Smart contracts are the beating heart of on-chain reinsurance platforms. They’re responsible for everything from capital pool management to automated claim payouts, and in this high-stakes, high-volatility environment, there’s zero room for error. The immutability of blockchain is both a blessing and a curse: once a contract is deployed, it can’t be changed. That’s why rigorous smart contract auditing isn’t just recommended, it’s absolutely essential for any blockchain insurance platform looking to build trust and scale securely.

Why On-Chain Reinsurance Demands Specialized Auditing

Traditional insurance audits focus on ledgers and compliance. On-chain reinsurance smart contract auditing takes that scrutiny to the code level, targeting not only security bugs but also systemic financial risk. With millions (sometimes billions) of dollars at stake in decentralized capital pools, any exploit or logic flaw can trigger catastrophic losses and a cascading loss of confidence across the ecosystem.

Let’s break down the five critical considerations that every audit team must address when reviewing smart contracts for blockchain reinsurance protocols:

Top 5 Audit Considerations for On-Chain Reinsurance

-

Comprehensive Vulnerability Assessment for Capital Pools and Payout Logic: Auditors must rigorously examine smart contract code for vulnerabilities like reentrancy, overflow/underflow, and faulty payout logic. Since reinsurance platforms manage sizable capital pools, even minor flaws can lead to major, irreversible financial losses. Using established tools such as MythX and ConsenSys Diligence is standard practice.

-

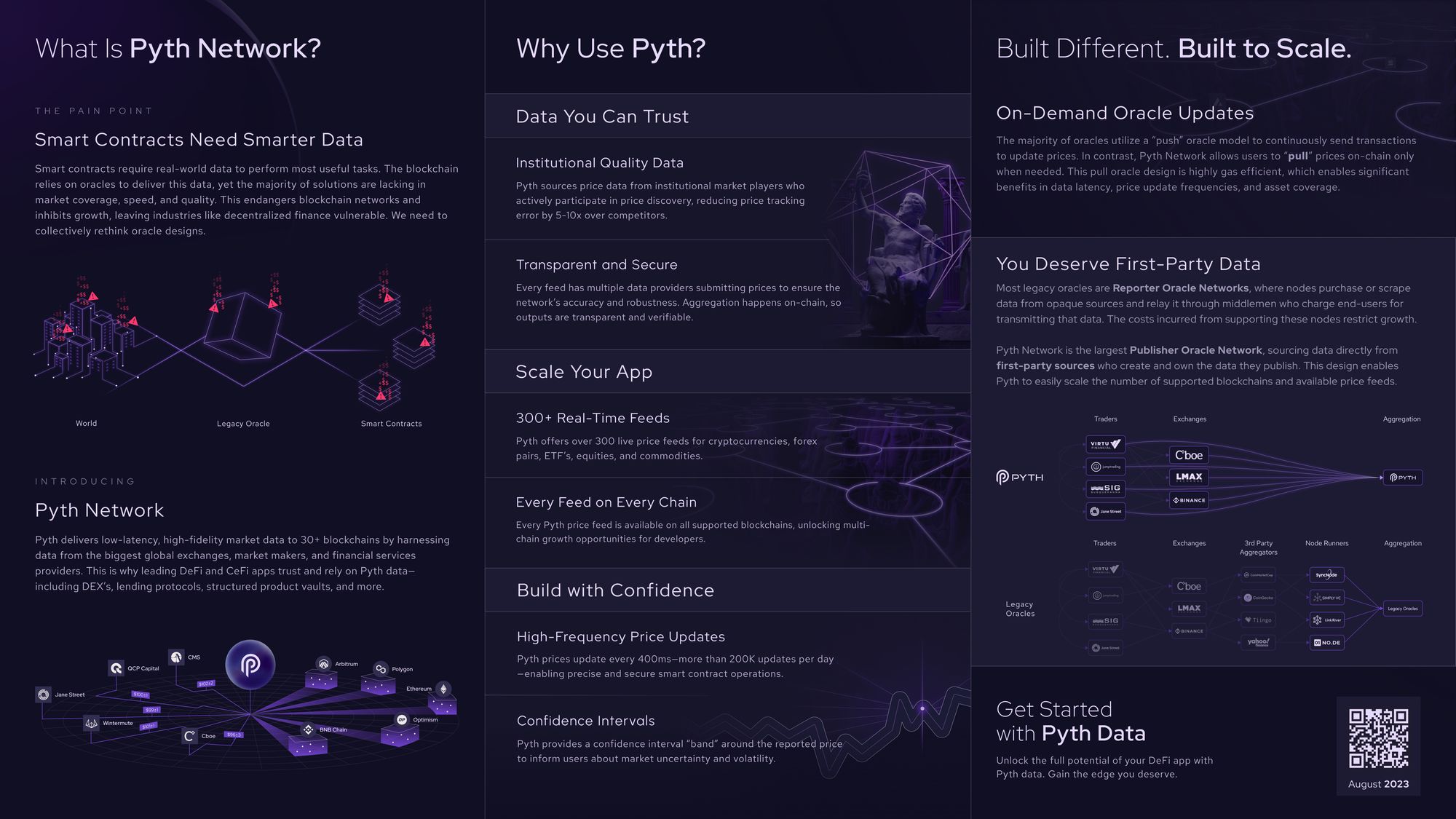

Verification of Oracle Integration and External Data Feeds: On-chain reinsurance relies on oracles (like Chainlink) to fetch real-world data for claims and risk assessment. Audits should confirm secure oracle integration, ensuring data feeds are tamper-resistant and downtime or manipulation risks are minimized.

-

Evaluation of Upgradeability and Governance Mechanisms: Many reinsurance platforms use upgradeable contracts (e.g., via OpenZeppelin Upgrades) and on-chain governance. Audits must check for secure upgrade paths, transparent voting, and robust admin controls to prevent unauthorized changes or centralization risks.

-

Assessment of Regulatory Compliance and Data Privacy Controls: Auditors should verify that contracts comply with evolving regulations (such as GDPR or local insurance laws) and implement strong data privacy measures. This is crucial for platforms operating in multiple jurisdictions and handling sensitive policyholder information.

-

Testing for Interoperability with Existing Insurance/Reinsurance Protocols: Reinsurance platforms often interact with established protocols like Nexus Mutual or Etherisc. Audits ensure seamless, secure interoperability, reducing the risk of integration bugs or cascading failures across protocols.

1. Comprehensive Vulnerability Assessment for Capital Pools and Payout Logic

This is ground zero for reinsurance security. Capital pools are essentially vaults holding user and institutional funds earmarked for claims payouts or risk transfer events. Auditors must dig deep into the payout logic, are there potential reentrancy attacks? Can an attacker manipulate state variables to drain funds? Overflow/underflow bugs, unchecked external calls, or subtle business logic errors can all spell disaster.

Unlike generic DeFi protocols, on-chain reinsurance deals with long-tail risks and complex triggers (think parametric weather events or multi-party loss sharing). Every edge case in payout calculation needs to be modeled and tested against adversarial scenarios. As blockchain reinsurance security becomes more sophisticated, so do potential attack vectors.

2. Verification of Oracle Integration and External Data Feeds

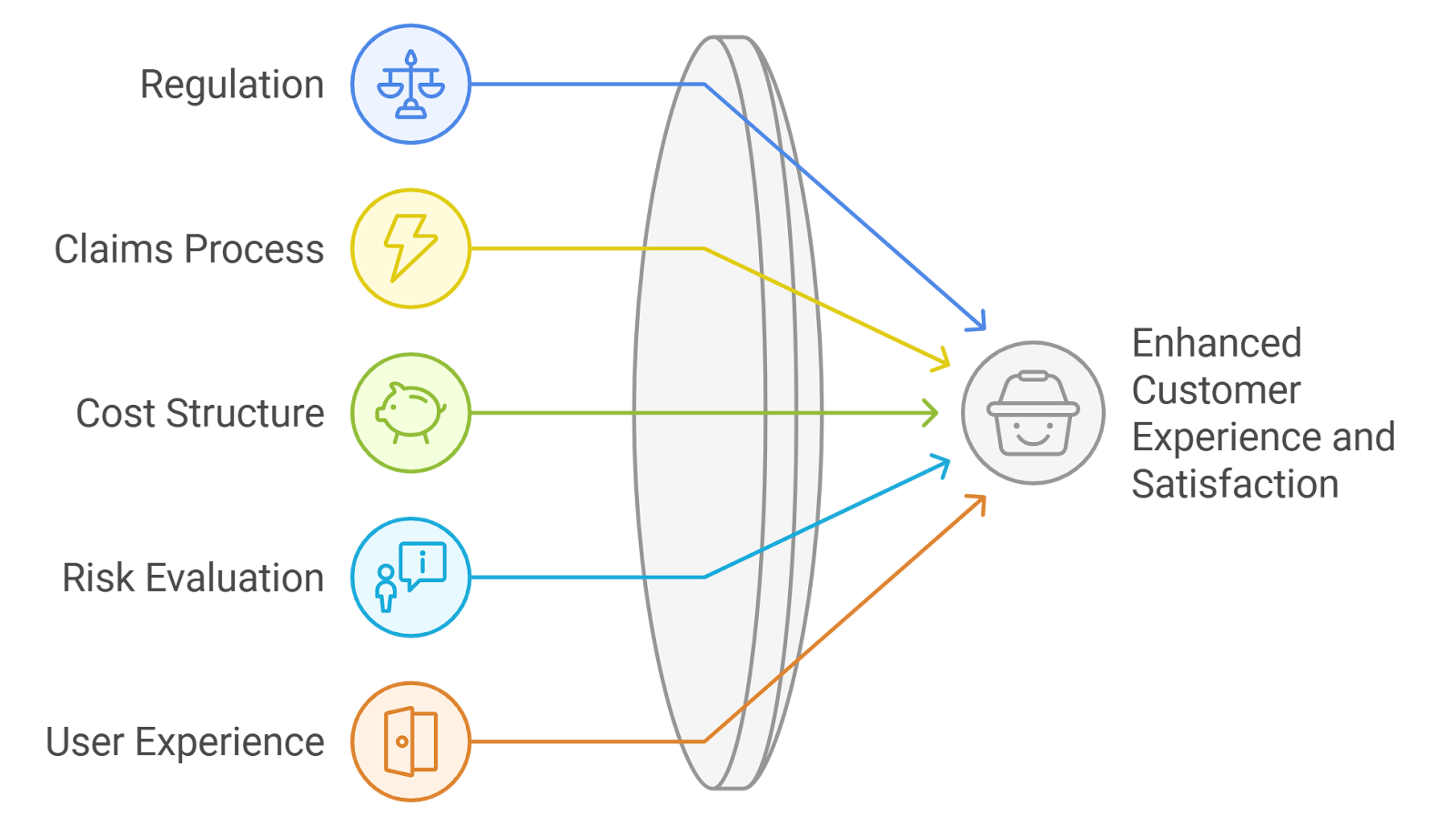

No smart contract operates in a vacuum, especially not in insurance. Most on-chain reinsurance products depend heavily on oracles to bring off-chain data (like weather events, asset prices, or claims triggers) onto the blockchain. But here’s the catch: if your oracle integration is weak, your entire protocol is vulnerable to manipulation.

A robust audit will scrutinize:

- The reliability and decentralization of data sources

- The handling of stale or manipulated feeds

- The fallback mechanisms if an oracle fails

This isn’t just about technical correctness, it’s about ensuring that no single point of failure can compromise policyholder funds or trigger false payouts.

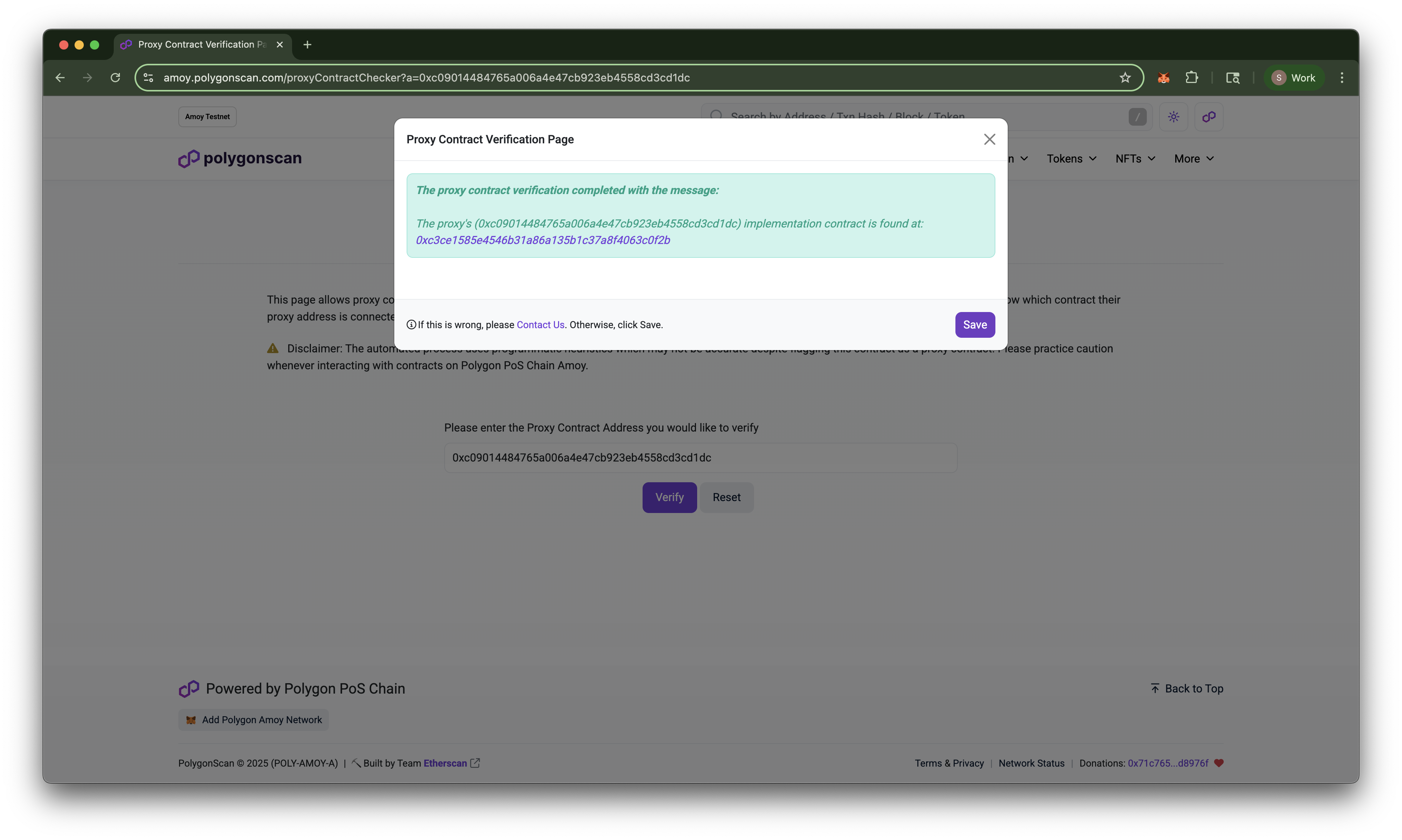

3. Evaluation of Upgradeability and Governance Mechanisms

Here’s where things get tactical: most modern protocols use upgradeable contracts (via proxies) so they can patch bugs or add features post-deployment. But every upgrade path introduces its own set of risks, what if governance is compromised? What if an upgrade disables withdrawal rights?

An effective audit must:

- Analyze access control structures (who can propose/execute upgrades?)

- Check timelocks and emergency pause mechanisms

- Test governance voting logic under stress scenarios

This layer is critical for maintaining user trust while still giving teams flexibility to respond to emerging threats, a balancing act unique to reinsurance on smart contracts.

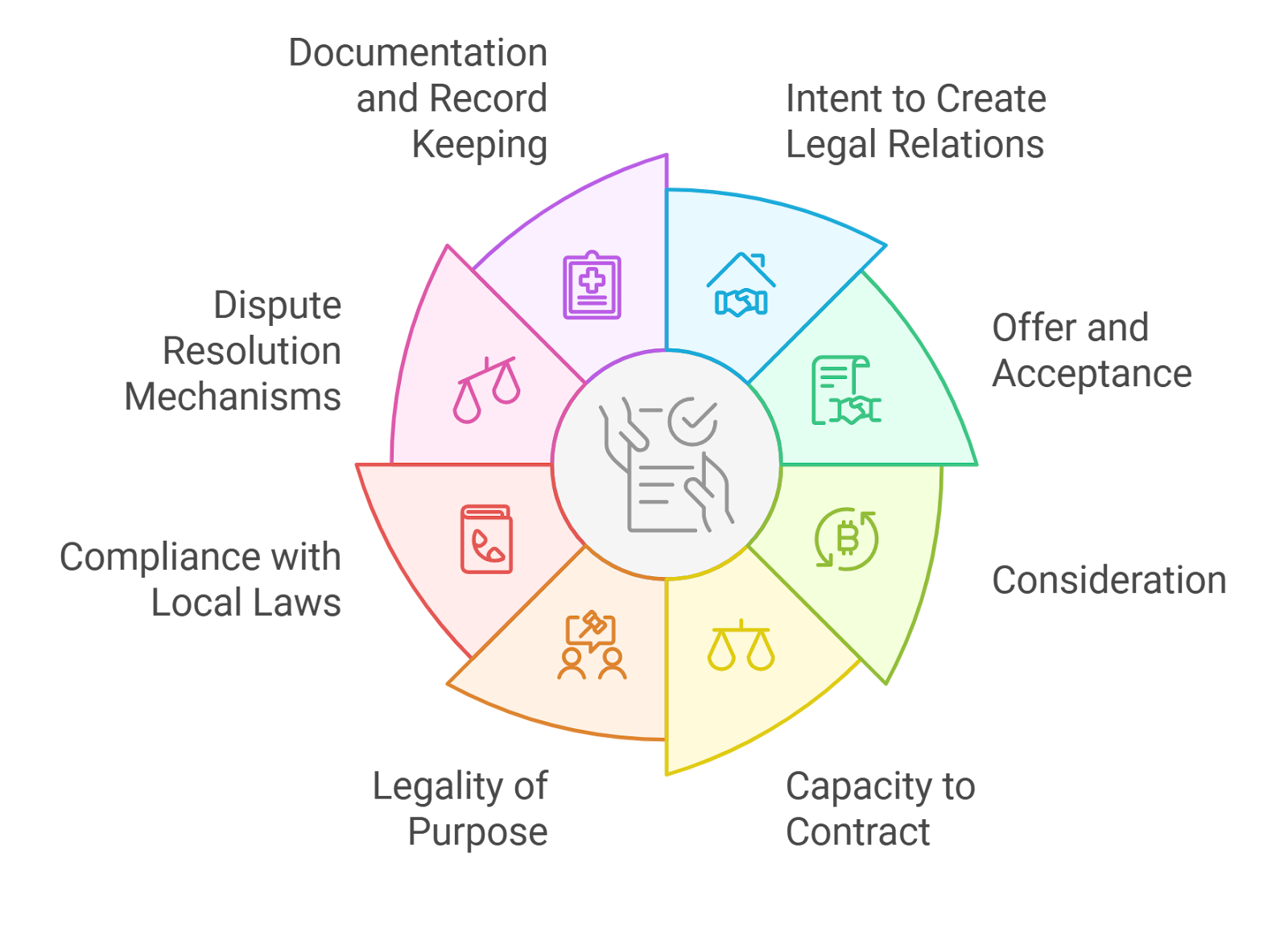

4. Assessment of Regulatory Compliance and Data Privacy Controls

Regulatory compliance in on-chain reinsurance is a moving target. Jurisdictions are evolving their stance on digital assets, and insurance-specific rules around data privacy, anti-money laundering (AML), and KYC are getting stricter. Smart contract audits must go beyond code safety, they need to ensure contracts enforce the right data-handling practices and access controls.

For example, does your protocol inadvertently leak sensitive claim details or user data onto a public chain? Are there mechanisms to redact or pseudonymize information in line with GDPR or local privacy laws? Auditors should verify that all regulatory requirements are met at the code level, not just through off-chain processes. This is critical for institutional adoption and long-term platform viability.

5. Testing for Interoperability with Existing Insurance/Reinsurance Protocols

The future of on-chain reinsurance isn’t siloed, it’s composable. Platforms will increasingly interact with other DeFi protocols, legacy insurance systems, and cross-chain bridges. That’s why auditors must rigorously test how smart contracts behave when interacting with external protocols, can your capital pool smart contract safely accept collateral from another DeFi lending protocol? Does it properly validate claims submitted via a third-party gateway?

Interoperability testing covers:

- Edge cases in cross-protocol asset transfers

- Reentrancy risks introduced by third-party calls

- Standard compatibility (ERC-20, ERC-721, etc. )

This step is often overlooked but can make or break the reliability of a blockchain insurance platform audit.

Why These Five Audit Considerations Matter More Than Ever

The explosion of DeFi has brought both innovation and new attack surfaces to blockchain insurance platforms. On-chain reinsurance smart contract auditing is no longer just about finding code bugs, it’s about safeguarding capital pools from systemic risk, defending against oracle exploits, ensuring upgrade paths aren’t attack vectors, meeting ever-tightening regulatory standards, and future-proofing interoperability as the ecosystem matures.

The teams that treat these five areas as non-negotiable audit checkpoints will set themselves apart, attracting institutional capital and building real community trust. The cost of skipping steps? Potentially existential losses as we’ve seen time and again in unaudited or poorly-audited protocols.

Which audit consideration do you find most challenging for on-chain reinsurance platforms?

Smart contract audits are crucial for secure and reliable on-chain reinsurance. Considering the unique challenges in this space, which of these audit considerations do you think is the toughest to address?

Actionable Next Steps for Reinsurance Innovators

If you’re building or investing in blockchain reinsurance protocols, demand transparency around these five audit pillars:

- Request detailed audit reports that explicitly cover capital pool logic, oracle integration testing, governance/upgrade controls, compliance checks, and interoperability scenarios.

- Favor platforms audited by multiple independent firms, not just internal reviews.

- Push for open bug bounties, ongoing monitoring tools, and transparent remediation timelines post-audit.

This approach isn’t just about ticking boxes, it’s about building resilient infrastructure that can handle black swan events without blowing up user funds or regulatory goodwill.

The bottom line: As the market matures and institutional players enter the fray, only those who embrace rigorous blockchain reinsurance security will survive, and thrive, in this new era of programmable risk transfer.