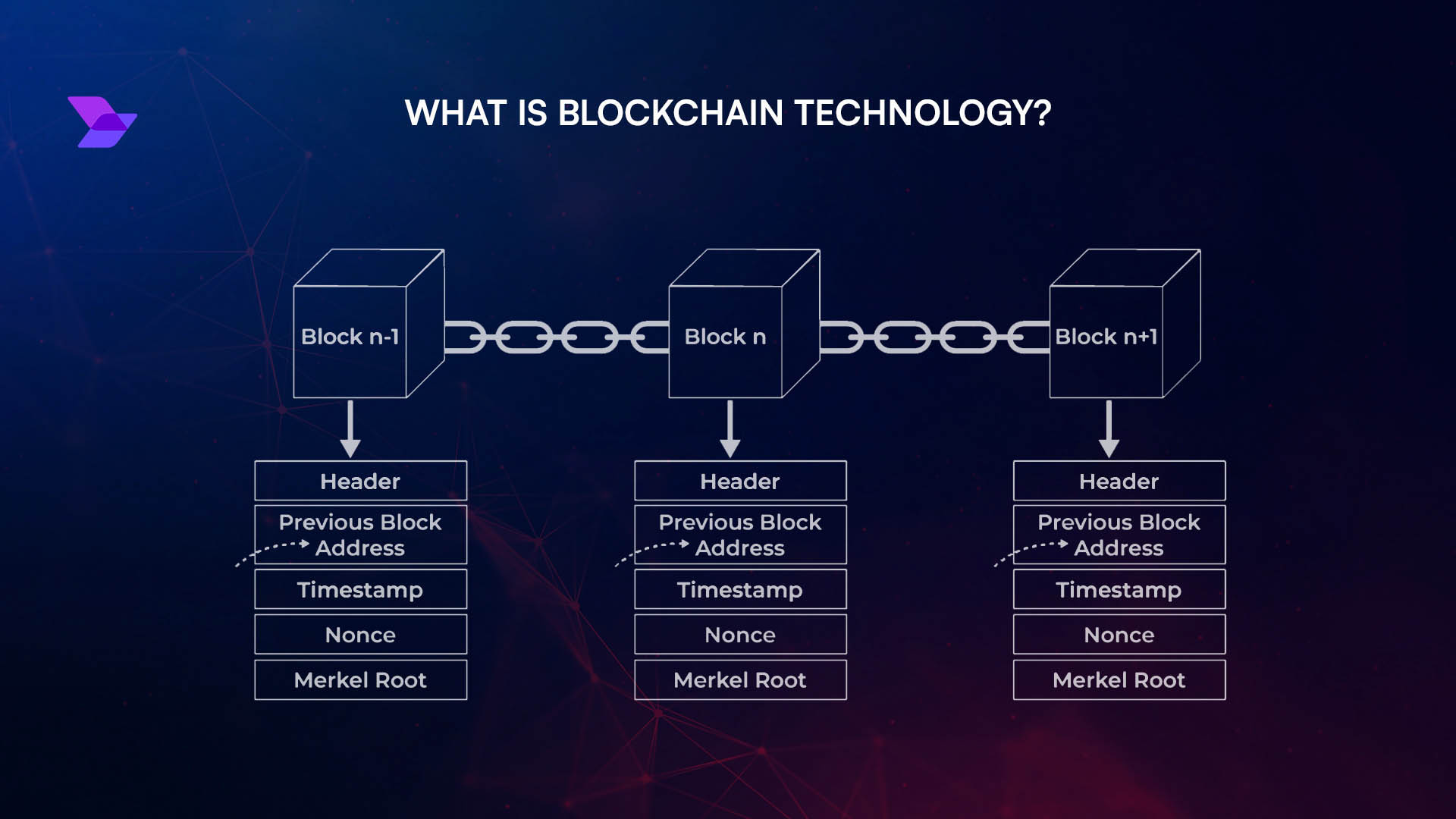

Tokenized reinsurance pools are emerging as a transformative force at the intersection of decentralized finance (DeFi) and institutional insurance markets. By leveraging blockchain technology, these pools offer investors direct access to real-world insurance risk and yield, previously locked behind regulatory and capital barriers. The result: on-chain reinsurance yield that is both transparent and uncorrelated to mainstream financial assets.

How Tokenized Reinsurance Pools Generate Real Yield

The core innovation of tokenized reinsurance pools lies in their ability to convert insurance risk into digital assets. These blockchain-based tokens represent fractional ownership in reinsurance contracts, allowing investors to earn a share of premiums paid by primary insurers for risk coverage. Unlike traditional DeFi yield products that often rely on speculative trading or leverage, the yield here is driven by real-world economic activity: the transfer and management of insurable risks.

- Reinsurance Premiums: Investors receive a portion of premiums from insurers seeking risk transfer, providing a stable income stream tied to genuine insurance demand.

- Collateral Asset Yield: The capital backing these contracts is typically held in stablecoins or other yield-bearing instruments, stacking additional returns on top of insurance performance.

- Token Incentives: Many protocols layer in extra rewards for liquidity providers, further boosting effective yields for participants.

Pioneering Examples: ONyc, EtaCat Re, and ZetaCat Re

The rapid evolution of tokenized reinsurance is best illustrated by recent launches across major blockchains. OnRe’s ONyc token, introduced in July 2025 on Solana, offers fractional ownership in a regulated reinsurance pool. This product targets a base yield above 16%, combining performance from underlying reinsurance contracts with returns generated by actively managed stablecoin collateral (source). Meanwhile, Oxbridge Re’s SurancePlus subsidiary has rolled out blockchain-powered securities like EtaCat Re and ZetaCat Re, targeting yields of 20% and 42% respectively, returns historically reserved for institutional portfolios (source).

Key Differences: ONyc, EtaCat Re, and ZetaCat Re Tokens

-

ONyc (OnRe): Solana-based token representing fractional ownership in a regulated reinsurance pool. ONyc targets a base yield exceeding 16%, generated through both reinsurance performance and yield from stablecoin collateral. The pool is regulated by the Bermuda Monetary Authority, enhancing investor protection and transparency.

-

EtaCat Re (Oxbridge SurancePlus): Tokenized reinsurance security launched by Oxbridge Re’s SurancePlus subsidiary. EtaCat Re offers exposure to real-world reinsurance contracts with a target return of 20%. The product is built to democratize access to reinsurance yields, traditionally reserved for institutional investors.

-

ZetaCat Re (Oxbridge SurancePlus): Another tokenized reinsurance offering from Oxbridge Re’s SurancePlus. ZetaCat Re distinguishes itself with a target return of 42%, reflecting a higher risk-reward profile compared to EtaCat Re and ONyc. It provides direct blockchain-based participation in reinsurance markets.

This shift isn’t just about higher yields; it’s about new forms of capital efficiency. For example, OnRe’s model allows users to deposit sUSDe stablecoins into its pool, turning idle digital dollars into productive collateral that supports regulated insurance transactions (source). Secondary market trading provides liquidity options never before seen in traditional reinsurance structures.

Comparing Token Models: reUSD vs. reUSDe

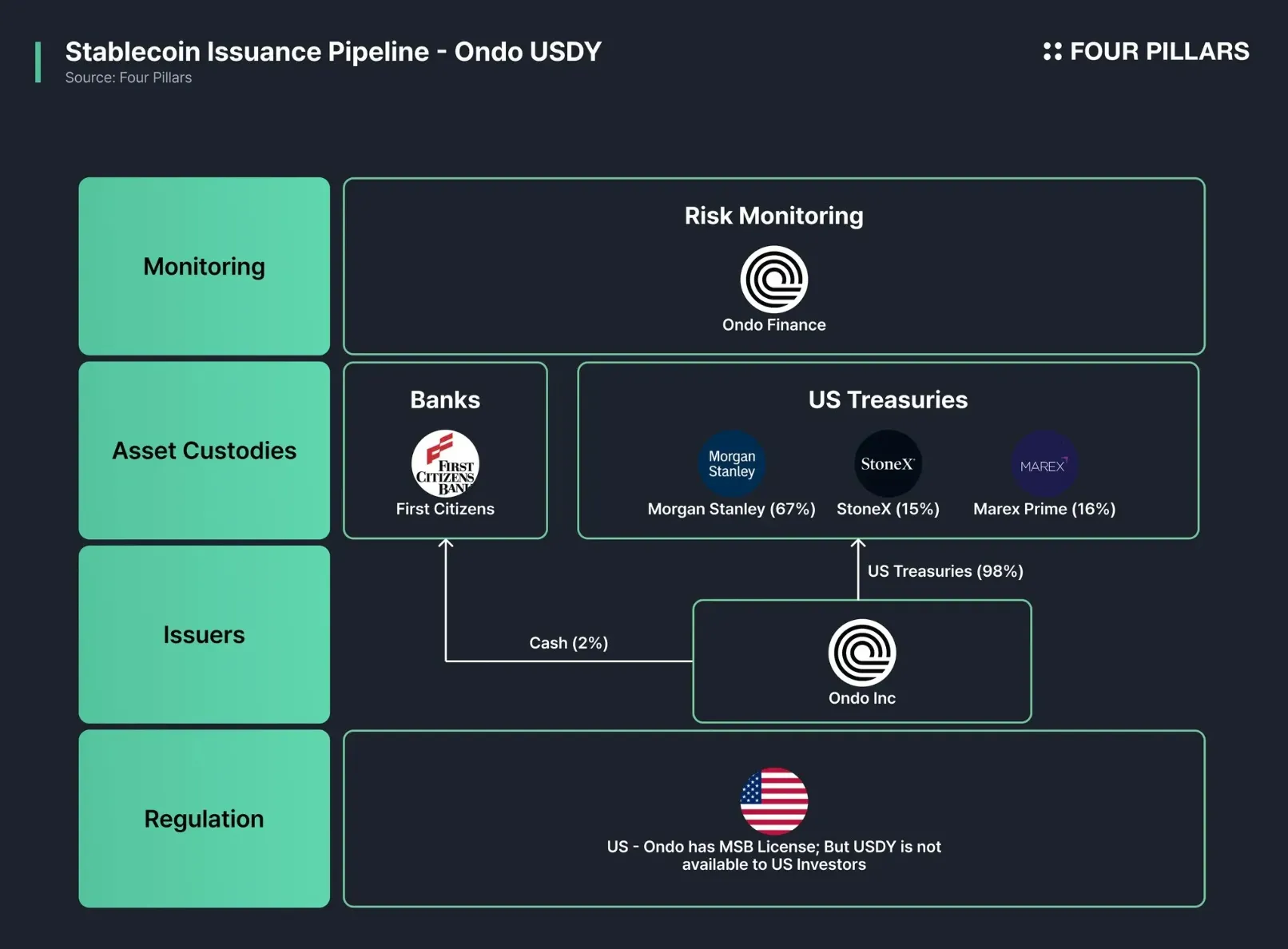

A nuanced understanding of token design is essential for any investor exploring this space. Projects like Re Protocol have introduced dual-token systems, most notably reUSD and reUSDe. While both deliver on-chain yield exposure, they achieve this through different mechanisms:

- reUSD: Backed by Treasury bills and Ethereum strategies, essentially mirroring principal-protected RWA (real world asset) models common across DeFi.

- reUSDe: Collateralized directly by U. S. insurance lines, tying its returns to actual premium flows from regulated insurance businesses (source). Both require KYC/AML compliance for participation.

This dual-token approach enables investors to fine-tune their exposure between low-volatility RWA-backed strategies (reUSD) and higher-yielding but more complex insurance premium streams (reUSDe). In both cases, the key differentiator is uncorrelated real-world asset yield, a rare commodity in today’s crypto market cycles.

As institutional adoption accelerates, the regulatory landscape is also evolving. Platforms like OnRe now operate under rigorous oversight, holding a Class F license from the Bermuda Monetary Authority and complying with both the Digital Asset Business Act 2018 and the Insurance Act 1978 (source). This level of compliance is critical for attracting sophisticated capital and ensuring that tokenized reinsurance pools are not just innovative, but also resilient to systemic shocks.

For investors, this means that real-world insurance risk – once opaque and illiquid – can now be accessed with unprecedented transparency. Blockchain’s immutable ledger enables ongoing verification of premium flows, collateral positions, and loss events. Automated smart contracts handle claims payouts and capital allocation, reducing administrative overhead while minimizing counterparty risk.

What Investors Should Watch: Key Considerations for Tokenized Reinsurance Pools

While tokenized reinsurance pools unlock compelling new opportunities for portfolio diversification and yield generation, a strategic approach is essential. Here are several critical factors to weigh before allocating capital:

Key Due Diligence Questions for Tokenized Reinsurance Pools

-

What is the regulatory status of the platform? Confirm if the platform is licensed and regulated by recognized authorities (e.g., OnRe is authorized by the Bermuda Monetary Authority with Class F and Class IIGB licenses). Regulatory oversight is crucial for investor protection and legal compliance.

-

How are reinsurance contracts structured and collateralized? Investigate the underlying reinsurance agreements, including how premiums are collected, risk is transferred, and what assets back the token (e.g., stablecoins or U.S. insurance lines as with reUSDe).

-

What are the sources and sustainability of yield? Assess whether yields are derived from real insurance premiums, collateral asset returns, or token incentives. For instance, ONyc targets a base yield of 16% from reinsurance performance and collateral yields, while ONe offers up to 40.35% with incentives.

-

What is the risk profile of the underlying reinsurance exposure? Review the types of risks being underwritten (e.g., natural disasters, specialty insurance) and the historical loss ratios. High-yield offerings like Oxbridge Re’s ZetaCat Re (targeting 42% returns) may come with elevated risk.

-

How transparent and secure is the platform? Check for real-time reporting on capital positions, premiums, and claims via blockchain. Evaluate the platform’s smart contract audits and security practices to safeguard digital assets.

-

What are the liquidity options and secondary market support? Determine if tokens can be traded on reputable secondary markets and the presence of sufficient liquidity, as tokenization should facilitate easier entry and exit compared to traditional reinsurance investments.

-

Are there clear disclosures on fees, lock-up periods, and redemption terms? Review all documentation for information on management fees, performance fees, minimum holding periods, and redemption processes to avoid unexpected costs or restrictions.

- Platform Security: Assess the robustness of smart contract audits, custody solutions, and operational track records.

- Risk Concentration: Understand how diversified each pool’s underlying insurance exposures are – catastrophe-heavy portfolios may carry event-driven volatility.

- Liquidity Provisions: Review how secondary trading works and what exit mechanisms exist in volatile or loss-heavy scenarios.

- KYC/AML Compliance: Confirm regulatory status to ensure legal participation, especially if targeting institutional-scale allocations.

The next wave of innovation is likely to feature even more granular risk tranching, dynamic pricing based on real-time data feeds, and cross-chain interoperability for global capital access. As DeFi continues its march into traditional finance territory, expect more hybrid models blending blockchain-native incentives with time-tested actuarial science.

The bottom line: tokenized reinsurance pools represent a paradigm shift in both insurance investment and DeFi market structure. By converting stablecoins or other digital assets into productive capital within regulated insurance frameworks, these protocols offer access to real yield that is not only transparent but also fundamentally uncorrelated with mainstream crypto cycles. For those seeking sustainable returns in an increasingly volatile macro environment, on-chain reinsurance yield stands out as one of the most promising frontiers in today’s digital asset landscape.