Decentralized finance has always thrived on the promise of open, efficient markets. But as DeFi protocols scale up, the stakes get higher – and so does the exposure to risk. Enter on-chain reinsurance: a game-changing layer for DeFi risk management that’s catching serious momentum in 2025. If you’re active in DeFi or insurance, you’ve probably noticed the buzz around platforms like OnRe and Re Protocol. Let’s break down how on-chain reinsurance is transforming risk management for DeFi protocols, and why it matters now more than ever.

Transparency and Efficiency: The Blockchain Edge

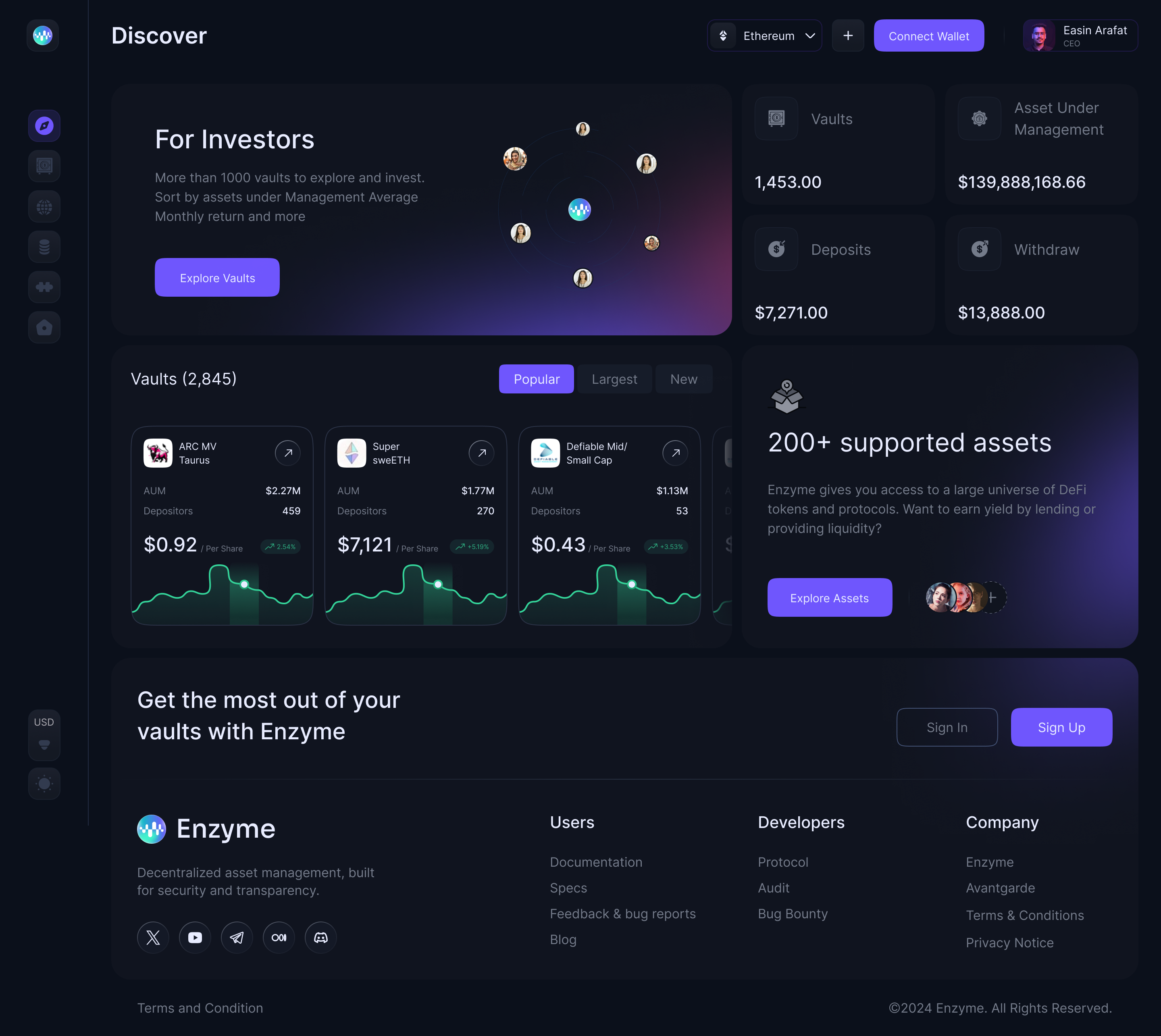

Traditional reinsurance is notorious for its opacity and slow-moving processes. On-chain reinsurance flips this script by leveraging blockchain’s immutable ledger. Every transaction – from premium payments to claims settlements – is transparently recorded on-chain. This isn’t just about trust; it’s about operational velocity. For example, OnRe automates reinsurance contracts with smart contracts, giving both DeFi protocols and capital providers real-time visibility into capital flows and risk exposures.

The result? Fewer intermediaries, lower overhead, and a dramatic reduction in disputes or settlement delays. When a smart contract exploit or market shock hits, claims can be processed with precision and speed – exactly what DeFi needs in times of volatility.

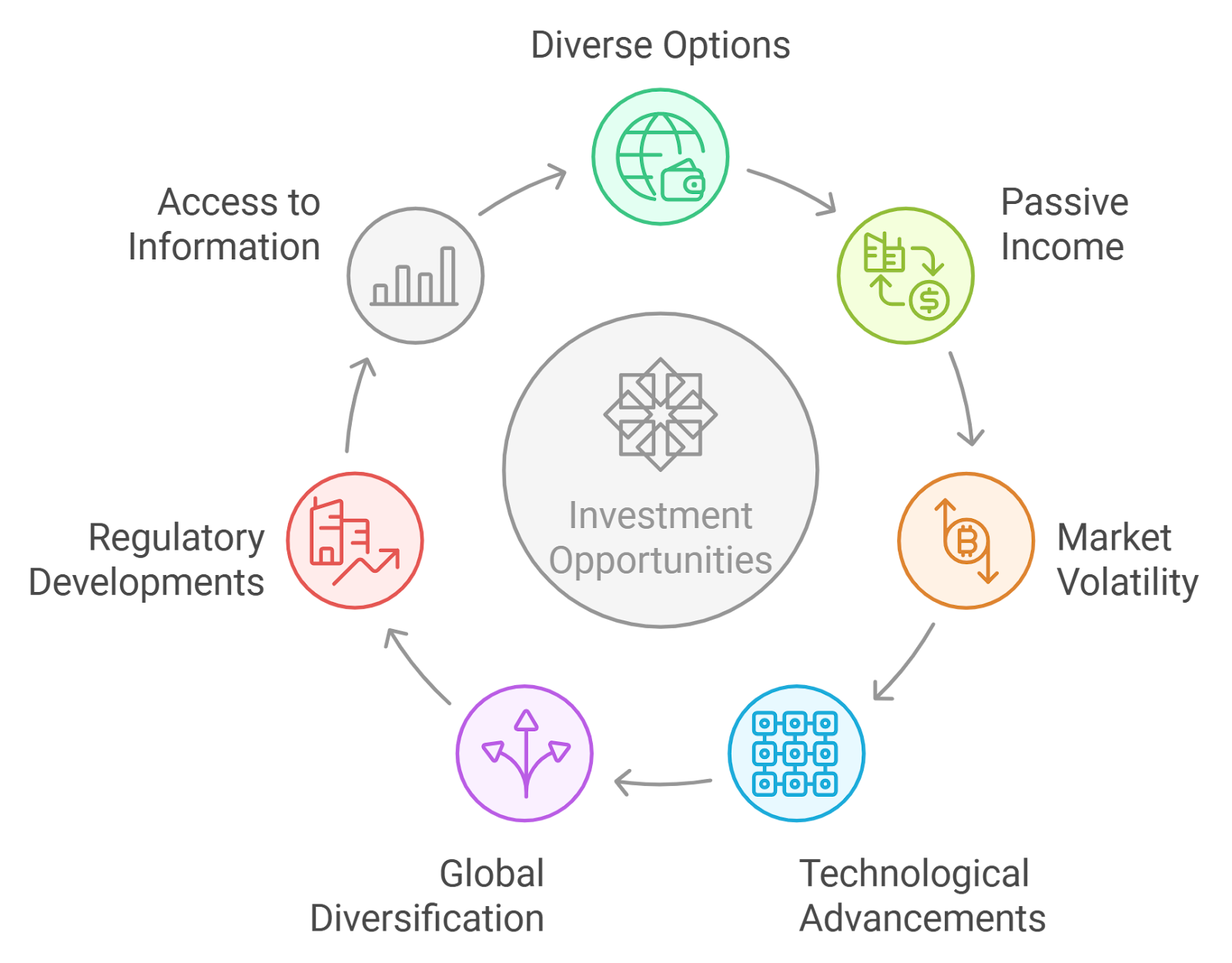

Diversified, Uncorrelated Yields for DeFi

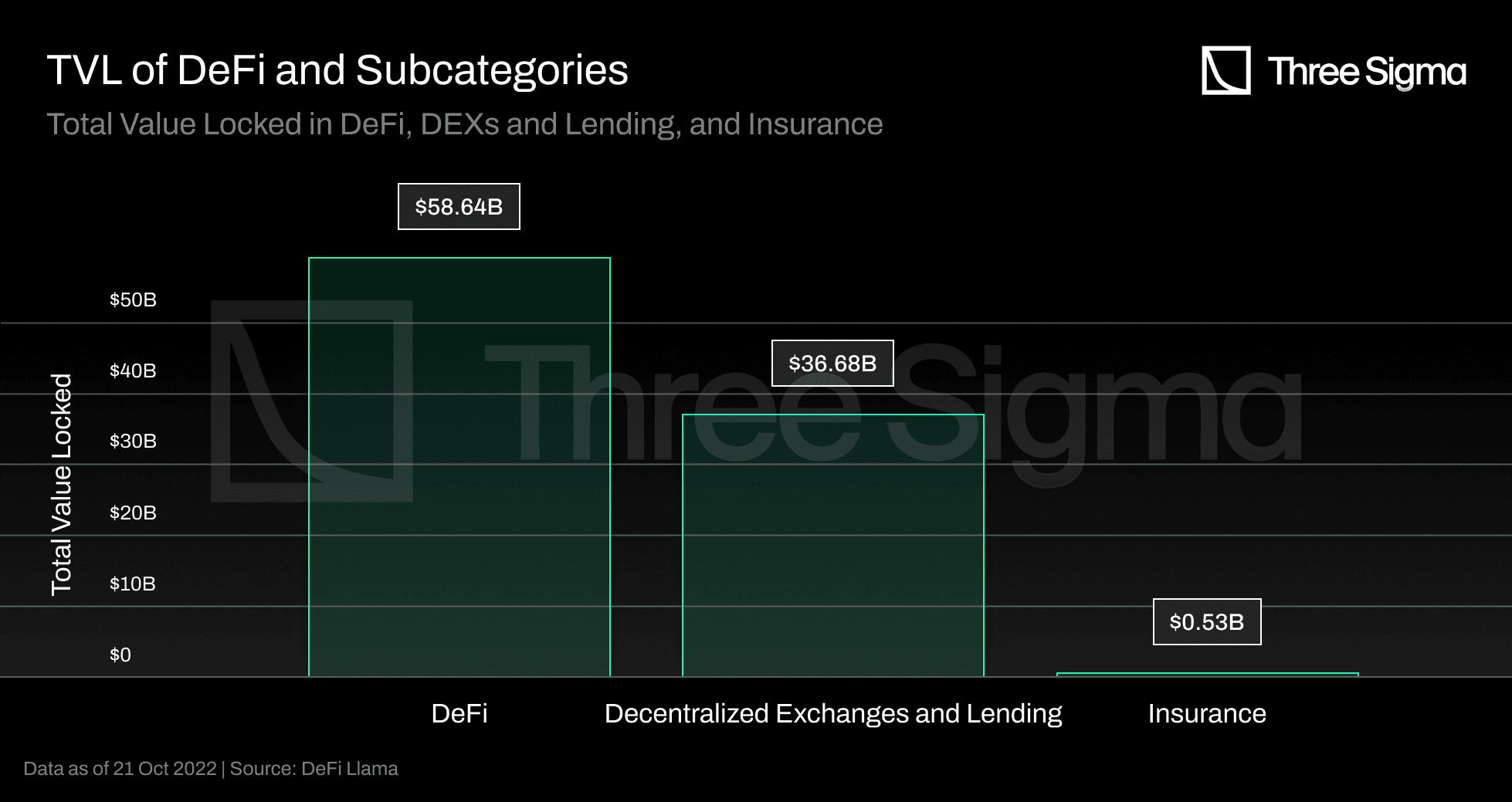

One of the most compelling advantages of on-chain reinsurance is access to uncorrelated yield streams. In 2025, DeFi protocols are increasingly hungry for stable returns that aren’t tied to crypto market swings. By participating in tokenized reinsurance pools, protocols can tap into the $750 billion global reinsurance market – a sector historically out of reach for digital asset investors.

Platforms like OnRe are pioneering structured yield products that connect on-chain capital directly with real-world insurance risks. This means DeFi treasuries can earn steady returns backed by actual insurance performance, not just speculative trading or liquidity mining. The kicker? These yields are typically uncorrelated with BTC or ETH prices, providing a much-needed ballast during crypto bear cycles.

Key Benefits of On-Chain Reinsurance for DeFi

-

Transparent & Automated Risk Management: On-chain reinsurance leverages blockchain’s immutable ledger to record all transactions, including premium payments and claims, providing real-time transparency and reducing reliance on intermediaries. Platforms like OnRe use smart contracts to automate these processes, streamlining operations and minimizing disputes.

-

Diversified, Uncorrelated Yields: By accessing tokenized reinsurance pools, DeFi protocols can earn stable returns that are uncorrelated with crypto market volatility. OnRe offers structured financial products that connect digital asset investors to real-world reinsurance performance, providing a new source of yield.

-

Enhanced Risk Mitigation: DeFi protocols can transfer specific risks—such as smart contract exploits or market downturns—to on-chain reinsurance pools. Re Protocol enables digital capital to participate in fully collateralized insurance risk, boosting platform resilience and reliability.

-

Composability Across DeFi: On-chain reinsurance tokens, like ONyc from OnRe, are fully composable—they can be used as collateral, integrated into yield farming, or traded on secondary markets. This flexibility enhances capital efficiency and unlocks new DeFi strategies.

-

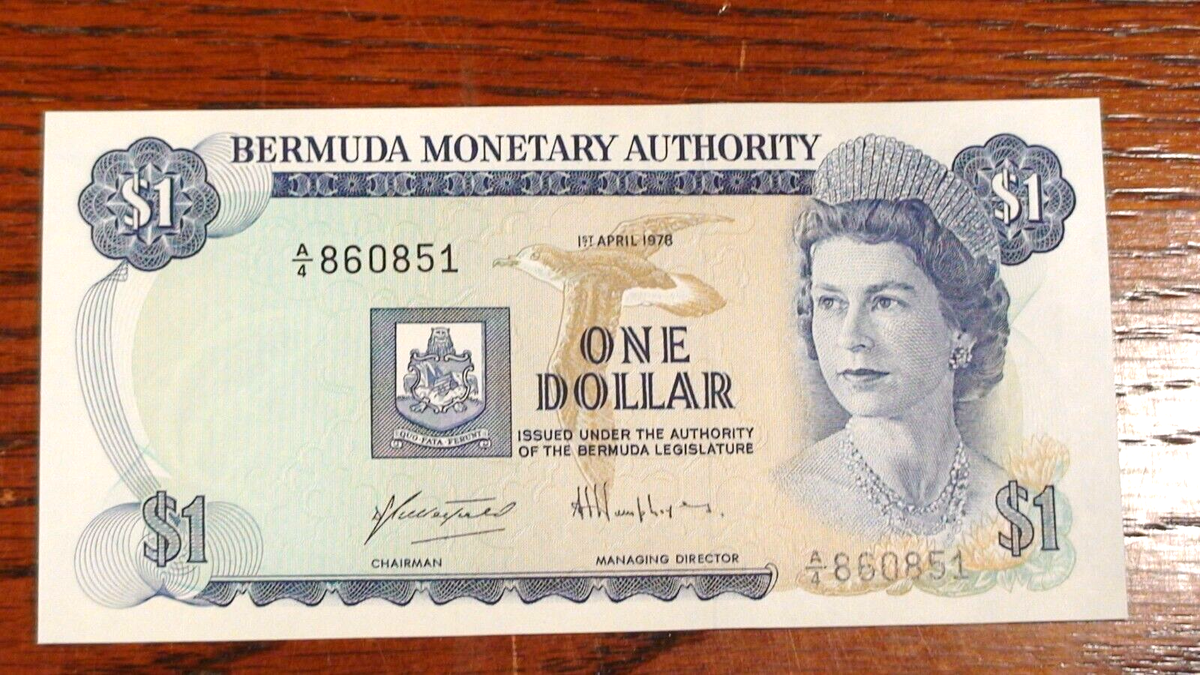

Regulatory Compliance & Security: Leading platforms such as OnRe operate under robust regulatory frameworks (e.g., Bermuda Monetary Authority), ensuring compliance and providing an added layer of security for users and institutional participants.

Smart Contract Risk Mitigation: Real-World Examples

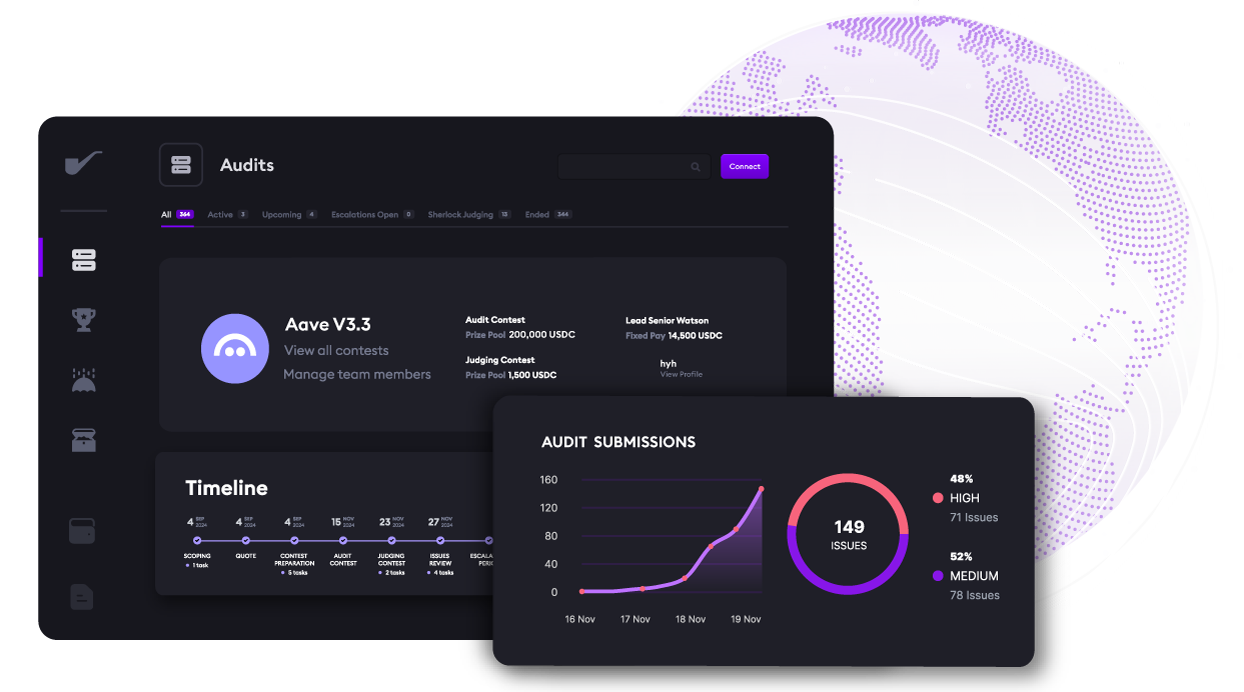

Smart contract exploits have cost DeFi billions over the last few years. While protocol-level security is improving, no codebase is bulletproof. That’s where on-chain reinsurance steps in as a tactical shield. By transferring specific risks – like those from oracle failures or flash loan attacks – into decentralized reinsurance pools, protocols can cushion themselves against catastrophic losses.

Consider Re Protocol, which connects institutional capital with fully collateralized insurance risk using smart contracts. When a covered event triggers a payout, funds are released automatically from the pool, ensuring fast relief and minimizing uncertainty for protocol users. This isn’t just theory; it’s already playing out in live markets as more DeFi projects integrate these solutions into their core architecture.

Composability: The Secret Weapon of On-Chain Reinsurance

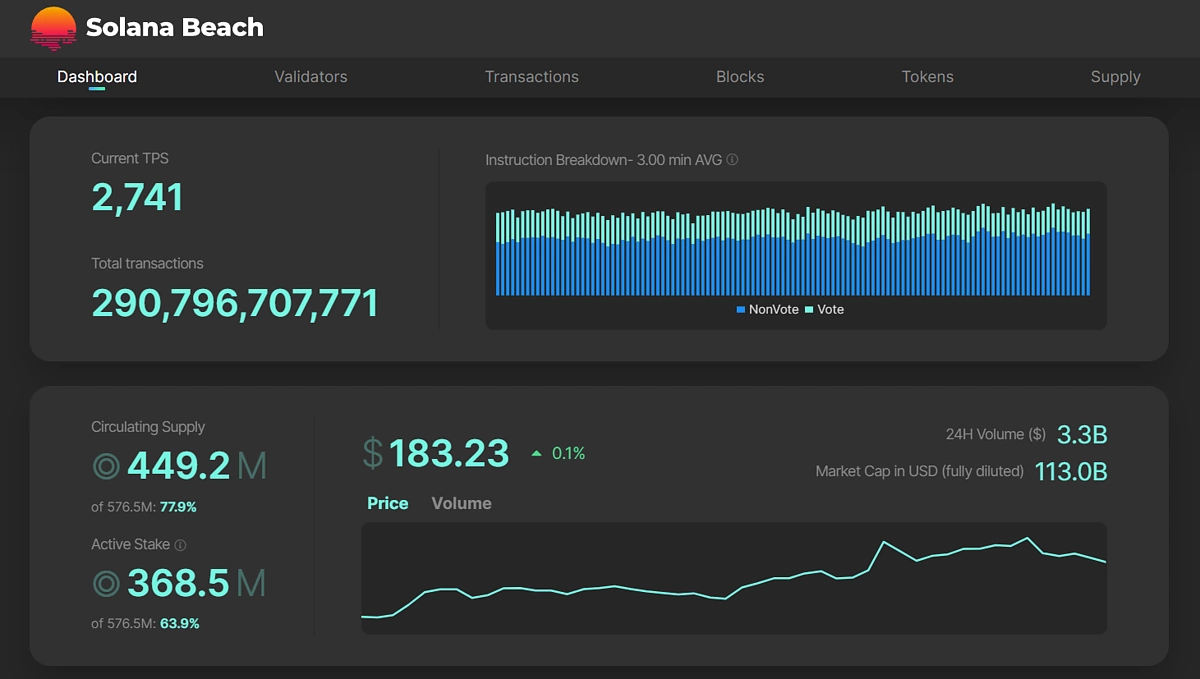

What really sets on-chain reinsurance apart is composability within the broader DeFi ecosystem. Tokens representing reinsurance positions aren’t just static assets – they can be plugged into lending markets, used as collateral, or traded on secondary markets to optimize capital efficiency. For instance, OnRe’s ONyc pool token is designed to be fully composable across Solana DeFi, unlocking new strategies for both passive investors and active traders.

This flexibility is a major upgrade over traditional reinsurance, where capital is often locked up for years. In DeFi, capital efficiency is king. The ability to move, stake, or leverage reinsurance tokens in real time means protocols can respond dynamically to changing market conditions, without sacrificing security or transparency.

Composability also opens the door for more creative risk management strategies. Imagine a DAO that not only reinsures its own protocol but also earns yield by providing liquidity to other insurance pools. This kind of cross-pollination was unthinkable in legacy insurance markets but is rapidly becoming standard practice in on-chain DeFi insurance pools.

Regulatory Momentum and Institutional Adoption

Let’s talk compliance and credibility, two areas where on-chain reinsurance is making huge strides. Platforms like OnRe aren’t just building smart contracts; they’re operating under full regulatory oversight via the Bermuda Monetary Authority, holding both IIGB and DABA licenses. This is a big deal for institutional investors who demand robust governance before allocating capital to new asset classes.

As regulatory frameworks mature, expect even more institutional capital to flow into tokenized reinsurance. The playbook is clear: combine blockchain’s transparency with traditional financial safeguards to create products that satisfy both crypto natives and TradFi gatekeepers. The result? Stronger, more resilient DeFi protocols that can weather black swan events and regulatory scrutiny alike.

What’s Next for On-Chain Reinsurance in DeFi?

The momentum behind on-chain reinsurance isn’t slowing down. With DeFi protocols like Falcon Finance launching $10 million insurance funds and platforms such as OnRe rolling out structured yield products even in bearish markets, the sector is evolving fast. The next wave? Greater composability, deeper integration with real-world assets, and the rise of programmable insurance products tailored for every DeFi vertical, from lending and DEXs to NFT platforms.

For active traders and protocol designers alike, this means new opportunities to hedge risk, unlock stable returns, and build more robust financial primitives. As on-chain reinsurance continues to mature, expect it to become a foundational layer of DeFi’s risk management stack, one that’s as transparent and dynamic as the protocols it protects.

Key Trends Shaping On-Chain Reinsurance in DeFi

-

Tokenized Reinsurance Pools Expand Real-World Asset (RWA) Access: Platforms like OnRe and Re Protocol are bridging DeFi and traditional reinsurance, letting protocols tap into uncorrelated, stable yields backed by real-world insurance premiums.

-

Composability Unlocks DeFi Integration: On-chain reinsurance tokens, such as ONyc from OnRe, are fully composable—usable as collateral, tradable, and integrable with lending and yield strategies across Solana and other DeFi ecosystems.

-

Automation and Transparency via Smart Contracts: Platforms like OnRe and Re Protocol use smart contracts to automate premium payments, claims, and capital allocation, ensuring transparent, real-time risk management and reducing reliance on intermediaries.

-

Institutional-Grade Compliance and Security: Leading providers such as OnRe operate under robust regulatory frameworks (e.g., Bermuda Monetary Authority), offering users added trust and security compared to unregulated DeFi insurance alternatives.

-

Diversified Risk Mitigation for DeFi Protocols: By transferring risk to on-chain reinsurance pools, DeFi platforms can protect against smart contract exploits and market volatility, as demonstrated by Nexus Mutual and Re Protocol.

If you’re ready to explore this frontier, keep an eye on innovators like OnRe and Re Protocol. The next bull market won’t just reward those who chase yield, but those who manage risk with precision, and on-chain reinsurance is quickly becoming the go-to playbook for smart DeFi teams in 2025.