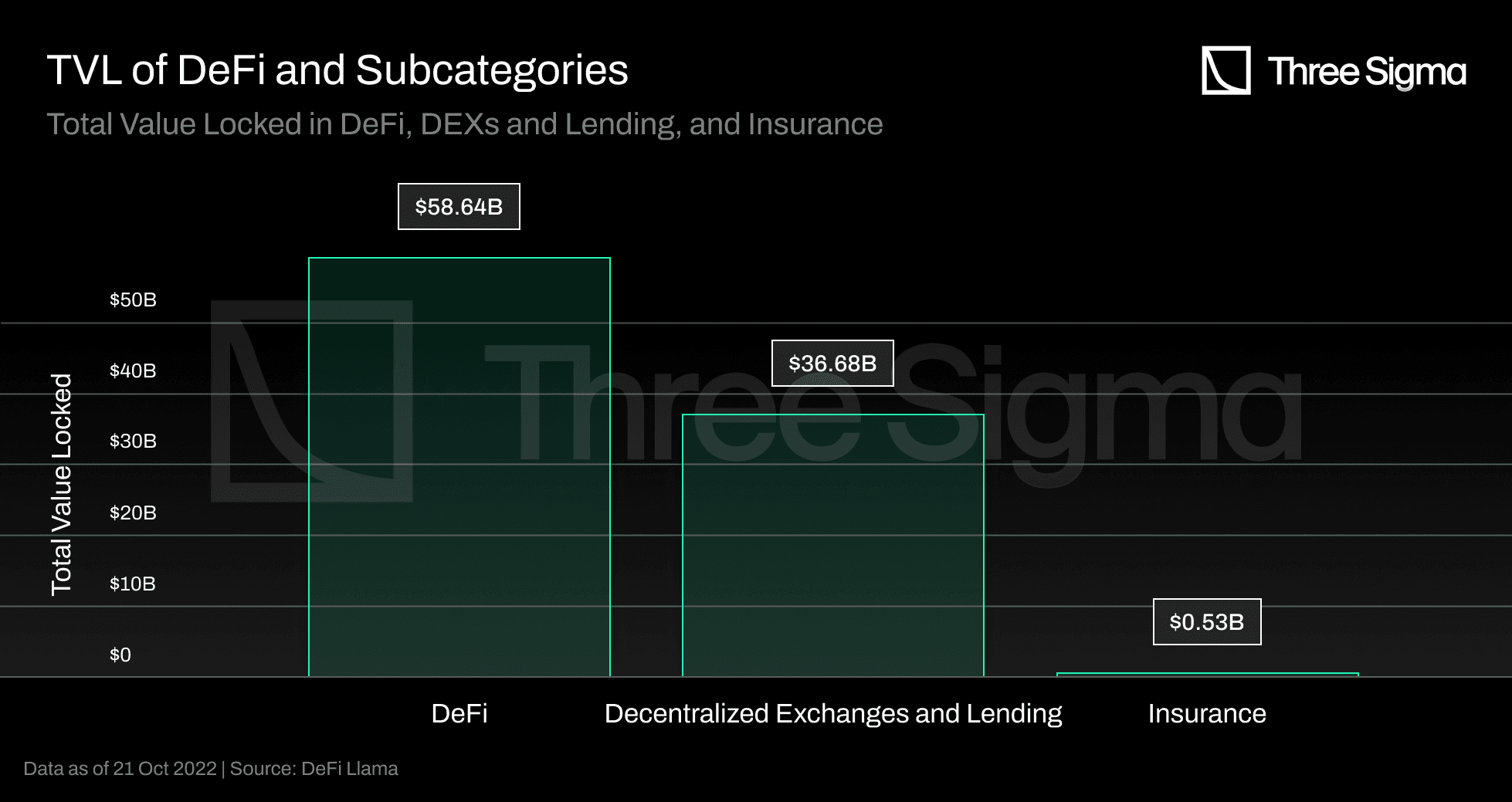

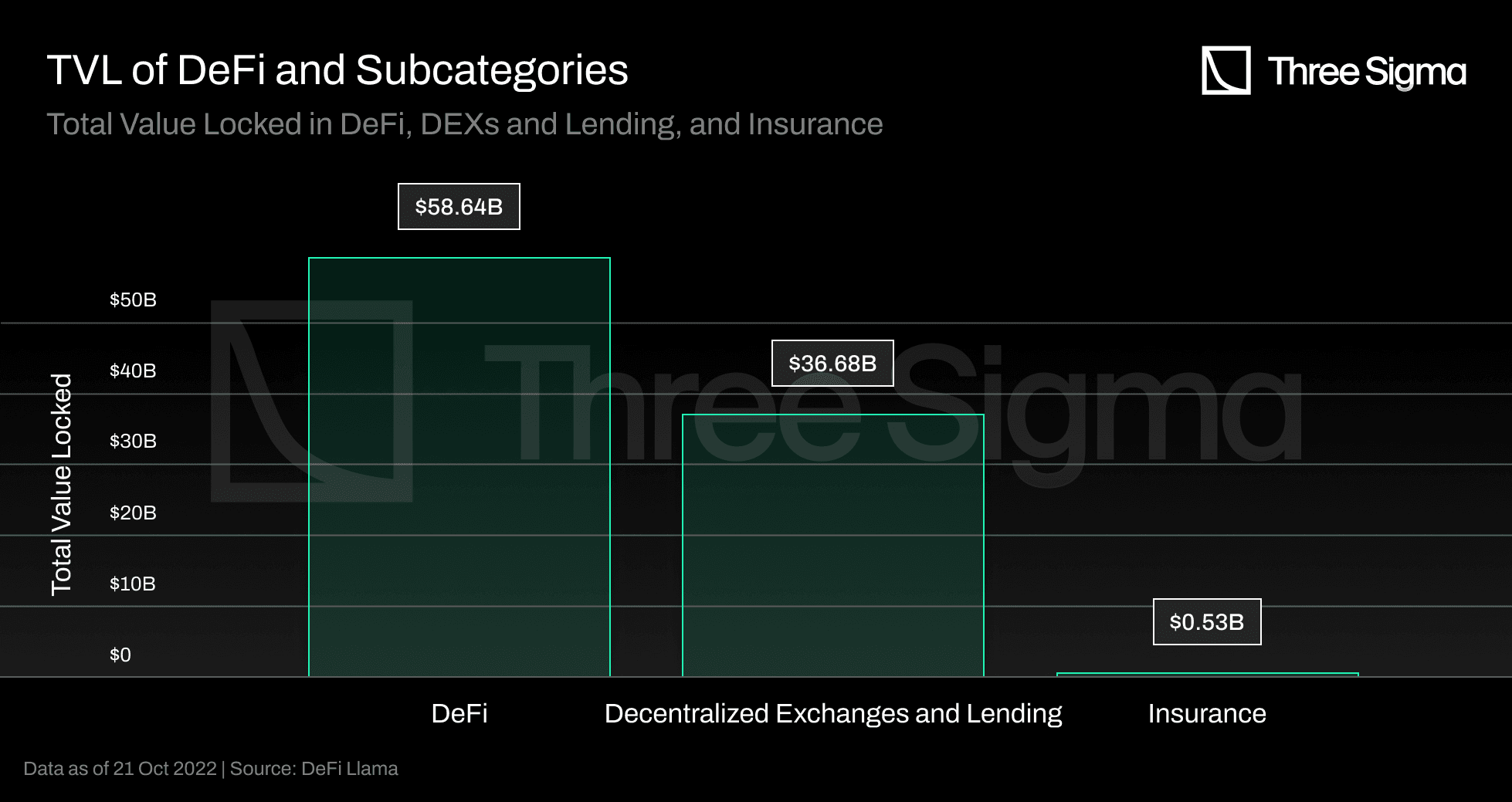

Tokenized reinsurance pools are rapidly becoming the new backbone for capital efficiency and transparency in both the insurance and DeFi sectors. By transforming traditional reinsurance contracts into blockchain-based tokens, these pools open access to real-world asset yield for crypto investors, while offering insurers a more transparent and streamlined way to manage risk.

Why Tokenize Reinsurance? The Institutional Perspective

Reinsurance is the insurance industry’s safety net. Insurers offload portions of their risk portfolios to reinsurers, protecting themselves against catastrophic losses. Traditionally, this process is opaque and capital-intensive, with limited access for outside investors. Tokenization changes the paradigm by converting these contracts into digital tokens on public blockchains.

This shift isn’t just about digitization. It’s about unlocking liquidity, enabling fractional ownership, and giving institutional investors and DeFi users a direct channel to participate in global insurance risk markets. As noted by Insurance Business America, tokenized reinsurance is already gaining ground as a core real-world asset (RWA) strategy for DeFi protocols seeking stable yield sources.

How Tokenized Reinsurance Pools Operate On-Chain

The mechanics are elegantly simple yet powerful:

How Tokenized Reinsurance Pools Operate: Step-by-Step

-

Capital Provision by Investors: DeFi investors supply capital to a tokenized reinsurance pool, often by purchasing blockchain-based tokens representing a share of the pool. This capital is used to underwrite insurance risk and is transparently recorded on-chain.

-

Tokenization and Pool Formation: The supplied capital is converted into digital tokens (such as reUSD or reUSDe on platforms like Re), which represent ownership and entitle holders to a share of the pool’s yield.

-

Underwriting and Risk Allocation: Insurers transfer specific risk portfolios into the pool. Smart contracts automate the underwriting process, allocating risk and matching it with the pool’s capital according to predefined parameters.

-

Premium Collection and Yield Generation: Policyholders pay insurance premiums into the pool. These premiums, along with investment returns, are distributed as real yield to token holders, offering stable, non-speculative returns backed by actual insurance activity.

-

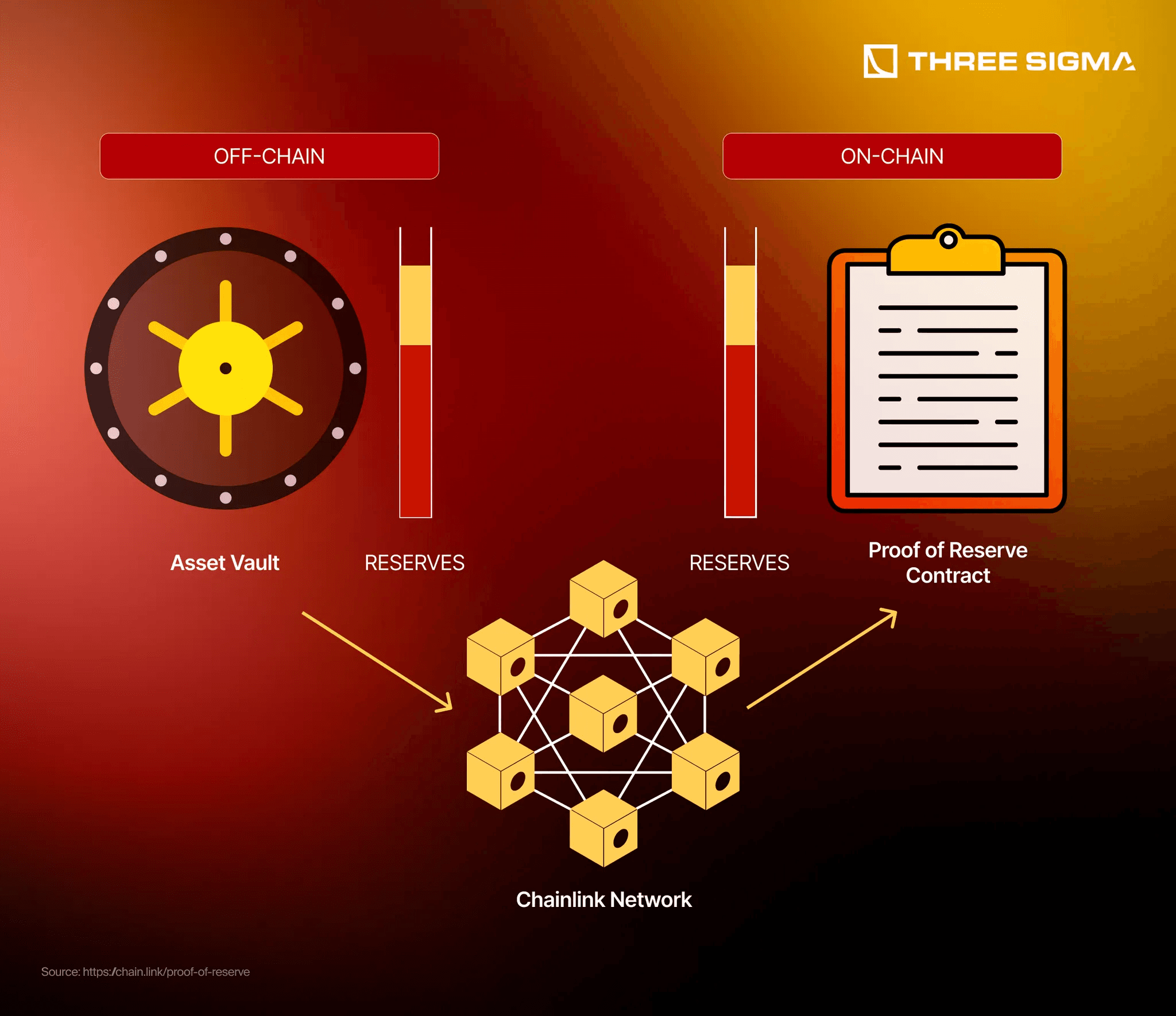

Ongoing Transparency and Performance Monitoring: All transactions, capital flows, and risk exposures are recorded on a public blockchain ledger, allowing investors and insurers to monitor pool performance and capital allocation in real-time.

-

Claims Assessment and Payout Automation: When claims are filed, smart contracts automatically assess eligibility and trigger payouts from the pool, ensuring rapid, transparent, and dispute-minimized settlements for policyholders.

At their core, tokenized reinsurance pools aggregate investor capital into smart contract-managed vaults. Insurers pay premiums into these pools in exchange for coverage against specific risks. When claims arise, payouts are executed automatically via smart contracts – no manual intervention or paperwork required.

This structure provides two key benefits:

- Real yield: Investors earn a share of collected premiums (and sometimes investment returns), generating income backed by genuine economic activity – not speculative emissions or unsustainable incentives.

- Transparency: Every transaction, premium payment, claim approval, and payout is recorded immutably on-chain. This level of auditability is unprecedented in traditional reinsurance.

The Real Yield Edge: Sustainable Income in DeFi

The most compelling feature for DeFi participants is the emergence of on-chain reinsurance yield. Unlike typical DeFi yields propped up by inflationary token rewards or leveraged speculation, returns from tokenized reinsurance pools are rooted in real-world cash flows, namely insurance premiums paid by actual businesses and individuals seeking coverage.

Platforms like Re are pioneering products such as reUSD (Basis-Plus) and reUSDe (Insurance Alpha), which allow crypto investors to deploy stablecoins into fully collateralized insurance programs. The resulting income stream comes directly from premium payments, creating a sustainable yield source that’s less correlated with broader crypto market volatility. For an in-depth guide on these mechanics, see our walkthrough at How Tokenized Reinsurance Pools Work: A Guide for Crypto Investors.

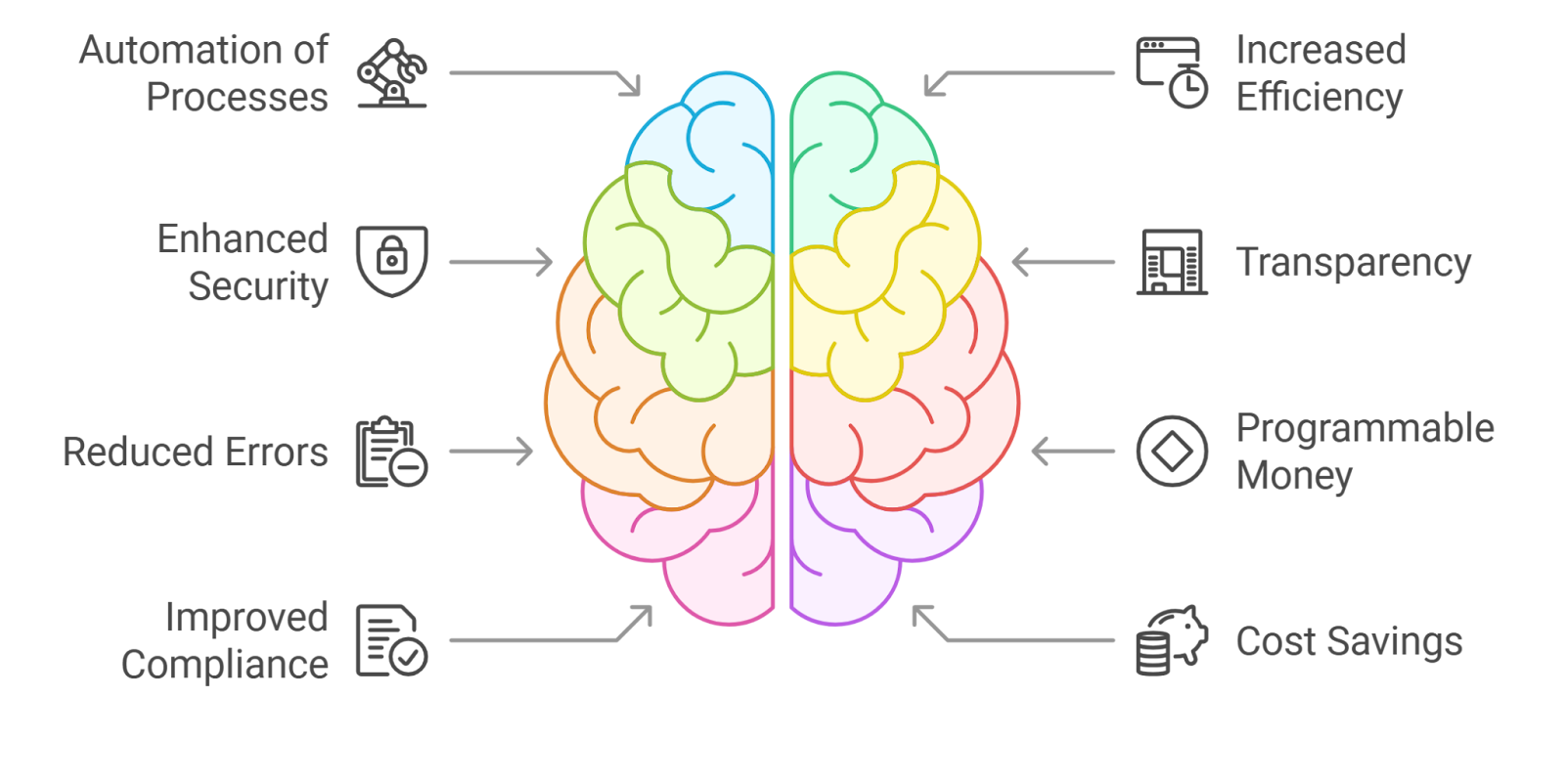

Pushing Transparency Further With Blockchain Automation

The use of smart contracts automates everything from underwriting logic to claims processing. This slashes administrative costs while minimizing disputes, a stark contrast to legacy systems bogged down by paperwork and manual reviews. The result? Faster settlements, lower overheads, and greater trust among participants at every level.

Blockchain technology doesn’t just make reinsurance more efficient, it makes it verifiable. Every premium, claim, and payout is immutably recorded on-chain, allowing both investors and insurers to audit the flow of capital in real time. This level of reinsurance transparency via blockchain is a game-changer for risk assessment and compliance. Smart contracts also allow for programmable triggers: for example, parametric insurance products can pay out instantly based on external data feeds, further reducing the lag between event and settlement.

Risk management is also enhanced. Since all participants can view the pool’s exposures, reserves, and claims history at any time, there’s less room for hidden liabilities or surprise losses, a persistent issue in traditional reinsurance markets. This open architecture not only builds trust but also allows DeFi protocols to integrate advanced analytics and actuarial models directly into their smart contracts.

Benefits to Investors: Real World Asset Yield Meets DeFi

For DeFi investors seeking diversification outside of volatile crypto-native assets, tokenized reinsurance pools offer something unique: access to real world asset yield. The returns are underpinned by insurance premiums, one of the most time-tested revenue streams in finance. As more insurers tokenize their risk portfolios, expect competition among pools to drive innovation in yield structures and risk tranching.

Top Benefits of Tokenized Reinsurance Pools for DeFi Users

-

Access to Real Yield: Tokenized reinsurance pools like Re offer DeFi investors exposure to yields backed by actual insurance premiums, not just token emissions or speculation. This provides a more stable and sustainable income stream.

-

Enhanced Transparency: All transactions and capital flows within tokenized reinsurance pools are recorded on public blockchains, allowing investors to monitor performance and risk in real time.

-

Efficient Capital Deployment: Smart contracts automate underwriting, premium collection, and claims processing, reducing administrative overhead and ensuring capital is allocated efficiently.

-

Diversification into Real-World Assets (RWA): Platforms such as Re and Etherisc enable DeFi users to invest in insurance-based RWAs, expanding portfolio diversification beyond crypto-native assets.

-

Broader Market Access: Tokenization lowers entry barriers, allowing a wider range of investors to participate in reinsurance markets that were traditionally limited to large institutions.

-

Improved Trust and Security: Blockchain’s immutable ledger and automated processes minimize disputes, fraud, and counterparty risk, fostering greater confidence among investors and insurers.

Yield stability is a major draw. Because insurance demand tends to be steady regardless of crypto market cycles, these pools can serve as a hedge within broader DeFi portfolios. Additionally, fractional ownership means investors can participate with smaller amounts of capital, no need for institutional-scale buy-ins.

The Insurer’s Advantage: Broader Capital Base and Efficiency

Insurers benefit from immediate access to global capital without the friction of traditional intermediaries or legacy clearinghouses. By tapping into DeFi liquidity through tokenized pools, they can scale coverage rapidly while retaining full transparency over capital flows and risk allocation. Automated claims handling also reduces operational drag and enhances customer satisfaction.

This model isn’t just theoretical, it’s already being piloted by forward-thinking reinsurers such as SurancePlus (in partnership with Zoniqx) and protocols like Re on Avalanche. As regulatory frameworks mature and more real-world data oracles come online, expect even greater adoption across both developed and emerging markets.

Looking Ahead: The Future of On-Chain Reinsurance Yield

The convergence of blockchain automation with centuries-old insurance principles is setting the stage for a new era in risk management, one that favors efficiency, transparency, and inclusivity. For both insurers seeking smarter capital solutions and DeFi investors hungry for sustainable yield sources tied to real economic activity, tokenized reinsurance pools are quickly becoming an essential pillar within the digital asset ecosystem.

The next wave will likely see further integration with other real-world assets (RWAs), cross-chain interoperability enhancements, and deeper partnerships between traditional financial institutions and Web3-native platforms, all underpinned by robust smart contract infrastructure designed for security at scale.