Smart contracts are rapidly becoming the backbone of on-chain reinsurance settlements, redefining how risk is transferred and claims are resolved in the digital era. By embedding insurance logic directly into blockchain code, these self-executing agreements eliminate much of the friction that has long plagued traditional reinsurance processes. As more carriers, reinsurers, and investors explore blockchain reinsurance solutions, understanding the mechanics and impact of smart contracts is essential for anyone looking to stay ahead in this evolving market.

From Manual Bottlenecks to Automated Precision

Legacy reinsurance settlements often involve slow, manual reconciliation across multiple parties and systems. This complexity can delay payouts for weeks or even months. With blockchain smart contracts insurance, terms such as premium payments, claim triggers, and settlement instructions are coded directly into transparent scripts on a decentralized ledger. When predefined conditions are met – such as a parametric trigger from a weather oracle – the contract automatically executes payment instructions without human intervention.

This automation delivers measurable efficiency gains. Recent industry analyses suggest that smart-contract-driven automation can reduce overall claims settlement time by threefold or more compared to traditional methods. Faster settlements mean improved liquidity for reinsurers and less capital tied up in administrative limbo.

Transparency, Trust, and Dispute Reduction

One of the most profound shifts brought by on-chain smart contracts is their ability to create an immutable audit trail for every transaction. Every action – from premium receipt to claims payout – is recorded on a public or permissioned blockchain, accessible to all counterparties in real time. This transparency radically reduces opportunities for dispute or fraud by making all contractual events verifiable against objective data sources.

For example, in parametric reinsurance models where payouts depend on external data (like rainfall measurements), trusted oracles feed information directly into the smart contract. If the data meets contractual thresholds, settlement is triggered instantly – no need for lengthy negotiations or third-party adjusters. This not only builds trust between cedents and reinsurers but also opens new possibilities for global collaboration across jurisdictions.

Cost Savings Through Automation and Reduced Fraud

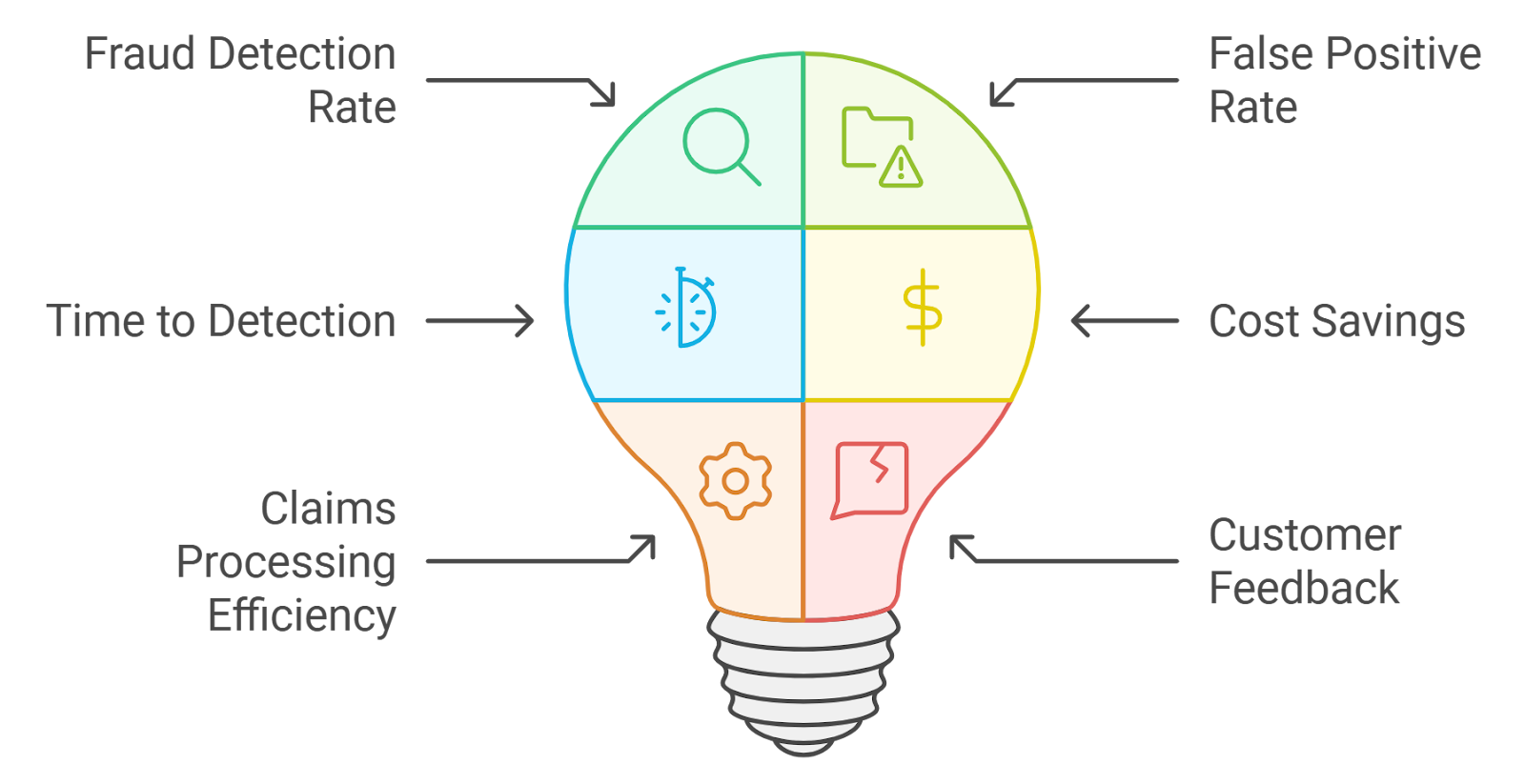

The transition to automated reinsurance claims via blockchain doesn’t just save time; it also slashes operational costs. By removing intermediaries and minimizing manual touchpoints, companies can cut administrative expenses significantly. The immutable nature of blockchain further reduces fraud risk: once a claim event is logged and validated on-chain, it cannot be altered retroactively.

This dual benefit of cost reduction and anti-fraud assurance makes crypto insurance settlement processes highly attractive to both established reinsurers seeking efficiency gains and DeFi-native players building new risk pools from scratch.

To explore more about how these innovations are reshaping legacy frameworks, see our deep dive at How Smart Contracts Are Transforming Reinsurance Settlements on Blockchain.

As the industry moves toward broader adoption, several real-world case studies highlight the tangible impact of on-chain reinsurance settlements. For instance, platforms like OnRe are pioneering tokenized yield models that directly connect reinsurance performance with investor returns. In these solutions, smart contracts not only automate claims and settlements but also manage collateral and distribute yields to token holders in a transparent, auditable manner.

Moreover, smart contracts are enabling the rise of peer-to-peer (P2P) reinsurance structures. Instead of relying solely on large institutional reinsurers, smaller entities and even individuals can pool risk capital and participate in reinsurance markets. Automated settlement logic ensures that payouts are handled impartially, based on pre-agreed triggers and real-time data feeds. This democratizes access to reinsurance capacity while maintaining robust standards for transparency and accountability.

Challenges and Considerations for Widespread Adoption

Despite these advances, challenges remain before blockchain smart contracts insurance can become the industry norm. Interoperability between legacy systems and blockchain networks is still evolving. Regulatory frameworks must adapt to accommodate automated settlements and ensure consumer protection without stifling innovation.

Another consideration is data quality: since smart contracts rely on external oracles for parametric triggers (such as weather events or market indices), ensuring the integrity and reliability of these data sources is crucial. Any weaknesses here could undermine trust in automated settlements.

What’s Next for On-Chain Reinsurance?

The future of blockchain reinsurance solutions lies in continued collaboration between technologists, insurers, regulators, and investors. As more platforms integrate automated settlement engines and experiment with new forms of risk transfer (like decentralized autonomous organizations for insurance), we can expect further reductions in administrative friction, and entirely new business models built atop programmable risk.

For insurance professionals looking to stay competitive in a rapidly digitizing market, now is the time to understand not just how smart contracts work but also how they are fundamentally reshaping roles within the value chain. From underwriters to claims managers to capital providers, every stakeholder stands to benefit from increased efficiency, lower costs, and improved trust enabled by transparent automation.

Major Benefits of Automated Reinsurance Claims

-

Faster Payouts: Smart contracts enable real-time claim processing, ensuring that settlements are executed automatically when predefined conditions are met. This dramatically reduces waiting times for payouts, improving liquidity for reinsurers and cedents. (Genesis Global RE Limited)

-

Reduced Fraud Risk: Automated claims are validated against immutable blockchain records, minimizing opportunities for fraudulent activity. Every transaction is transparent and verifiable, building trust among all parties. (VMMCAE)

-

Lower Administrative Costs: By eliminating manual paperwork and intermediaries, smart contracts streamline the reinsurance claims process. This automation leads to significant operational savings for insurers and reinsurers. (Coinlaw.io)

-

Enhanced Transparency: All claim settlements are recorded on a decentralized ledger, providing an auditable trail accessible to all stakeholders. This transparency reduces disputes and increases accountability. (Appinventiv)

-

Global Accessibility: Smart contracts facilitate cross-border claim settlements by providing a secure, decentralized platform accessible worldwide, enabling seamless collaboration between insurers, reinsurers, and brokers. (IIARD International Institute)

The transformation underway isn’t just incremental, it’s foundational. Smart contracts are rewriting the rules for how risk is transferred globally. As adoption accelerates across both traditional insurers and DeFi-native startups, those who embrace this shift early will be best positioned to lead in tomorrow’s marketplace.

If you’re interested in learning more about practical steps toward implementation or want deeper technical insights into crypto insurance settlement processes, check out our related guide: How Blockchain Smart Contracts Transform Reinsurance Settlements.