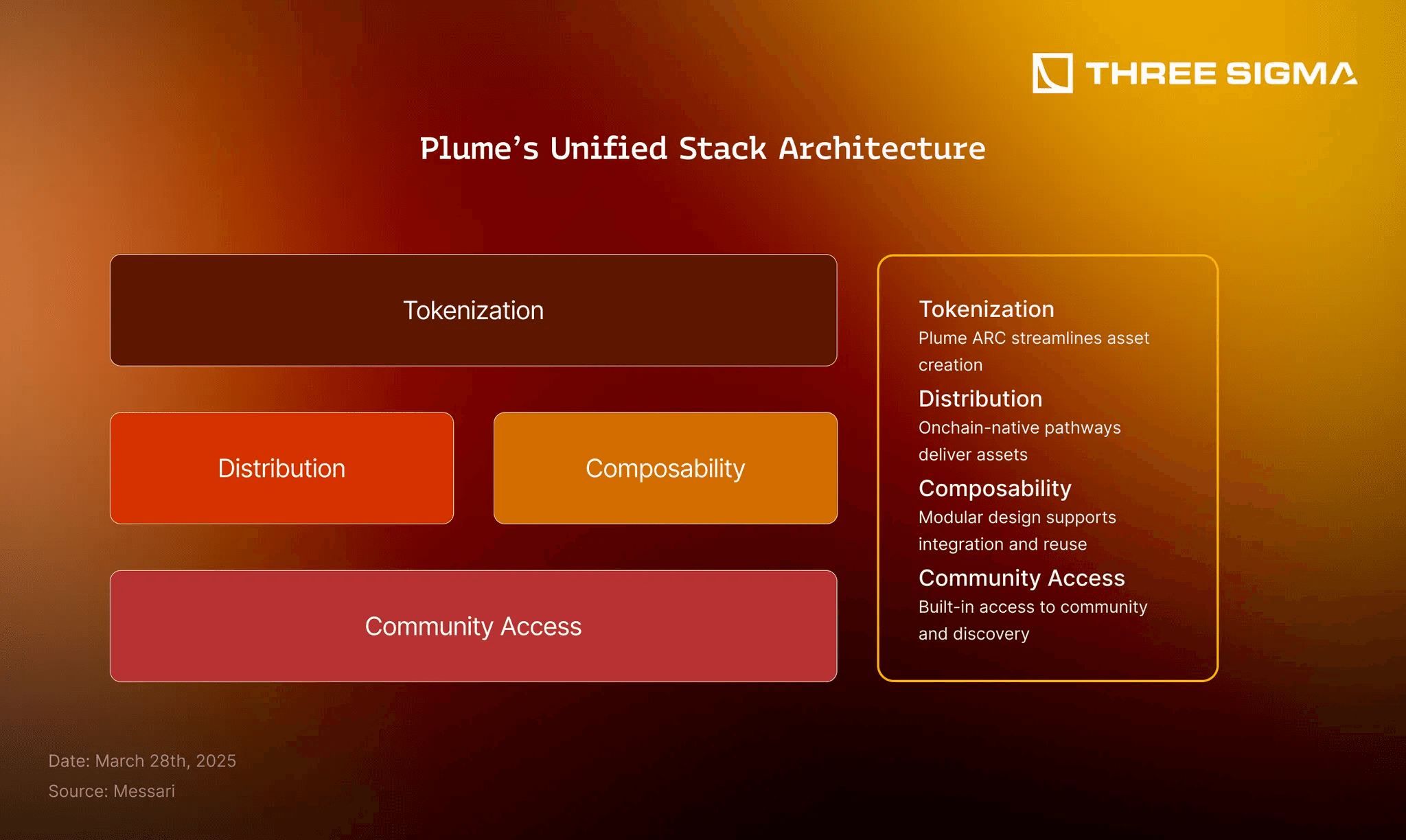

Transparency isn’t optional in RWA reinsurance transparency; it’s the oxygen sustaining deposits. Oracle networks like Chainlink and Pyth deliver continuous asset verification, feeding real-world data into reinsurance smart contracts. Cross-chain bridges-LayerZero, Wormhole-facilitate RWA transfers without custody silos, yet privacy-preserving tech addresses fragmentation concerns.

Consider NAV transparency: real-time attestations prove reinsurance liabilities match collateral. Redemptions, once clunky, now flow via compliant wrappers. As tokenized reinsurance garners fund manager attention, these mechanisms-close the trust gap. In 2026, expect custodians to lead with transparent billing and anomaly dashboards, boosting user confidence in on-chain reinsurance custody.

These tools don’t just verify; they enforce accountability in reinsurance pools where premiums hit $191 million and deposits reach $100 million on-chain. Without them, opacity breeds doubt, stalling the institutional rush into on-chain reinsurance deposits.

Building Compliant On-Chain Reinsurance Protocols

Protocol designers must prioritize custody from day zero. Start with regulated structures: embed KYC/AML gates, pair them with licensed custodians for asset safeguarding. Smart contracts then handle risk pooling, but only after oracle feeds confirm off-chain collateral integrity. I’ve audited enough DeFi setups to know that skipping this invites exploits; hybrid custody flips the script, blending blockchain speed with TradFi safeguards.

Operators of RWA reinsurance products report smoother capital inflows once these basics lock in. Bermuda’s frameworks exemplify this, mandating oracle integrations for on- and off-chain harmony. In practice, this means reinsurance contracts tokenized as RWAs carry verifiable pedigrees, attracting fund managers wary of unproven yields.

Challenges persist, though. Cross-chain fragmentation demands bridges that preserve privacy while enabling liquidity. Custodians counter with multi-jurisdictional wallets, operational controls tuned for reinsurance’s long-tail risks. My take: treat custody as dynamic infrastructure, not static storage. Evolve it with anomaly detection and transparent billing to future-proof against 2026’s regulatory waves.

Top RWA Custodians for Reinsurance

| Provider | Key Features | Jurisdictions | Trust Signals |

|---|---|---|---|

| BitGo | Segregated wallets, hack insurance, API integrations | US, EU | Independent audits, proof-of-reserves, A+ compliance score (SEC-aligned) |

| Anchorage Digital Bank | Segregated wallets, hack insurance, multi-jurisdictional controls | US, Bermuda | SOC 2 audits, proof-of-reserves, regulated bank status |

| ChainUp | Custodial APIs, anomaly detection, on-chain transparency | EU, Bermuda | Audits, NAV transparency, high compliance score (eIDAS framework) |

The Path Forward for Blockchain Reinsurance Regulations 2026

Looking ahead, blockchain reinsurance regulations 2026 will hinge on pilots like the CFTC’s tokenized collateral programs. Stablecoin issuers joining these could collateralize reinsurance pools, slashing costs for primary insurers. RIAs upgrading Form PF for digital assets signal broader adoption; private funds now classify tokenized reinsurance alongside treasuries.

Europe leads with eIDAS-linked seals, automating counterparty diligence in reinsurance smart contracts. This cryptographic compliance erodes the need for manual intermediaries, a boon for global pools. Yet, success demands vigilance: users still demand those top trust signals before depositing into $100 million pools.

Institutional appetite grows as infrastructure matures. Tokenized private credit yields arbitrage against traditional reinsurance, but only where custody shines. Platforms integrating USD* backing, like OnRe, prove the model: audited assets, transparent reserves, fluid redemptions. For insurers eyeing the blockchain edge, master these fundamentals. Custody compliance isn’t a checkbox; it’s the force multiplier turning RWAs into resilient reinsurance engines, poised to redefine risk transfer in a tokenized world.