For decades, reinsurance has been the backbone of global insurance risk management, yet its yields have remained locked behind institutional walls. The sector, valued at over $750 billion, traditionally offers robust returns but has limited access to major reinsurers and sophisticated investors. That landscape is rapidly changing as blockchain technology and decentralized finance (DeFi) protocols break down these barriers, ushering in a new era where retail and crypto-native investors can participate directly in reinsurance yields.

Tokenization: Opening the Gates to Reinsurance Yields

At the heart of this transformation is tokenization, converting real-world reinsurance assets into blockchain-based tokens that anyone can own, trade, or stake. Platforms like OnRe and Re are pioneering this movement. OnRe’s ONe token, for example, grants holders exposure to actual reinsurance performance and collateral yield, returns previously reserved for large institutions. Their model projects up to 40.35% returns for liquidity providers, while Re’s on-chain products like reUSD (Basis-Plus) and reUSDe (Insurance Alpha) connect DeFi capital with insurance premium flows on the Avalanche blockchain.

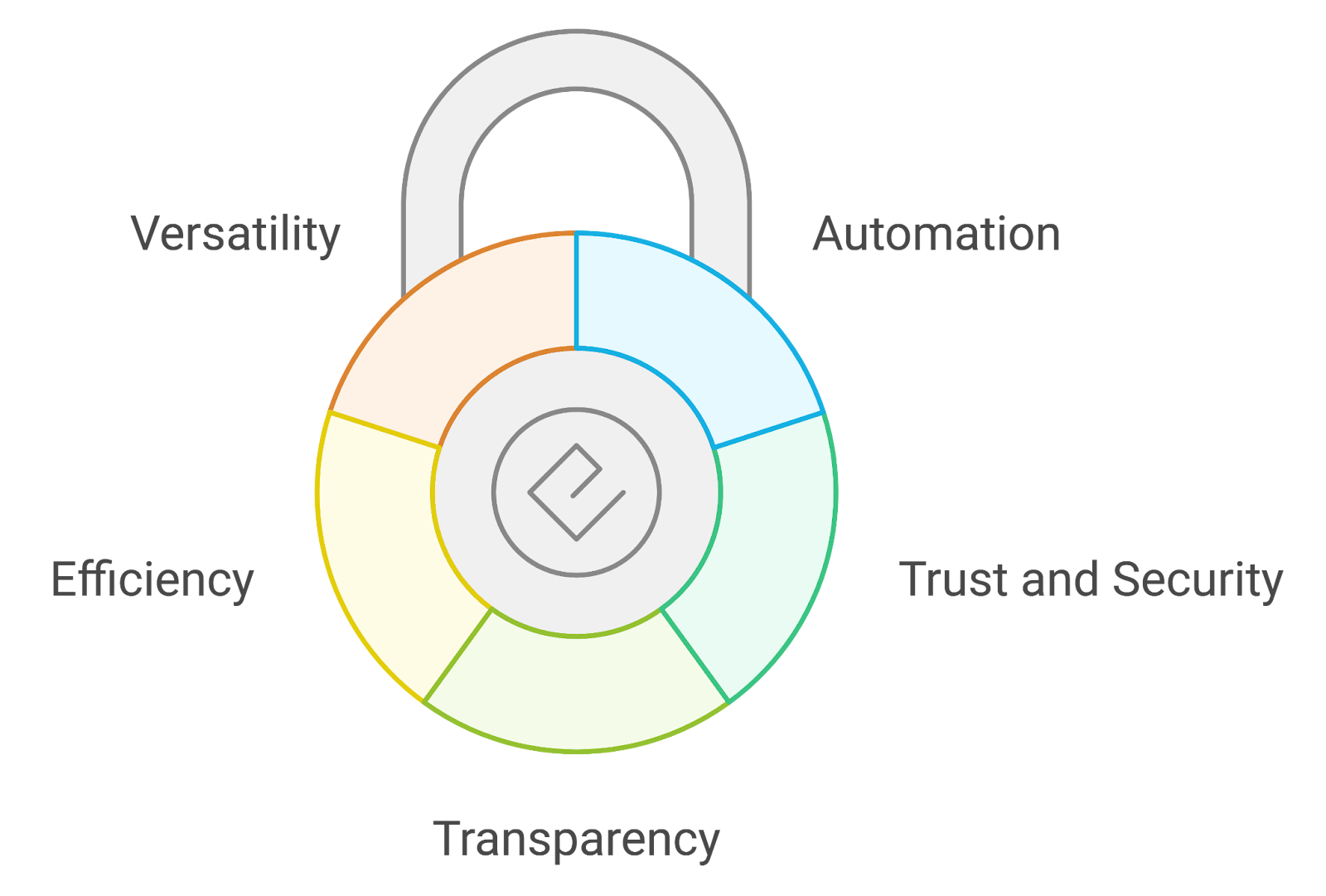

This innovation is more than just technical wizardry; it is fundamentally redefining who can benefit from the risk-transfer economy. By leveraging smart contracts and oracle networks, these platforms ensure that yield calculations, claim settlements, and collateral management are transparent and automated, a significant leap from the opaque spreadsheets of legacy reinsurers.

Integration with DeFi: Real Yields Meet Crypto Liquidity

The blending of on-chain reinsurance with DeFi ecosystems is not just theoretical, it’s already happening. Take Ethena’s recent partnership with Re: Ethena users can now deposit stablecoins like USDe or sUSDe directly into Re’s risk pools. This gives them access to high-yield opportunities (for example, a headline 23% APY as reported by AInvest) that are uncorrelated with typical crypto lending or staking products.

“By leveraging blockchain technology, smart contracts, and oracle networks, Re can help connect the reinsurance market to the DeFi space in a manner that is efficient and transparent. ”

This integration means that retail investors, previously sidelined by high capital requirements or regulatory complexity, can now diversify their portfolios with an asset class historically proven to be resilient even during market downturns.

The Retail Advantage: Transparency, Diversification and Accessibility

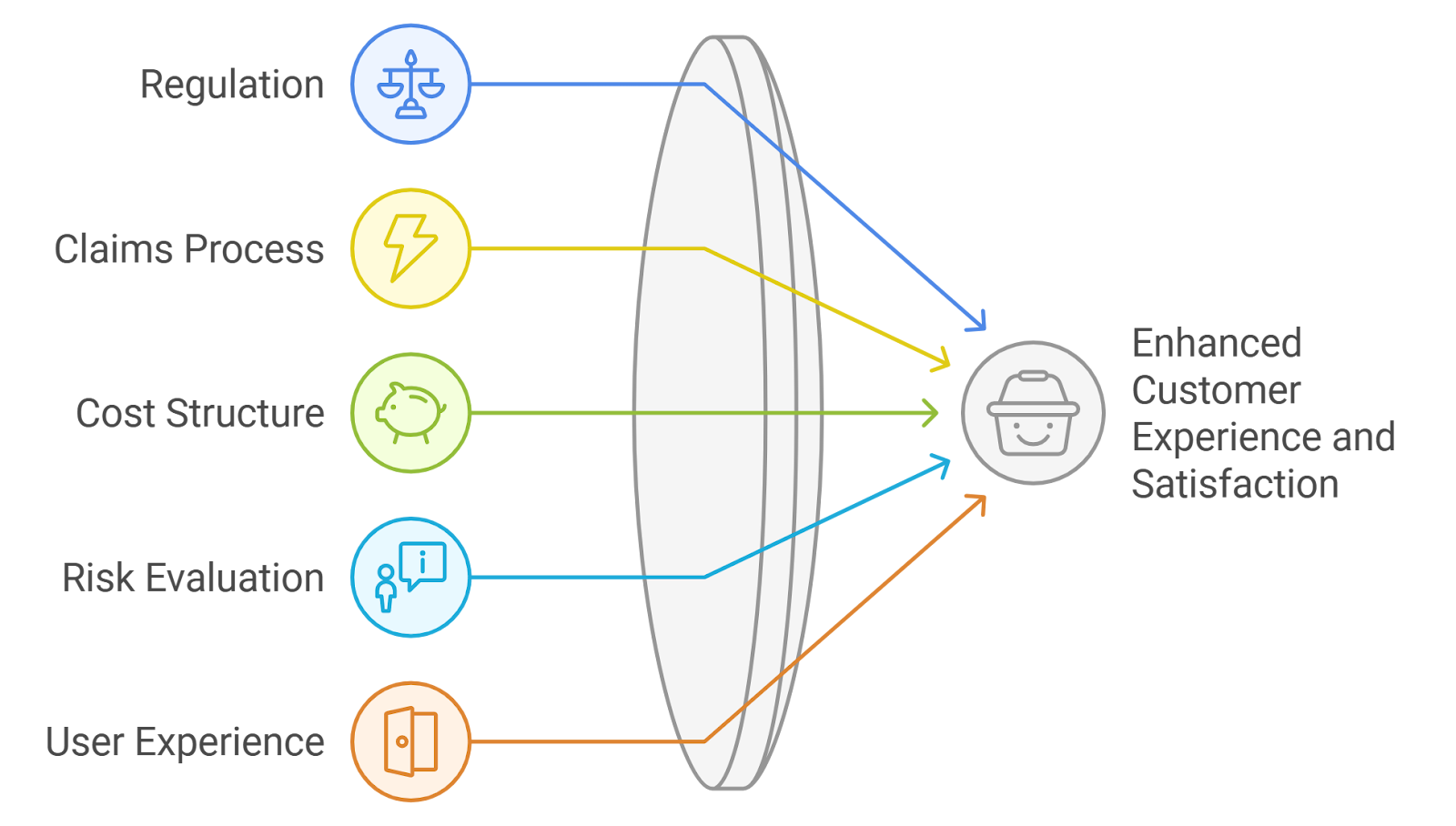

Key Benefits of Blockchain-Based Reinsurance Yields for Retail Investors

-

Enhanced Transparency and Trust: Platforms like Re utilize blockchain technology and smart contracts to ensure transparent, immutable tracking of investments and returns, reducing the opacity that has historically characterized the reinsurance sector.

-

Lower Barriers to Entry: By tokenizing reinsurance assets (e.g., ONe token on OnRe), retail investors can participate with smaller capital amounts, democratizing access to a market previously reserved for institutional players.

-

Attractive Yield Opportunities: On-chain reinsurance platforms like OnRe project returns of up to 40.35% for liquidity providers, while collaborations such as Ethena and Re offer stablecoin holders high, non-correlated APYs by tapping into the reinsurance market.

-

Seamless Integration with DeFi Ecosystems: Partnerships like Ethena x Re allow users to deposit stablecoins (USDe, sUSDe) into reinsurance risk pools, expanding DeFi investment options beyond traditional staking or lending.

The democratization of reinsurance yields via blockchain delivers several unique advantages:

- Diversification: Insurance premium flows are largely uncorrelated with equity or crypto markets, offering a rare hedge against volatility.

- Transparency: Blockchain ledgers allow anyone to independently verify investment flows, claims payouts, and reserve status in real time, addressing one of the main criticisms of traditional insurance finance.

- Accessibility: Lower minimums mean retail participants can allocate capital alongside institutions without needing millions up front.

- Efficiency: Smart contracts automate much of what was previously manual paperwork, reducing costs for all participants.

This shift isn’t merely theoretical; it’s being validated by growing volumes on platforms like OnRe and Re as they onboard both crypto-native users and traditional investors seeking new sources of alpha.

Despite these advancements, it’s important to recognize that democratized access also brings new challenges. Blockchain-based reinsurance protocols are only as robust as their underlying smart contracts and oracle integrations. Risk management in DeFi remains a moving target, with vulnerabilities ranging from contract exploits to inaccurate data feeds. However, the transparency inherent in on-chain systems allows for faster detection and remediation of issues than legacy reinsurance markets ever could.

Smart Contracts and Oracles: Building Trust and Efficiency

The backbone of this transformation is the use of smart contracts to automate underwriting, claims assessment, and yield distribution. These self-executing agreements reduce human error and deliver verifiable outcomes. When paired with decentralized oracle networks, platforms like Re can source real-world insurance data directly onto the blockchain, ensuring that all participants have equal access to critical information. This not only bolsters trust but also opens the door for innovative risk-sharing models that operate at global scale.

Regulatory clarity is evolving in tandem with technology. On-chain reinsurance providers such as OnRe have adopted regulated frameworks and third-party audits to ensure compliance and build confidence among both institutional and retail investors. As highlighted by OnRe’s tokenized yield model, transparency isn’t just a technical feature, it’s becoming a regulatory requirement.

What’s Next? The Future of Blockchain Reinsurance Yields

The integration of blockchain reinsurance yields into DeFi protocols is still in its early innings, but momentum is building rapidly. As more retail investors seek alternatives to saturated DeFi lending markets or volatile crypto assets, tokenized reinsurance products stand out for their unique risk-return profile and real-world utility.

This trend is likely to accelerate as on-chain platforms continue to innovate around capital efficiency, think dynamic collateralization based on real-time risk metrics, and as regulatory frameworks mature. The next wave will likely see further interoperability between traditional insurance pools and DeFi protocols, allowing capital to flow seamlessly across both domains while maintaining robust risk controls.

For those considering entry into this space, due diligence remains paramount: understand the protocol mechanics, review audit reports, and monitor governance updates closely. The rewards are significant, returns like 23% APY on stablecoins or up to 40.35% for liquidity providers, but so are the risks inherent in any emerging technology sector.

The bottom line: blockchain is not just unlocking access but fundamentally reshaping how capital meets insurance risk. Retail investors now have tools once reserved for global reinsurers, transparency, efficiency, diversification, all delivered at unprecedented speed via programmable finance rails.