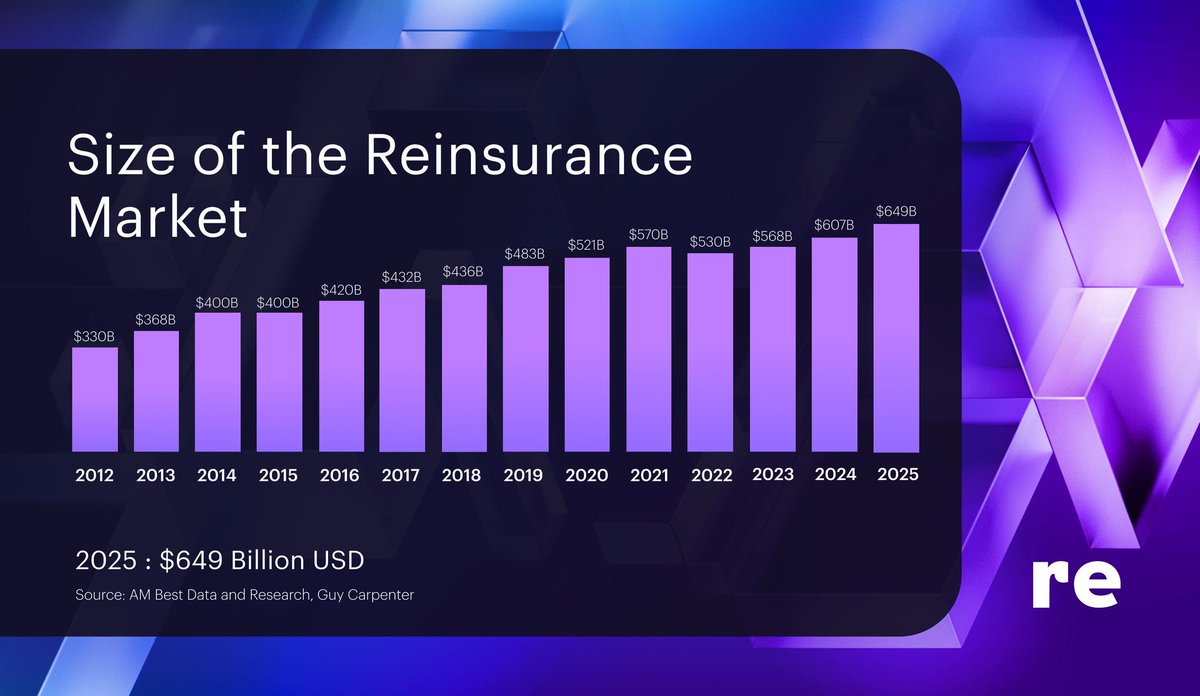

In the evolving landscape of on-chain reinsurance 2026, the Re platform stands out by delivering a remarkable 92% combined ratio while backing substantial real-world risks. As traditional reinsurance grapples with opaque capital flows and manual processes, Re’s blockchain infrastructure has already written $191.6 million in premiums in 2025, tokenizing over $100 million in risks and closing 16 deals – an 80% year-over-year surge. This data-driven performance signals a maturing ecosystem ready to capture a slice of the trillion-dollar reinsurance market.

Re Platform’s 2025 Milestones Signal On-Chain Maturity

The Re platform reinsurance model hit stride in 2025, establishing itself as a leader in decentralized reinsurance. With $191.6 million in reinsurance premiums written and backed by verifiable on-chain collateral, Re demonstrated that blockchain can handle real-world insurance liabilities at scale. This figure, drawn from Re’s official updates, underscores a pivotal shift: on-chain protocols now rival legacy players in premium volume while offering superior transparency.

Key achievements include onboarding eight new partners and integrating Chainlink Proof of Reserve alongside a Certora audit. These steps fortified trust, enabling Re to deploy $134 million in capital against diversified risks like property and cyber exposures. In Q3 alone, written premiums reached $168.8 million with that consistent 92% combined ratio, proving operational efficiency amid expanding multicover products.

Re’s 2025 Milestones

-

$191.6M in reinsurance premiums written, backing real-world risks.

-

92% combined ratio, showcasing superior risk-adjusted performance.

-

16 reinsurance deals closed, an 80% YoY increase.

-

>$100M in real-world risks tokenized on-chain.

-

8 new partners onboarded, expanding the ecosystem.

-

Completed Certora audit for enhanced security and verification.

-

Integrated Chainlink Proof of Reserve (PoR) for transparency.

Unpacking the 92% Combined Ratio Advantage

A 92% combined ratio means Re retained profitability on 92 cents of every premium dollar after claims and expenses – a strong metric for a protocol insuring tangible assets. Contrast this with RenaissanceRe’s 71.4% ratio and 27.8% return on equity; while incumbents boast lower ratios through scale, Re achieves this in a nascent on-chain environment, backing real-world risk on-chain with tokenized capital.

This efficiency stems from Re’s on-chain capital structure, which provides granular visibility into risks and collateral. Investors gain access to DeFi reinsurance yields from auto, homeowners, and cyber premiums, all verifiable via blockchain. As Aon’s Reinsurance Market Dynamics report highlights trends for January 2026 renewals, Re positions itself strategically: cyber rates dropped 32% due to capacity gluts, yet on-chain models like Re offer precise, data-rich pricing to capitalize on these dynamics. Check out detailed comparisons in our analysis on how on-chain reinsurance outperformed traditional models.

Tokenized Reinsurance Capital Fuels 2026 Expansion

Re’s tokenization of over $100 million in risks bridges Web3 liquidity with licensed insurers, creating tokenized reinsurance capital pools that attract institutional flows. Platforms like OnRe echo this with verifiable capital flows, but Re leads by deploying against live portfolios. This approach not only diversifies yield sources beyond crypto volatility but also embeds real premiums into DeFi, yielding inflation-resistant returns.

Strategically, as reinsurance 2.0 leverages data for capacity sourcing, Re’s blockchain edge shines: automated payouts, real-time risk pricing, and programmable coverage reduce friction. With 2026 renewals looming, Re’s infrastructure – audited and reserve-proven – sets the stage for scaling to billions in premiums, drawing parallels to how blockchain transforms the $700B reinsurance market.

Looking ahead to on-chain reinsurance 2026, Re’s momentum positions it to capture more capacity amid softening rates. Gallagher Re notes a 32% drop in cyber reinsurance pricing at January renewals, creating opportunities for efficient protocols to underwrite profitably. Re’s data-rich approach, powered by blockchain oracles and tokenized collateral, enables precise risk selection that traditional models struggle to match.

Key Metrics Comparison: Re Platform (2025) vs RenaissanceRe

| Metric | Re Platform (2025) | RenaissanceRe |

|---|---|---|

| Combined Ratio 💹 | 92% ⭐* | $71.4%* |

| Premiums Written 💰 | $191.6M 🚀* | Implied scale** |

| ROE 📈 | N/A | 27.8%* |

| Tokenized Risks 🔗 | $100M+ * | None |

| Deals Closed 🤝 | 16, 80% YoY growth* | N/A |

| * Re Platform: LinkedIn, Re.xyz, X posts (2025 data) | * RenaissanceRe: Official reports (e.g., $2.6B net income) |

Strategic Edge for Institutional and DeFi Investors

For portfolio managers like myself, Re represents a bridge between insurance-linked securities and programmable finance. Traditional ILS funds demand long lockups and opaque modeling; Re offers liquid, on-chain access to similar profiles with DeFi reinsurance yields. The 92% combined ratio blockchain achievement proves these aren’t gimmicks – they’re sustainable. Early adopters tokenized over $100 million, signaling demand from sophisticated allocators seeking uncorrelated returns.

In a market where Aon’s dynamics point to ample capacity for 2026, Re’s agility shines. Automated smart contracts handle renewals and claims faster than manual cedents, reducing expenses baked into that ratio. Pair this with multicover expansions, and Re could double premiums in the coming year, drawing from the $700 billion addressable market.

This trajectory invites scrutiny: can on-chain scale match legacy giants? RenaissanceRe’s $2.6 billion net income sets a high bar, yet Re’s growth rate – 80% in deals – suggests exponential potential. With audits complete and reserves proven, risk-averse capital now has few excuses. Platforms like OnRe complement this by tokenizing further exposures, but Re’s live deployments set the pace.

Navigating 2026 requires blending these innovations strategically. Cedents gain from granular visibility; investors from verifiable yields; protocols from network effects. Re’s playbook – transparent, efficient, real – charts the path for reinsurance’s digital renaissance, turning opaque risks into programmable opportunities.