Reinsurance is getting a major upgrade, and it’s happening on-chain. Forget the days of opaque balance sheets and months-long claims disputes. With on-chain reinsurance protocols, we’re seeing capital move with the speed of code and transparency that’s verified by cryptography, not promises. The secret sauce? Tokenized collateral and smart contracts that automate every step from capital deployment to claims payouts.

Tokenized Collateral: The Engine of Blockchain Reinsurance

Let’s break down how this works in the real world. Traditional reinsurance relies on big institutions pooling capital in ways that are hard to audit and slow to move. On-chain protocols like Re Protocol flip the script by letting anyone stake digital assets into smart contracts, which then mint yield-bearing tokens representing their share of the pool.

A great example is Re Protocol’s Insurance Capital Layer (ICL). When you deposit stablecoins like USDC, you receive either:

- reUSD: A principal-protected token with stable returns. Think of it as your low-volatility anchor.

- reUSDe: A first-loss, profit-sharing token that absorbs risk but captures higher yields, historically clocking in at 16, 25% IRR after fees.

This isn’t just some DeFi magic trick. These tokens are backed by real, staked collateral deployed into actual reinsurance treaties via legally binding agreements (like Surplus Notes). Every movement of capital is tracked on-chain, visible, auditable, and immutable.

Automation and Transparency: Smart Contracts Do the Heavy Lifting

The real game-changer here is automation. Smart contracts don’t just hold funds, they execute logic based on data feeds and pre-set rules. For instance:

- Capital deployment: Funds are allocated to specific reinsurance contracts instantly when a new treaty is signed.

- Claims processing: If a claim event occurs (say, a hurricane triggers a payout), the protocol can automatically verify it using external data oracles, then release funds without human intervention or bias.

- Compliance checks: The pool’s reserves are programmatically monitored to ensure they always meet regulatory or policy minimums (learn more about smart contract collateralization).

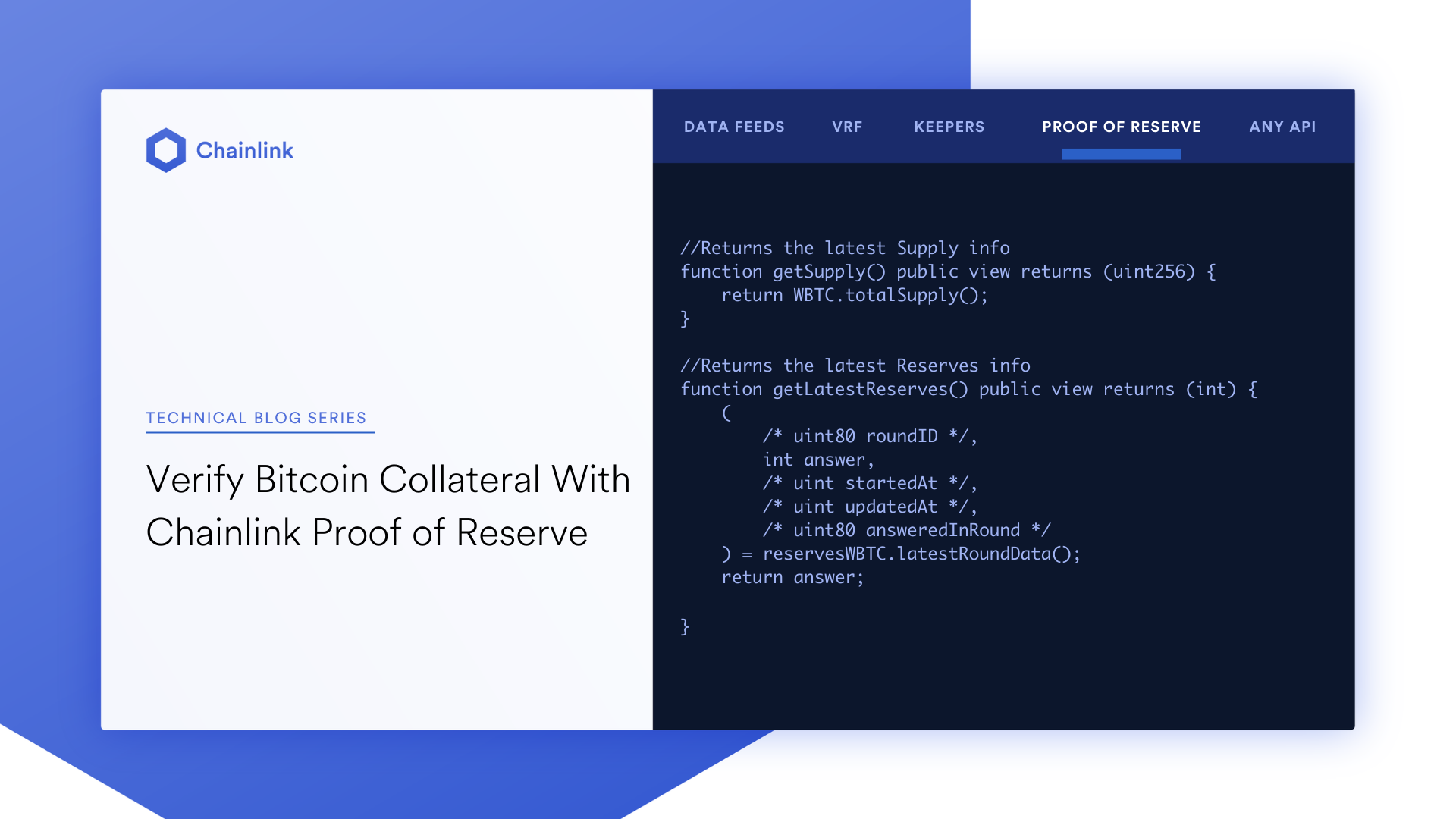

This level of transparency isn’t marketing fluff, it’s enforced by code. Platforms like Re integrate Chainlink’s Proof of Reserve so anyone can verify collateralization status in real time. That means investors don’t have to trust, they can check for themselves.

The Benefits: Accessible, Liquid, Trustless Coverage

The impact? Massive improvements for both insurers and investors:

- Bigger access: Tokenization opens up reinsurance markets to a global audience, not just big institutional players.

- Smoother liquidity: Yield-bearing tokens like reUSD can be traded or used as DeFi collateral for other strategies, no more locked-up capital for years at a time.

- Total transparency: Every dollar staked, every premium paid, every claim settled, all recorded on an open ledger for anyone to audit at any time (see how real-time transparency works here).

- No more paperwork bottlenecks: Automation slashes admin overhead and accelerates everything from onboarding to payouts.

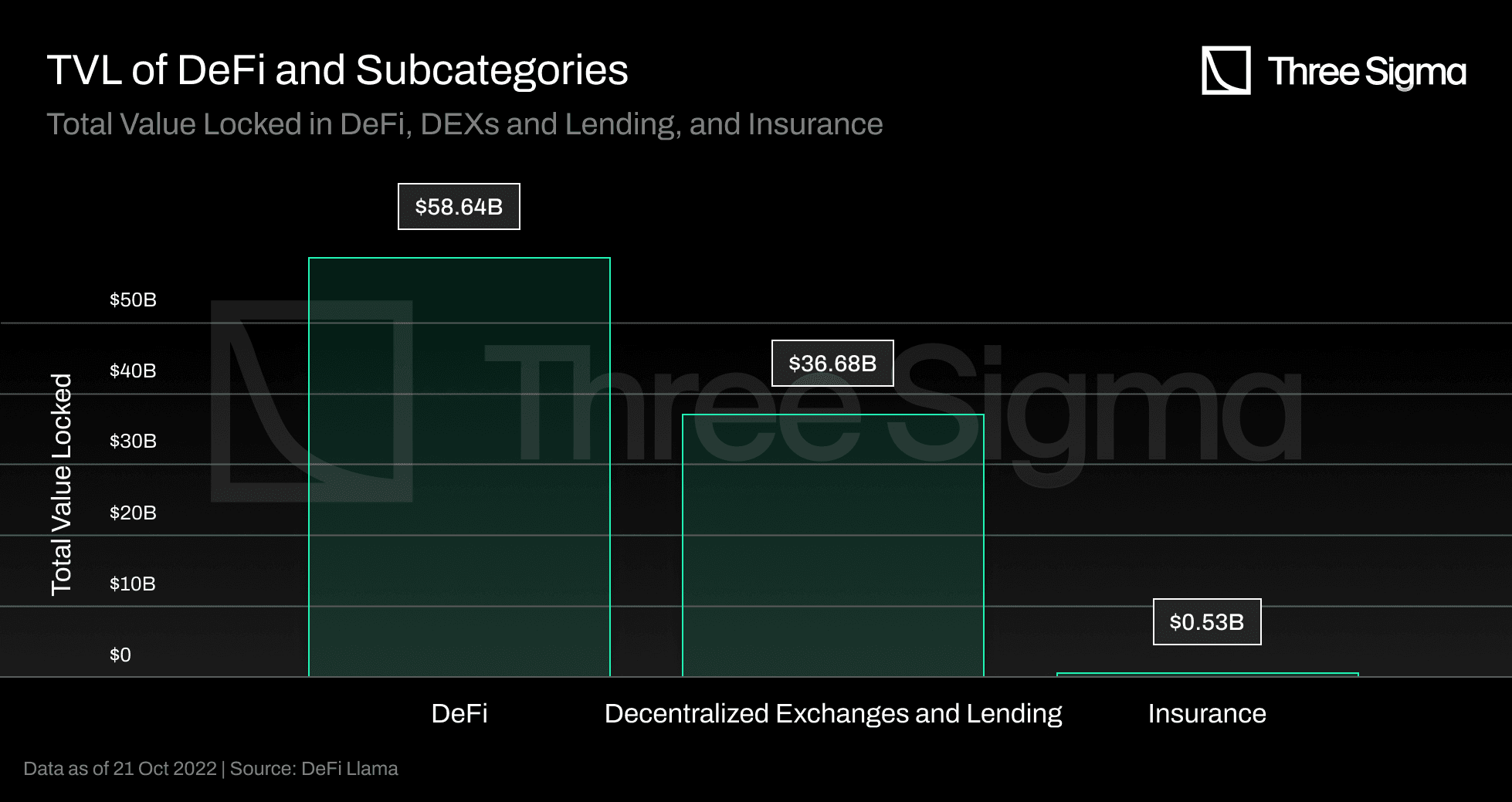

This shift isn’t hypothetical, it’s live today with protocols like Re and Nayms channeling billions in crypto-native capital into real-world insurance risk. And as regulation catches up with technology, expect even broader adoption across both traditional insurers and DeFi-native players.

We’re now seeing the emergence of a new breed of reinsurance coverage, one that’s liquid, composable, and open to anyone with digital capital. Instead of being locked into multi-year, illiquid contracts, investors can move in and out of positions as market conditions change. Want to rebalance your portfolio or chase yield elsewhere? Just trade your reUSD or reUSDe tokens on secondary markets or use them as collateral across DeFi protocols. This flexibility is a game-changer for active capital allocators.

Automated Claims Processing Steps in On-Chain Reinsurance

-

1. Claim Submission via Smart ContractPolicyholders initiate a claim directly on-chain, submitting required details to a smart contract—no paperwork or intermediaries needed.

-

2. Real-Time Data VerificationThe protocol leverages oracles like Chainlink Proof of Reserve to verify off-chain data (e.g., event occurrence, collateral status), ensuring claim conditions are met.

-

3. Automated Claim AssessmentSmart contracts automatically assess the claim by checking policy terms and real-time data, eliminating manual reviews and speeding up decisions.

-

4. Instant Payout ExecutionIf approved, the smart contract triggers an immediate payout from the tokenized collateral pool (such as reUSD or reUSDe), sending funds directly to the claimant’s wallet.

-

5. On-Chain Audit Trail CreationEvery step—submission, verification, assessment, and payout—is recorded on the blockchain, creating a transparent, auditable trail for all participants.

Let’s talk about risk management. The transparency of tokenized collateral means that both insurers and investors can continually verify reserve adequacy and exposure levels. Protocols like Re don’t just publish quarterly reports, they offer live dashboards powered by blockchain data feeds. This real-time oversight reduces the risk of under-collateralization and helps prevent the kind of hidden leverage that’s sunk traditional players in the past. Curious about how these vaults back real insurance risk? Dive deeper here.

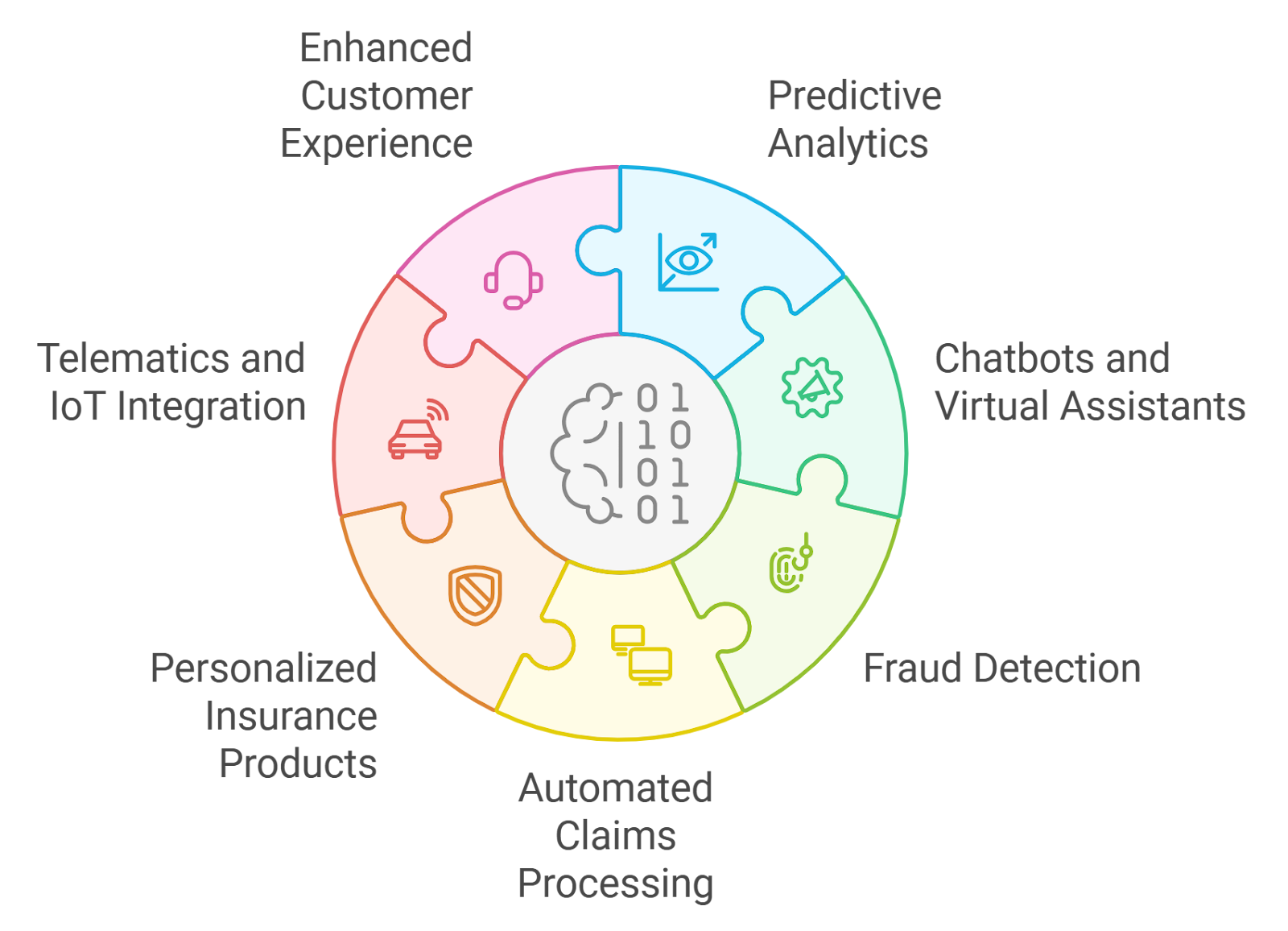

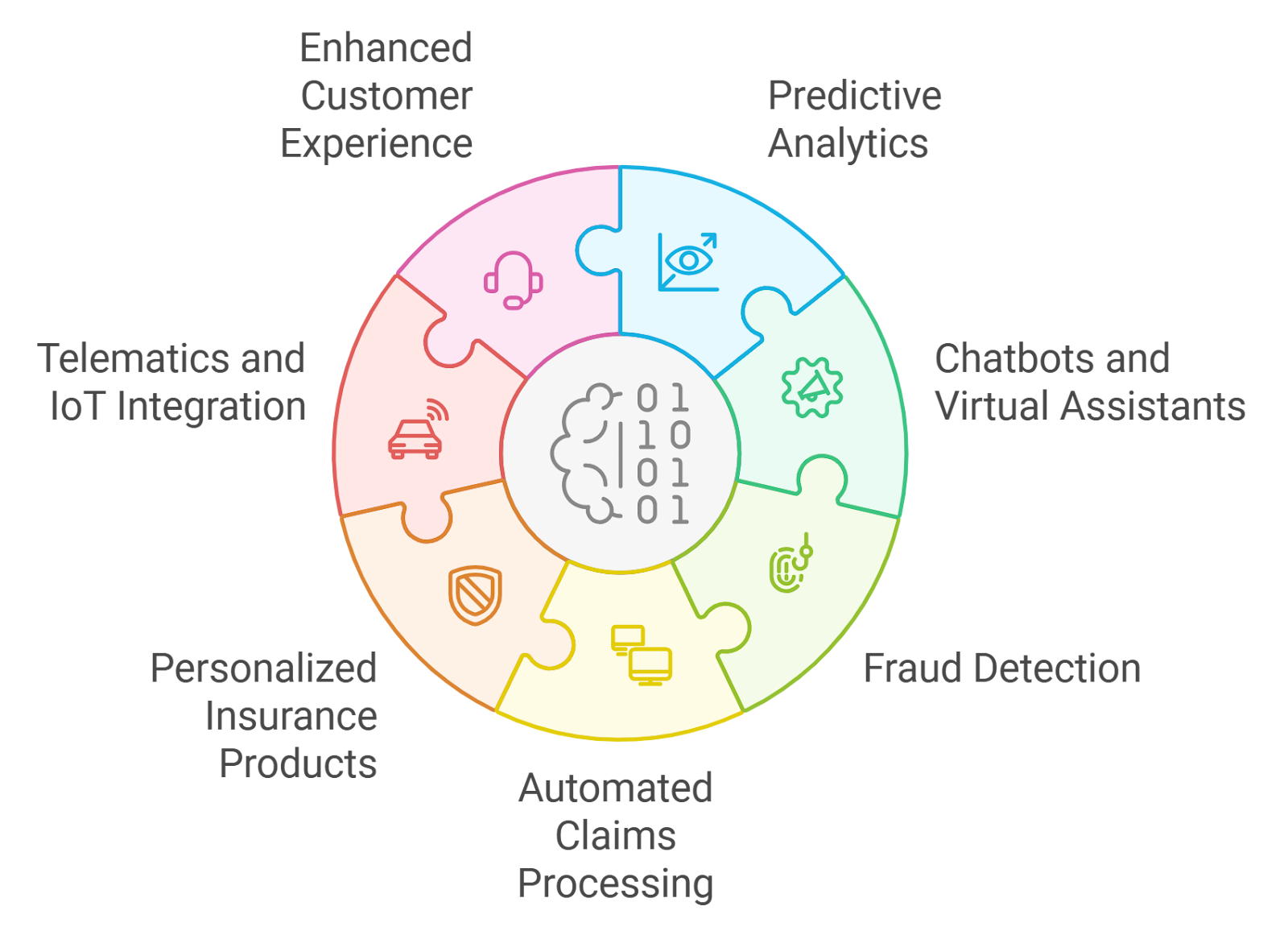

Even more compelling is how smart contracts enable programmable risk tranching. Investors can choose between senior (safer, lower yield) and junior (riskier, higher yield) tokens based on their appetite. This kind of granular risk selection was nearly impossible in legacy reinsurance but is frictionless on-chain, just pick your tranche and let the protocol handle allocations automatically.

What’s Next? The Road Ahead for On-Chain Reinsurance

The early results are promising: protocols like Re have already delivered double-digit net IRRs to first-loss token holders while maintaining full collateralization verified by independent oracles. As more insurers recognize the cost savings and efficiency gains, expect a surge in adoption, and a growing menu of tokenized insurance products covering everything from natural disasters to cyber risk.

Of course, this isn’t without hurdles. Regulatory frameworks are still evolving to catch up with crypto-native models, and robust governance remains critical to prevent exploits or misaligned incentives. But the momentum is undeniable: as capital continues to migrate on-chain, insurance itself becomes more accessible, auditable, and aligned with investor interests than ever before.

If you’re an insurer looking for efficient capital or an investor hunting for real-world yield with blockchain-level transparency, on-chain reinsurance protocols represent one of the most exciting frontiers in both DeFi and traditional finance. The old guard may not like it, but for everyone else, volatility is finally becoming opportunity.