Parametric reinsurance is rapidly emerging as the most transparent, efficient, and scalable solution for climate and catastrophe risk transfer. By leveraging blockchain technology, insurers and reinsurers can automate payouts based on objective event data, streamline settlement, and minimize disputes. The recent launch of Arbol’s dRe platform with The Institutes RiskStream Collaborative demonstrates how smart contracts and decentralized oracles are transforming severe weather reinsurance markets (see Artemis. bm). But how can insurance professionals actually implement such solutions in practice?

Defining Parametric Triggers and Data Sources

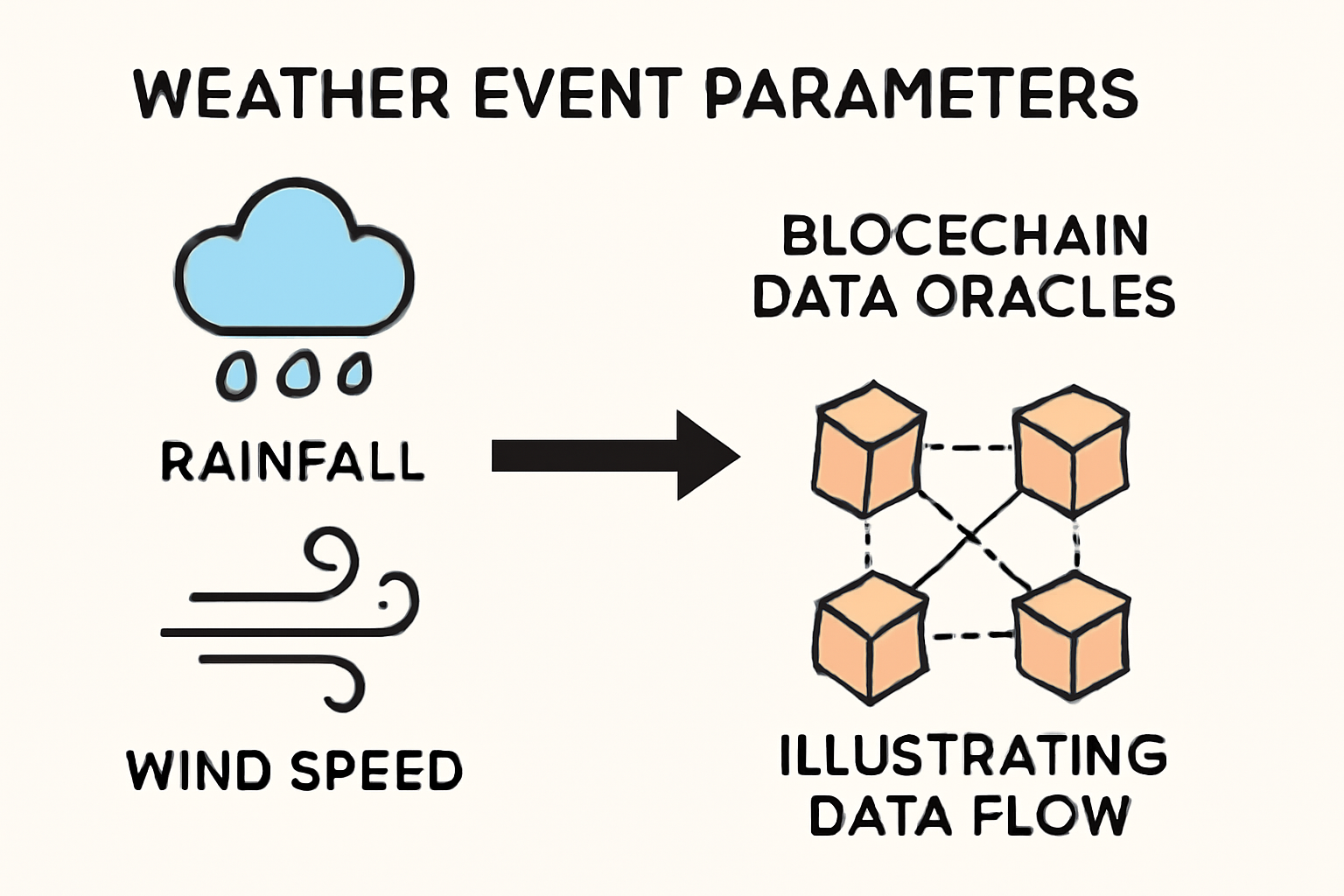

The first step in building parametric reinsurance on blockchain is to define objective, measurable triggers. These are event parameters like rainfall above 100mm in 24 hours or wind speeds exceeding 120 km/h. The key is to choose criteria that are unambiguous, easily verifiable, and relevant to the insured risk.

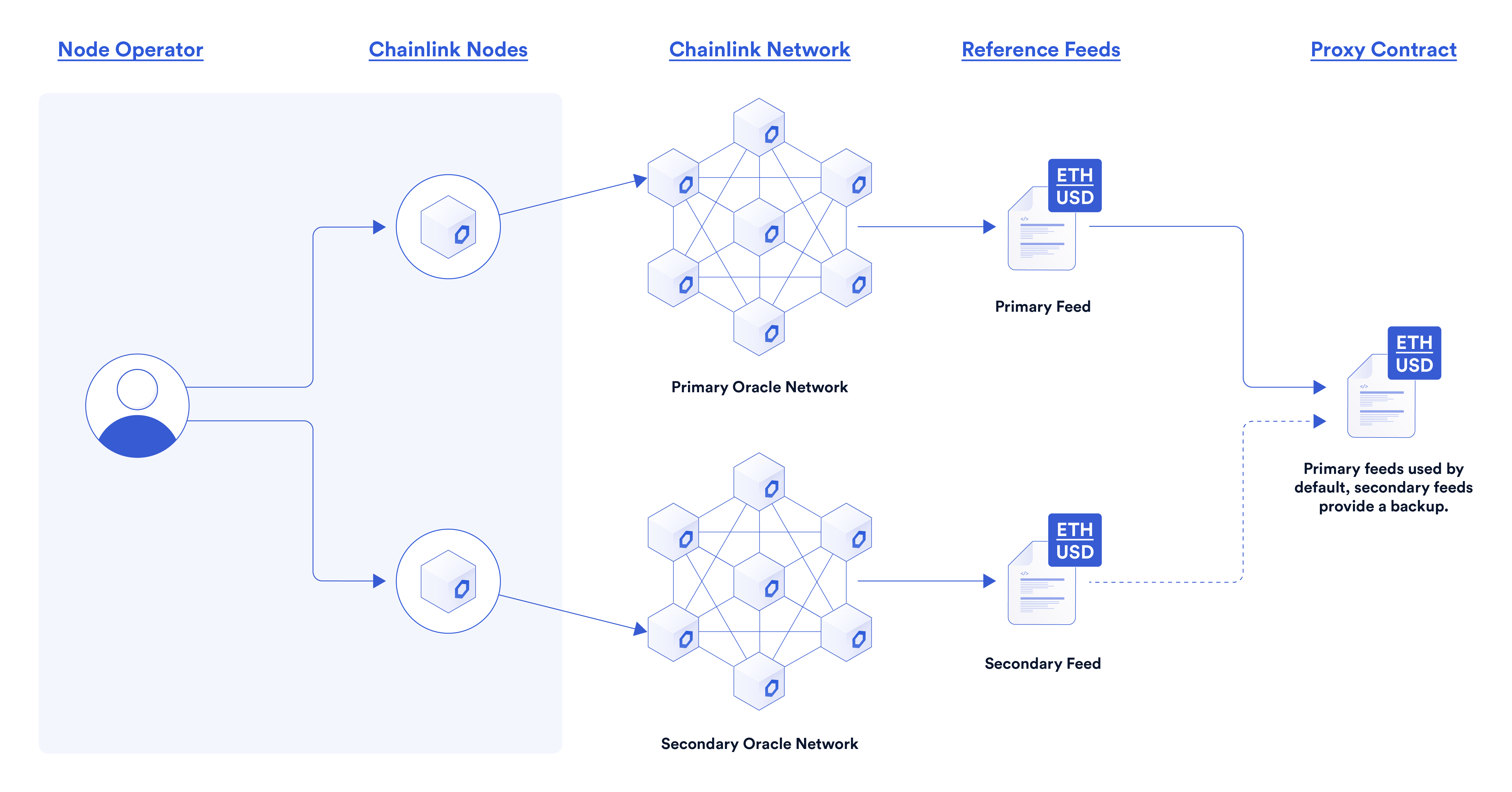

Equally important is selecting reliable data sources. Blockchain-based parametric solutions rely on external data, often delivered via decentralized oracles, to determine if a trigger has been met. Platforms like Chainlink have become industry standards for delivering tamper-proof weather data directly to smart contracts. For instance, dRe uses dClimate and Chainlink to power its real-time catastrophe triggers.

Key Steps to Implement Parametric Reinsurance on Blockchain

-

Define Parametric Triggers and Data Sources: Identify objective, measurable event parameters—such as rainfall totals, wind speed, or earthquake magnitude—and select reliable, tamper-proof data oracles (e.g., Chainlink, dClimate) for automated trigger verification.

-

Design Smart Contract Architecture: Develop self-executing smart contracts on a suitable blockchain (such as Ethereum or Avalanche) to automate policy issuance, trigger evaluation, and payout processes.

-

Integrate Secure Data Oracles: Connect the smart contract to trusted third-party data oracles (e.g., Chainlink) that deliver real-time, verifiable event data, ensuring accurate and transparent trigger activation.

-

Establish Regulatory Compliance and KYC/AML Procedures: Incorporate regulatory requirements for reinsurance contracts, including Know Your Customer (KYC) and Anti-Money Laundering (AML) checks, using on-chain identity solutions where feasible.

-

Develop User Interfaces and Policy Management Tools: Build intuitive front-end platforms for insurers, reinsurers, and clients to manage policies, monitor triggers, and track claims in real time.

-

Conduct Security Audits and Pilot Testing: Perform thorough smart contract audits and run pilot programs with limited capital exposure to validate system integrity, operational workflows, and user experience before full-scale deployment.

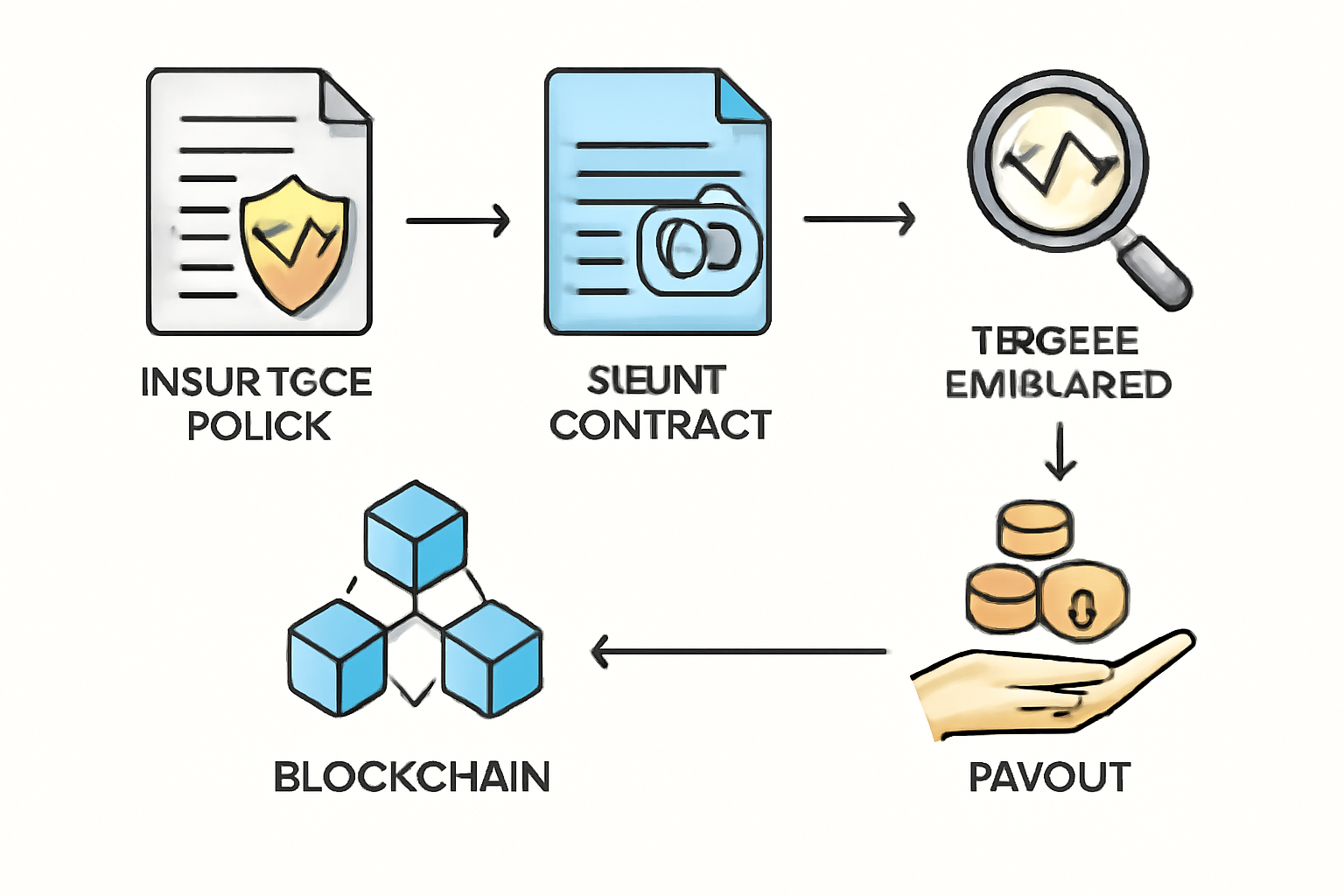

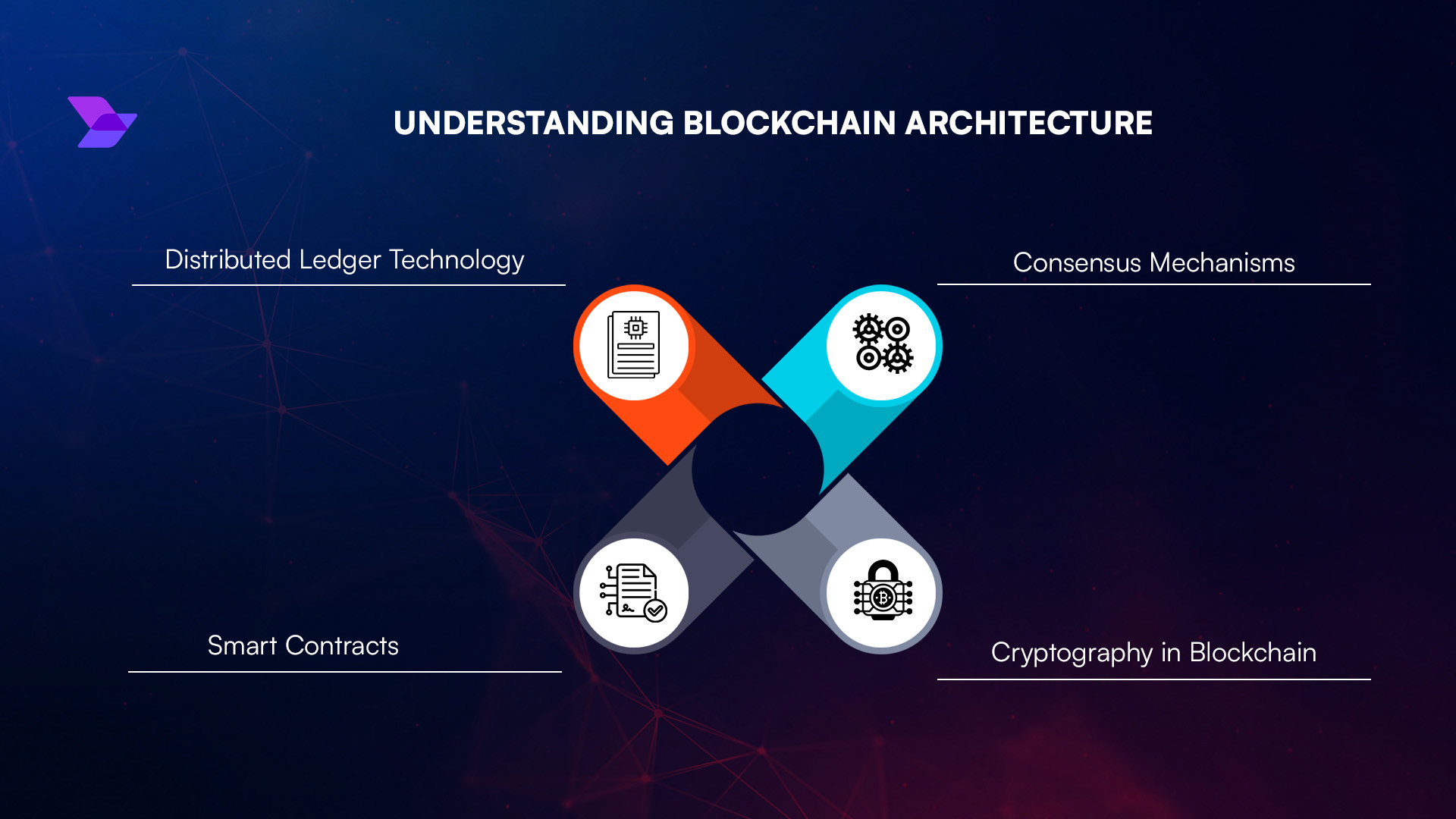

Designing Smart Contract Architecture

Once triggers and data sources are set, the next step is to develop a robust smart contract architecture. This means writing self-executing code that automates the entire policy lifecycle, from issuance through trigger evaluation to payout, on a suitable blockchain network such as Ethereum or Avalanche.

Smart contracts should clearly encode:

- The terms of coverage (e. g. , what event constitutes a valid claim)

- The logic for evaluating triggers based on incoming oracle data

- The calculation and disbursement of payouts upon trigger activation

This automation reduces manual intervention, speeds up settlement, and ensures transparency for all participants. However, careful attention must be paid to security best practices during development; vulnerabilities can lead to catastrophic losses.

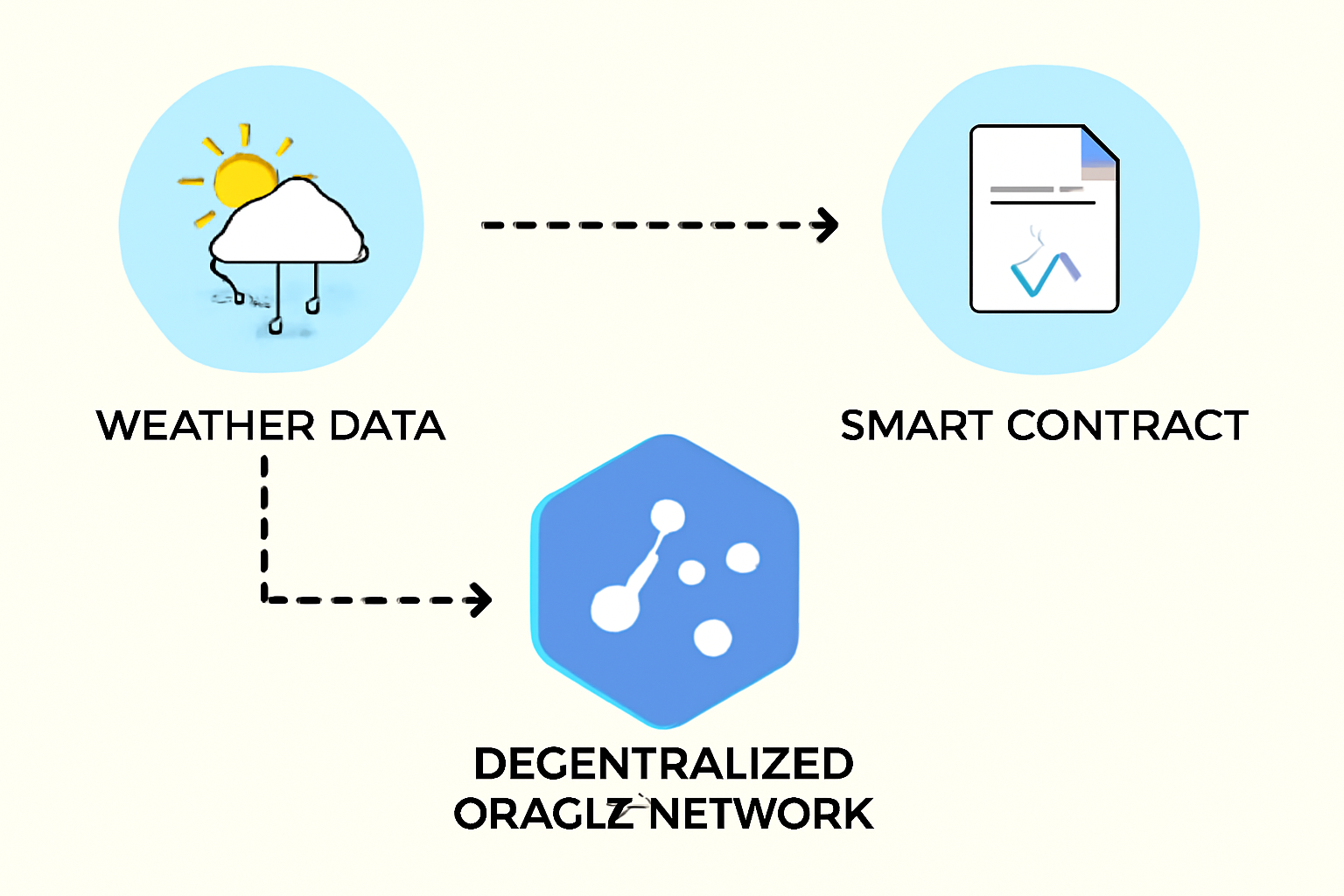

Integrating Secure Data Oracles

No parametric solution succeeds without trustworthy data feeds. Integration with secure third-party data oracles is essential for accurate trigger activation. Oracles like Chainlink deliver real-time weather or seismic event data directly onto the blockchain in a verifiable manner, a critical requirement for automated payouts.

For example, Arbol’s dRe platform automates severe storm loss calculations using weather data from dClimate piped through Chainlink’s decentralized oracle network (see RiskStream. org). This approach eliminates subjectivity and drastically reduces claims processing time compared to traditional models.

Navigating Regulatory Compliance and KYC/AML Procedures

No matter how innovative your technical stack is, compliance remains non-negotiable in reinsurance. Blockchain platforms must incorporate regulatory requirements such as Know Your Customer (KYC) and Anti-Money Laundering (AML) protocols, ideally using on-chain identity verification tools where possible. This ensures your solution meets both local laws and international standards while providing auditability for all stakeholders.

“Blockchain makes it possible to automate not only payouts but also compliance workflows, provided you integrate identity checks at the protocol level. “: Renee Carver

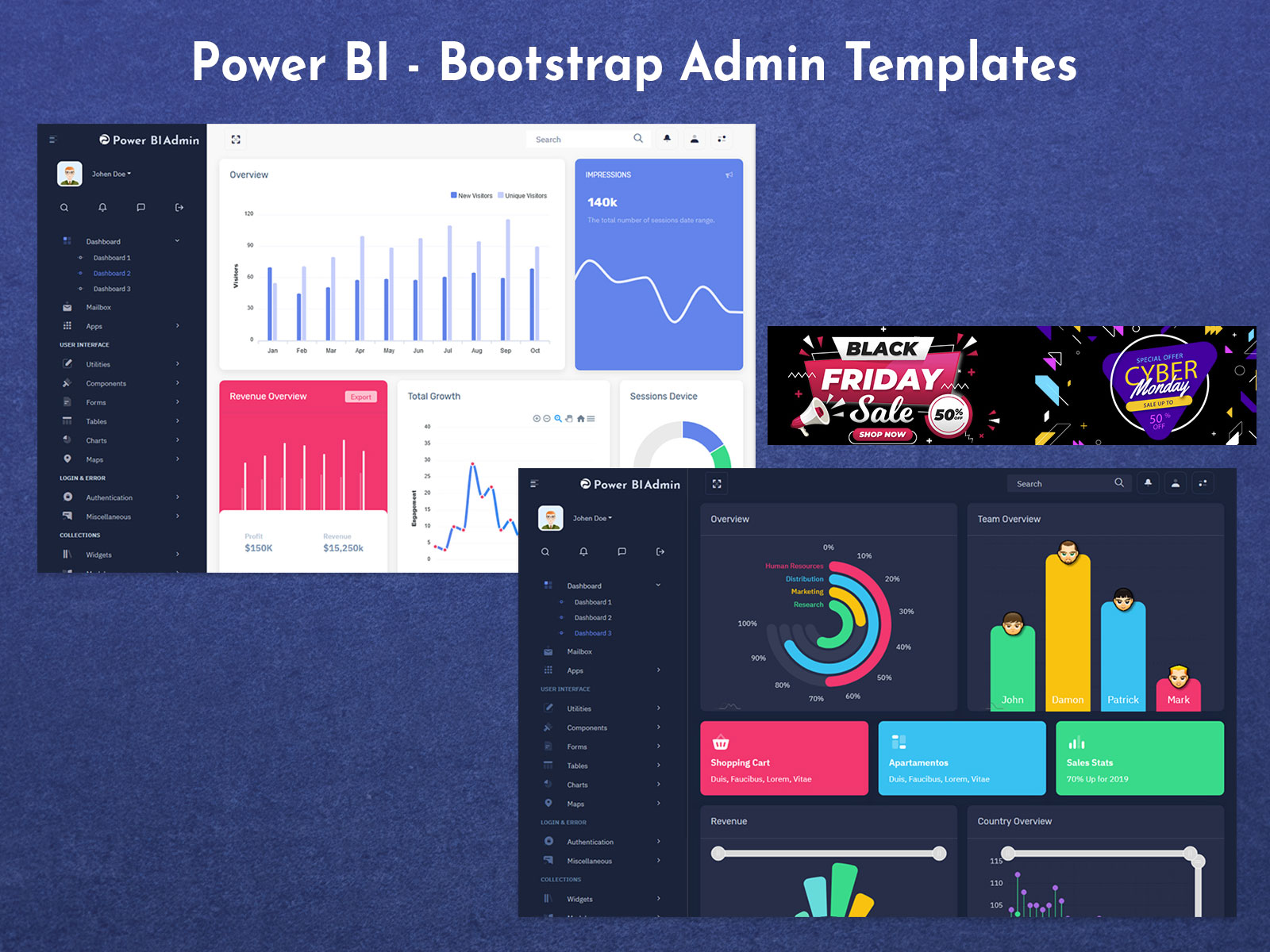

With compliance frameworks in place, the next focus is on usability. Even the most sophisticated parametric reinsurance blockchain solution will falter without intuitive, accessible interfaces for all market participants. Insurers, reinsurers, and end clients need clear dashboards to manage policies, monitor real-time triggers, and track claim statuses. User experience is not just a nice-to-have; it’s essential for adoption and operational efficiency.

Developing User Interfaces and Policy Management Tools

Building effective front-end platforms bridges the gap between smart contract logic and real-world usability. Modern parametric reinsurance platforms often provide:

- Self-service portals for policy issuance and renewal

- Live trigger monitoring with data visualizations

- Automated claim status updates and payout notifications

These tools empower clients to verify trigger events independently, reducing disputes and fostering trust in on-chain reinsurance models. The best interfaces abstract away blockchain complexity while retaining transparency, think simple login flows leveraging on-chain identity, or one-click claim initiation when a trigger is met.

What’s your biggest challenge in adopting blockchain-based parametric reinsurance?

Implementing parametric reinsurance on blockchain involves several technical and operational steps. Which part of the process do you find most challenging?

Conducting Security Audits and Pilot Testing

Before launching at scale, it’s crucial to rigorously test every component of your parametric reinsurance blockchain stack. Smart contract security audits are mandatory, unpatched vulnerabilities can result in instant capital loss or protocol manipulation. Engage reputable third-party auditors who specialize in DeFi and insurance protocols.

Pilot testing with limited capital exposure allows you to validate:

- The integrity of smart contract logic under real-world conditions

- The reliability of oracle data feeds during live events

- User experience across all interfaces and workflows

- The effectiveness of compliance checks in onboarding/claims processes

This phase should include simulated event scenarios (e. g. , triggering mock hurricane payouts), stress tests for oracle downtime, and hands-on feedback from actual users. Only after successful pilots should you proceed to full-scale deployment.

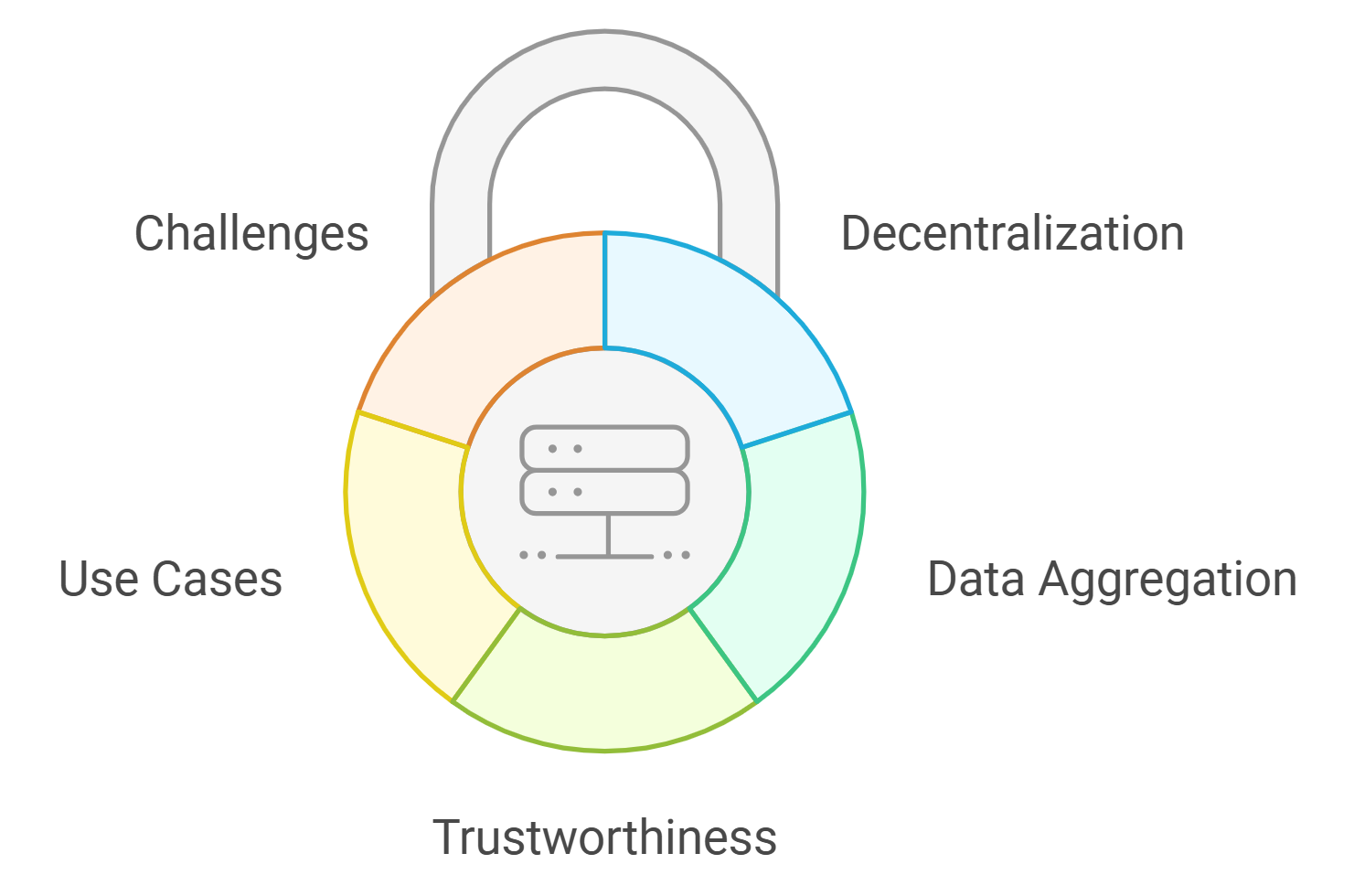

Bringing It All Together: The Future of Parametric Reinsurance on Blockchain

The convergence of parametric insurance models with blockchain technology is already reshaping the landscape of catastrophe risk transfer. As demonstrated by platforms like Arbol’s dRe, where decentralized oracles such as Chainlink deliver real-time weather data directly to smart contracts, parameters become objective, settlements become near-instantaneous, and trust shifts from intermediaries to code (see Artemis. bm, see RiskStream. org).

This transformation isn’t theoretical, it’s happening now. By following these six steps:

6 Steps to Implement Parametric Reinsurance on Blockchain

-

Define Parametric Triggers and Data Sources: Identify objective, measurable event parameters (e.g., rainfall, wind speed) and select reliable, tamper-proof data oracles for automated trigger verification. For example, dClimate provides validated weather data used in platforms like Arbol’s dRe.

-

Integrate Secure Data Oracles: Connect the smart contract to trusted third-party data oracles (e.g., Chainlink) that deliver real-time, verifiable event data to ensure accurate and transparent trigger activation.

-

Establish Regulatory Compliance and KYC/AML Procedures: Incorporate regulatory requirements for reinsurance contracts, including Know Your Customer (KYC) and Anti-Money Laundering (AML) checks, using on-chain identity solutions where feasible. Platforms like RiskStream Collaborative support compliance integration.

-

Develop User Interfaces and Policy Management Tools: Build intuitive front-end platforms for insurers, reinsurers, and clients to manage policies, monitor triggers, and track claims in real time. User-friendly dashboards are essential for adoption and transparency.

-

Conduct Security Audits and Pilot Testing: Perform thorough smart contract audits and run pilot programs with limited capital exposure to validate system integrity, operational workflows, and user experience before full-scale deployment. Engage reputable audit firms and leverage sandbox environments for testing.

…you can build robust, compliant solutions that deliver transparency, speed, and fairness to insurers and insureds alike.

The path forward will require ongoing collaboration between technologists, underwriters, regulators, and data providers. But with each new deployment, and each successful pilot, the future of on-chain parametric reinsurance grows more tangible.