The reinsurance industry is undergoing a seismic shift, powered by blockchain-based innovations that promise to resolve its most persistent pain points: opacity, inefficiency, and trust deficits. At the heart of this transformation is on-chain collateral transparency, a concept that’s rapidly gaining traction thanks to the integration of Chainlink’s Proof of Reserve (PoR) technology. With Chainlink (LINK) currently trading at $16.80, the protocol has become a linchpin for real-time insurance reserve verification and blockchain insurance transparency. Let’s explore how these developments are reshaping reinsurance for both crypto-native and institutional players.

Why On-Chain Collateral Transparency Matters in Reinsurance

Traditional reinsurance relies heavily on periodic, manual audits and opaque off-chain reporting cycles. This creates blind spots where under-collateralization or mismanagement can go unnoticed until it’s too late. In contrast, on-chain collateral transparency leverages blockchain’s open ledger to make every dollar of collateral and premium payment visible in real time. The Re Protocol exemplifies this approach by allowing participants to stake stablecoins, receive yield-bearing tokens, and earn diversified insurance returns – all tracked transparently on-chain.

This shift doesn’t just build trust; it fundamentally changes how risk is assessed and shared. Stakeholders can independently verify that reserves meet required thresholds at any moment, reducing systemic risk and enabling more efficient capital allocation across the insurance sector.

Chainlink Proof of Reserve: The Backbone of Real-Time Verification

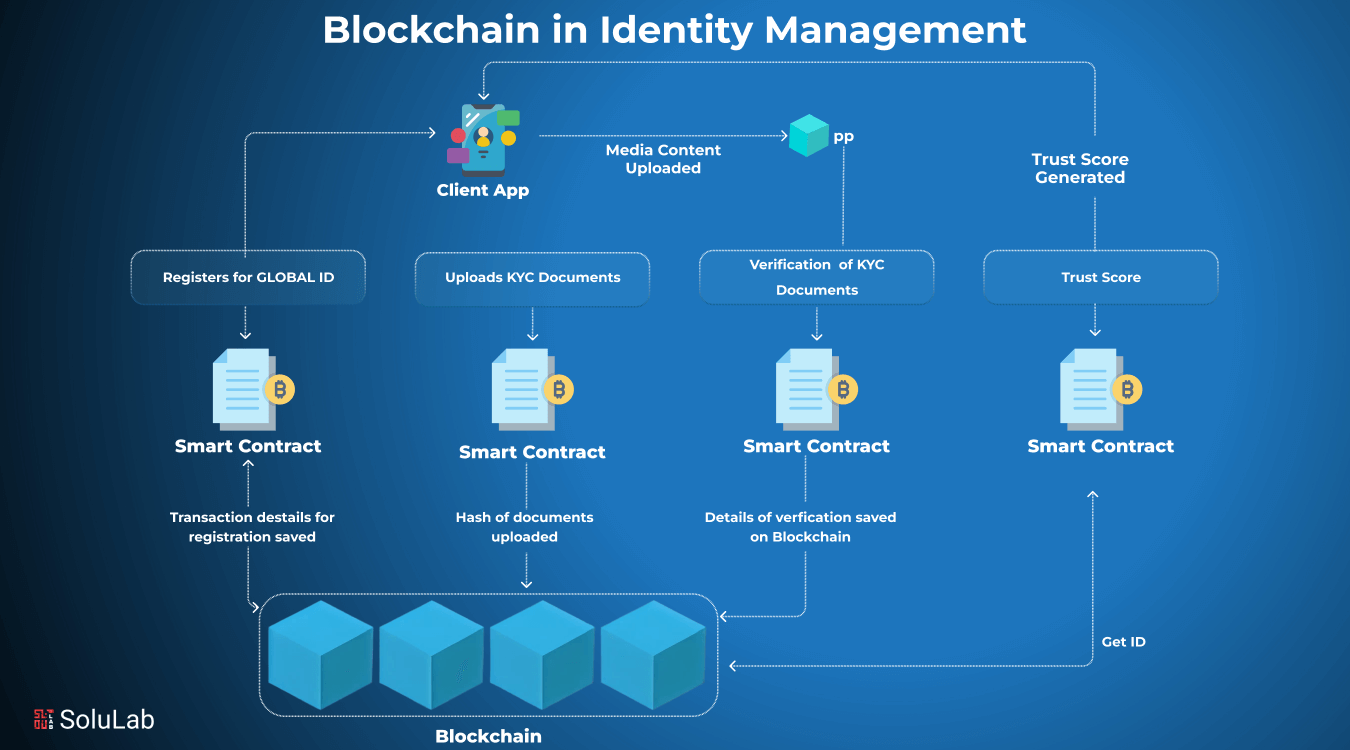

Chainlink’s PoR feeds are revolutionizing blockchain insurance verification by delivering near real-time on-chain proof that digital assets are fully backed by verifiable reserves. Whether those reserves exist on-chain or off-chain (such as fiat currencies or other tangible assets), Chainlink PoR provides smart contracts with tamper-proof data about current collateralization levels.

This is particularly critical for reinsurance smart contracts, which often involve large pools of capital backing complex risk arrangements. By integrating Chainlink PoR, platforms like Re can automate circuit breakers that halt operations if reserves fall below pre-set thresholds – all without human intervention or trust in a single party.

The result? A new standard for accountability in DeFi insurance protocols, where every participant – from underwriters to investors – can see exactly what backs their positions at any time.

The Market Impact: Trust Through Transparency at $16.80 LINK

The broader crypto market has recognized the value proposition here: as Chainlink continues to trade at $16.80, its PoR solution is driving adoption across both DeFi-native insurance projects and traditional financial institutions entering the space. Recent integrations with platforms like Crypto Finance and StablR underscore how PoR enables greater transparency compared to legacy reporting cycles – offering depositors and policyholders unprecedented visibility into reserve adequacy.

This isn’t just a technical upgrade; it’s a paradigm shift for the entire industry. As more reinsurance treaties move on-chain via protocols like Re, backed by automated verification from Chainlink PoR, we’re witnessing the emergence of an ecosystem where trust is engineered into every transaction rather than assumed or outsourced.

Institutional investors, insurance professionals, and crypto-native users alike are beginning to demand this level of transparency as a baseline, not a bonus. The days when opaque balance sheets and delayed audits could pass muster are numbered. Real-time insurance reserves, validated by on-chain oracles, mean that every stakeholder can independently verify collateralization at the click of a button. This is particularly transformative for reinsurance smart contracts, which often manage massive sums and complex risk structures across jurisdictions.

What’s more, blockchain insurance verification isn’t just about preventing under-collateralization or fraud. It also unlocks new efficiencies for capital providers. Automated proof-of-reserve feeds allow protocols to dynamically adjust yield rates or risk exposure in response to real-time data, rather than waiting weeks for an external audit report. This agility is especially valuable in volatile markets or when onboarding new institutional capital that demands rigorous transparency.

Key Benefits of Chainlink PoR for On-Chain Reinsurance

Key Benefits of Chainlink Proof of Reserve in Reinsurance

-

Real-Time On-Chain Collateral Verification: Chainlink Proof of Reserve (PoR) enables near real-time, automated verification of reinsurance collateral, ensuring that all staked assets are transparently accounted for on-chain. This continuous monitoring helps platforms like Re Protocol maintain integrity and trust with users.

-

Enhanced Transparency and Trust: By leveraging Chainlink PoR, reinsurance platforms provide verifiable, tamper-proof proof that all digital assets are fully backed. This transparency fosters greater user confidence and meets the growing demand for auditable, on-chain insurance operations.

-

Automated Risk Mitigation: Chainlink PoR can trigger oracle-based circuit breakers if collateralization thresholds are breached, automatically halting operations to prevent systemic risk. This automation reduces manual intervention and strengthens platform security.

-

Streamlined Regulatory Compliance: With public, immutable records of all collateral and premium flows, Chainlink PoR assists platforms in meeting regulatory requirements for transparency and solvency, simplifying audits and reporting.

-

Increased Efficiency and Reduced Costs: Automated, on-chain verification eliminates the need for manual reserve attestations and third-party audits, lowering operational costs and enabling faster, more efficient reinsurance settlements.

Chainlink PoR offers several concrete benefits that are already being realized by leading platforms:

- Automated Circuit Breakers: Smart contracts can pause new underwriting if reserves dip below safe levels.

- Regulatory Alignment: Real-time reserve verification supports compliance with evolving digital asset regulations.

- User Empowerment: Investors and policyholders can monitor collateral status independently, without relying on centralized disclosures.

- Ecosystem Interoperability: PoR enables seamless integration across DeFi protocols, stablecoins, and tokenized assets.

This technology is not just theoretical. Platforms like Re Protocol have already implemented these features in production environments, setting a precedent for the next wave of blockchain-powered insurance products. For a deeper dive into how PoR enhances security for DAOs and stablecoins, see this resource: How Chainlink Proof of Reserve Enhances On-Chain Treasury Security.

Looking Ahead: The Future of Reinsurance is Transparent

The integration of on-chain collateral transparency via Chainlink PoR is setting the stage for a future where reinsurance is not only more efficient but fundamentally more trustworthy. As regulatory scrutiny increases and institutional adoption grows, protocols that offer real-time visibility into reserves will enjoy a significant competitive advantage. With Chainlink (LINK) maintaining its position at $16.80, its role as the backbone oracle network for these innovations remains unchallenged.

The next phase will likely see further convergence between traditional insurance giants and DeFi-native protocols as both seek to capitalize on the operational advantages offered by real-time blockchain verification. Expect continued growth in integrations and ever-more sophisticated use cases, from automated claims processing to global risk-sharing pools, all underpinned by transparent reserve data delivered through decentralized oracles.

If trust is the currency of insurance, then on-chain collateral transparency, powered by solutions like Chainlink Proof of Reserve, is its gold standard.