For decades, the reinsurance industry has been an exclusive club, accessible only to large institutions with deep pockets and a high tolerance for regulatory complexity. Now, blockchain tokenization is rapidly dismantling these barriers, unlocking new opportunities for both investors and insurers. By converting reinsurance contracts into digital tokens on-chain, protocols like Re and Nayms are transforming a traditionally opaque, illiquid market into one defined by transparency, efficiency, and broad participation.

Fractionalization: Lowering the Bar for Reinsurance Investment

Historically, reinsurance deals demanded multi-million dollar commitments and came with significant due diligence costs. The result: only a handful of institutional players could participate, leaving vast pools of capital on the sidelines. Tokenized reinsurance flips this paradigm by enabling fractional ownership. Instead of investing millions, qualified investors can now buy small fractions of reinsurance exposure as blockchain tokens. These tokens are tradable on secondary markets, unlocking liquidity and lowering the minimum entry for participation.

Consider the case of Oxbridge Re Holdings Limited’s SurancePlus, which recently launched tokenized reinsurance securities offering access to reinsurance-linked investments with estimated annualized returns between 20% and 40%. This is a seismic shift: investors who previously had no path into this asset class can now diversify their portfolios with blockchain insurance capital and enjoy returns uncorrelated with traditional crypto or equity markets.

Smart Contracts: Streamlining Operations for Insurers

On the insurer side, blockchain tokenization is more than just a capital-raising tool, it’s a force multiplier for operational efficiency. By leveraging smart contracts, platforms like Re Protocol and Schroders Capital automate complex processes such as deal subscription, claims adjudication, and settlement. When catastrophe data triggers a payout event, smart contracts execute payments automatically and transparently, eliminating manual intervention and reducing administrative overhead.

This automation not only accelerates settlement times but also minimizes disputes and errors, providing a trustless environment where all parties can independently verify transactions. The result is a more resilient and responsive reinsurance ecosystem, where costs are lower and capital can flow more freely to where it’s needed most.

Real-World Adoption: Protocols Leading the Charge

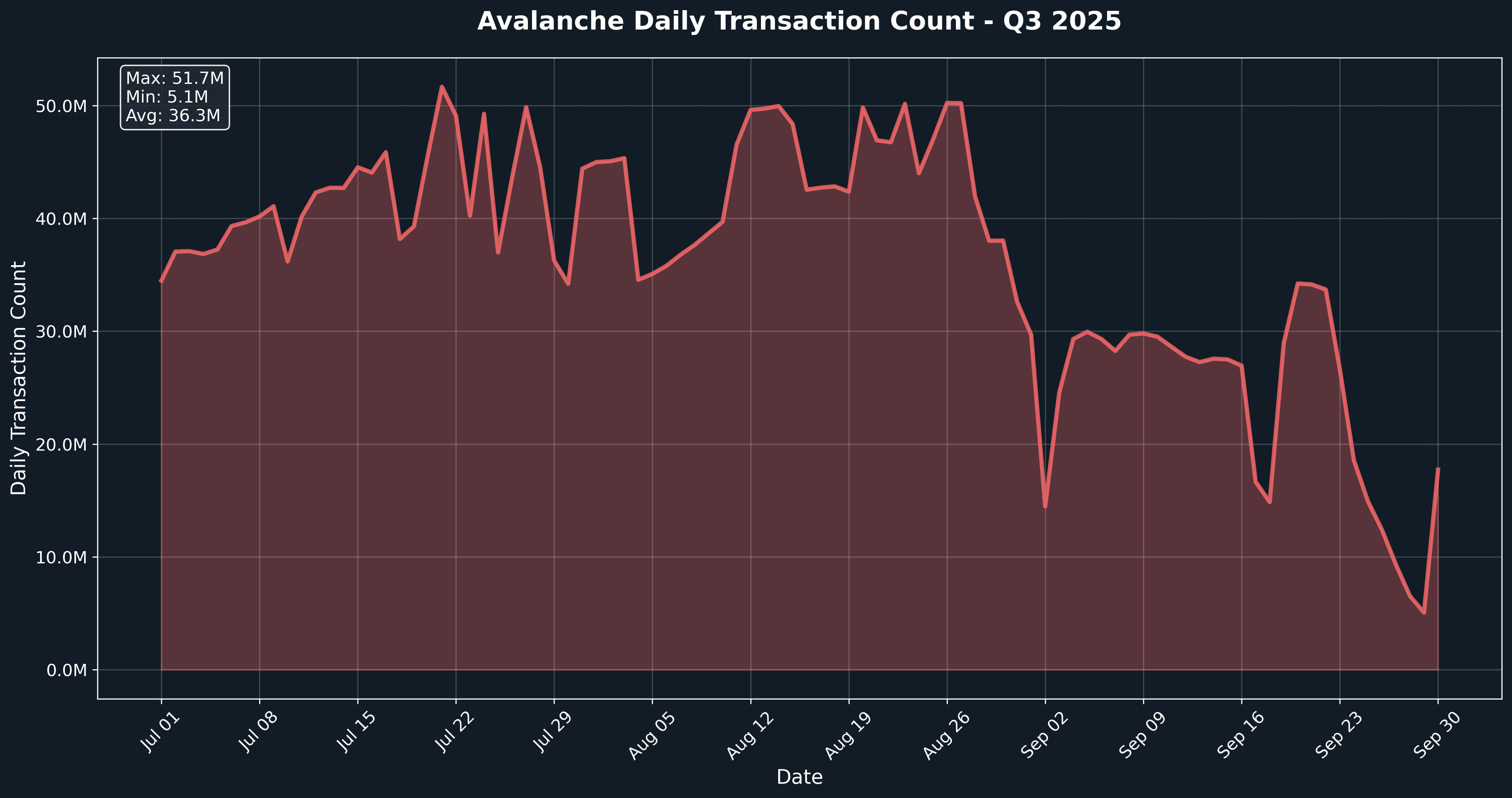

Several pioneering platforms are already demonstrating the real-world impact of on-chain reinsurance protocols. Nayms, for example, has launched its tokenized reinsurance marketplace on Ethereum’s layer-2 Base, allowing investors to access yield-generating opportunities in the form of tradable tokens. Similarly, Re has introduced an open-ended reinsurance fund on Avalanche, attracting institutional interest from entities like Nexus Mutual and raising $14 million in seed funding to build a decentralized system for investors.

3 Leading Protocols in Tokenized Reinsurance

-

Re Protocol: Re is a decentralized reinsurance platform built on Avalanche, enabling institutional and qualified investors to access fully collateralized insurance risk via blockchain-based tokens. Through products like reUSD and reUSDe, Re allows fractional investment in reinsurance contracts, with automated settlements and transparent risk pools. The protocol has attracted notable backers and integrates real-world insurance data for enhanced underwriting and claims automation.

-

Nayms: Nayms operates a tokenized reinsurance marketplace on Ethereum’s layer-2 Base network. It connects investors with yield-generating reinsurance opportunities, offering tokenized insurance-linked securities that can be traded and managed on-chain. Nayms emphasizes regulatory compliance and institutional-grade security, making reinsurance exposure accessible to a broader range of investors through digital asset infrastructure.

-

Oxbridge Re/SurancePlus: Oxbridge Re Holdings, via its SurancePlus subsidiary, has launched tokenized reinsurance securities that provide investors with fractional access to reinsurance-linked returns. These digital tokens are backed by real reinsurance contracts, offering estimated annualized returns between 20% and 40%. The platform aims to democratize reinsurance investment by lowering entry barriers and increasing transparency for non-institutional participants.

These platforms are not only increasing market efficiency but also expanding the pool of available capital. By unlocking global crypto liquidity, they are helping address the persistent capacity shortfall in traditional reinsurance, a vital step for an industry facing mounting climate risks and growing demand for coverage.

To explore further how blockchain is transforming access to the $1 trillion reinsurance market, see this in-depth guide.

Tokenization is also driving a new era of transparency in reinsurance. Every transaction, whether it’s the purchase of a fractional contract or the automatic settlement of a claim, is immutably recorded on-chain. This auditability means investors and insurers can scrutinize contract terms, collateralization status, and historical performance in real time, something that was previously impossible in the legacy system. For institutional allocators and risk managers, this level of visibility is not just a regulatory advantage but a fundamental shift in how trust is established and maintained.

Secondary market liquidity is another critical benefit. Tokenized reinsurance assets can be traded on compliant digital marketplaces, allowing investors to rebalance positions or exit before maturity, an unprecedented flexibility compared to traditional locked-up reinsurance deals. This opens new avenues for portfolio management and risk diversification, especially for crypto-native funds and institutional investors seeking non-correlated yield streams.

Risks and Considerations: What Investors Should Know

Despite these advances, tokenized reinsurance is not without its risks. Smart contract vulnerabilities, regulatory uncertainty, and the evolving nature of on-chain insurance markets all require careful due diligence. Investors should evaluate protocol security audits, counterparty risk frameworks, and the legal enforceability of digital contracts before allocating capital. Likewise, insurers must ensure that tokenized capital pools remain fully collateralized and compliant with jurisdictional requirements.

Still, the pace of innovation is accelerating. As more protocols undergo rigorous third-party audits and engage with regulators, confidence in the ecosystem continues to grow. Qualified investors are increasingly viewing tokenized reinsurance as a legitimate alternative asset class, one with the potential for double-digit returns and real-world impact on global insurance resilience.

Key Benefits and Risks of Tokenized Reinsurance Markets

-

Fractional Ownership and Broader Access: Tokenization enables investors to purchase small fractions of reinsurance contracts, lowering entry barriers and democratizing access. Platforms like Re and Nayms allow participation with significantly lower capital than traditional reinsurance deals.

-

Enhanced Liquidity Through Secondary Markets: Tokenized reinsurance assets can be traded on blockchain-powered secondary markets, offering investors greater flexibility and the potential to exit positions more easily compared to traditional reinsurance investments.

-

Increased Transparency and Automation: Blockchain technology ensures transparent transaction records and automates processes like claims and settlements via smart contracts. For example, Schroders Capital and Hannover Re demonstrated automated catastrophe insurance payouts using public blockchain infrastructure.

-

Portfolio Diversification and Attractive Returns: Reinsurance-linked tokens provide exposure to an asset class uncorrelated with traditional markets. Initiatives like Oxbridge Re Holdings’ SurancePlus offer investors estimated annualized returns between 20% and 40%.

-

Regulatory and Counterparty Risks: The evolving regulatory landscape for tokenized securities may pose compliance challenges. Investors must also consider the reliability of smart contracts and the risk of platform vulnerabilities or failures.

-

Market Volatility and Limited Historical Data: As a relatively new market, tokenized reinsurance may experience price volatility and lacks long-term performance data, making risk assessment more challenging for both investors and insurers.

Looking Ahead: A New Paradigm for Risk Capital

The democratization of reinsurance access through blockchain tokenization is more than a technological upgrade, it’s a paradigm shift in how risk capital is sourced and deployed. By lowering entry barriers, enhancing transparency, and enabling real-time settlement, on-chain protocols are setting new standards for efficiency and inclusion in an industry long overdue for disruption.

For those ready to explore the mechanics of tokenized reinsurance pools and their transparency advantages, dive deeper with this comprehensive resource. As platforms like Re Protocol and Nayms continue to mature, expect the line between traditional insurance finance and decentralized capital markets to blur, opening doors for both seasoned institutions and innovative crypto investors alike.