Imagine a world where reinsurance – once the exclusive playground of massive institutions – is now open to a global pool of investors, all thanks to blockchain tokenization. That’s not just hype. It’s happening right now, and it’s reshaping how risk, capital, and opportunity flow through the insurance sector.

Fractional Ownership: Breaking Down Barriers in Reinsurance

Traditionally, reinsurance investments have been walled off behind high minimums and opaque deal structures. Only large insurers or deep-pocketed institutional players could get in on the action. Blockchain reinsurance tokenization is flipping that script by turning reinsurance contracts into digital tokens that can be bought and sold in fractions.

This means investors can now own just a slice of a $10 million catastrophe bond or parametric cover instead of ponying up for the whole thing. Platforms like Re are already live with tokenized reinsurance funds on Avalanche, attracting serious capital – Nexus Mutual recently committed $15 million, signaling growing confidence in these new instruments (beinsure.com).

Key Benefits of Fractional Ownership in On-Chain Reinsurance

-

Enhanced Liquidity & Market Access: Fractional ownership lets investors buy and sell portions of reinsurance contracts, boosting liquidity and opening the market to a wider range of participants. Platforms like Re on Avalanche have made it possible for digital asset investors, including Nexus Mutual, to access tokenized reinsurance funds.

-

Lower Barriers to Entry: Tokenizing reinsurance contracts into smaller, affordable units allows accredited investors to participate with less capital. Oxbridge Re Holdings offers tokenized reinsurance securities, enabling digital investors to buy fractionalized interests that were previously out of reach.

-

Operational Efficiency & Transparency: Blockchain-based smart contracts automate processes and reduce administrative costs. This is especially impactful for parametric insurance, where claims are settled automatically based on real-world events. The transparent nature of blockchain also allows for real-time auditing of transactions and exposures.

-

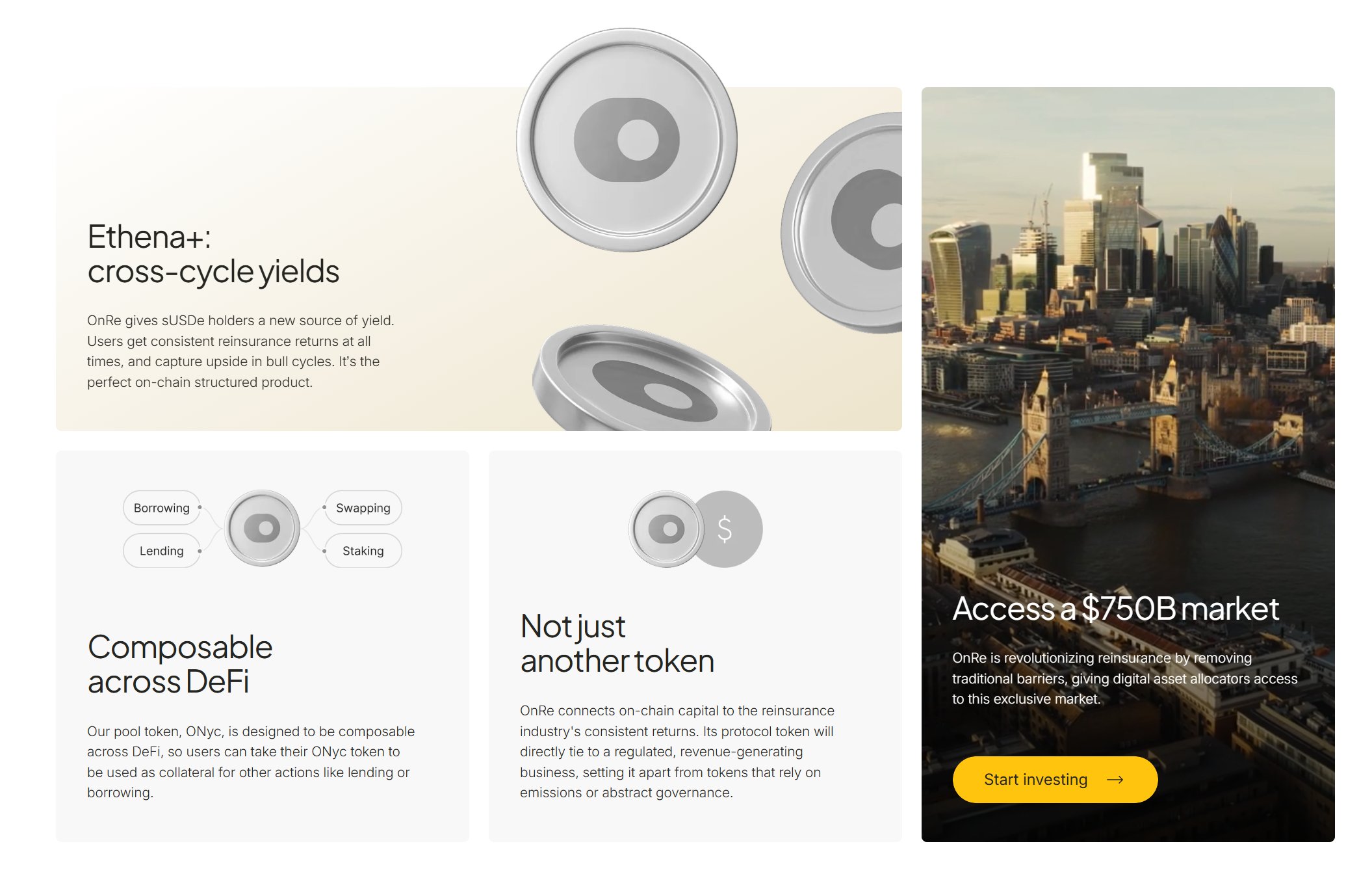

Integration with DeFi Ecosystems: Fractionalized reinsurance tokens can be traded, used as collateral, or staked in decentralized finance platforms. Nayms has introduced the NAYM token for decentralized governance and staking in tokenized insurance programs, expanding opportunities for investors.

The result? A more diverse investor base and deeper pools of capital flowing into the market. As more platforms launch tokenized offerings – like Oxbridge Re Holdings’ fractionalized securities (thetokenizer.io) – expect to see this trend accelerate.

Enhanced Liquidity and New Capital Channels

Liquidity, once the Achilles heel of insurance-linked securities (ILS), is getting a major upgrade. Tokenization lets investors trade their positions more easily, opening up secondary markets that were previously illiquid or outright non-existent. This flexibility is turning reinsurance from a static commitment into an asset class with real-time tradability for accredited digital investors.

This isn’t just theory either. The integration with DeFi means these assets can be used as collateral or traded against other crypto assets, giving investors tactical tools for hedging risk or leveraging returns. Nayms’ NAYM token is a prime example, enabling decentralized governance and staking within tokenized insurance programs (cointelegraph.com).

Transparency and Efficiency: Blockchain’s Double Punch

If there’s one thing the legacy reinsurance market has struggled with, it’s transparency. Deals are complex, data is siloed, and settlement can drag on for weeks or months. Blockchain changes all that by making every transaction auditable in real time and automating processes via smart contracts.

This isn’t just about speed (though near-instant settlements are possible) – it’s also about trust. Investors can see exactly what risks they’re exposed to and track performance without relying on third-party reports or delayed updates (rockawayx.com). For parametric covers triggered by objective events like hurricanes or earthquakes, smart contracts can execute payouts automatically when conditions are met.

What’s really exciting is how this transparency and automation are translating into operational efficiency. No more endless paperwork, manual reconciliations, or surprise administrative fees. Everything from premium payments to claims settlements can be streamlined through code, reducing both cost and error rates. For investors, that means less friction and more confidence in the process.

Let’s not overlook the regulatory upside either. Blockchain’s immutable ledger makes compliance audits far simpler. Regulators can monitor exposures, capital adequacy, and transaction flows in real time, something that was unthinkable with legacy systems. This could open the door for broader adoption as regulators become more comfortable with these digital-native structures.

Reinsurance as an Accessible Asset Class

The combination of fractional ownership, liquidity, and radical transparency is transforming reinsurance from a niche institutional play into a mainstream asset class for digital portfolios. Investors seeking stable yield, especially those wary of crypto volatility, are taking notice. Tokenized reinsurance offers exposure to insurance risk that is often uncorrelated with traditional markets, making it a powerful tool for diversification.

It’s not just about yield either. The ability to trade or stake these assets within DeFi protocols adds another layer of flexibility that simply didn’t exist before. As more tokenized insurance risk products hit the market, expect to see creative new strategies emerge from both retail and institutional players.

How Tokenization Opens Up Reinsurance Investing

-

Fractional Ownership Lowers Entry Barriers: Platforms like Re on Avalanche allow investors to buy small, affordable fractions of reinsurance contracts, letting more people participate with less capital than ever before.

-

Enhanced Liquidity and Secondary Markets: Tokenized assets can be traded on blockchain-powered secondary markets, making it easier for investors to buy or sell their positions. This increased liquidity attracts a wider range of participants.

-

Streamlined Operations with Smart Contracts: Blockchain-based smart contracts automate claims and settlements, reducing paperwork and speeding up processes—especially for parametric insurance products. This efficiency benefits both investors and insurers.

-

Transparency and Real-Time Auditing: All transactions and risk exposures are recorded on the blockchain, enabling real-time auditing and boosting investor confidence in the integrity of the process.

-

Integration with Decentralized Finance (DeFi): Projects like Nayms enable tokenized reinsurance assets to be used in DeFi protocols for trading, lending, and staking, expanding investment strategies and access.

What Comes Next?

The pace of innovation here is blistering. As platforms like Re, Oxbridge Re Holdings, and Nayms continue to push boundaries, we’re likely to see tokenized reinsurance evolve beyond simple fractionalization into programmable risk transfer instruments, think dynamic pools that rebalance based on real-time data or parametric covers that interact directly with IoT sensors in the field.

There are still hurdles: regulatory clarity, security best practices, and education for both investors and insurers. But the momentum is undeniable. With $15 million commitments already flowing into live products on Avalanche and other chains (beinsure.com), it’s clear this isn’t just a proof-of-concept phase anymore.

Volatility is opportunity, but in the world of blockchain reinsurance tokenization, opportunity now comes wrapped in transparency and efficiency too.