Smart contracts are rapidly redefining the landscape of on-chain reinsurance settlements, introducing a level of automation and transparency previously unattainable in legacy systems. As blockchain technology matures, the reinsurance sector is leveraging these digital agreements to streamline settlements, reduce administrative overhead, and foster trust among counterparties. Recent innovations from platforms like OnRe and Zoniqx illustrate how smart contracts are at the heart of this transformation, automating everything from premium calculations to claims payouts.

From Manual Reconciliation to Automated Settlements

Traditional reinsurance settlements have long been plagued by manual processes, delayed reconciliations, and opaque record-keeping. Disputes over claim triggers or premium adjustments could take weeks to resolve, often requiring costly human intervention. With the advent of on-chain reinsurance smart contracts, these pain points are being systematically eliminated.

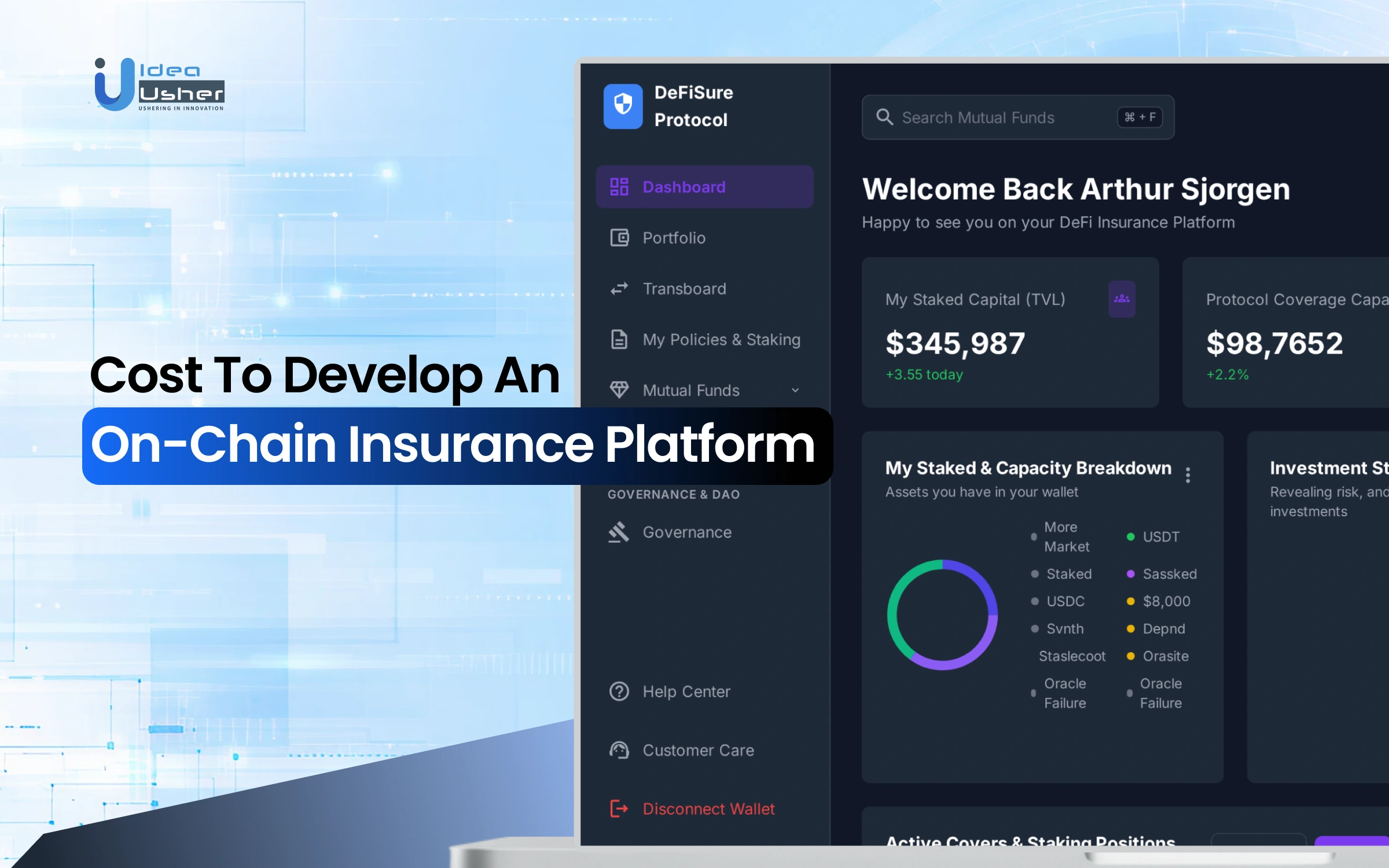

Smart contracts function as self-executing digital agreements with business logic encoded directly onto the blockchain. When pre-defined conditions are met – such as a certain loss threshold or time-based event – the contract automatically triggers settlement actions. This means premiums can be recalculated in real time using trusted data feeds (oracles), while claims payments are released without manual approval cycles. For example, Zoniqx’s Tokenized Asset Lifecycle Management (TALM) system digitizes entire reinsurance contracts, enabling automated premium collection and claim disbursement based on real-world events.

Transparency and Trust Through Blockchain

The power of blockchain insurance technology lies in its ability to provide an immutable, shared ledger accessible by all parties involved in a reinsurance agreement. Every transaction – from initial underwriting to final settlement – is recorded transparently and can be audited at any time. This dramatically reduces opportunities for disputes or errors.

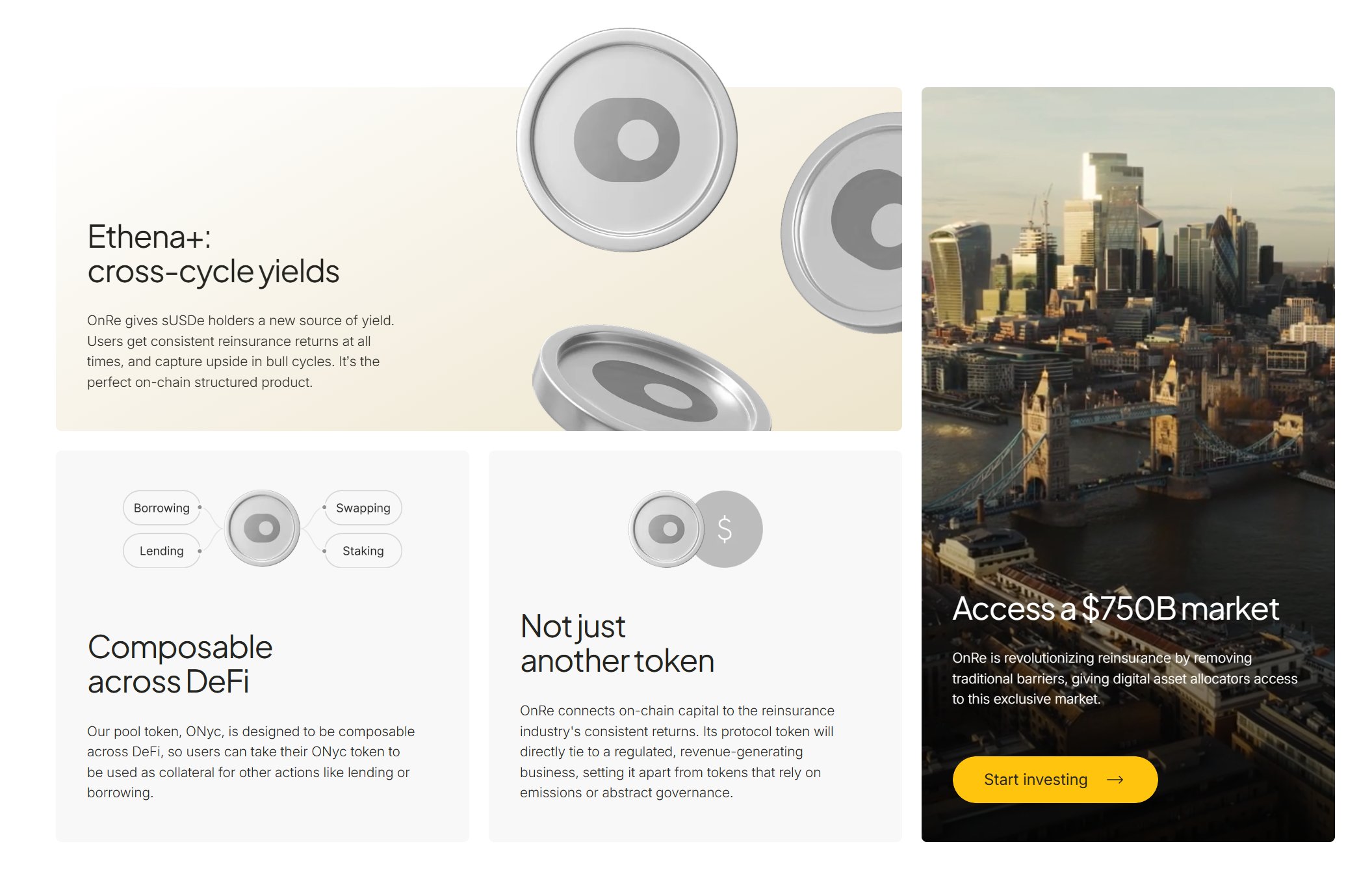

Platforms like OnRe go further by tokenizing exposure to reinsurance risk through native tokens whose value is tied to the total value locked (TVL) on their protocol. Investors can monitor underwriting activity in real time, ensuring that capital flows align with actual risk transfer events. The result is a more efficient capital market for risk-sharing that operates with far lower friction than traditional models.

Efficiency Gains: Speeding Up Claims and Lowering Costs

The integration of smart contract insurance claims capabilities has cut claim settlement times by more than threefold according to industry research. This acceleration is particularly valuable for parametric products where payouts depend on objective data sources such as weather APIs or IoT sensors rather than subjective loss assessments.

The cost savings are equally significant: automated execution slashes administrative expenses associated with document verification, reconciliation, and error correction. According to PwC’s analysis of blockchain reinsurance settlements, these efficiencies not only reduce operational costs but also unlock new business models where micro-policies or high-frequency risk pools become viable at scale.

Beyond speed and savings, smart contracts introduce a new paradigm for compliance and regulatory oversight. Since all actions are logged on a tamper-proof ledger, auditors and regulators can instantly verify that settlements adhere to contract terms and industry standards. This is a major leap forward from legacy systems where fragmented data silos often hinder oversight and delay regulatory reporting.

For reinsurers, the ability to automate settlements reduces capital trapped in slow-moving processes. Capital efficiency improves as funds are released or redeployed more quickly, supporting greater underwriting capacity without increasing risk exposure. For cedents (primary insurers), this means faster access to reinsurance recoveries, critical for liquidity during catastrophe events or periods of elevated claims activity.

Real-World Applications: Tokenization and Data Integration

One of the most compelling developments is the tokenization of reinsurance contracts themselves. Platforms like OnRe have pioneered tokenized yield models where investors hold digital assets representing fractional interests in pools of reinsurance risk. The value of these tokens is directly linked to the protocol’s total value locked (TVL) and underlying performance, providing unprecedented transparency compared to opaque sidecar structures or retrocession markets.

Meanwhile, Zoniqx’s TALM system leverages smart contracts to automate not only settlements but also ongoing premium adjustments, risk-sharing calculations, and claims validation. By integrating with trusted off-chain data sources, such as weather stations or hospital records, smart contracts can trigger payouts automatically when objective criteria are met. This model minimizes disputes by removing subjectivity from loss assessment and ensures that capital flows exactly as intended by the contract logic.

Key Benefits of On-Chain Reinsurance Smart Contracts

-

Automated Settlements: Platforms like Zoniqx TALM use smart contracts to automate premium payments, claims processing, and risk-sharing settlements, drastically reducing manual intervention and accelerating the entire process.

-

Enhanced Transparency: Blockchain-based reinsurance solutions provide a shared, immutable ledger accessible to all parties, ensuring that every transaction and contract update is visible and auditable in real time. This minimizes disputes and builds trust among stakeholders.

-

Significant Cost Savings: By automating administrative tasks and reducing the need for intermediaries, smart contracts help reinsurance platforms like OnRe lower operational costs and eliminate redundant processes.

-

Improved Capital Efficiency: Tokenized reinsurance models, such as those offered by OnRe, allow investors to gain exposure to reinsurance returns via native tokens linked to total value locked, optimizing capital allocation and unlocking new investment avenues.

-

Seamless Real-Time Data Integration: Smart contracts can connect with trusted data sources—such as IoT devices, weather APIs, or financial databases—to trigger automatic settlements, enabling faster and more accurate claims processing.

Challenges Ahead: Interoperability and Standardization

Despite these advances, several challenges remain before blockchain insurance technology achieves mass adoption in reinsurance. Chief among them is interoperability between different blockchain networks and legacy systems. The industry must also develop standardized templates for smart contracts so that terms are interpreted consistently across jurisdictions and counterparties.

Another consideration is oracle reliability, the accuracy of external data feeds used to trigger contract actions. Robust governance frameworks are needed to ensure that oracles provide timely and accurate information without introducing new vectors for manipulation or error.

The Road Forward

The trajectory is clear: automated reinsurance blockchain solutions will continue to expand as stakeholders recognize their transformative impact on operational resilience and market efficiency. As more reinsurers embrace tokenization and automated settlements, expect a wave of innovation in product design, from micro-reinsurance pools serving emerging markets to highly customized retrocession arrangements executed at lightning speed.

The convergence of smart contract automation with real-time data integration is not just a technical upgrade, it’s a fundamental shift in how risk is shared across the global insurance ecosystem. Stakeholders who adapt early will be best positioned to capitalize on new efficiencies while setting higher standards for transparency and trust.