Imagine a world where reinsurance is as transparent and frictionless as trading crypto on your favorite DEX. That’s not a distant vision anymore. On-chain reinsurance is rapidly rewriting the rules of crypto risk management, leveraging blockchain’s power to deliver what traditional insurance never could: automated protection, capital efficiency, and real-time transparency.

Smart Contracts: The Engine of Automated Protection

At the heart of on-chain reinsurance are smart contracts. These self-executing agreements live on blockchains, enforcing treaty terms automatically when certain conditions are met. Think of them as programmable insurance robots that never sleep or make mistakes from fatigue. This isn’t just theoretical, platforms like the Model Context Protocol (MCP) Reinsurance Framework have already demonstrated how smart contracts can automate everything from premium collection to claims settlement. The result? Reduced admin overhead, fewer disputes, and near-instant execution.

This automation matters because crypto markets move fast and risks emerge in real time. With smart contracts, protocols can offer coverage for volatile DeFi exploits or impermanent loss scenarios, triggering payouts the moment a loss event is detected, no manual paperwork required.

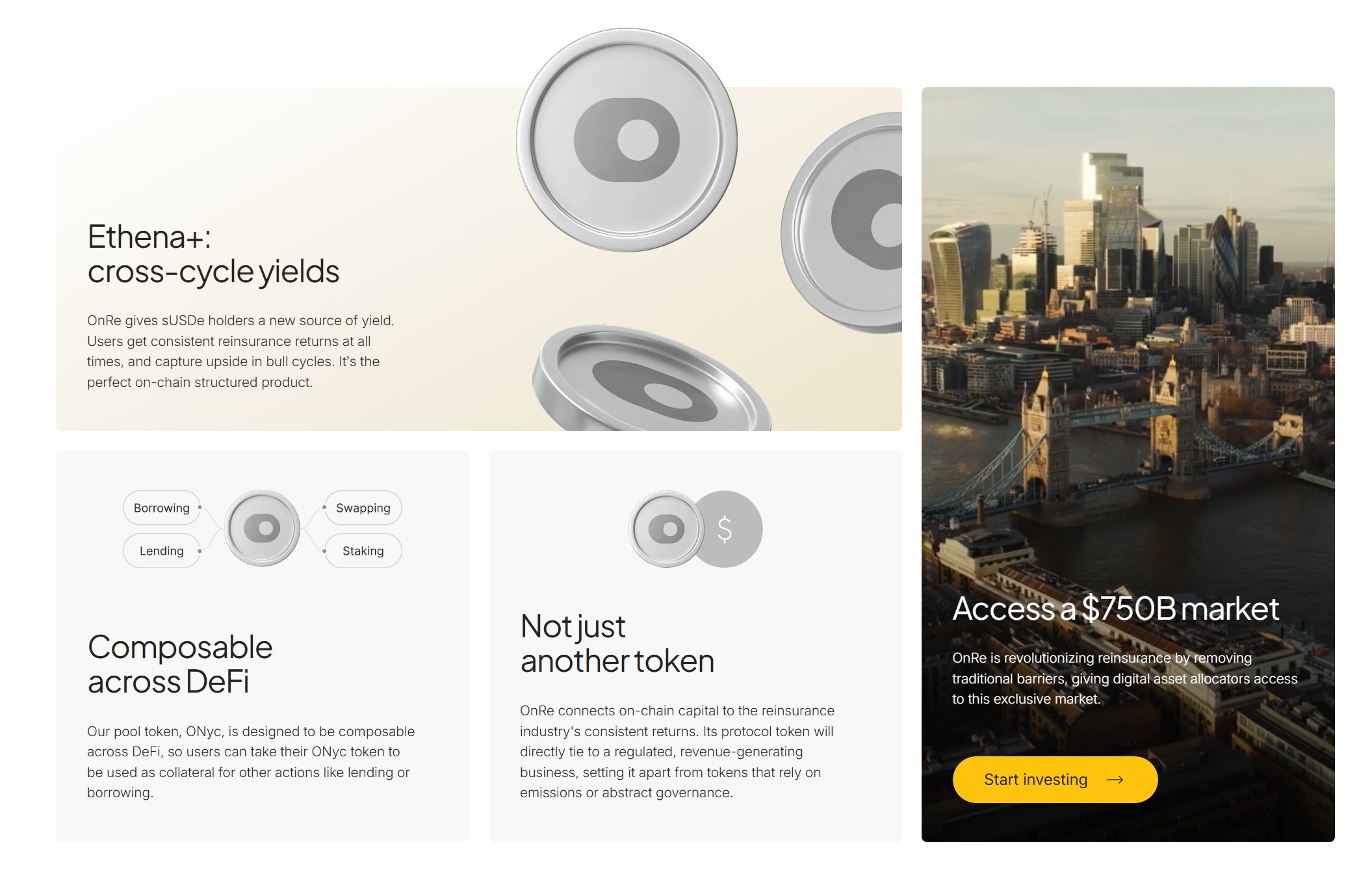

Capital Efficiency: Tokenization Unlocks New Investment Models

The next game-changer is capital efficiency in DeFi. On-chain reinsurance platforms like OnRe are pioneering tokenized yield models that let investors participate directly in global reinsurance risk pools. By tokenizing reinsurance contracts, capital can be fractionalized and traded in secondary markets, opening up a traditionally exclusive asset class to a broader base of crypto-native investors.

This means more liquidity for risk carriers and more flexibility for investors seeking yield uncorrelated with mainstream DeFi assets. For example, OnRe’s approach links real-world risk origination with blockchain-native capital formation, allowing collateral to earn yield while backing insurance obligations (read more here). It’s a win-win for both sides: insurers access deeper liquidity, while investors tap into the steady returns of insurance premiums, now transparently tracked on-chain.

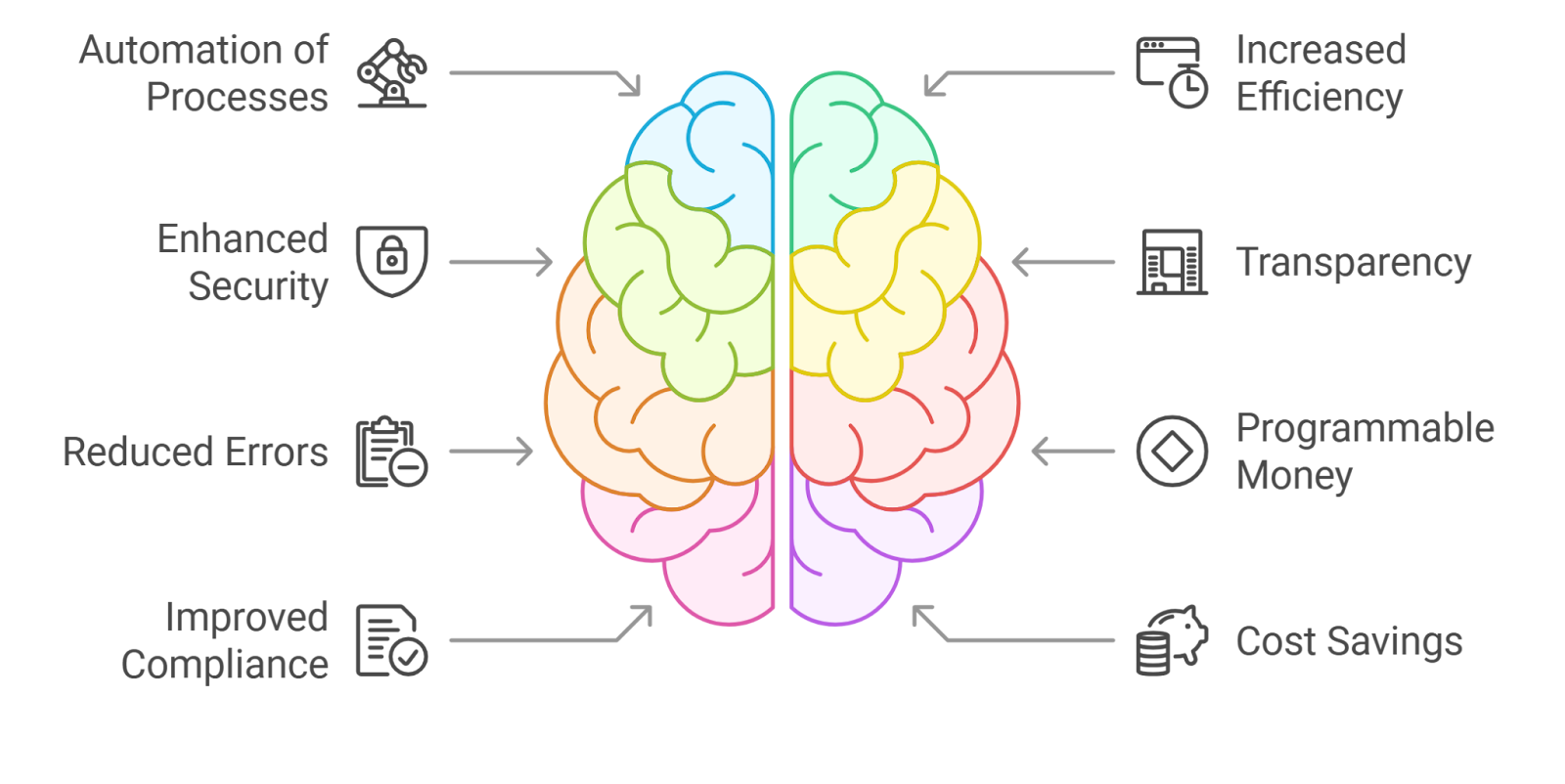

Key Benefits of Tokenized Reinsurance for Crypto Investors

-

Automated Smart Contracts Reduce Human Error: Platforms like Model Context Protocol (MCP) use smart contracts to automate premium collection, claims settlement, and treaty management, minimizing manual mistakes and speeding up processes.

-

Enhanced Capital Efficiency and Liquidity: Solutions such as OnRe enable tokenized reinsurance contracts, allowing fractional ownership and secondary trading. This increases liquidity and lets investors access scalable, yield-bearing reinsurance products.

-

Real-Time Transparency and Data Access: Blockchain-based reinsurance, as seen with Genesis Global RE, provides all stakeholders with real-time access to performance metrics, claims history, and risk exposure, boosting trust and reducing disputes.

-

Direct Exposure to DeFi-Linked Yields: Platforms like Nayms offer tokenized insurance pools, letting investors trade exposure and earn returns tied to both reinsurance performance and DeFi collateral yields.

-

Regulatory Innovation and Security: Jurisdictions such as Bermuda and the Cayman Islands provide regulatory sandboxes for digital asset-backed reinsurance, supporting secure, compliant tokenized models and innovative collateral options like stablecoins.

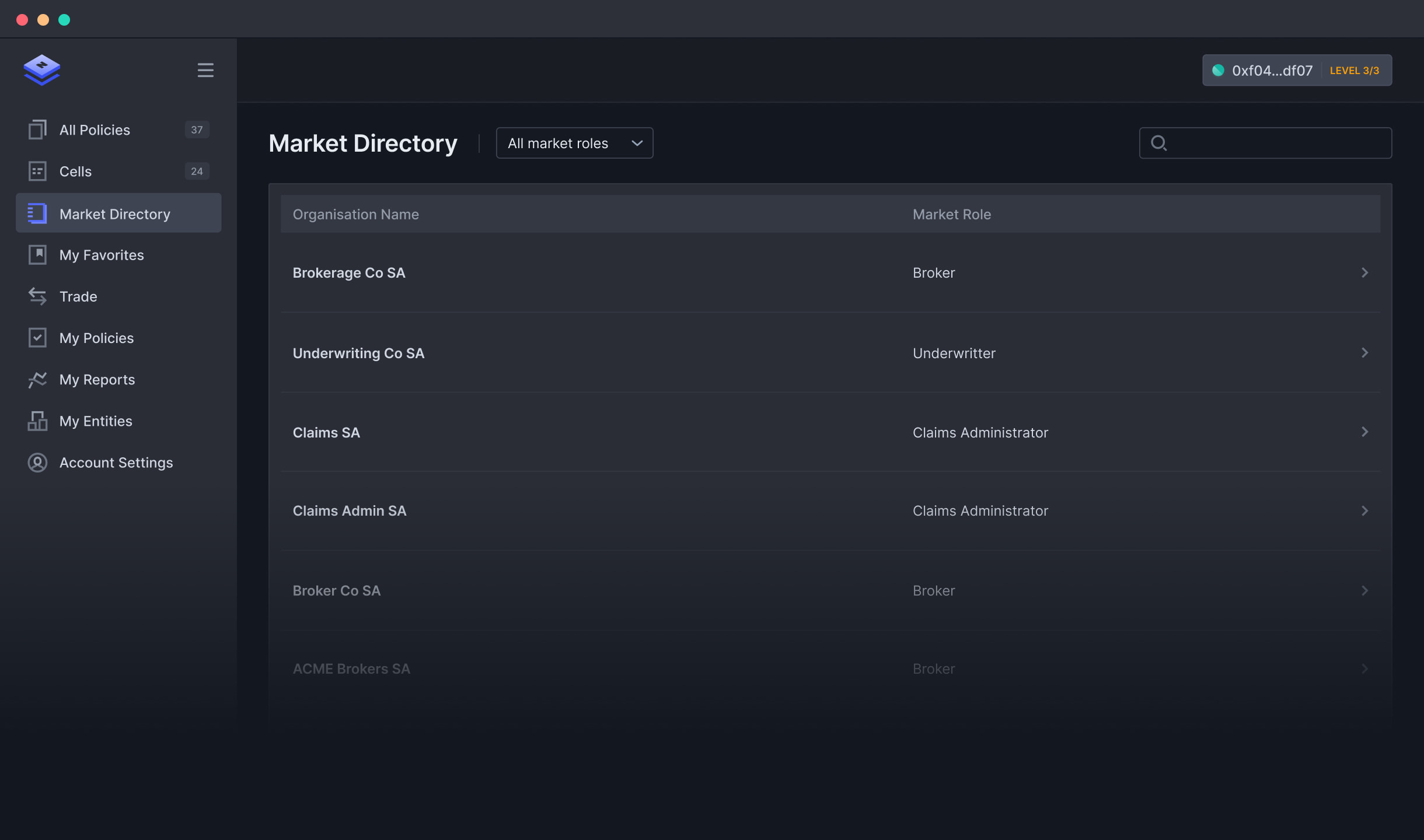

Real-Time Risk Signals and Radical Transparency

If you’ve ever waited weeks for an insurance claim to process, or worse, had it denied due to murky policy language, you’ll appreciate what blockchain brings to the table here. With every transaction immutably recorded on-chain, all stakeholders get shared access to verified data in real time. This eliminates information asymmetry and slashes dispute rates.

The integration of IoT devices with blockchain takes this even further: imagine property damage sensors reporting directly to a smart contract that triggers instant payouts (see how this works here). In DeFi protocols, real-time oracle feeds can signal market anomalies or protocol breaches straight into insurance logic, delivering immediate protection when it’s needed most.

What’s truly transformative is that real-time risk signals and on-chain transparency don’t just speed up claims, they empower both insurers and insured to make better decisions. For example, reinsurance pools can adjust risk exposures dynamically as new data flows in, rather than waiting for quarterly reports or annual audits. This continuous feedback loop means capital is always allocated where it’s most needed, reducing systemic risk across the crypto ecosystem.

Platforms like Nayms and Genesis Global RE Limited are already leveraging blockchain to provide real-time dashboards for investors, underwriters, and regulators. These dashboards offer a live snapshot of performance metrics, claims activity, and collateralization ratios, all verifiable by anyone with access to the chain. The days of black-box insurance accounting are fading fast.

Regulatory Innovation Meets On-Chain Opportunity

The regulatory landscape is evolving in tandem with these technical advances. Progressive jurisdictions like Bermuda and the Cayman Islands have rolled out sandbox environments tailored for digital asset-backed reinsurance models. Here, tokenized reinsurers can hold collateral in stablecoins or tokenized money-market instruments, yielding assets that work double duty as both security and income generators (more details here). This flexibility not only enhances capital efficiency but also creates fertile ground for new insurance products tailored to the unique risks of DeFi and Web3.

Of course, smart contract risk remains a critical consideration. Insurers like Munich Re are now offering specialized coverage for smart contract failures, an essential safeguard as more value migrates on-chain. The convergence of robust protocols, transparent ledgers, and forward-thinking regulation is setting the stage for crypto-native risk management solutions that simply weren’t possible before.

Key Regulatory Innovations Driving On-Chain Reinsurance

-

Bermuda’s Digital Asset Insurance Sandbox: Bermuda has established a regulatory sandbox specifically for digital asset insurance and reinsurance, enabling licensed entities to pilot on-chain models under close regulatory supervision. This approach encourages innovation while maintaining robust consumer protections.

-

Cayman Islands’ Framework for Tokenized Reinsurers: The Cayman Islands Monetary Authority (CIMA) has introduced guidelines allowing reinsurance companies to hold collateral in digital assets, such as stablecoins and tokenized money-market instruments. This regulatory clarity supports the formation and operation of on-chain reinsurance entities.

-

EU’s MiCA Regulation and Blockchain Insurance: The European Union’s Markets in Crypto-Assets (MiCA) regulation sets a harmonized legal framework for digital assets, including insurance products built on blockchain. This fosters cross-border adoption and innovation in on-chain reinsurance across EU member states.

-

OnRe’s Regulatory-Approved Tokenized Yield Model: OnRe Finance has launched a tokenized yield model for reinsurance, operating within regulatory parameters to offer investors exposure to reinsurance returns and collateral yield. This model demonstrates how compliant, blockchain-based reinsurance products can scale globally.

-

Nayms’ Regulated On-Chain Insurance Marketplace: Nayms operates as a regulated platform for on-chain insurance and reinsurance, providing tokenized insurance pools that comply with capital and reporting requirements. Its regulatory approval enables institutional participation and broader market trust.

The Road Ahead: What’s Next for Crypto Insurance?

The on-chain reinsurance revolution is just getting started. As blockchain insurance matures, expect to see even more granular products, like impermanent loss protection, parametric weather coverage for NFT-backed assets, or real-time slashing insurance for staking pools. The ability to bundle these micro-policies into diversified portfolios will attract both institutional capital and retail investors hungry for new sources of yield uncorrelated with traditional markets.

For crypto founders and DeFi builders, integrating on-chain reinsurance unlocks powerful new tools: automated coverage against protocol exploits, instant settlement after market shocks, and transparent reporting that builds user trust from day one. For investors? It means access to an emerging asset class with steady returns, finally made accessible by blockchain rails.

If you’re ready to explore this brave new world of blockchain-powered protection, and you want your capital working as efficiently as possible, on-chain reinsurance offers a front-row seat to the future of crypto risk management. The next chapter is being written right now. Will you be part of it?