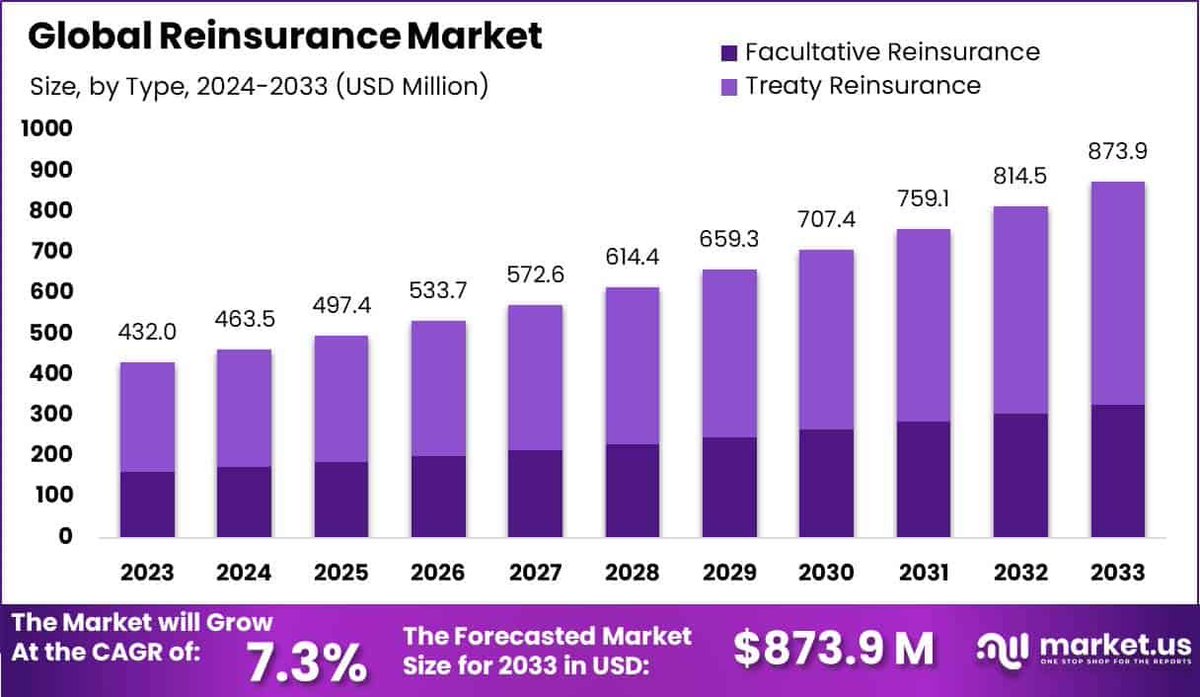

In the trillion-dollar reinsurance arena, where traditional models have long dominated risk transfer, Re Protocol is scripting a transformative chapter by channeling DeFi capital to back 35 insurers across the U. S. With total value locked (TVL) hovering around $400 million and recent authorizations of $134 million in capacity, this on-chain reinsurance pioneer is not just theorizing blockchain reinsurance risk management-it’s executing at scale in a market projected to command over $1 trillion in premiums annually.

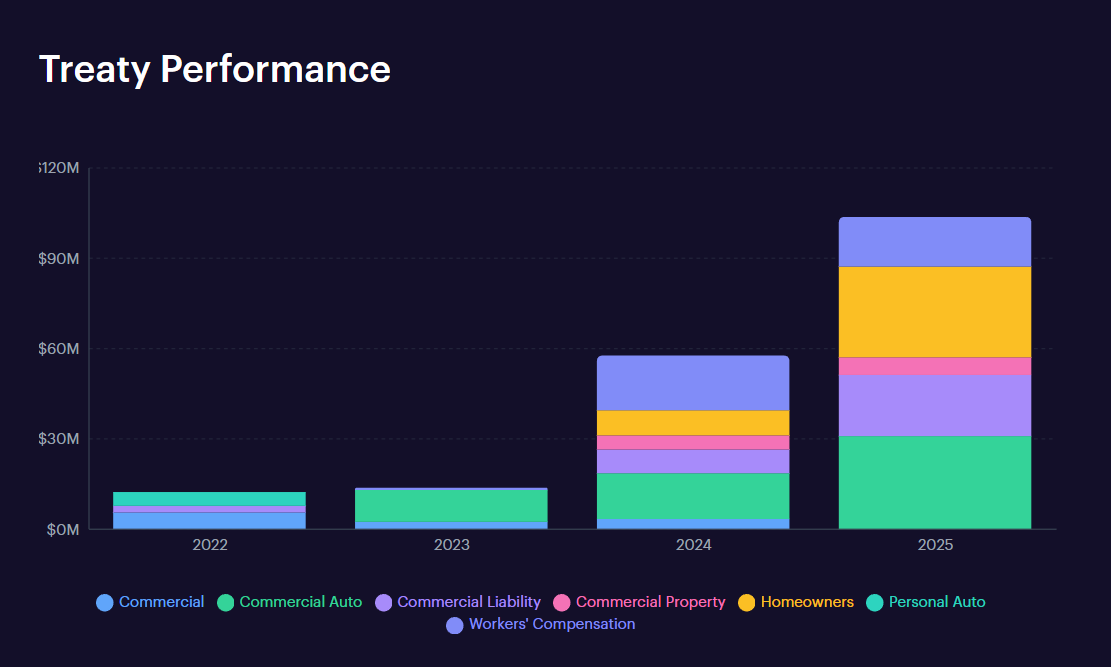

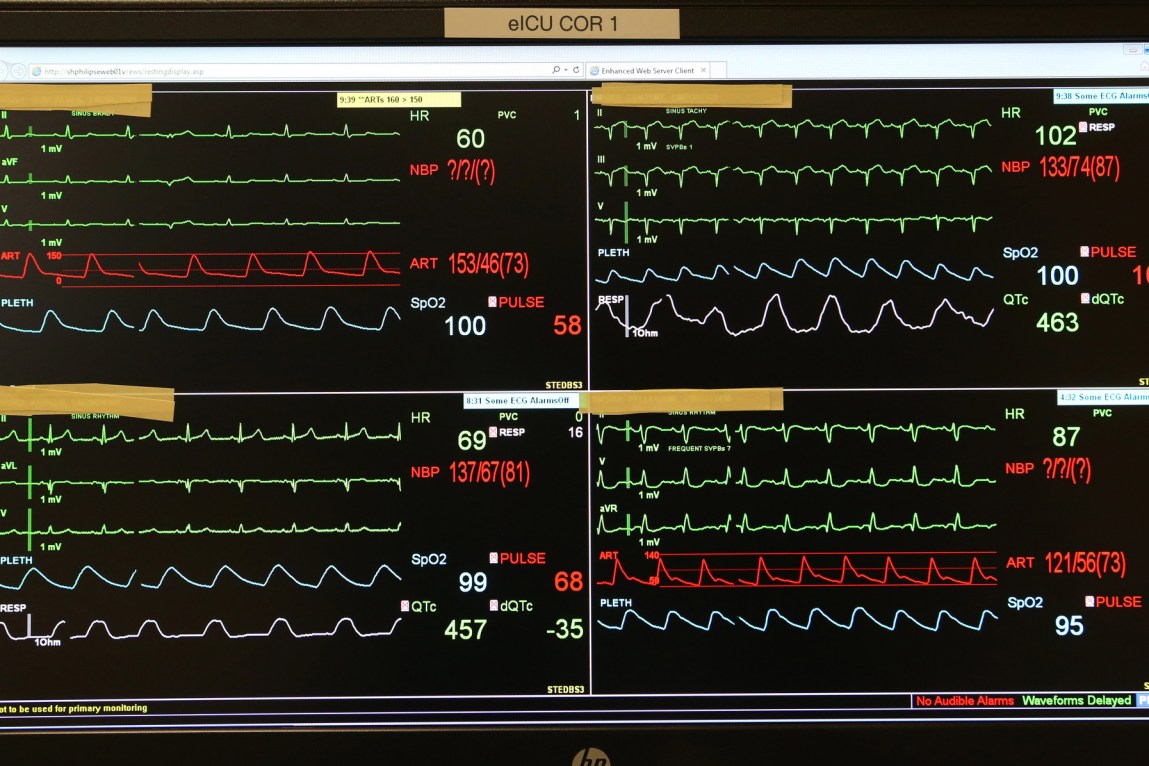

The convergence of decentralized finance and insurance is yielding tangible results. Re Protocol connects institutional and DeFi reinsurance capital with fully collateralized, real-world risks through smart contracts, offering transparency that legacy systems envy. As global reinsurance dedicated capital hit $805 billion by mid-2025, platforms like Re are carving out a niche by tokenizing risks in lines such as commercial auto, general liability, property, and workers’ compensation.

Re Protocol’s Nationwide Footprint: 35 Insurers Underwritten

Re Protocol’s growth trajectory underscores its maturity. By underwriting for 35 insurers spread across the United States, the platform demonstrates real-world adoption far beyond pilot stages. This isn’t speculative DeFi yield-chasing; it’s Re protocol reinsurance anchoring stable, collateral-backed coverage for tangible exposures. Karn Saroya, a key voice in the ecosystem, highlighted this scale on LinkedIn, emphasizing how Re underwrites genuine risks at institutional volumes.

Consider the mechanics: Insurers cede risk to Re’s on-chain pools, where capital providers earn reinsurance DeFi yields from premiums. This marketplace dynamic leverages blockchain for immutable ledgers, slashing settlement times from weeks to near-instant. In 2025 alone, Re wrote $191.6 million in reinsurance premiums while posting a stellar 92% combined ratio-a metric that signals superior underwriting discipline compared to industry averages often exceeding 100% during volatile periods.

Re Protocol Key Metrics

-

$400M TVL powering on-chain reinsurance

-

35 U.S. insurers backed with DeFi capital

-

$191.6M in 2025 reinsurance premiums written

-

92% combined ratio showing strong performance

-

$134M new reinsurance capacity authorized

-

>$100M in on-chain deposits

Strategic Capacity Expansion Ahead of 2026 Renewals

Timing is everything in reinsurance, and Re Protocol’s move to authorize $134 million in capacity just before the January 1,2026, renewal season positions it advantageously. This capital spans diversified programs, mitigating concentration risks inherent in traditional cat-bond structures. For DeFi reinsurance capital providers, it translates to accessible entry into a sector historically gated by minimum commitments in the tens of millions.

What sets Re apart is its risk-adjusted performance. Surpassing $100 million in on-chain deposits reflects eroding skepticism among sophisticated allocators. Audits by Hacken affirm the protocol’s robustness, bridging traditional insurance markets with DeFi seamlessly. As retail investors increasingly tap tokenized reinsurance via platforms like Re, the democratization of this asset class accelerates, promising yields uncorrelated to crypto volatility.

Bridging DeFi Capital to a $1 Trillion Opportunity

The reinsurance market’s enormity-$1 trillion in addressable premiums-dwarfs many DeFi sectors, yet its inefficiencies scream for blockchain intervention. Re Protocol tokenizes real-world insurance risk, enabling precise allocation and automated payouts. This on-chain reinsurance model outperforms incumbents by embedding oracles for real-time claims verification, reducing moral hazard, and optimizing capital efficiency.

From my vantage as a portfolio manager navigating insurance-linked securities and blockchain vehicles, Re’s 92% combined ratio in a year of elevated catastrophe losses is noteworthy. It suggests algorithmic risk pricing honed by data, not guesswork. Providers of blockchain reinsurance risk capital now access consistent returns, with premiums flowing directly into yield-bearing positions. As the protocol scales, expect deeper liquidity and tighter spreads, further entrenching on-chain reinsurance as a staple for institutional portfolios.

Re Protocol’s integration of DeFi reinsurance capital isn’t merely additive-it redefines capital deployment in insurance. Traditional reinsurers grapple with opaque balance sheets and protracted negotiations; Re’s smart contracts enforce parametric triggers, ensuring payouts align precisely with verified events. This precision underpins the protocol’s appeal, drawing deposits that crossed $100 million as allocators prioritize verifiable performance over narrative-driven pitches.

Risk-Adjusted Returns: 92% Combined Ratio in Focus

A 92% combined ratio speaks volumes in reinsurance, where every percentage point above 100% erodes profitability. Re Protocol achieved this amid 2025’s heightened catastrophe activity, underscoring the efficacy of its data-driven underwriting. By tokenizing risks across diversified lines-commercial auto at 25% of capacity, general liability at 30%, property 25%, and workers’ compensation 20%-the platform disperses exposure intelligently. This isn’t luck; it’s the byproduct of oracle-fed models that price risks in real time, a feat legacy players approximate through actuarial tables updated quarterly.

Re Protocol 2025 Performance vs Industry Benchmarks

| Metric | Re Protocol | Industry Benchmarks |

|---|---|---|

| Combined Ratio | 92% | 102% |

| Premiums Written | $191.6M | N/A for peers at scale |

| TVL/Deposits | $400M TVL / $100M deposits | Traditional min $10M commitments |

| Capacity Authorized | $134M diversified | Concentrated cat bonds |

For institutional investors, these metrics translate to reinsurance DeFi yields that rival high-yield bonds without equity-like volatility. My experience with insurance-linked securities reveals Re’s edge: full collateralization via stablecoins eliminates credit risk, while blockchain immutability curtails disputes. As one of the most audited DeFi protocols-Hacken validations confirm no critical vulnerabilities-capital providers sleep easier knowing risks are quantified on-chain.

Scaling Toward the $1 Trillion Horizon

With global dedicated capital at $805 billion and premiums eyeing $1 trillion, Re Protocol’s trajectory aligns perfectly with market tailwinds. The protocol’s dashboard reveals steady inflows, signaling maturation. Retail access via tokenized positions lowers barriers, enabling yields from real-world premiums that traditional sidecar funds reserve for ultra-high-net-worth players. Imagine stablecoin holders earning from U. S. property risks without KYC hurdles or geographic limits-this is blockchain reinsurance risk management democratized.

Yet strategic allocation demands nuance. While Re excels in non-cat lines, blending with cat-bond proxies could enhance portfolio convexity. From a portfolio construction standpoint, allocating 5-10% to on-chain reinsurance diversifies beyond crypto-native risks, capturing insurance’s low-beta returns. Re’s $134 million capacity authorization for 2026 renewals sets the stage for premium growth, potentially doubling 2025’s $191.6 million if uptake mirrors deposit momentum.

Re Protocol’s Strategic Advantages

-

Transparent on-chain risk pools: Full visibility into risks via blockchain transparency dashboard, enabling real-time monitoring at $400M TVL.

-

Diversified U.S. insurer backing: Supports 35 insurers across the U.S., underwriting real-world risks at scale with $191.6M premiums written in 2025.

-

Superior 92% combined ratio: Achieved strong risk-adjusted performance on $191.6M reinsurance premiums, outperforming industry benchmarks.

-

Instant settlements via smart contracts: Streamlined payouts through blockchain, connecting DeFi capital to real-world insurance efficiently.

-

Audited security for DeFi capital: Verified by Hacken, ensuring robust protection for on-chain deposits exceeding $100M.

Looking ahead, interoperability with layer-2 solutions could slash fees further, amplifying net yields. As regulators acclimate to tokenized insurance-Re’s compliant structure paves the way-institutional inflows may surge. Platforms bridging this chasm don’t just participate in the $1 trillion market; they redefine its infrastructure. For those navigating DeFi’s evolution, Re Protocol stands as a beacon of pragmatic innovation, where real-world scale meets blockchain efficiency.