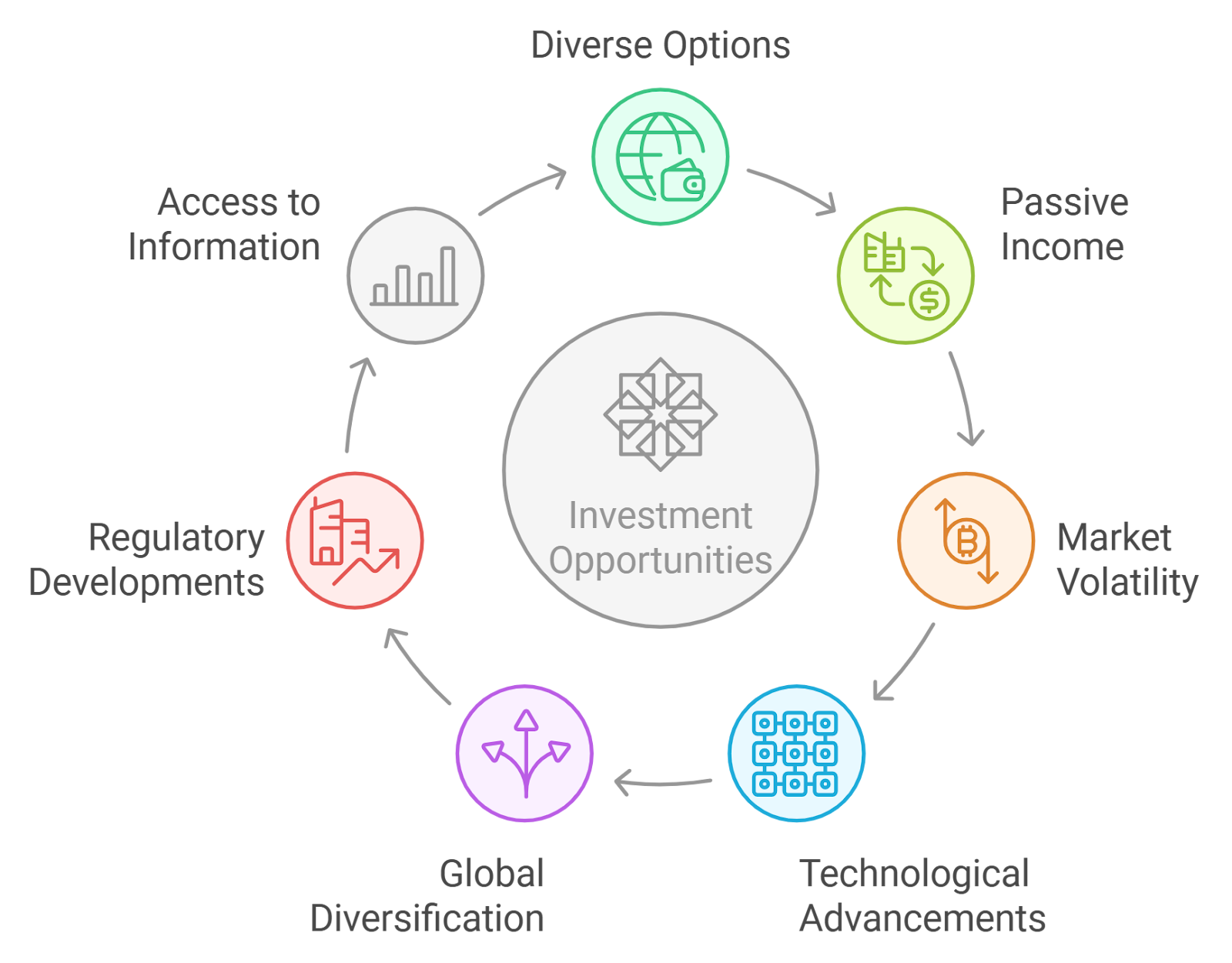

The reinsurance industry, valued at over $700 billion in 2025, is experiencing a profound transformation as blockchain technology migrates from pilot projects to core market infrastructure. For decades, reinsurance has been characterized by opaque risk pools, slow settlement cycles, and high barriers to entry. Today, on-chain protocols are rewriting these rules by introducing transparency, capital efficiency, and new forms of investor participation previously unthinkable for this sector.

Tokenization: Unlocking Liquidity and Access in Reinsurance

At the heart of this shift is tokenization. By converting reinsurance contracts and risk pools into digital tokens on public blockchains, platforms like Nayms and OnRe are making it possible for a broader range of investors to participate in what was once an exclusive club. The NAYM token, for example, enables decentralized governance and staking within insurance programs, while OnRe’s ONyc asset turns regulated reinsurance yield into a transparent on-chain instrument.

This democratization has real-world effects. Tokenized reinsurance assets can now be traded on secondary markets or used as collateral across DeFi protocols. As a result, liquidity is no longer locked up for years but can move fluidly between opportunities. These innovations are not just theoretical; they’re being validated by institutional adoption. The London Stock Exchange Group (LSEG) recently completed its first blockchain-powered capital raise for a reinsurance asset manager, a milestone that signals mainstream finance’s embrace of this new infrastructure.

Yield-Bearing Crypto Assets Meet Reinsurance Returns

The convergence of DeFi yield mechanics with traditional underwriting profits is giving rise to hybrid products that blend the best of both worlds. Ethena’s sUSDe stablecoin, designed to deliver yield regardless of market conditions, has been paired with tokenized reinsurance pools to create uncorrelated income streams for LPs and institutional allocators alike. Protocols like ONe now offer projected returns up to 40.35%, combining performance from reinsurance risk-taking with collateral yields and native token incentives.

This model is particularly attractive as regulatory clarity improves. The GENIUS Act in the US has provided legal certainty around stablecoins, which in turn accelerates capital flows into these interest-bearing assets. With $2.74 billion already deployed in blockchain insurance markets, and projections hitting $82.56 billion by 2033, the appetite for secure and transparent yield sources is only increasing.

Transparency and Efficiency: The Core Value Proposition

One of the most powerful promises of blockchain-based reinsurance protocols is radical transparency. Every transaction, from premium payments to claims settlements, is immutably recorded on-chain and accessible to all stakeholders in real time. This level of oversight reduces fraud risk and builds trust among cedents, reinsurers, regulators, and investors alike.

Smart contracts further automate claims processing and settlement cycles that once took weeks or months can now be executed instantly upon event verification. For a deep dive into how smart contracts are transforming operational efficiency in this space, see our analysis on blockchain-powered settlements.

The result? Enhanced capital efficiency across the value chain, less trapped collateral, faster recycling of capital after loss events, and more precise matching between risk appetite and investment opportunity.

As protocols like Re Protocol and OnRe continue to mature, the reinsurance sector is seeing a new wave of products that emphasize programmable risk sharing and dynamic capital allocation. Audited smart contracts, such as those reviewed by Hacken, are becoming the backbone of these decentralized platforms, minimizing operational risk while maximizing transparency. For reinsurers, this means less manual reconciliation and more focus on portfolio optimization. For investors, it opens the door to real-time reporting on performance, exposures, and claims activity.

Capital Efficiency: Redefining How Risk Is Financed

The shift toward on-chain reinsurance protocols is fundamentally changing how capital backs risk. Instead of large pools of idle collateral sitting in traditional accounts, tokenized assets can be deployed across multiple strategies or even staked for additional yield within DeFi ecosystems. This composability allows for greater capital efficiency, one of the most sought-after benefits in an era where underwriting margins are under pressure.

Consider the case study of ONe: liquidity providers (LPs) can allocate capital to tokenized reinsurance pools while simultaneously earning yield from underlying stablecoins like sUSDe. This dual-source return model is attracting both crypto-native funds and traditional asset managers seeking diversification beyond equities and bonds. The ability to exit or rebalance positions on secondary markets further enhances flexibility compared to legacy lock-up periods.

Institutional Adoption: Bridging TradFi and DeFi

The entrance of blue-chip institutions signals a tipping point for blockchain reinsurance protocols. LSEG’s deployment of a fully integrated blockchain system, handling everything from issuance to settlement, demonstrates that established players see real value in this technology. As regulatory frameworks like the GENIUS Act provide clarity around digital assets and stablecoins, expect a surge in institutional allocations to both primary insurance-linked securities (ILS) and secondary tokenized reinsurance markets.

This confluence of regulatory certainty, technological maturity, and investor demand is creating a flywheel effect. More capital means deeper liquidity; deeper liquidity attracts higher-quality risks; higher-quality risks drive better returns, and so the cycle accelerates.

Looking Forward: What’s Next for On-Chain Reinsurance?

The next phase will likely see even greater integration between off-chain actuarial models and on-chain execution environments. Expect advances in oracle infrastructure for real-time event verification, further reducing basis risk between triggers and payouts. Additionally, as smart contract templates become standardized across jurisdictions, cross-border reinsurance transactions will become as seamless as any other blockchain transfer.

For insurers exploring their own digital transformation strategies, or investors seeking uncorrelated yield, the message is clear: on-chain reinsurance is not just a trend but an emerging pillar of global risk management. Those who adapt early stand to benefit from superior transparency, efficiency gains, and access to new forms of risk-adjusted return.

If you’re interested in how tokenized collateral specifically powers these innovations or want practical guidance on deploying capital into on-chain reinsurance pools, explore our guide on tokenized collateral for transparent coverage.