Transparency is the lifeblood of trust in insurance and reinsurance. For years, the industry has relied on periodic audits, opaque reporting, and manual verification to ensure that reserves backing insurance contracts are actually there. But in the world of blockchain, expectations are shifting. Today, on-chain reinsurance transparency is no longer a lofty ideal – it’s fast becoming a baseline requirement, thanks to innovations like Chainlink Proof of Reserve (PoR).

Why On-Chain Reinsurance Needs Real-Time Collateral Verification

Traditional reinsurance relies on trust in counterparties and auditors. But as insurance moves on-chain, policyholders, investors, and regulators demand stronger, more granular proof. Manual audits are slow, expensive, and vulnerable to manipulation. This is where blockchain insurance collateral verification comes in.

Smart contracts promise automated payouts and programmatic risk transfer, but only if the underlying collateral is verifiably present. If reserves are missing or overstated, systemic risk can ripple across protocols, triggering undercollateralization events and eroding confidence in the entire ecosystem.

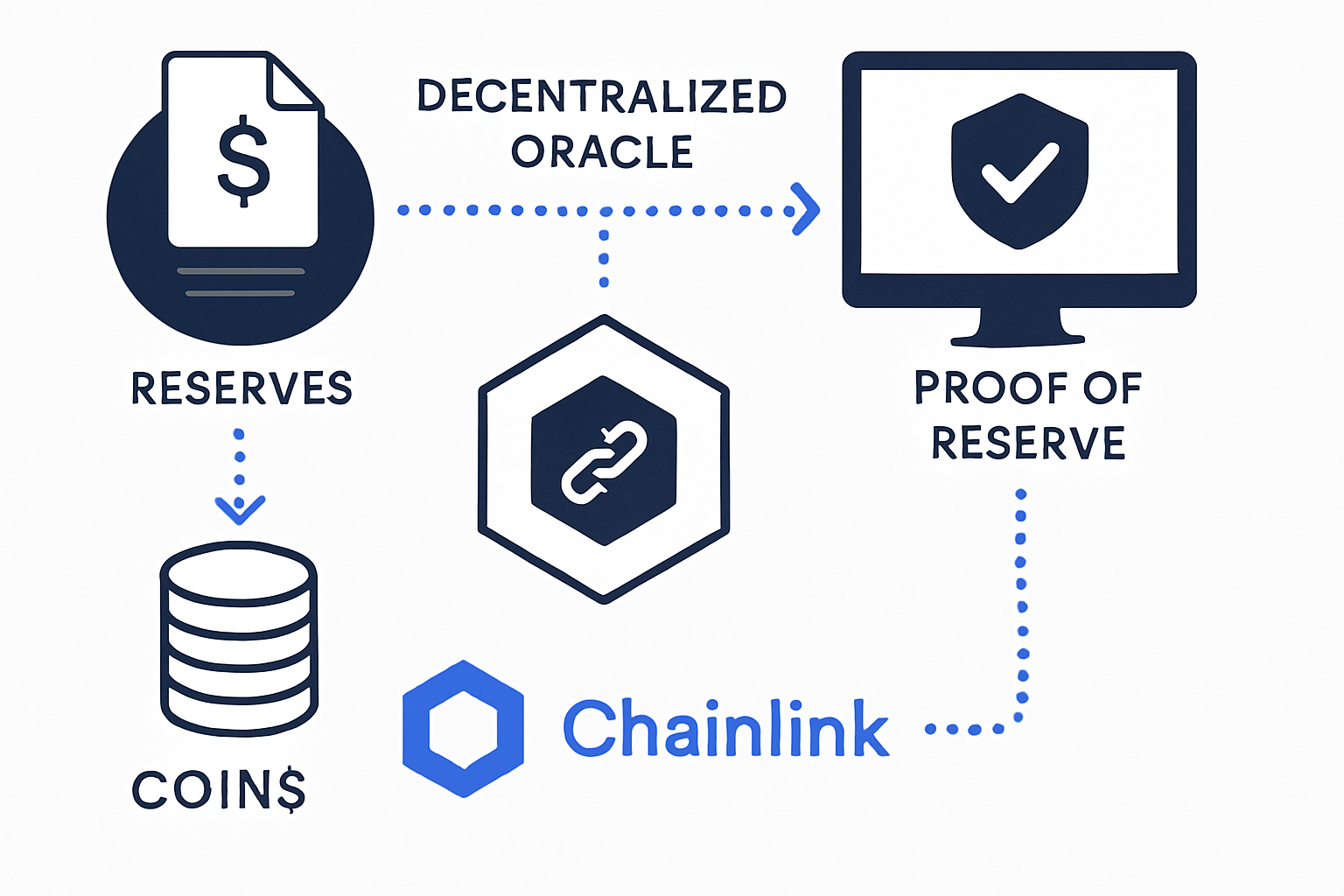

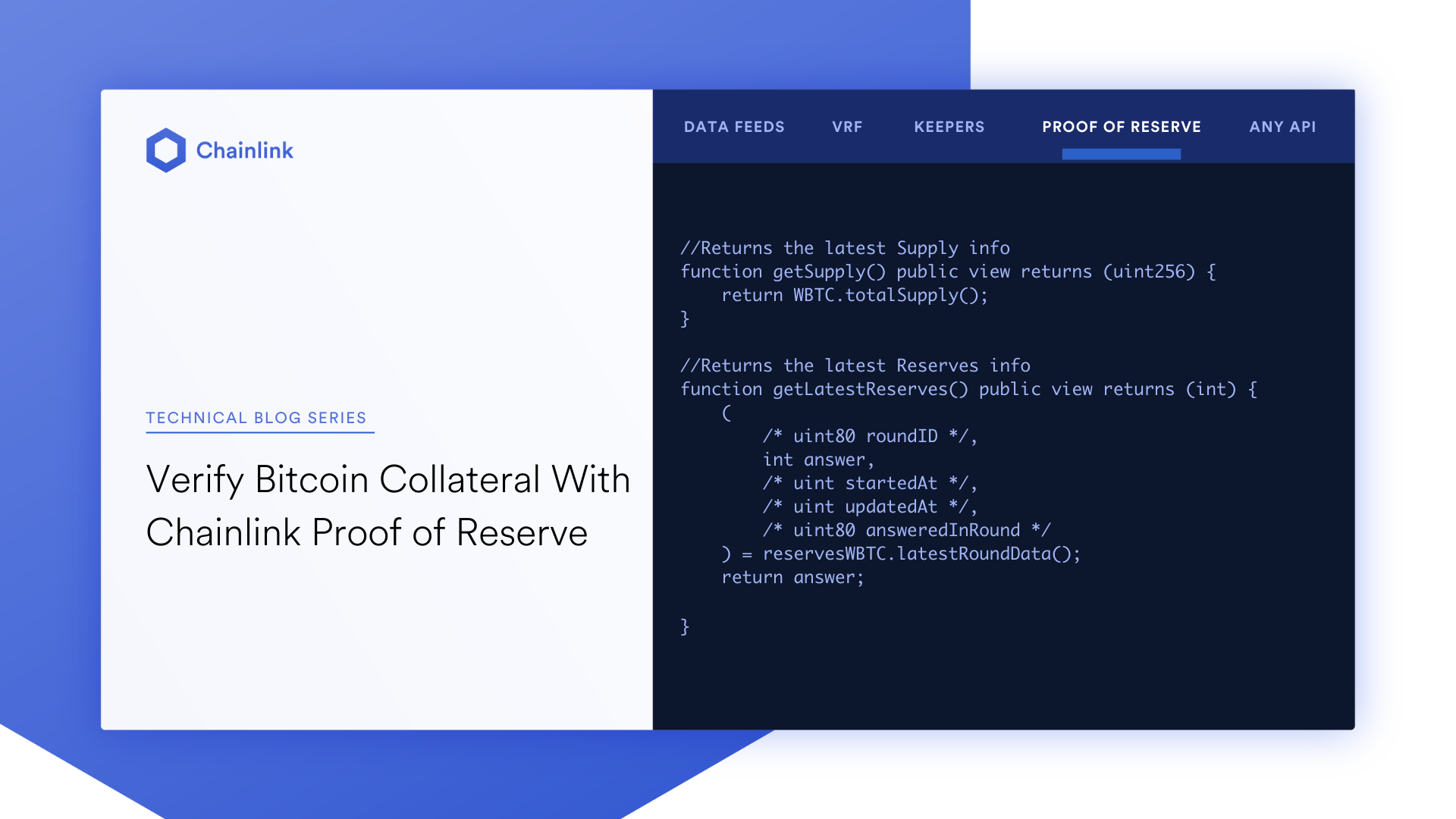

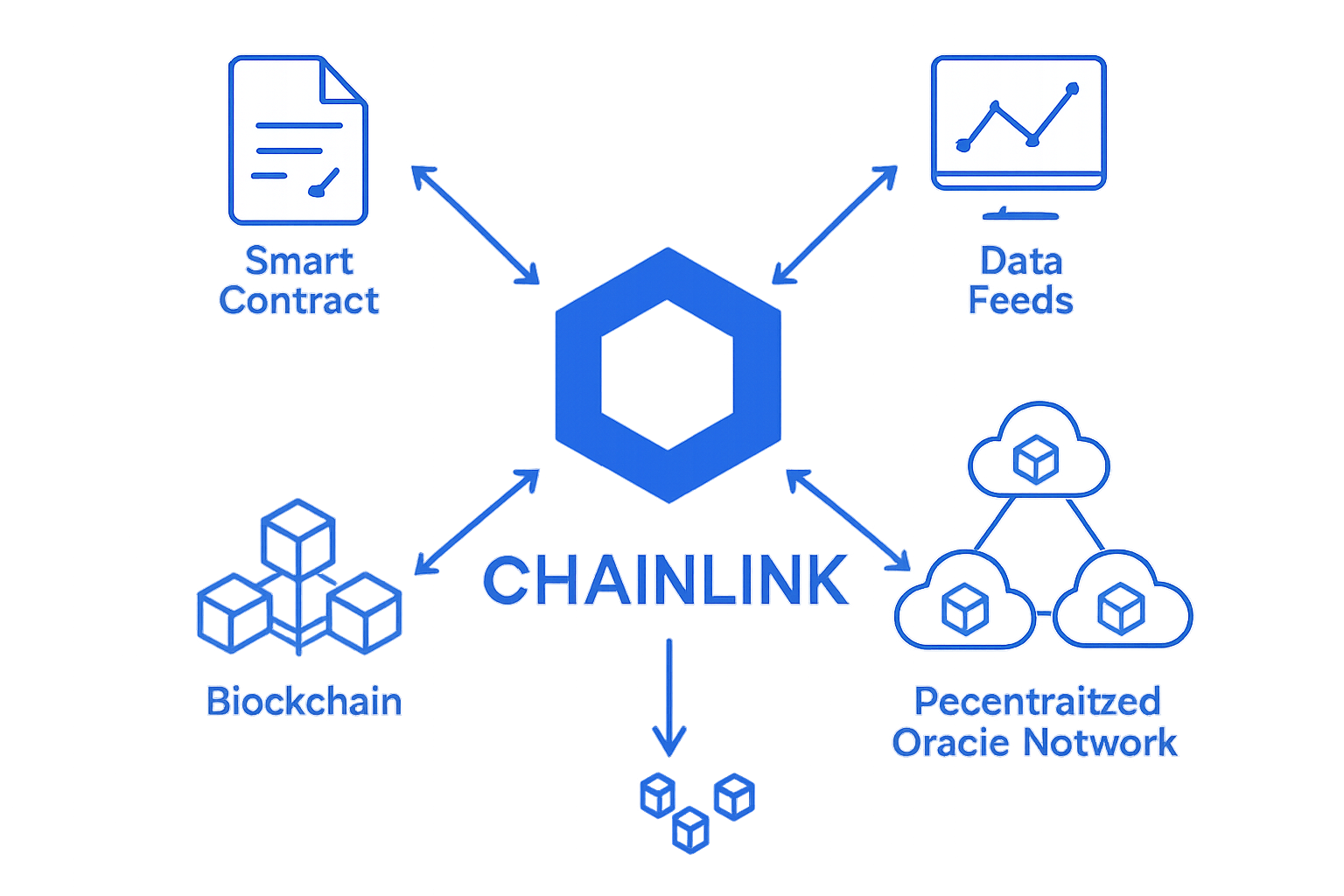

Enter Chainlink Proof of Reserve: a decentralized oracle network that delivers automated, tamper-proof verification of reserves backing on-chain assets. This technology is now being adopted by leading reinsurance protocols, such as Re Protocol, to provide real-time, on-chain proof that every contract is adequately backed by regulated, off-chain assets.

How Chainlink Proof of Reserve Works for Reinsurance

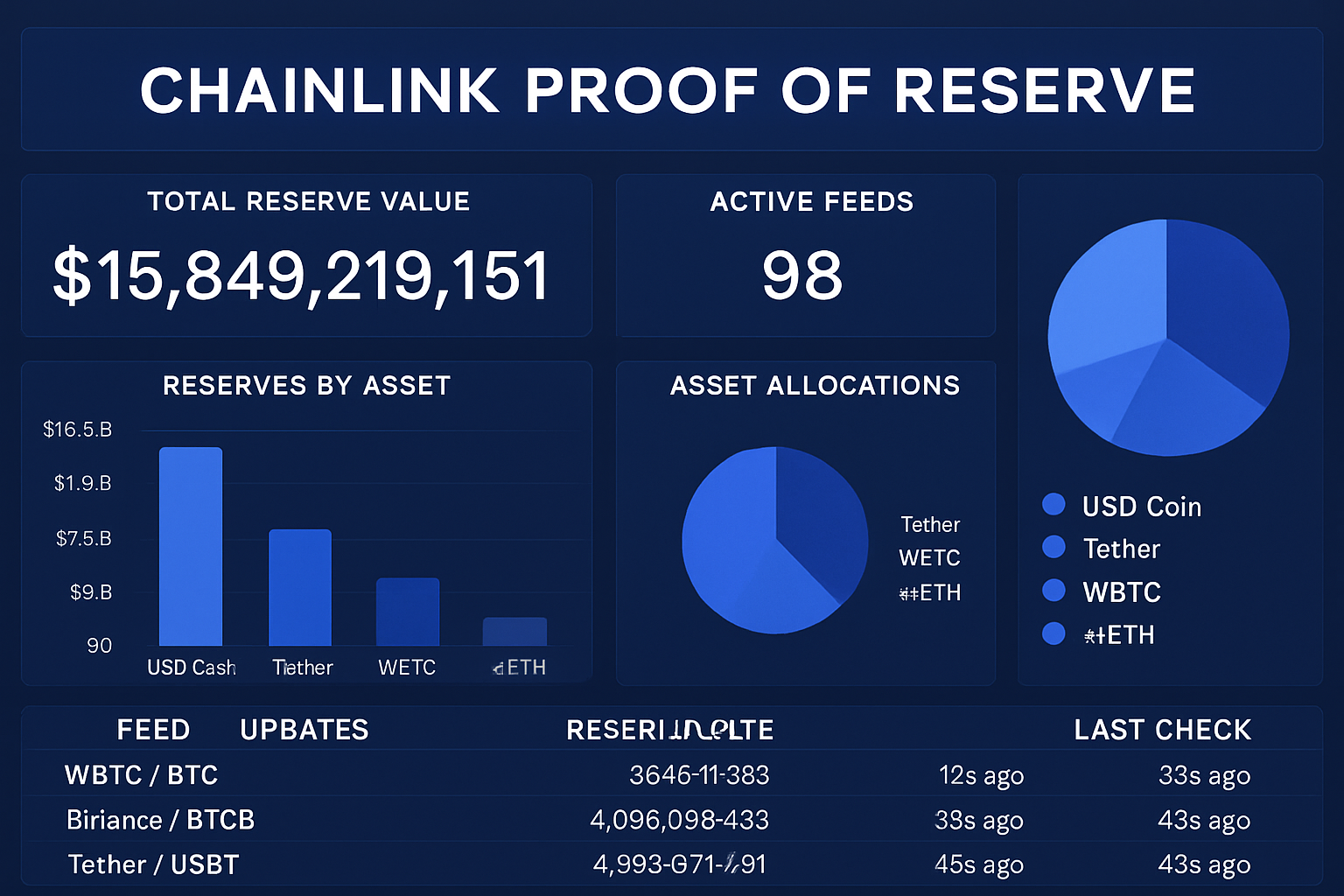

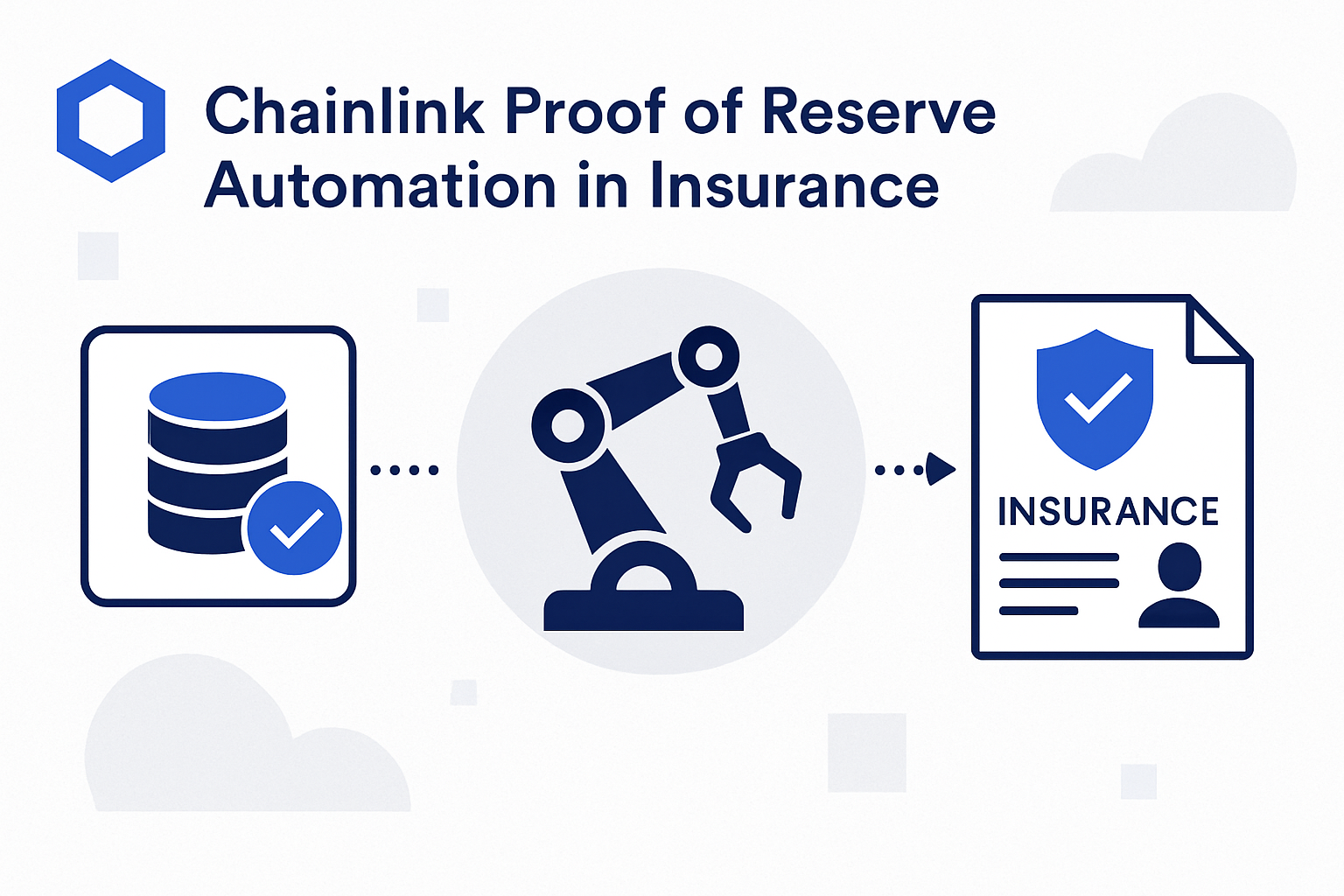

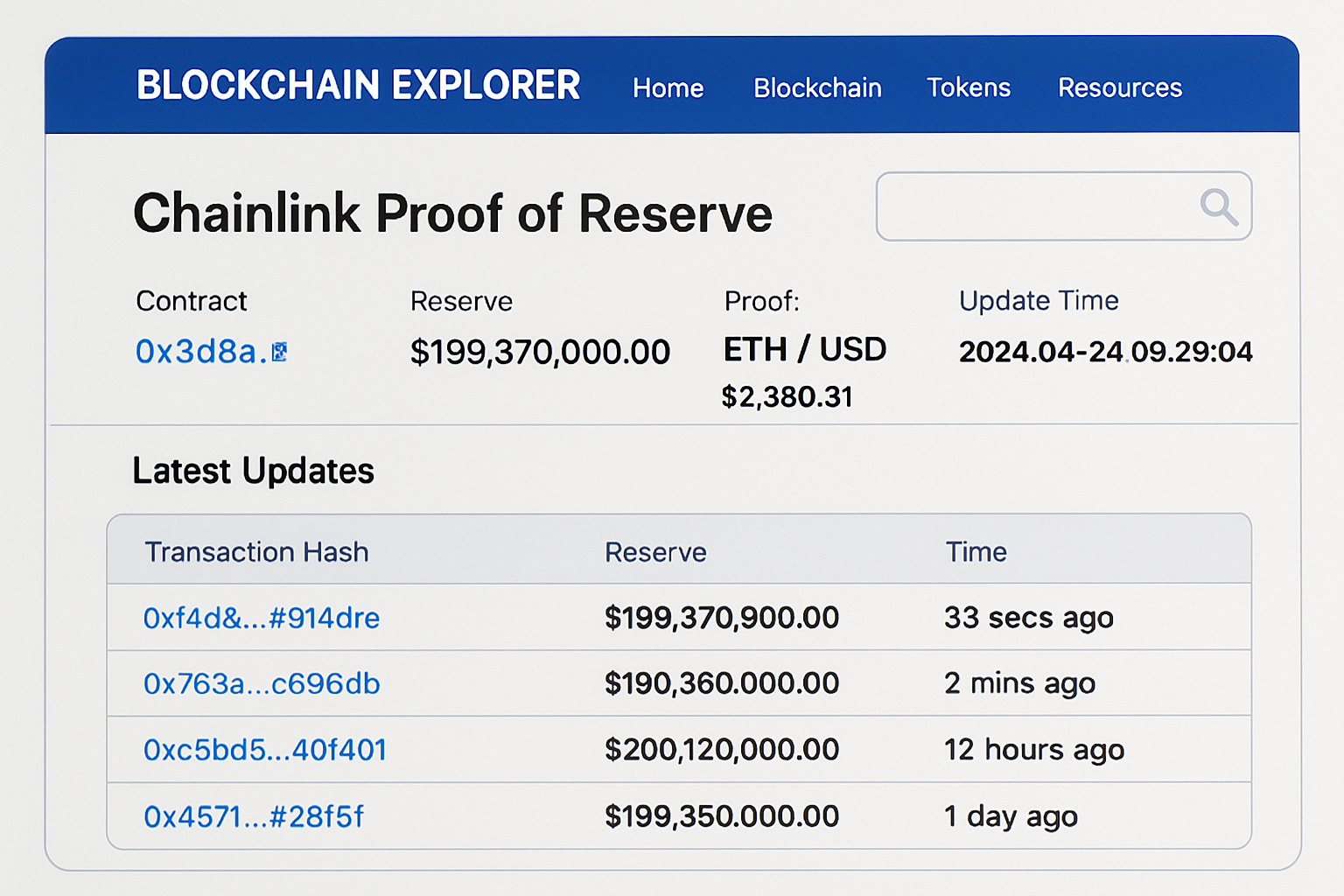

At its core, Chainlink Proof of Reserve reinsurance feeds operate as automated auditors. They continuously monitor off-chain accounts, bank balances, or physical assets (like gold or fiat reserves), and then publish cryptographic attestations of those balances directly to the blockchain. This allows anyone – from institutional investors to retail policyholders – to independently verify that the collateral is present, in real time.

For example, when Re Protocol integrated Chainlink PoR, they enabled their users to monitor the collateralization of reinsurance contracts with unprecedented speed and accuracy. The result? Real-time reinsurance audits that reduce risk and boost investor confidence. Instead of waiting weeks or months for a third-party report, stakeholders can see the status of reserves instantly and transparently.

Key Benefits of Chainlink Proof of Reserve for On-Chain Reinsurance

-

Real-Time Reserve Verification: Chainlink Proof of Reserve delivers near real-time, automated verification of reinsurance collateral, ensuring that on-chain contracts are always fully backed by regulated off-chain assets.

-

Enhanced Transparency and Trust: By providing public, tamper-proof data feeds about reserve status, Chainlink PoR boosts transparency for all stakeholders and increases trust in reinsurance operations.

-

Reduced Counterparty and Systemic Risk: Continuous monitoring of reinsurance reserves helps mitigate risks of undercollateralization and protects users from potential insolvency or overissuance of tokens.

-

Operational Efficiency Through Automation: Automated, on-chain verification reduces reliance on manual audits, streamlining processes and lowering operational costs for reinsurance providers.

-

Independent, Decentralized Verification: Anyone can independently verify reserve data using Chainlink’s decentralized oracle network, eliminating the need for trust in a single party or opaque reporting.

Case Study: CACHE Gold and Tokenized Asset Backing

The power of Proof of Reserve isn’t limited to insurance alone. Take CACHE Gold, which uses Chainlink PoR to verify that every CGT token is backed 1: 1 by physical gold held in secure vaults. This same model is now being applied in reinsurance, where protocols must prove that every policy and risk pool is fully collateralized with real-world assets.

This paradigm shift means less reliance on trust and more on verifiable, programmatic guarantees. As more reinsurance platforms like Re Protocol adopt these tools, we’re witnessing a new standard for operational integrity and investor protection in blockchain insurance.

The Road Ahead: Setting a New Benchmark for Trust

The integration of Chainlink Proof of Reserve isn’t just a technical upgrade – it’s a cultural shift for the industry. By embracing automated and transparent reserve verification, on-chain reinsurance protocols are setting a new benchmark for accountability and risk management. This move not only strengthens user trust but also paves the way for more sophisticated and scalable insurance products in the crypto era.

Stakeholders no longer have to rely on opaque quarterly statements or manual attestations. Instead, they gain on-demand access to reserve data, verifiable directly on-chain. This shift is particularly critical as reinsurance protocols scale and attract institutional capital, where the stakes for accurate collateralization are exponentially higher.

For investors, this means near real-time assurance that their capital is protected. For risk managers and actuaries, it means the ability to model exposures with confidence, knowing that the underlying data is both current and tamper-resistant. And for regulators, it opens the door to new forms of oversight, where compliance can be monitored continuously rather than retroactively.

What Sets Chainlink PoR Apart in Blockchain Insurance?

While other oracle solutions exist, Chainlink’s reputation for security, decentralization, and market adoption puts it in a league of its own. Its Proof of Reserve feeds are already powering major DeFi protocols, tokenized asset platforms, and now, a new generation of reinsurance products. The result is a transparent ecosystem where collateral shortfalls are detected early, and systemic risks are contained before they can spiral.

Chainlink Proof of Reserve vs. Legacy Audit Approaches

-

Real-Time, Automated Verification: Unlike legacy audits that occur periodically, Chainlink Proof of Reserve delivers near real-time, automated verification of collateralization, ensuring up-to-date transparency for all stakeholders.

-

On-Chain Transparency: With Chainlink, reserve data is published directly on-chain, enabling public, tamper-proof monitoring by anyone, whereas traditional audits rely on private reports and are less accessible.

-

Decentralized Oracle Network: Chainlink leverages a decentralized network of oracles to source and verify reserve data, minimizing single points of failure and reducing trust in any one party—unlike centralized legacy audit firms.

-

Continuous Collateral Monitoring: Chainlink Proof of Reserve provides continuous monitoring of reserves, quickly alerting users to any undercollateralization, while legacy audits may miss rapid changes between audit periods.

-

Independent User Verification: Anyone can independently verify reserves using Chainlink’s public Proof of Reserve feeds, increasing confidence and reducing reliance on third-party attestations common in legacy systems.

Consider the alternative: In traditional reinsurance, collateral shortfalls might go unnoticed for months, allowing risks to accumulate beneath the surface. With Chainlink PoR, discrepancies are flagged immediately, and smart contracts can be designed to respond autonomously, pausing or unwinding positions as needed. This is not just a technical improvement – it’s a fundamental upgrade to how risk is managed and trust is established in insurance markets.

For those seeking deeper insight into the mechanics and impact of Chainlink PoR within reinsurance, see our comprehensive guide on how Chainlink Proof of Reserve enables real-time transparency in on-chain reinsurance.

The Future: Scaling On-Chain Reinsurance with Verifiable Transparency

Looking ahead, the adoption of real-time collateral verification will define the winners in on-chain reinsurance. As protocols like Re Protocol and tokenized asset leaders such as CACHE Gold demonstrate, the ability to prove reserves instantly is quickly becoming table stakes. Those who lag behind risk losing market share and credibility in an increasingly transparent world.

Ultimately, on-chain reinsurance transparency is about more than compliance – it’s about building resilient financial infrastructure for the digital age. By leveraging Chainlink Proof of Reserve, the industry can unlock new efficiencies, attract broader participation, and set a higher standard for trust. As the ecosystem matures, expect to see real-time collateral verification become not just a feature, but the foundation of every credible blockchain insurance protocol.