Institutional investors are facing a new era of risk management in 2025, thanks to the rapid evolution of on-chain reinsurance protocols. As digital asset regulation matures and blockchain adoption accelerates, these protocols are unlocking efficiencies and transparency that were unthinkable just a few years ago. The global reinsurance market, long dominated by opaque processes and limited access, is now being reshaped by smart contracts, real-time data feeds, and tokenized capital pools.

Transparency and Trust: The Blockchain Advantage

One of the most profound shifts brought by on-chain reinsurance is radical transparency. Traditional reinsurance contracts often involve layers of intermediaries and delayed reporting. In contrast, blockchain-based platforms like Re Protocol leverage immutable ledgers to record every transaction, from premium payments to claims settlements, in real time. This provides institutional investors with an unprecedented view into the health of their capital pools, collateralization ratios, and exposure levels.

Notably, integrations such as Chainlink’s Proof of Reserve have become industry standards for verifying off-chain collateral backing on-chain contracts. This cryptographic proof ensures that every policy is fully collateralized and verifiable by anyone with a blockchain explorer. Such innovations are crucial for regulated institutions seeking to meet evolving compliance standards while maintaining investor trust. For more technical detail on how smart contracts enable this level of transparency, see our guide on full transparency with smart contracts.

The Rise of Tokenized Reinsurance Assets

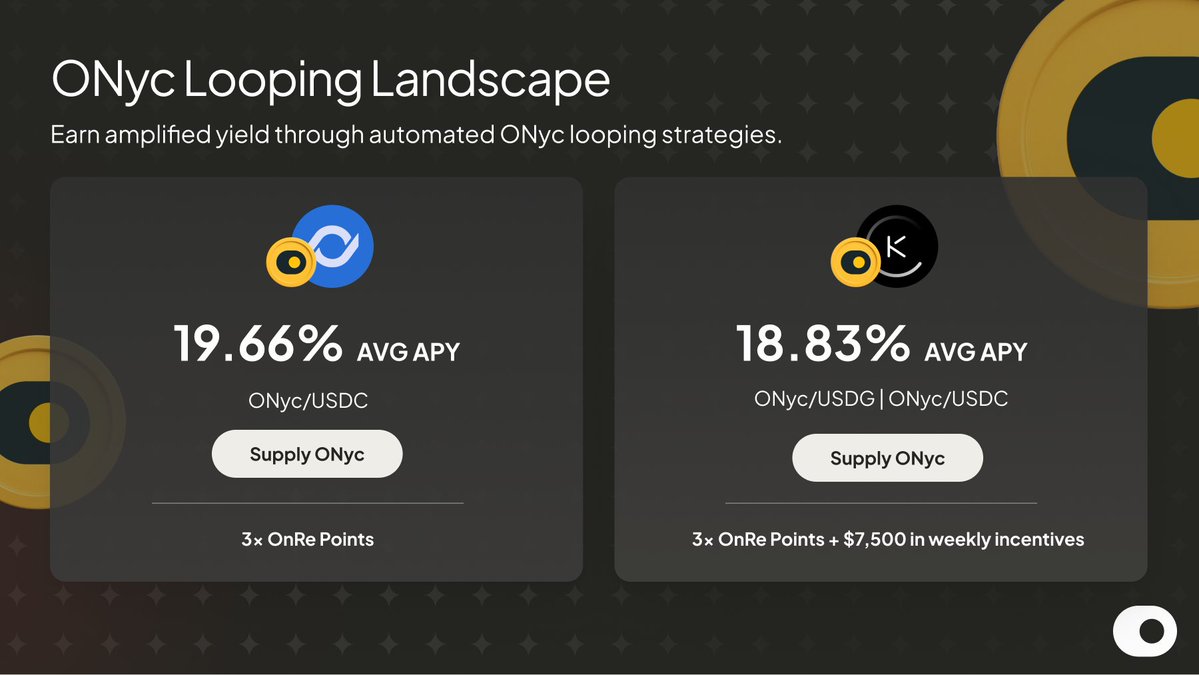

The tokenization trend is democratizing access to an asset class that was once reserved for the world’s largest insurers and reinsurers. Platforms such as OnRe have introduced yield-bearing tokens, backed by stablecoin reserves and real-world insurance premiums, that represent fractional ownership in diversified reinsurance pools. These tokens provide investors with stable returns uncorrelated to traditional markets or crypto volatility.

This model is particularly attractive in 2025’s macro environment, where portfolio diversification is paramount. By blending real-world underwriting profits with crypto-native yields, tokenized reinsurance offers a compelling alternative to both bonds and DeFi lending platforms. For a deeper dive into how tokenized vaults back real insurance risk, check out our article here.

Automated Collateral Management: Efficiency Unlocked

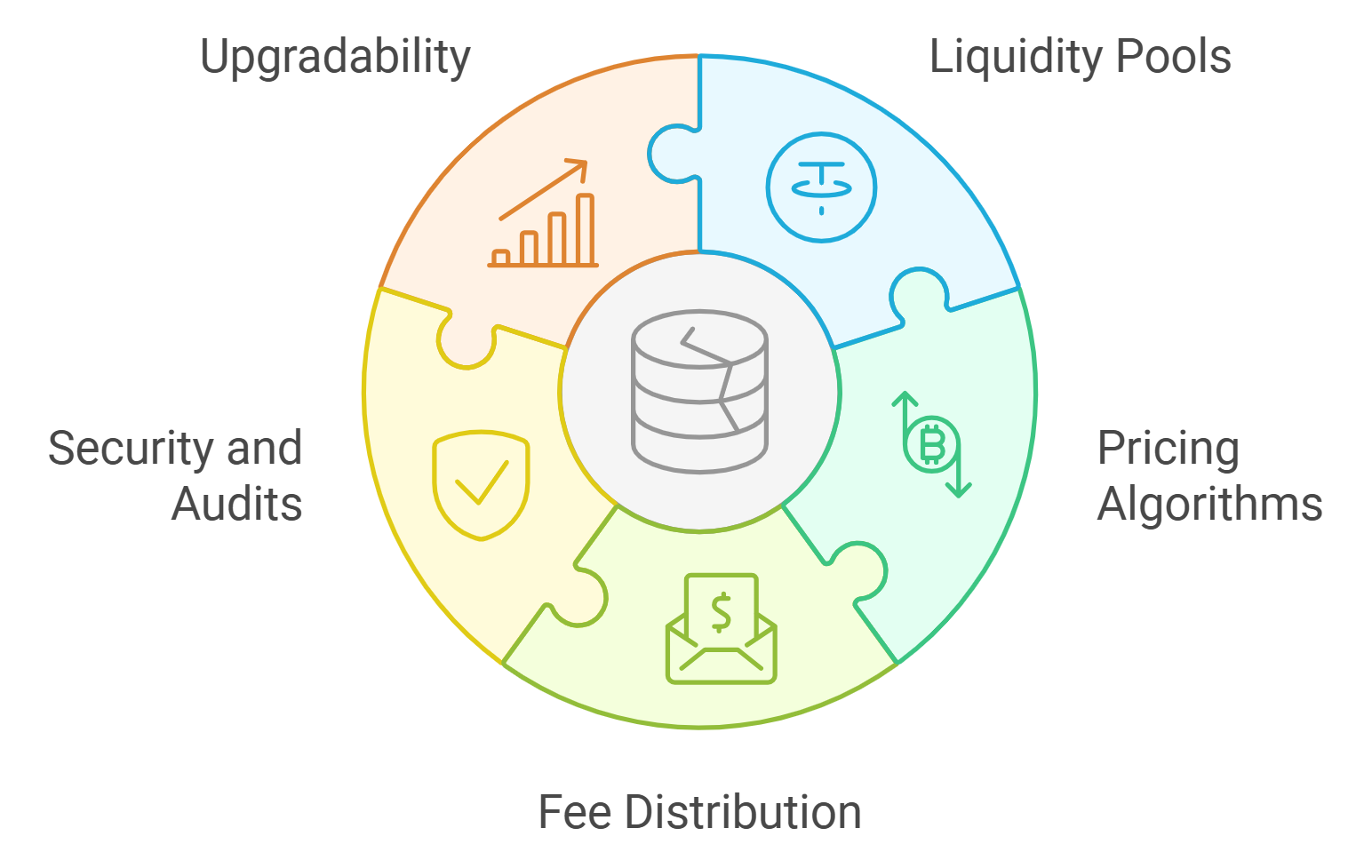

Smart contract automation lies at the heart of this transformation. Administrative overhead, once a major cost driver in reinsurance, is slashed as smart contracts handle premium collection, claims triggers, loss settlements, and fund distributions autonomously. This not only reduces operational costs but also minimizes human error and settlement delays.

A standout example is Re Protocol’s fully collateralized insurance capital pools: institutional investors deposit stablecoins directly into smart contracts that allocate funds across off-chain agreements based on predefined logic. Premiums flow back to these pools as on-chain yield, delivered transparently and efficiently without manual intervention.

This streamlined approach has attracted attention from both legacy insurers (58% plan increased blockchain investment in 2025) and forward-thinking institutional investors seeking reliable uncorrelated returns amid volatile markets.

Risk Analytics, Compliance, and Real-Time Auditing

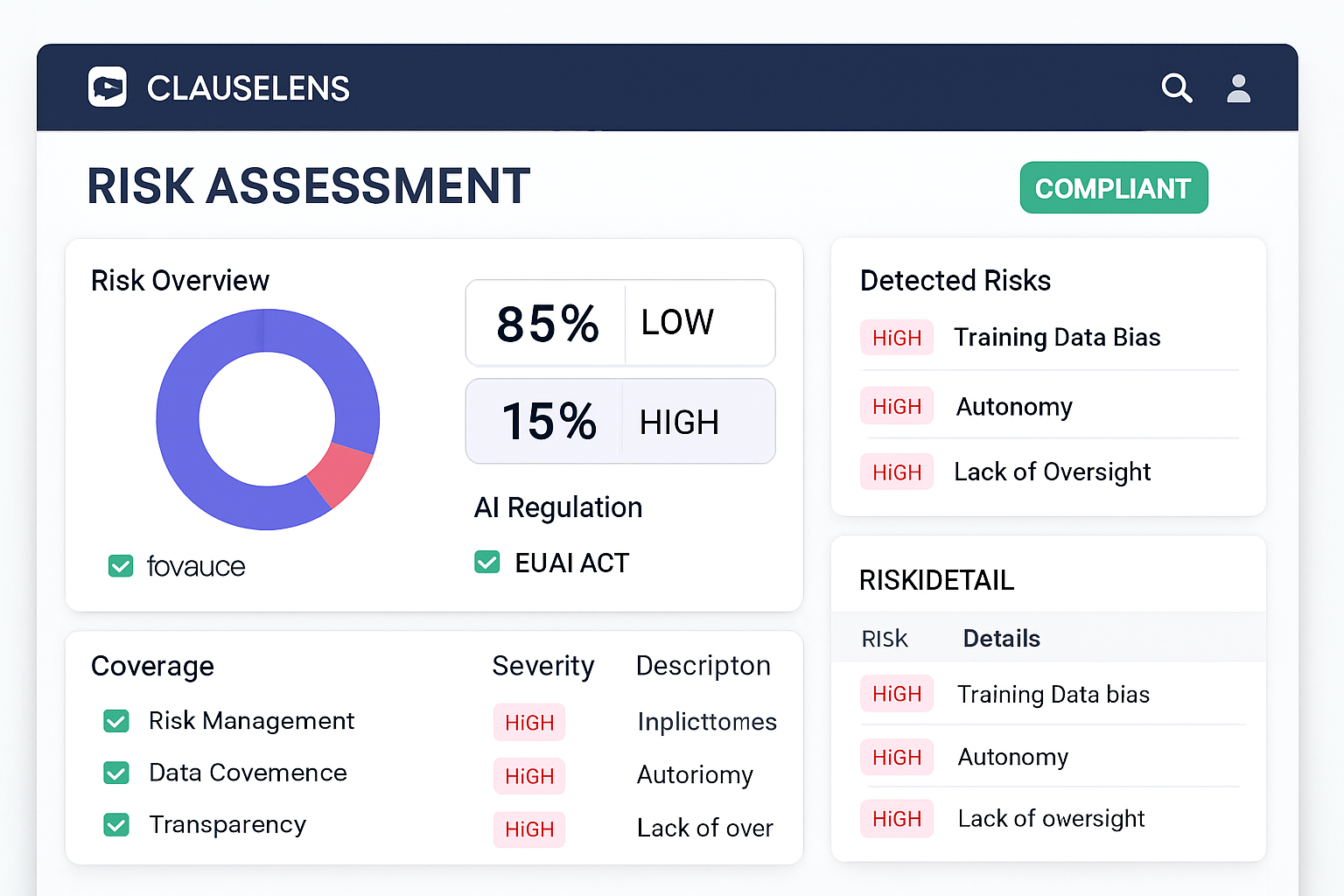

The convergence of on-chain data feeds and AI-powered analytics is elevating risk assessment to a new standard. Protocols now embed regulatory logic directly into smart contracts, allowing for automatic compliance with frameworks such as Solvency II and NAIC RBC. ClauseLens, for instance, applies reinforcement learning to generate treaty quotes that are not only competitive but also legally robust and instantly auditable. This means institutional investors can access transparent risk metrics and regulatory reporting with a few clicks, no more waiting weeks for actuarial reviews or relying on opaque third-party statements.

Regulatory clarity is also improving. In 2025, agencies like the SEC are shifting toward explicit guidelines rather than enforcement-first approaches. The result: institutions can confidently deploy capital into blockchain reinsurance protocols knowing their exposures are tracked in real time and their compliance obligations are met automatically. For a closer look at how blockchain is democratizing the $1 trillion reinsurance market, visit this resource.

Access to Uncorrelated Yields and Portfolio Resilience

Perhaps the most powerful draw for institutional investors is the access to uncorrelated yield streams. Tokenized reinsurance pools, backed by real premiums from global insurance markets, offer returns that move independently from equities or crypto cycles. This is particularly valuable in 2025’s climate of persistent macro uncertainty and cross-asset volatility.

Unlike traditional DeFi lending protocols tethered to crypto price swings, these reinsurance-backed tokens provide stability grounded in real-world risk transfer economics. Investors gain diversification without sacrificing transparency or liquidity: tokens can be traded or redeemed on-chain, and capital allocation can be adjusted dynamically as risk appetites shift.

Top Advantages of Decentralized Reinsurance Protocols for Institutions

-

Enhanced Transparency with Real-Time Data: On-chain reinsurance platforms like Re leverage blockchain’s immutable ledger to provide real-time visibility into contracts, collateral, and claims. Integrations such as Chainlink Proof of Reserve ensure that all reinsurance agreements are fully backed and instantly verifiable, boosting institutional trust.

-

Tokenization Unlocks New Yield Opportunities: Platforms like OnRe have introduced yield-bearing tokens (e.g., ONyc) that represent shares in reinsurance pools. This allows institutions to access stablecoin-backed, uncorrelated returns from real-world reinsurance premiums and tokenized treasuries.

-

Automated, Efficient Collateral Management: Smart contracts automate premium collection, claims processing, and fund distribution. For example, Re Protocol connects on-chain stablecoin capital directly to off-chain insurance risk, resulting in faster settlements, lower costs, and minimized human error.

-

Improved Risk Assessment & Regulatory Compliance: Solutions like ClauseLens use AI-driven frameworks to produce transparent, regulation-compliant treaty quotes. These systems embed legal context and support compliance with standards such as Solvency II and the EU AI Act, making risk assessment more robust and auditable.

-

Access to Uncorrelated, Diversified Yield: Tokenized reinsurance pools tap into the $784 billion global reinsurance market, offering income streams uncorrelated with traditional assets. This enhances institutional portfolio diversification and resilience across market cycles.

What’s Next? The Future of Institutional Risk Management on Blockchain

As adoption accelerates, we’re seeing rapid innovation across collateralization models, automated claims processing, and cross-chain interoperability. Major protocols are exploring integrations with AI-driven underwriting tools, further reducing friction between capital providers and insurance markets. The next wave will likely see even tighter integration with global regulatory frameworks, making on-chain reinsurance not just an alternative but a preferred standard for institutional risk management.

For those considering entry into this space, it’s crucial to evaluate platform transparency, collateral verification mechanisms (like Chainlink Proof of Reserve), regulatory alignment, and historical performance data before allocating significant capital. As always in insurance, due diligence remains paramount, but the tools now available make this process more data-driven than ever before.

Frequently Asked Questions: On-Chain Reinsurance and Institutional Investors

The transformation underway is more than technological, it’s cultural. By opening up previously exclusive markets through radical transparency and programmable trust, blockchain-based reinsurance is empowering institutions to build smarter portfolios while helping close global protection gaps. Those who embrace these innovations today will set the pace for tomorrow’s financial ecosystem.