Imagine a world where reinsurance claims are settled in minutes, not months. That’s the reality blockchain smart contracts are bringing to on-chain reinsurance. The traditional reinsurance industry has long been plagued by slow settlements, opaque processes, and costly disputes. Blockchain is flipping the script, creating a new era of claims settlement automation, transparency, and efficiency for insurers and reinsurers alike.

Why Claims Settlement Needs an Upgrade

Let’s be honest: legacy claims processes are a drag. Manual paperwork, endless back-and-forth between insurers and reinsurers, and data silos all add friction to an already complex system. These inefficiencies lock up capital, frustrate policyholders, and eat into margins. In a volatile risk environment, speed and clarity aren’t just nice-to-haves, they’re essential for survival.

Enter blockchain smart contracts. By encoding reinsurance agreements into self-executing code, these contracts trigger payouts automatically when predefined conditions are met. No more waiting for human intervention or debating over policy terms, everything is transparent, auditable, and enforced by the blockchain itself. According to Genesis Global RE Limited, this tech enables real-time processing and settlement of claims, boosting liquidity for reinsurers and delivering faster payouts downstream.

The Blockchain Advantage: Transparency and Trust

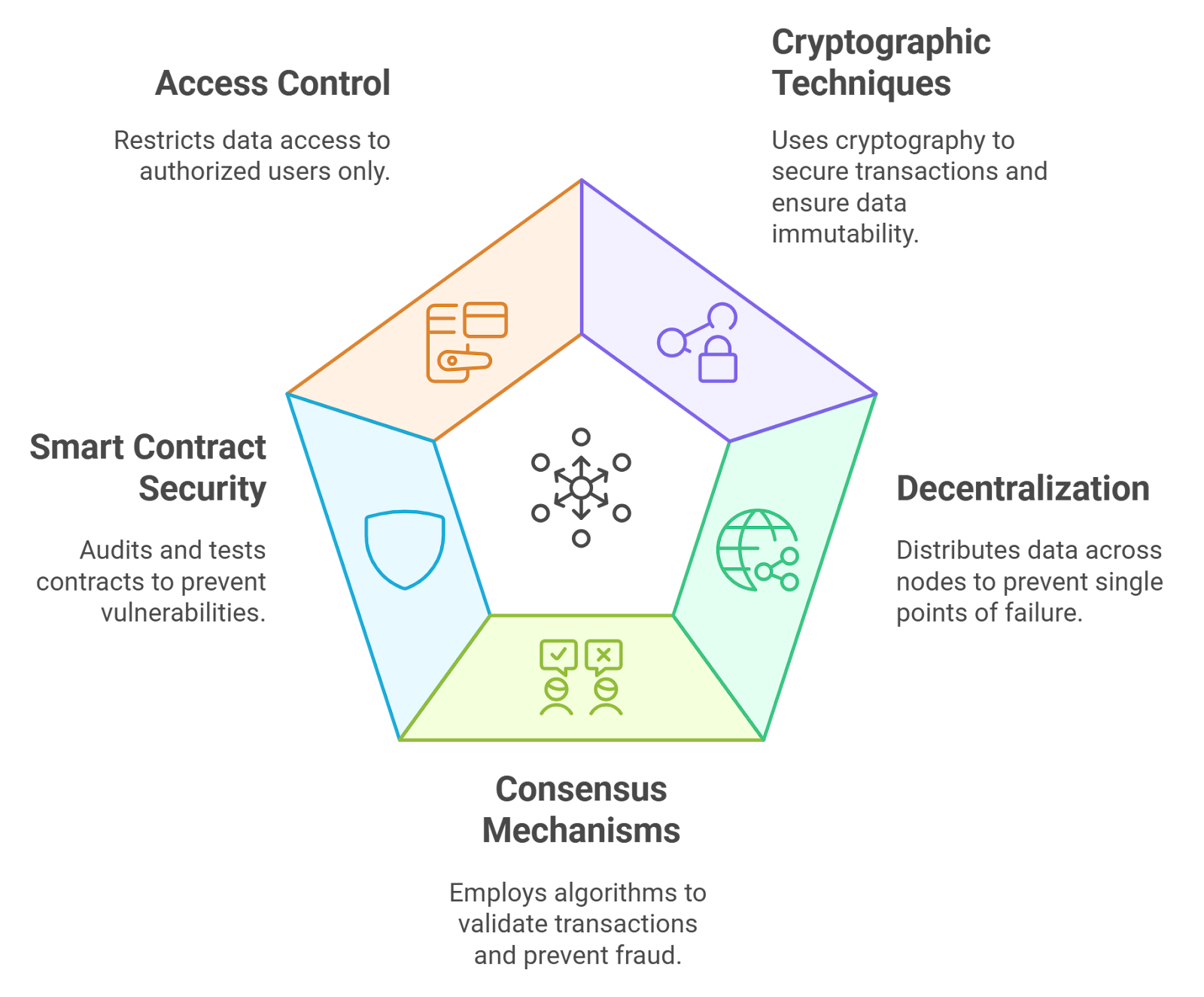

One of the biggest pain points in reinsurance? Trust between counterparties. Blockchain solves this by providing an immutable, shared ledger where every party accesses the same single source of truth. There’s no room for tampering or selective disclosure, all actions are recorded transparently for everyone to see.

This transparency is a game-changer for insurance blockchain transparency. When a claim event occurs, say, a hurricane triggers a parametric insurance payout, the smart contract instantly verifies the event using external data sources (think IoT sensors or oracles). If the terms are met, payment is released automatically. No disputes, no delays, no ambiguity.

How Smart Contracts Automate Claims Settlement

Let’s break down what’s actually happening under the hood. Here’s how a typical on-chain reinsurance claim settlement might work:

How Smart Contracts Automate Reinsurance Claims

-

Agreement Encoding: Reinsurance contracts are digitized and encoded as smart contracts on a blockchain, ensuring all terms are transparent and immutable for all parties.

-

Triggering Events via Real-Time Data: Smart contracts integrate with external data sources (like IoT devices or oracles) to automatically detect claim-triggering events, such as natural disasters or policyholder losses.

-

Automated Validation: When a claim event occurs, the smart contract automatically verifies policy coverage and eligibility by cross-referencing on-chain data and external feeds, reducing manual intervention.

-

Instant Settlement Execution: Upon successful validation, the smart contract automatically initiates payout to the reinsured party, enabling near real-time settlement and improving liquidity for reinsurers.

-

Immutable Audit Trail: All actions and transactions are permanently recorded on the blockchain, providing an auditable, dispute-resistant record accessible to insurers, reinsurers, and regulators.

First, the reinsurance agreement is coded into a smart contract on a permissioned blockchain. The contract defines all the triggers, payout formulas, and data sources required for settlement. When a loss event occurs, the contract automatically pulls in real-time data from trusted feeds (like weather APIs or sensor networks). If the event matches the contract criteria, payment instructions are executed instantly, funds move from reinsurer to insurer with no manual approval needed.

This isn’t science fiction, it’s already happening. Smart-contract-based automation can slash settlement times by threefold or more, according to ScienceSoft. For insurers and reinsurers used to multi-month delays, that’s a radical leap forward.

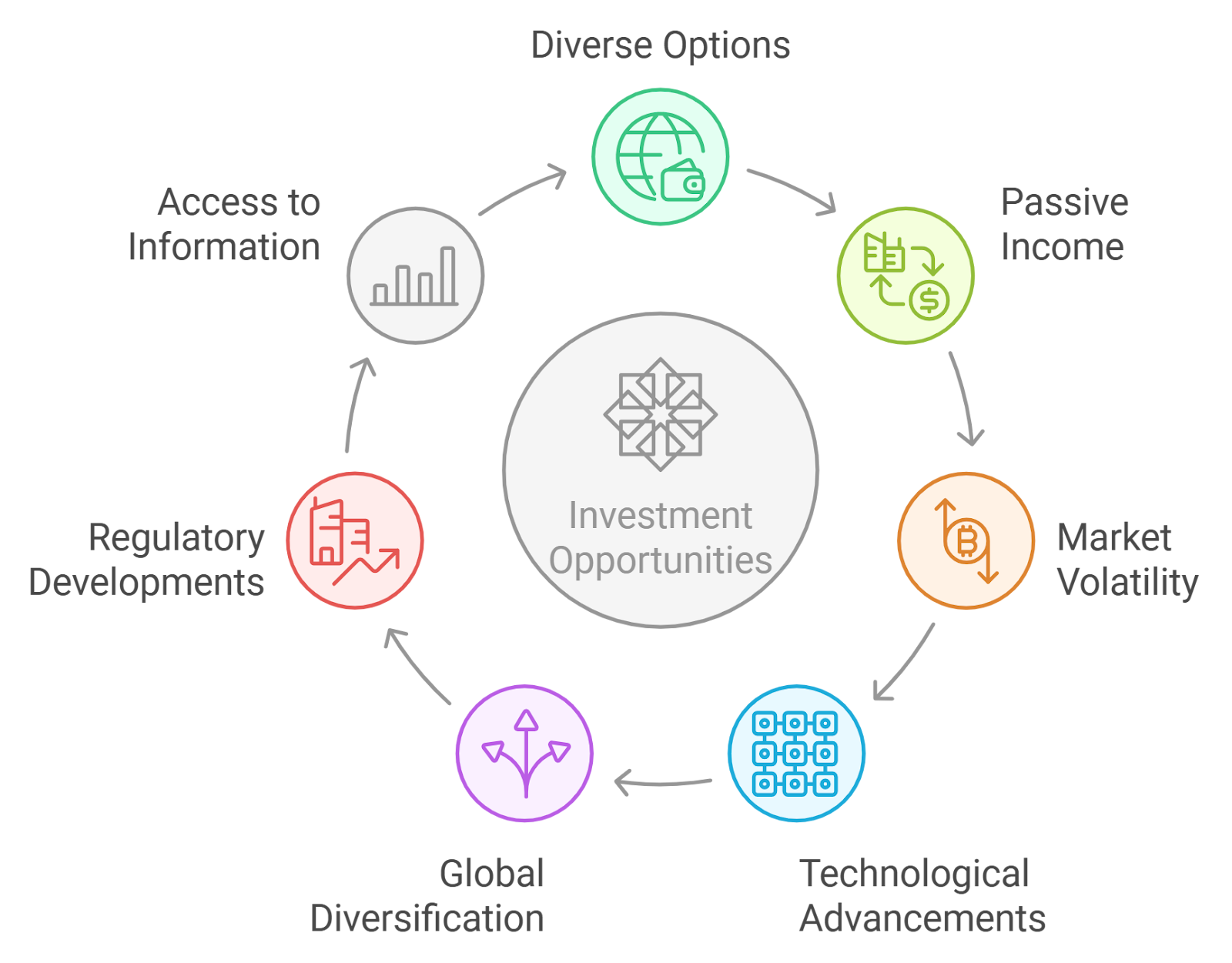

Market Context: Why On-Chain Reinsurance Is Gaining Traction

So why is the industry moving so quickly toward reinsurance smart contracts? The answer is simple: risk is rising, and so is the need for operational agility. With extreme weather events, cyber threats, and new forms of risk emerging daily, reinsurers need tools that let them respond in real time. Blockchain delivers that, plus enhanced security, better audit trails, and a huge reduction in operational overhead.

As Swiss Re points out, smart contracts don’t just speed up claims, they optimize liquidity management across the entire value chain. The result? Lower costs, happier clients, and a more resilient reinsurance ecosystem. If you’re ready to dive deeper into how these technologies are transforming settlements, check out our guide on how blockchain smart contracts transform reinsurance settlements.

But speed and transparency are just the beginning. The real magic happens when smart contracts are integrated with external data sources. Think parametric insurance for hurricanes, where the smart contract is wired directly to weather data or satellite feeds. When the wind speed at a specific location crosses a threshold, the contract triggers instantly, no paperwork, no subjective interpretation. This level of automation isn’t just a nice-to-have, it’s rapidly becoming table stakes for competitive reinsurers.

Let’s spotlight how this plays out in practice. Imagine a catastrophic flood event. The insurer’s policy is linked to a smart contract that references real-time hydrological data. As soon as the data confirms river levels have exceeded the agreed threshold, the contract executes. Funds are transferred to the insurer, who can then pay out claims to policyholders within hours. No more waiting weeks for loss adjusters or haggling over details, the process is objective, auditable, and lightning-fast.

Unlocking New Efficiencies and Reducing Disputes

Disputes have always been a headache in reinsurance. Ambiguous language, lost paperwork, and delayed reporting can turn even minor claims into drawn-out battles. Smart contracts cut through this noise by codifying every term and trigger in code, removing interpretation and human error from the equation.

What about compliance and audit? Blockchain’s immutable ledger means every step in the claims process is recorded and time-stamped. Regulators and auditors can trace the entire lifecycle of a claim with unparalleled clarity. This not only reduces compliance costs but also builds trust with stakeholders across the value chain.

Top Benefits of On-Chain Reinsurance Smart Contracts

-

Enhanced Transparency: Every transaction and contract update is immutably recorded on the blockchain, giving all parties—insurers, reinsurers, and policyholders—access to a single, tamper-proof source of truth.

-

Reduced Disputes: With clear, pre-coded rules and automatic execution, smart contracts minimize ambiguity and human error, leading to fewer disagreements and smoother settlements.

-

Improved Operational Efficiency: By automating manual tasks and integrating with external data sources like Chainlink oracles and IoT devices, smart contracts streamline the entire claims process from notification to settlement.

-

Stronger Data Security: Blockchain’s cryptographic protocols ensure sensitive claims data is securely stored and only accessible to authorized parties, protecting against fraud and cyber threats.

The result? Lower legal costs, fewer disputes, and a system that runs smoother for everyone involved. And as more reinsurers adopt these protocols, network effects start to kick in, making the entire industry faster and more responsive.

Challenges and What’s Next

No technology shift comes without challenges. Coding complex reinsurance treaties into smart contracts requires specialized expertise, and integrating legacy systems with blockchain infrastructure isn’t always straightforward. There are also legal and regulatory questions to resolve around enforceability and cross-border operations.

Still, the trajectory is clear: as standards evolve and technical hurdles fall away, on-chain reinsurance will set a new benchmark for claims settlement automation. The industry’s leaders are already investing heavily in blockchain pilots and partnerships to future-proof their operations.

Volatility is opportunity: In an era of heightened risk, those who can settle claims fastest, and most transparently, will win market share.

If you want to see how smart contracts are unlocking capital efficiency and real-time protection for crypto-native risks, don’t miss our deep dive on how on-chain reinsurance transforms crypto risk management.

The bottom line? On-chain reinsurance powered by blockchain smart contracts isn’t just about faster payouts, it’s about building a more agile, transparent, and resilient insurance ecosystem for the digital age.