What if you could earn double-digit, stablecoin-denominated yield that’s uncorrelated to crypto market swings? That’s not a DeFi fever dream, it’s the new reality thanks to on-chain reinsurance protocols. These platforms are transforming how capital flows into the insurance sector, blending the reliability of real-world premiums with blockchain’s transparency and speed.

How On-Chain Reinsurance Yield Works

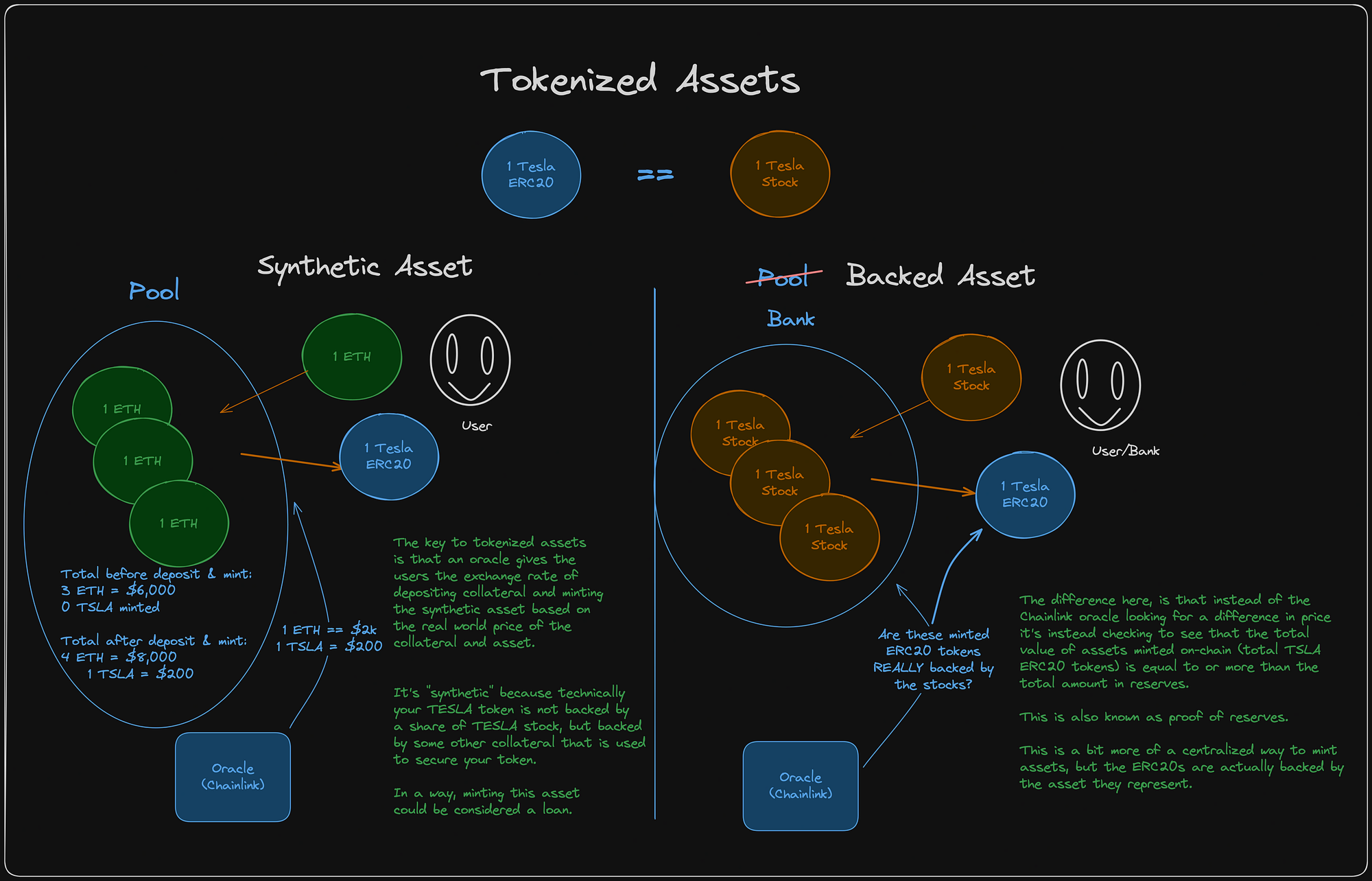

The magic starts when investors stake stablecoins like USDC into smart contracts. Protocols such as OnRe and Re Protocol tokenize this capital, issuing yield-bearing tokens that represent your share in a global reinsurance pool. Here’s where it gets tactical: these pools underwrite actual insurance contracts, think cyber risk, natural disasters, or specialty lines, earning premiums from primary insurers (the cedents) seeking coverage.

Unlike most DeFi yield farms that rely on unsustainable token emissions or leverage loops, on-chain reinsurance yield is powered by real-world cash flow. For example, OnRe’s ONyc token targets a base yield of 16%, derived directly from reinsurance premium income and returns on collateral assets. Meanwhile, Re Protocol’s reUSDe token currently trades at $1.23, reflecting live premium-driven yield generation (source).

The Engine: Tokenized Premiums Meet Blockchain Transparency

This isn’t just about high APYs, it’s about radically transparent finance. Every capital movement, premium inflow, and claim payout is recorded immutably on-chain. Investors can monitor their exposure in real time and verify that every dollar is accounted for. Compliance is baked in by design; protocols like OnRe have integrated Chainlink-powered oracles to provide always-on NAV tracking for regulated markets (details here).

Key Benefits of Yield from Tokenized Reinsurance

-

Stable, Uncorrelated Returns: Yields from on-chain reinsurance premiums are typically unaffected by crypto and equity market swings, offering a reliable income stream even during bear markets. For example, Re Protocol’s reUSDe token is currently priced at $1.23, reflecting real yield generation from insurance premiums.

-

Direct Exposure to Real-World Assets: Protocols like OnRe and Re Protocol let investors tap into the $750 billion global reinsurance market—a sector traditionally reserved for institutional players.

-

Enhanced Liquidity & Composability: Tokenized reinsurance assets such as ONyc can be used as collateral across DeFi platforms, enabling flexible strategies and improved capital efficiency.

-

Transparent, On-Chain Operations: All premium inflows, claim payouts, and capital movements are recorded on blockchain, giving investors real-time visibility and auditability of their investments.

-

Regulated, Revenue-Generating Products: Leading protocols like OnRe offer regulated, yield-bearing tokens that combine the stability of traditional insurance with the upside of on-chain finance.

Stable Returns in Any Market Cycle

The killer feature? Yields from insurance premiums are largely uncorrelated with equities or crypto prices. Even during bear markets when DeFi yields collapse, protocols like OnRe aim to deliver consistent returns through exposure to global reinsurance, a $750 billion market that’s been a fortress of stability for decades (see how ONyc works). This makes on-chain reinsurance an attractive play for anyone seeking diversification beyond the usual suspects.

What’s even more compelling is the composability unlocked by tokenized reinsurance assets. Because these yield-bearing tokens are native to blockchains like Avalanche and Solana, they can be used as collateral in other DeFi protocols, traded in secondary markets, or integrated into structured products. This liquidity layer means you’re not locked up for years like in traditional insurance investments, you can dynamically manage your exposure or tap into new strategies as the market evolves.

Re Protocol reUSDe Price Prediction 2026-2031

Expert Forecasts for reUSDe Token Based on On-Chain Reinsurance Yield and Market Trends

| Year | Minimum Price | Average Price | Maximum Price | Year-over-Year Change (%) | Market Scenario |

|---|---|---|---|---|---|

| 2026 | $1.15 | $1.28 | $1.40 | +4% | Stabilized real-yield, slow but steady DeFi adoption |

| 2027 | $1.18 | $1.34 | $1.52 | +4.7% | Further institutional adoption, Avalanche and DeFi integration |

| 2028 | $1.22 | $1.39 | $1.62 | +3.7% | Broader RWA adoption, regulatory clarity, increased composability |

| 2029 | $1.25 | $1.44 | $1.75 | +3.6% | Rising demand for uncorrelated yield, expansion to new chains |

| 2030 | $1.28 | $1.49 | $1.89 | +3.5% | Mainstream penetration, competitive DeFi landscape |

| 2031 | $1.32 | $1.54 | $2.05 | +3.4% | Mature on-chain reinsurance market, global investor access |

Price Prediction Summary

Re Protocol’s reUSDe token is forecast to appreciate gradually over the next six years, reflecting the growing adoption of on-chain reinsurance, real-world asset (RWA) tokenization, and demand for stable, uncorrelated yield. The minimum price projection reflects downside risks such as regulatory headwinds or market downturns, while the maximum scenario assumes accelerating institutional adoption, further DeFi integration, and global market expansion. Average prices are expected to trend upwards in line with yield growth and increased utility, with annual gains moderating as the market matures.

Key Factors Affecting Re Protocol reUSDe Price

- Growth and stability of reinsurance premium flows into the protocol

- Expansion of on-chain reinsurance adoption among DeFi and TradFi investors

- Yield sustainability and competitive rates versus other RWA and DeFi products

- Regulatory clarity and acceptance of tokenized insurance products

- Technological advancements, platform integrations, and composability within DeFi ecosystems

- Competition from other on-chain RWA protocols and synthetic yield products

- Broader crypto market cycles and macroeconomic conditions

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Let’s talk about risk management. On-chain protocols are obsessed with transparency and risk controls. Every underwriting decision, claim event, and premium payout is algorithmically tracked and visible to all stakeholders. This removes much of the opacity that’s plagued legacy reinsurance, no more black boxes or delayed reporting. Instead, investors get a real-time dashboard of their capital at work, with the ability to audit flows on-chain 24/7.

Why Real Yield From Insurance Premiums Is a Game-Changer

Here’s why this model is getting so much attention from both crypto-native investors and TradFi institutions:

Top Reasons On-Chain Reinsurance Yield Attracts Capital

-

Stable, Uncorrelated Returns: On-chain reinsurance protocols like OnRe and Re Protocol generate yield from real-world insurance premiums, offering returns that are typically uncorrelated with crypto and equity markets. This stability is especially attractive during market downturns.

-

Direct Exposure to Real-World Assets: Investors can access the $750 billion reinsurance market by staking stablecoins and receiving yield-bearing tokens, such as OnRe’s ONyc or Re Protocol’s reUSDe (currently priced at $1.23), providing genuine exposure to insurance premium flows.

-

Transparent and Regulated Operations: All capital movements, premium inflows, and claim payouts are recorded on-chain, ensuring real-time transparency and regulatory compliance. This builds trust for both institutional and retail investors.

-

Enhanced Liquidity and DeFi Composability: Tokenized reinsurance assets can be used as collateral across DeFi platforms, unlocking new liquidity and enabling advanced financial strategies for yield optimization.

-

Consistent Yield in All Market Conditions: Products like OnRe’s structured yield pools target base yields (e.g., 16% for ONyc) sourced from reinsurance performance and collateral asset returns, delivering steady income even during bear markets.

- Uncorrelated Returns: Insurance premium flows don’t care about Bitcoin volatility or equity drawdowns. That’s a huge edge for portfolio diversification.

- Regulated Market Access: Protocols like OnRe are building bridges between DeFi and regulated financial products (learn more), making it easier for institutions to get involved.

- Programmable Liquidity: Your exposure isn’t static, tokenized reinsurance assets can be plugged into lending markets or used as collateral across DeFi.

- Transparent Risk and Return: Blockchain ensures every premium dollar and claim payout is auditable in real time.

The numbers speak for themselves: with Re Protocol’s reUSDe trading at $1.23, investors see live proof of premium-driven yield generation, not just speculative growth (see breakdown). Meanwhile, OnRe’s ONyc product targets a base yield of 16%, showing how stablecoin insurance yield can offer strong returns even when crypto markets go sideways.

The Future: Scaling Real Yield With On-Chain Reinsurance

The momentum isn’t slowing down. As more primary insurers look to tap into on-chain capital pools, and as protocols expand across multiple chains, the reach of tokenized reinsurance premiums will only grow. Expect new structured products, cross-chain integrations, and even broader access for retail investors seeking stable, blockchain insurance yield that stands apart from hype cycles.

If you’re looking to diversify your portfolio with uncorrelated returns powered by real-world cash flow, it’s time to take a hard look at on-chain reinsurance protocols. The combination of transparency, programmability, and access to a massive global risk pool could redefine what “real yield” means in crypto, and beyond.