Tokenized reinsurance pools are rapidly becoming a cornerstone of the Real-World Asset (RWA) movement within decentralized finance. For crypto investors seeking yield, diversification, and exposure to non-correlated markets, these pools represent a compelling new frontier. By leveraging blockchain technology, on-chain reinsurance transforms traditional risk transfer into a digital asset class, opening doors that were previously locked for all but the largest institutional players.

What Are Tokenized Reinsurance Pools?

At their core, tokenized reinsurance pools are blockchain-based representations of reinsurance contracts. Instead of requiring millions in capital and complex legal agreements to access this market, investors can now purchase tokens that represent fractional ownership in a pool of reinsurance risks. Each token corresponds to a share of the premiums collected and claims paid by the pool.

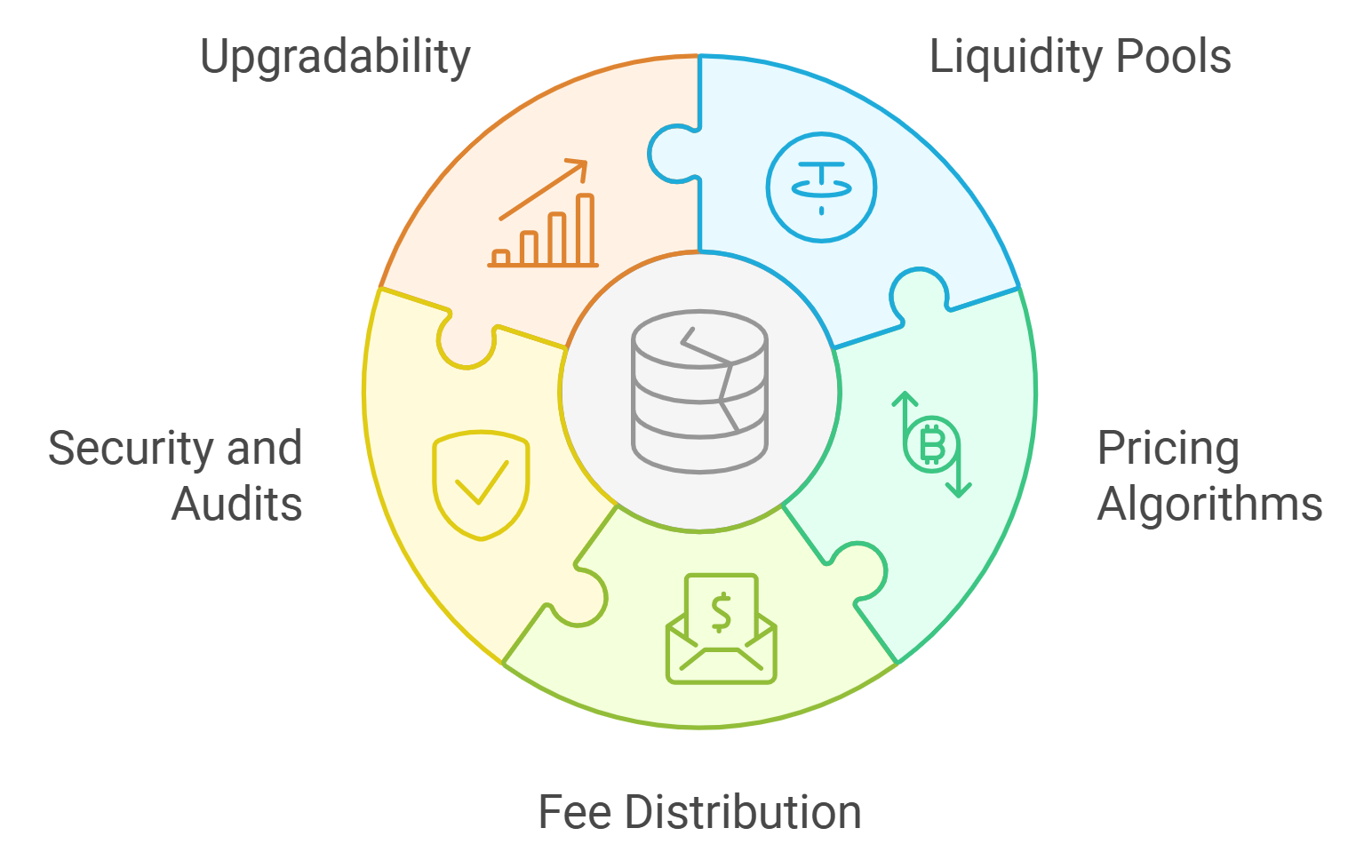

This model introduces several key innovations:

Top Advantages of Tokenized Reinsurance Pools

-

Enhanced Liquidity & Accessibility: Tokenizing reinsurance contracts makes them tradable on blockchain platforms, allowing investors to easily buy or sell positions—unlike traditional, illiquid reinsurance investments. Learn more

-

Operational Efficiency & Transparency: Smart contracts automate premium collection and claims processing, reducing administrative overhead and minimizing errors. Blockchain’s immutable ledger ensures real-time, auditable transactions. Explore operational benefits

-

Diversification & Stable Yield: Tokenized reinsurance pools offer exposure to uncorrelated insurance risk, providing potential for stable returns even during broader market volatility. See diversification insights

-

Democratized Access: Fractional ownership enables a wider range of investors to participate in reinsurance pools, breaking down barriers that once limited access to institutional players. Read about democratization

-

Integration with DeFi Ecosystems: Tokenized reinsurance assets can be used in DeFi applications—as collateral for loans or in yield farming—unlocking new financial products and strategies. Discover DeFi integration

-

Supportive Regulatory Frameworks: Jurisdictions like Bermuda and the Cayman Islands have introduced regulations for digital asset-backed reinsurance, allowing innovative collateral forms such as stablecoins. Review regulatory updates

-

Growing Market Adoption: Platforms like Re and OnRe are launching tokenized reinsurance funds on major blockchains, attracting significant investor interest and validating the sector’s momentum. Find out about market developments

As platforms like Etherisc and OnRe demonstrate, holding these tokens is akin to running your own part-time reinsurer, without the overhead or regulatory friction associated with legacy structures. Investors gain exposure to insurance-linked returns while maintaining liquidity and transparency through on-chain assets.

How Blockchain Powers On-Chain Reinsurance

The engine behind tokenized reinsurance is blockchain’s ability to create trustless, transparent systems for managing real-world risk. Smart contracts automate critical functions such as premium collection, claims validation, and payout distribution. This automation reduces administrative costs and minimizes human error, two chronic pain points in traditional insurance operations.

Transparency is another game changer. Every transaction, whether it’s premium inflow, claim approval, or investor payout, is recorded immutably on-chain. This means investors can audit performance in real time rather than relying on opaque quarterly reports or third-party audits.

This operational efficiency also enables new financial products. For example, some protocols let users deposit stablecoins like sUSDe into reinsurance pools on networks such as Solana (Insurance Business America). These innovations bridge traditional insurance with DeFi infrastructure and unlock creative yield opportunities.

Diversification and Yield: The Crypto Investor’s Perspective

The promise of crypto insurance yield is drawing both seasoned reinsurers and digital asset investors into this space. Historically, reinsurance returns have been largely uncorrelated with equity or crypto markets, a rare source of stability in volatile cycles. By accessing these yields via tokenization, investors can build more resilient portfolios without sacrificing liquidity.

- Diversification: Exposure to insurance risk helps offset drawdowns from other asset classes.

- Stable Yields: Premiums collected by the pool provide consistent returns even during market turbulence.

- Fractional Ownership: Tokenization allows participation at any scale, not just for institutions but for qualified retail investors as well (Beinsure).

- DeFi Integration: Tokens can be used as collateral or staked across DeFi protocols for additional yield streams (Dzilla).

The democratization effect here cannot be overstated: fractionalization breaks down barriers that kept retail capital out of high-yield insurance-linked securities until now. As regulatory frameworks mature in hubs like Bermuda and the Cayman Islands (RockawayX), expect more compliant products, and more competition, for investor capital within this space.

But the opportunity comes with new considerations. While tokenized reinsurance pools offer an accessible entry point, investors must understand the unique characteristics of these assets. Unlike typical DeFi tokens, risk pool tokens are backed by real-world insurance contracts, which means their performance hinges on the underlying claims experience and operational integrity of the pool. Smart contract audits, risk transparency, and regulatory oversight are essential for investor protection.

Risk Management and Due Diligence

Participating in on-chain reinsurance is not a passive endeavor. Crypto investors should evaluate:

Due Diligence Checklist for Tokenized Reinsurance Pools

-

Verify Regulatory Compliance and Jurisdiction: Ensure the pool operates within established regulatory frameworks, such as those in Bermuda or the Cayman Islands, which have adopted digital asset-backed reinsurance regulations.

-

Assess Smart Contract Security and Audits: Review whether the platform’s smart contracts have undergone reputable third-party audits and if audit reports are publicly available for scrutiny.

-

Examine Underlying Reinsurance Contracts: Confirm that funds are invested in genuine reinsurance contracts, ideally held in secure accounts such as a US Bank Trust account as practiced by platforms like SurancePlus.

-

Evaluate Transparency and On-Chain Data: Check if the pool provides real-time, immutable transaction data and clear reporting on premium collection, claims, and payouts on-chain.

-

Understand Token Mechanics and Liquidity: Analyze the structure of risk pool tokens (e.g., Etherisc’s risk pool tokens), their tradability on secondary markets, and any mechanisms for redemption or exit.

-

Review Collateralization and Custody: Investigate how collateral is managed—whether stablecoins or tokenized money-market instruments are used, and which custodians or trust structures are in place.

-

Analyze Historical Performance and Yield: Request historical data on pool returns, loss ratios, and how yields compare to traditional reinsurance or other RWA investments.

-

Identify Platform Reputation and Partnerships: Look for established platforms like Re or OnRe Finance that have attracted significant investment or partnered with recognized DeFi protocols (e.g., Ethena).

-

Assess Integration with DeFi Ecosystems: Determine if the pool’s tokens can be used in DeFi applications for lending, staking, or yield farming, expanding utility and potential returns.

-

Understand Investor Rights and Risk Disclosure: Ensure the platform provides clear documentation on investor rights, risk factors, and procedures in the event of claim events or pool insolvency.

Platforms like Etherisc and Re have made strides in publishing real-time data feeds and third-party risk assessments to help investors monitor performance. However, as with all innovations bridging traditional finance and crypto, counterparty risk remains. The underlying smart contracts must be robust, and custody arrangements for funds (such as US Bank Trust accounts) should be clearly disclosed.

Emerging Market Structures and Regulatory Shifts

The regulatory landscape is evolving rapidly to accommodate blockchain risk management. Jurisdictions such as Bermuda have created frameworks that allow tokenized reinsurers to hold collateral in stablecoins or tokenized money-market instruments (RockawayX). This flexibility enables more efficient capital deployment while maintaining compliance with solvency standards.

Recent launches, like OnRe’s partnership with Ethena to accept sUSDe deposits on Solana, demonstrate how swiftly this market is expanding (Insurance Business America). These developments are attracting both crypto-native funds seeking yield and traditional insurers eager to diversify their capital stack.

Savvy investors recognize that tokenized reinsurance is not just a new asset class, it’s a structural shift in how insurance capital is sourced, managed, and rewarded.

What’s Next for Reinsurance in DeFi?

The convergence of RWAs with DeFi protocols hints at even broader applications: from crypto CAT bonds that pay out after natural disasters to algorithmic pricing models that respond dynamically to on-chain data. As liquidity deepens and more sophisticated products emerge, expect competition between platforms offering different flavors of reinsurance exposure, some focused on short-tail risks like weather events, others targeting long-tail liabilities.

If you’re considering allocation, start by tracking live market activity on established platforms. Engage with community governance where possible, many protocols allow token holders to vote on underwriting criteria or capital deployment strategies. This active participation can sharpen your understanding of both upside potential and embedded risks.

The future is collaborative: As institutional adoption grows alongside retail participation, we’re likely to see hybrid models where traditional reinsurers co-invest alongside DAOs or DeFi treasuries. The result will be more resilient risk pools, and a deeper integration between legacy insurance markets and blockchain-based finance.