There’s a seismic shift happening in the world of yield generation, and it’s not coming from the usual suspects in DeFi. Instead, it’s from the intersection of blockchain and reinsurance – a market that’s historically been locked away from everyday investors. Thanks to platforms like OnRe, collateralized on-chain reinsurance is now opening the door to stable, real-world yields for crypto investors. If you’re looking for uncorrelated returns that don’t hinge on whether Bitcoin is mooning or dumping, this is a trend you can’t afford to ignore.

How Collateralized On-Chain Reinsurance Actually Works

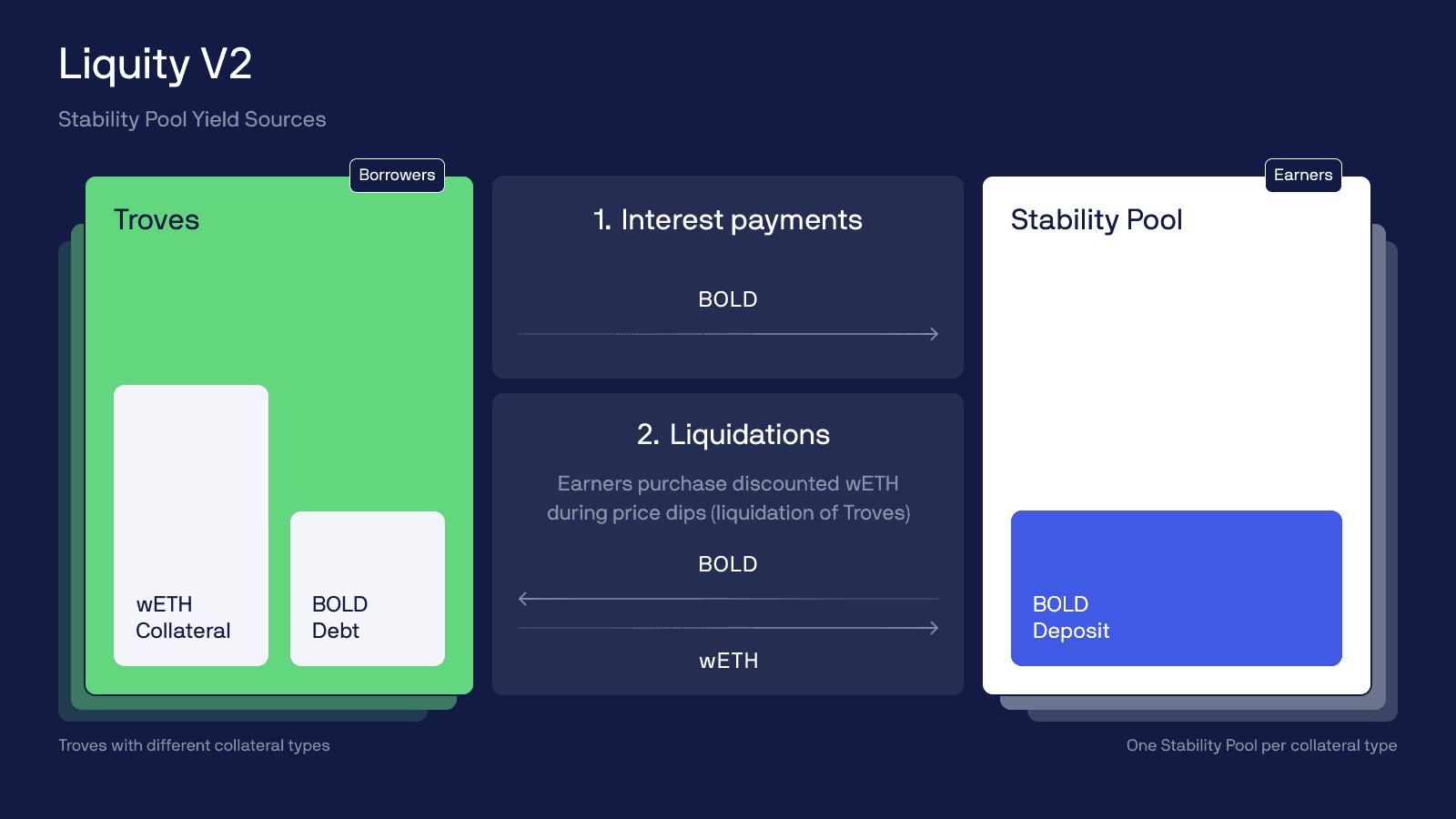

Let’s break down what makes collateralized reinsurance blockchain models so compelling. Traditionally, reinsurance is the safety net behind insurance companies – reinsurers take on some of the risk so insurers aren’t wiped out by big events. Now, with blockchain tech, this risk-sharing process is being tokenized and brought fully on-chain.

Platforms like OnRe allow investors to deploy stablecoins as collateral that backs real insurance policies. In return, these investors earn:

- Premiums paid by insurers, which are distributed as yield

- Returns from how the collateral itself is managed, often through tokenized treasuries or conservative DeFi strategies

This means you’re not just speculating on token prices – you’re earning a slice of real-world economic activity. For example, OnRe’s ONyc product targets a base yield of 16% APY, sourced directly from insurance premiums plus additional returns from well-managed collateral strategies (see documentation here).

The Yield Engine: Real-World Premiums Meet Crypto Collateral

The magic here is that these yields aren’t just another DeFi ponzi relying on new deposits. The core engine is:

Key Yield Sources for On-Chain Reinsurance Investors

-

Reinsurance Premiums: Investors earn a share of the premiums paid by insurance companies for reinsurance coverage. These premiums are collected in exchange for assuming a portion of insurance risk, and provide a steady, real-world yield uncorrelated to crypto market swings.

-

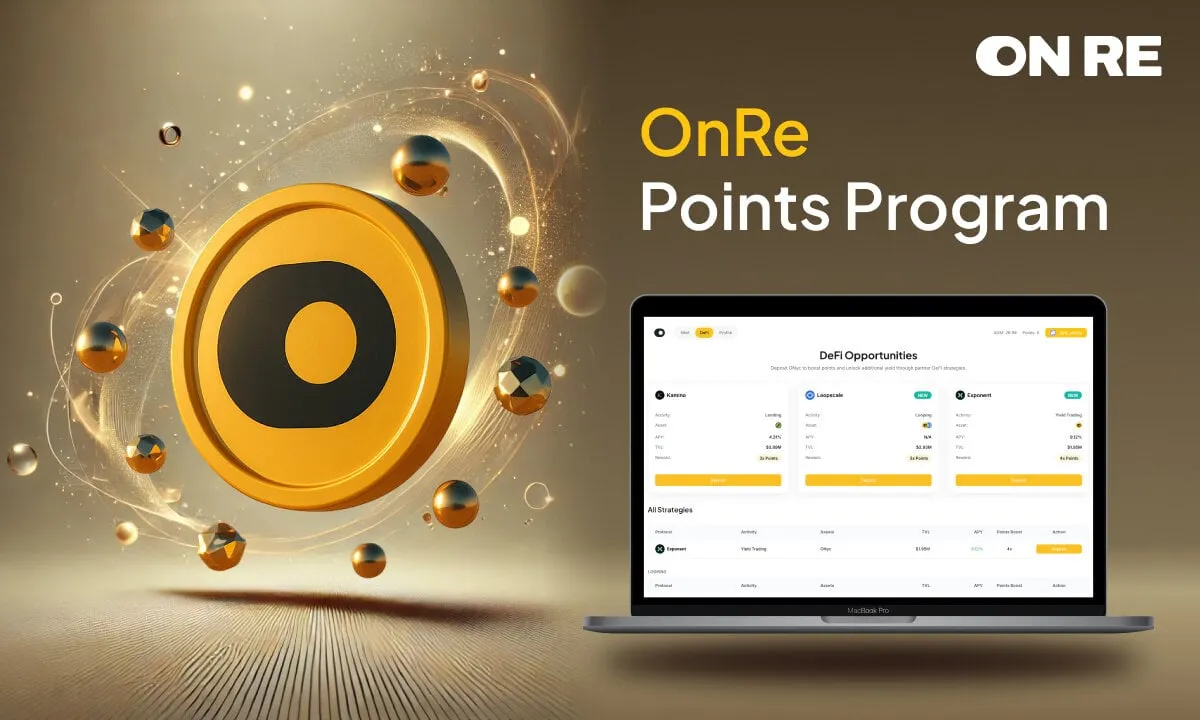

Collateral Asset Returns: The stablecoins used as collateral are often deployed into yield-generating strategies, such as tokenized treasuries or DeFi lending, which accrue additional returns on top of reinsurance performance. Platforms like OnRe actively manage these assets to maximize yield.

-

Structured Yield Products (e.g., ONyc): Innovative tokens like OnRe’s ONyc offer exposure to both reinsurance returns and supplemental yield from collateral strategies, targeting a base yield of 16% APY through a multi-collateral model.

-

Uncorrelated Yield via Blockchain Platforms: Platforms such as Re on Avalanche and OnRe deliver uncorrelated, fully collateralized returns by backing insurance programs on-chain, providing a hedge against crypto and equity market downturns.

-

Composability and DeFi Integration: On-chain reinsurance leverages DeFi composability, allowing collateral to interact with other protocols for optimized returns—expanding yield opportunities beyond traditional insurance markets.

The first component is insurance premiums – actual companies pay real money for risk coverage, which gets distributed to those providing capital (that’s you). The second layer comes from how your stablecoin collateral is put to work while it sits in reserve; think tokenized T-bills or blue-chip DeFi lending.

This dual-source approach has two huge implications:

- Diversification: Your returns are uncorrelated with wild swings in crypto or equities. Even if markets tank, people still need insurance.

- Sustainability: There’s no reliance on speculative inflows – yields are grounded in ongoing insurance business.

Why Crypto Investors Are Flocking to On-Chain Reinsurance Now

Bored of unstable DeFi APYs and tired narratives about “real-world assets” that never deliver? Here’s why projects like OnRe are suddenly seeing massive attention:

- Stable Yield in Bear Markets: Platforms like OnRe have proven they can deliver consistent returns even when crypto prices crater (OnRe Finance resources). That’s because their revenue comes from global insurance demand – not trading fees or token emissions.

- No More Middlemen: By cutting out layers of traditional finance bureaucracy, blockchain protocols can offer higher yields directly to capital providers.

- Regulatory Clarity and Transparency: Many platforms operate under strict oversight and provide clear reporting, giving institutional and retail investors alike more confidence than your average DeFi farm.

This isn’t just theory anymore; products like ONyc have already launched with multi-collateral models designed for scale (docs.onre.finance). As institutional players pile into uncorrelated yields backed by real-world assets (RWAs), expect competition – and innovation – to heat up fast.

What’s really game-changing is how on-chain reinsurance yield protocols are finally bridging the gap between DeFi and tangible, off-chain economic activity. We’re seeing a new breed of crypto-native products that can stand up in any market cycle, not just when the bull is raging. With platforms like OnRe, you don’t have to worry about the next rug pull or whether APYs will evaporate overnight. The underlying risk engine is time-tested: insurance companies will always need to hedge catastrophic risk, and now you can be part of that value chain with just a few clicks.

Risks and What to Watch For

Of course, no yield is ever truly risk-free. Collateralized reinsurance blockchain models come with their own set of considerations:

- Insurance Risk: If there’s a black swan event, claims could eat into your principal. It’s rare but possible.

- Regulatory Uncertainty: While OnRe and similar projects operate under regulatory oversight today, rules for both crypto and insurance can shift quickly.

- Collateral Management: Even with stablecoins, there’s always some exposure to smart contract risk or depegging events if not managed carefully.

The good news? These platforms are laser-focused on transparency. You can track exactly where your capital is deployed, how much premium has been collected, and what claims (if any) have hit the pool, all in real time thanks to blockchain rails. That level of visibility simply doesn’t exist in legacy reinsurance markets.

The Future of Reinsurance DeFi Returns

This isn’t just another fleeting DeFi narrative provides tokenized reinsurance returns are here to stay. As more capital flows into these protocols and underwriting scales up, expect yields to become even more competitive while still remaining uncorrelated with traditional asset classes. Institutional adoption is already underway; Avalanche-based Re Protocol and Solana-native OnRe are both onboarding large allocators seeking real world asset crypto yield without the drama of meme coins or vaporware RWA tokens.

If you’re looking for ways to future-proof your portfolio against crypto cycles, and want exposure to one of the oldest, most reliable cash flow businesses in finance, it’s time to pay attention. Platforms like OnRe are setting a new standard for what “real yield” means in Web3: sustainable income streams rooted in centuries-old insurance economics but turbocharged by blockchain composability.

The bottom line? Collateralized on-chain reinsurance isn’t just a buzzword, it’s a practical way for crypto investors to earn steady, transparent returns that aren’t tied to speculative hype cycles. As this sector matures and regulation catches up with innovation, expect even more robust opportunities at the intersection of insurance premium blockchain models and DeFi infrastructure. Volatility may be opportunity, but real-world cash flow is king.