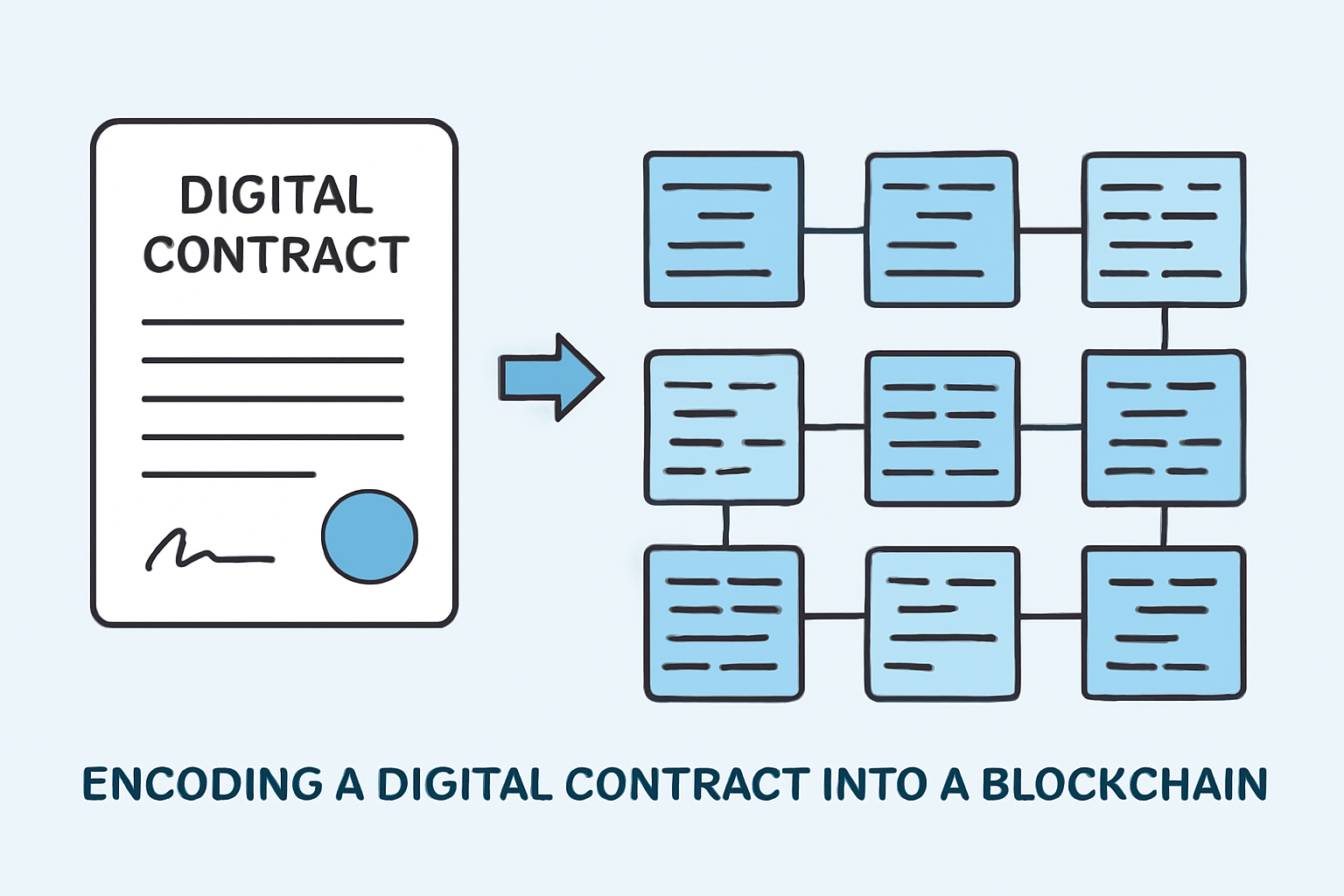

Smart contracts are rapidly redefining the reinsurance landscape, turning what was once a slow, opaque, and paperwork-heavy process into something far more dynamic and transparent. By encoding reinsurance agreements into self-executing digital contracts on blockchain platforms, the industry is finally addressing some of its most persistent pain points: settlement delays, administrative overhead, and lack of transparency.

From Manual Settlements to On-Chain Automation

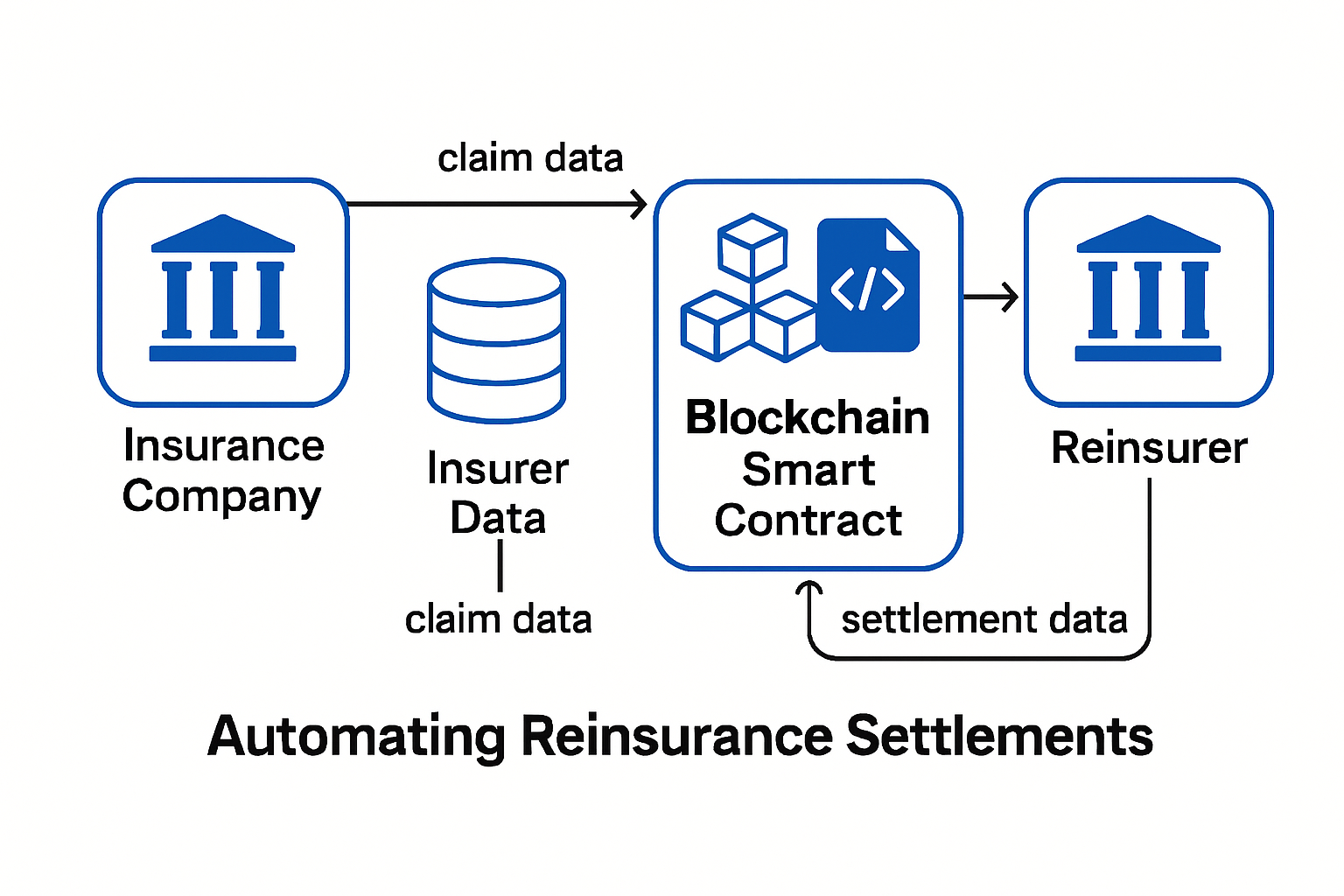

The traditional reinsurance settlement process is notorious for its complexity. Multiple parties must reconcile data across siloed systems, manually validate claims, and negotiate payouts – often over weeks or months. Smart contracts in reinsurance cut through this inefficiency by automating premium calculations, claim apportionment, and payment execution based on pre-agreed rules written directly into code.

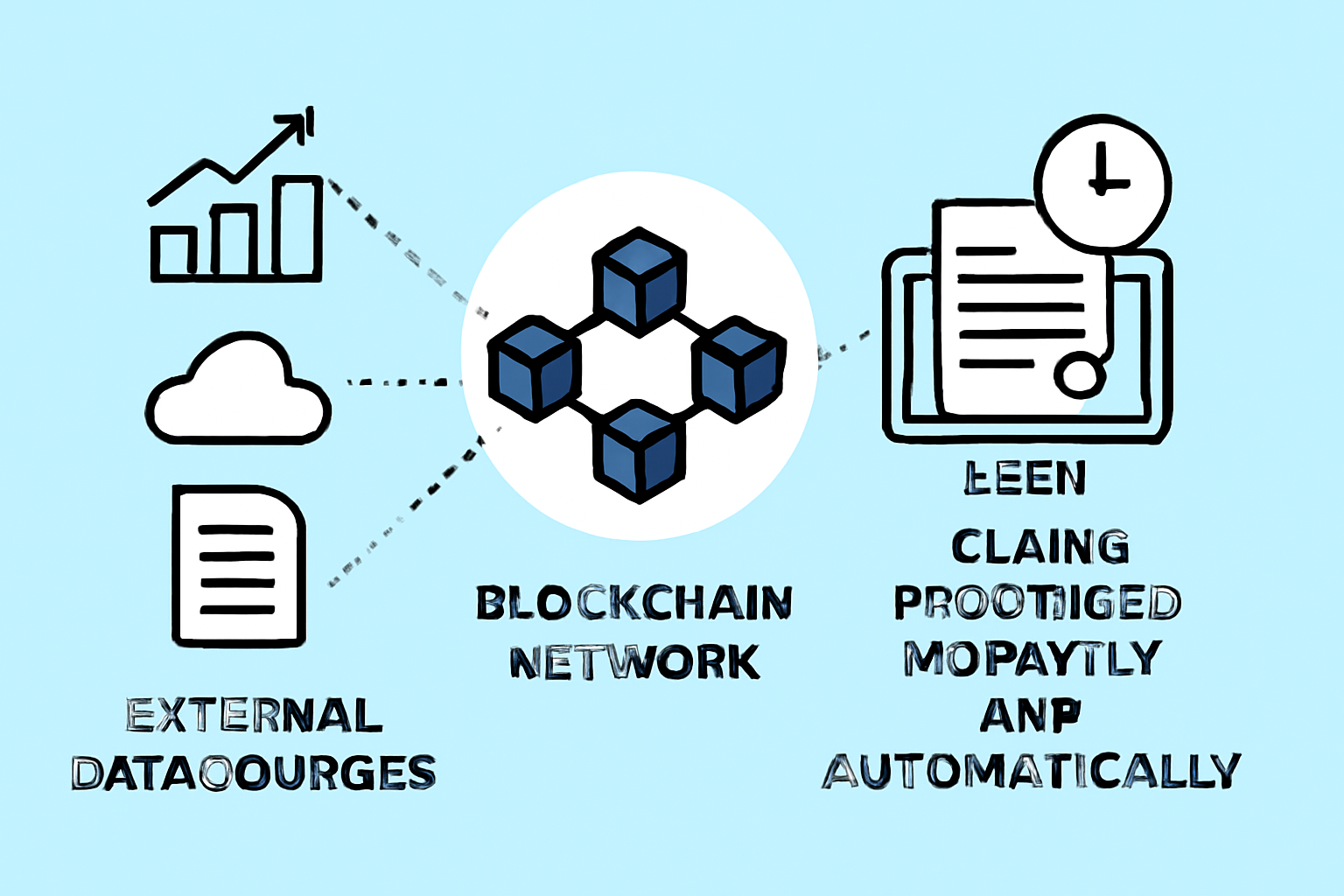

For example, with solutions like the Model Context Protocol (MCP) Reinsurance Framework, Hyperledger-based smart contracts integrate with risk pool servers to automate treaty management. Real-time data feeds from both on-chain and off-chain sources trigger contract functions automatically – whether that means recalculating premiums after an event or executing multi-party settlements as soon as claims are validated. This level of automation not only slashes administrative costs but also reduces human error and operational friction.

Radical Transparency: The Tamper-Proof Ledger Advantage

One of the most significant advantages of blockchain reinsurance settlements is the shared ledger’s inherent transparency. All parties to a contract – cedents, reinsurers, brokers – have access to an immutable record of every transaction and document related to a treaty. This visibility minimizes disputes over claim validity or payment timing because every action is cryptographically recorded.

Consider the 2022 milestone when Allianz and Swiss Re placed a legally binding reinsurance contract directly onto a distributed ledger. Not only did this reduce settlement times from weeks to hours but it also provided both parties with real-time access to all contractual data and payment flows. As more industry leaders follow suit, the expectation for transparency in reinsurance will only intensify.

Cost Savings Through Smart Contract Efficiency

Administrative costs have long been a thorn in the side of reinsurers. Every claim processed through legacy systems involves multiple layers of review, manual data entry, compliance checks, and reconciliation between different IT platforms. By contrast, insurance smart contracts are self-validating and self-executing: they can instantly verify coverage triggers (for example via trusted data oracles), calculate payouts according to policy wording coded into the contract itself, and transfer funds automatically upon approval.

This efficiency translates directly into cost savings for both insurers and reinsurers. Recent case studies show that blockchain-powered automation can cut settlement processing costs by up to 30%. At scale across global markets this represents billions in potential savings annually – capital that can be reinvested into innovation or passed back to policyholders as lower premiums.

The Road Ahead: Challenges and Real-World Adoption

Despite these advances it would be naïve to assume that smart contracts can simply replace all traditional processes overnight. Reinsurance treaties are often highly nuanced with bespoke terms that do not always lend themselves easily to pure code-based execution. Industry experts caution that while routine transactions (such as parametric triggers or quota-share arrangements) are ripe for automation more complex negotiations may still require human oversight.

Still, the industry is steadily moving toward broader adoption of on-chain reinsurance automation. Major players are piloting hybrid models that combine smart contracts for standardized processes with traditional oversight for bespoke contract terms. The momentum is clear: as more data becomes digitized and accessible via APIs and oracles, the scope of what can be automated expands.

Another critical factor is regulatory acceptance. Supervisory bodies are beginning to recognize the auditability benefits of blockchain reinsurance settlements. With every transaction recorded immutably, compliance checks become faster and more reliable, a significant advantage in a sector where regulatory scrutiny is intense and ever-evolving.

Yet, technical hurdles remain. Interoperability between blockchains, integration with legacy systems, and ensuring data privacy while maintaining transparency all require robust solutions. Projects like MCP’s integration with Hyperledger demonstrate that these challenges are surmountable, but they demand ongoing collaboration between technologists, insurers, and regulators.

What’s Next for Blockchain Reinsurance Settlements?

The future of smart contracts in reinsurance will likely be shaped by three converging trends: increasing standardization of treaty terms for automation, greater use of parametric insurance products (where payouts are triggered by objective data), and the continued evolution of secure data oracles feeding real-world information into on-chain contracts.

As these developments mature, we can expect settlement times to shrink even further, from hours to potentially minutes, while operational costs continue to fall. The ultimate vision? A global ecosystem where reinsurers instantly share risk via transparent protocols, capital flows seamlessly across borders, and disputes over claims become rare exceptions rather than routine headaches.

Key Takeaways for Industry Stakeholders

- Cedents: Gain faster access to claim recoveries and improved transparency into treaty performance.

- Reinsurers: Achieve operational efficiencies that free up capital for growth or innovation initiatives.

- Brokers: Offer clients new value propositions around speed, cost savings, and data integrity.

- Investors: Access a more liquid and transparent secondary market for insurance-linked securities powered by on-chain settlement data.

- Regulators: Benefit from enhanced oversight tools built atop immutable ledgers and real-time reporting capabilities.

The path forward won’t be frictionless, but it is increasingly clear that the future of reinsurance will be built on code as much as on trust. Those who embrace smart contracts today are setting themselves up not only to survive but to lead in a rapidly digitizing risk landscape. For a deeper dive into how these technologies work in practice, and their strategic implications, see our comprehensive resource at /how-blockchain-smart-contracts-transform-reinsurance-settlements.