On-chain reinsurance protocols are fundamentally reshaping the way investors access and participate in the global insurance market. By leveraging blockchain technology, these platforms are tokenizing real-world insurance yields, transforming stablecoins into yield-generating collateral and unlocking new avenues for uncorrelated DeFi returns. This is not just a technical evolution – it’s a structural shift that brings transparency, efficiency, and accessibility to a historically opaque sector.

From Stablecoins to Yield-Bearing Insurance Tokens

The core innovation lies in converting stablecoin deposits into yield-bearing tokens that represent exposure to real-world insurance risk. Protocols like Re Protocol and OnRe have pioneered models where users deposit assets such as USDC or sUSDe into smart contracts, which then allocate these funds to capital pools backing actual reinsurance contracts.

Re Protocol‘s structure is instructive: participants stake stablecoins and receive either reUSD or reUSDe. The former is designed as a low-risk, principal-protected token earning yield from safe assets like U. S. Treasury bills or blue-chip DeFi strategies, typically targeting 6, 10% APY. The latter, reUSDe, assumes genuine underwriting risk in exchange for higher returns – around 15, 23% APY – by sharing in the profits (and potential losses) of insurance pools. This bifurcation lets investors select their preferred risk/return profile while gaining exposure to insurance yields that are uncorrelated with crypto market volatility or traditional equities.

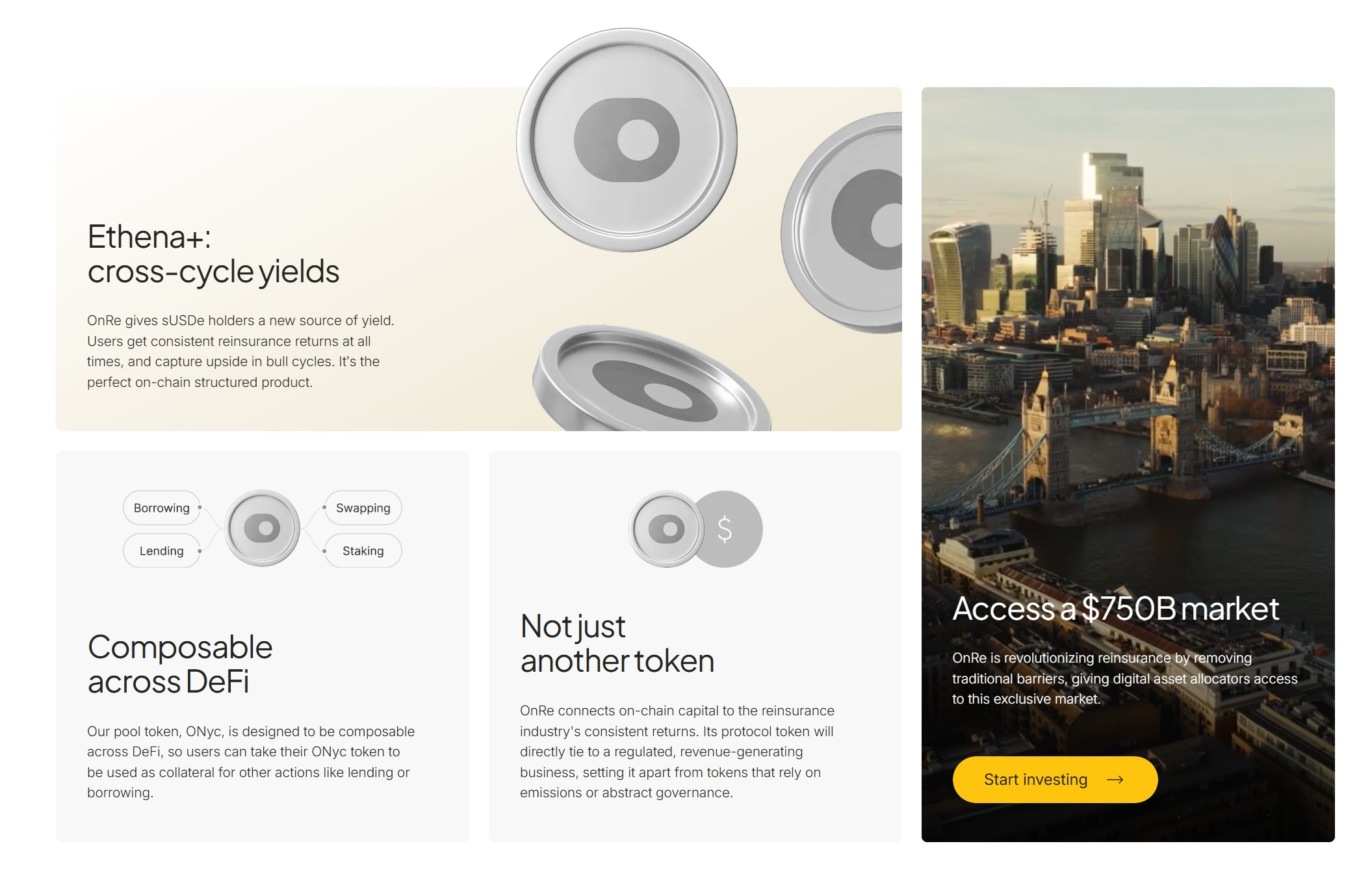

OnRe, meanwhile, has launched its ONe token with projected returns reaching up to 40.35%, combining reinsurance performance, collateral yield, and token incentives. Through partnerships like Ethena on Solana, sUSDe deposits are pooled across diversified reinsurance contracts underwritten by actuarial experts. The result: digital asset holders can tap into real-world financial markets without leaving the blockchain ecosystem.

The Mechanics of Tokenization: Collateral Pools and Smart Contracts

The process starts when an investor deposits stablecoins into a protocol-managed smart contract. These funds become part of an insurance capital pool that serves as collateral for underwriting actual reinsurance deals with insurers seeking risk transfer solutions. Every dollar is accounted for on-chain; smart contracts enforce transparency and immutability, reducing counterparty risk and operational inefficiencies endemic to legacy systems.

This architecture enables fractionalization – large reinsurance exposures can be divided into thousands of digital tokens, each representing a claim on future premium income or profit-sharing from the underlying portfolio of risks. Investors receive these tokens (such as reUSD or ONe), which accrue yield based on the realized performance of the insurance pool plus any additional incentives provided by the protocol.

This model also addresses regulatory scrutiny around capital adequacy: fully collateralized pools ensure that every insured obligation is backed by verifiable on-chain assets, increasing trust among both investors and traditional counterparties.

Why Tokenized Insurance Yields Matter Now

The surge in interest around tokenized insurance yields reflects broader trends across both DeFi and institutional finance. As traditional fixed income struggles with compressed spreads and correlated risks, investors are seeking alternative sources of return that remain robust during macroeconomic stress events. Insurance-linked securities have long been prized for their low correlation with equities or bonds; bringing these instruments on-chain democratizes access well beyond the usual cohort of hedge funds or reinsurers.

The ability to earn double-digit APYs from real-world economic activity – not just speculative trading – marks a significant step forward for DeFi’s maturation. Moreover, blockchain’s programmability enables rapid settlement cycles, granular transparency into asset flows, and automated compliance checks via oracles (e. g. , OnRe’s Chainlink-powered NAV reporting). For insurers themselves, this means improved access to global capital pools at lower frictional costs – supporting resilience amid rising catastrophe exposures worldwide.

If you want a deeper dive into how these mechanisms deliver true real-world yield on-chain (and why this matters), see our detailed breakdown at How Tokenized Reinsurance Pools Deliver Real Yield On-Chain.

As tokenized reinsurance protocols gain traction, the data increasingly supports their transformative potential. Recent market launches such as OnRe’s ONe token and Re Protocol’s dual-token system are attracting crypto-native and institutional capital alike. The numbers speak volumes: OnRe’s ONe token is offering projected returns of up to 40.35%, while Re Protocol’s reUSDe targets yields in the 15, 23% APY range, all from real-world insurance activity rather than speculative DeFi loops. This yield profile is especially compelling in a macro environment where traditional bond returns remain subdued and risk-adjusted performance is under scrutiny.

Transparency and accessibility are not just slogans here, they’re engineered into the protocols through on-chain accounting, verifiable collateralization, and automated reporting. For example, OnRe’s integration with Chainlink ensures that Net Asset Value (NAV) calculations are transparent and tamper-proof, directly addressing one of the most persistent concerns among both regulators and institutional allocators.

Risks, Regulatory Considerations, and What Comes Next

No discussion of tokenized insurance yields would be complete without acknowledging the unique risks and regulatory challenges. While full collateralization mitigates counterparty risk, investors must still consider underwriting risk (in higher-yield tranches), smart contract vulnerabilities, and evolving legal frameworks around digital asset-backed securities. Jurisdictions like Bermuda and Switzerland are leading with flexible regimes that recognize tokenized reinsurance structures while ensuring robust capital standards, an approach likely to influence global best practices as adoption accelerates.

Liquidity remains a work in progress. Secondary markets for these tokens are nascent but growing, with some protocols exploring permissioned trading venues or partnerships with established exchanges to facilitate exits prior to contract maturity. The potential for composability, integrating these yield tokens into broader DeFi strategies, could further enhance their appeal for sophisticated portfolio construction.

The next wave of innovation will likely focus on expanding access (including via regulated stablecoins), refining risk modeling through on-chain data feeds, and bridging traditional insurance capital markets with DeFi liquidity rails. As more insurers seek cost-effective capital solutions amid climate-driven loss volatility, expect continued momentum behind blockchain-based reinsurance platforms.

Key Takeaways: The Future of Blockchain Reinsurance Yield

- Tokenized insurance yields offer stablecoin holders access to real-world economic returns uncorrelated with crypto or equity markets.

- Diversification benefits: Investors can tailor exposure, from principal-protected tranches to higher-yielding insurance risk pools, using transparent smart contracts.

- Protocols like Re Protocol and OnRe have demonstrated that blockchain infrastructure can support secure, efficient reinsurance funding at scale.

- Learn more about the mechanics behind blockchain-powered insurance yields here.

The bottom line: On-chain reinsurance is no longer a theoretical experiment, it’s an emerging asset class that combines the rigor of actuarial science with the openness of DeFi rails. For those seeking uncorrelated yield backed by real economic activity, and willing to do their due diligence, the opportunity set is expanding fast.