Picture this: your stablecoins, those reliable digital dollars, suddenly start generating yields pulled straight from the trillion-dollar reinsurance market. No more chasing volatile DeFi farming strategies or settling for meager savings rates. With tokenized reinsurance, investors are tapping into on-chain reinsurance yields ranging from 6% to 23%, fueled by actual insurance premiums collected from real-world policies. This isn’t hype; it’s happening now on platforms like OnRe and Re Protocol, where blockchain turns opaque insurance risks into transparent, accessible opportunities.

Reinsurance has long been the quiet powerhouse of finance, where insurers offload risks to specialized players for a slice of steady premiums. Tokenizing these contracts changes everything. Stablecoin holders deposit into pools that back live insurance underwriting, earning a cut of the profits minus claims. It’s reinsurance stablecoin yield at its finest: principal-protected in many cases, with returns uncorrelated to crypto market swings. As someone who’s crunched actuarial numbers for years, I see this as the missing link for DeFi maturity, blending the predictability of insurance with blockchain’s efficiency.

Why Tokenized Reinsurance Stands Out in the RWA Boom

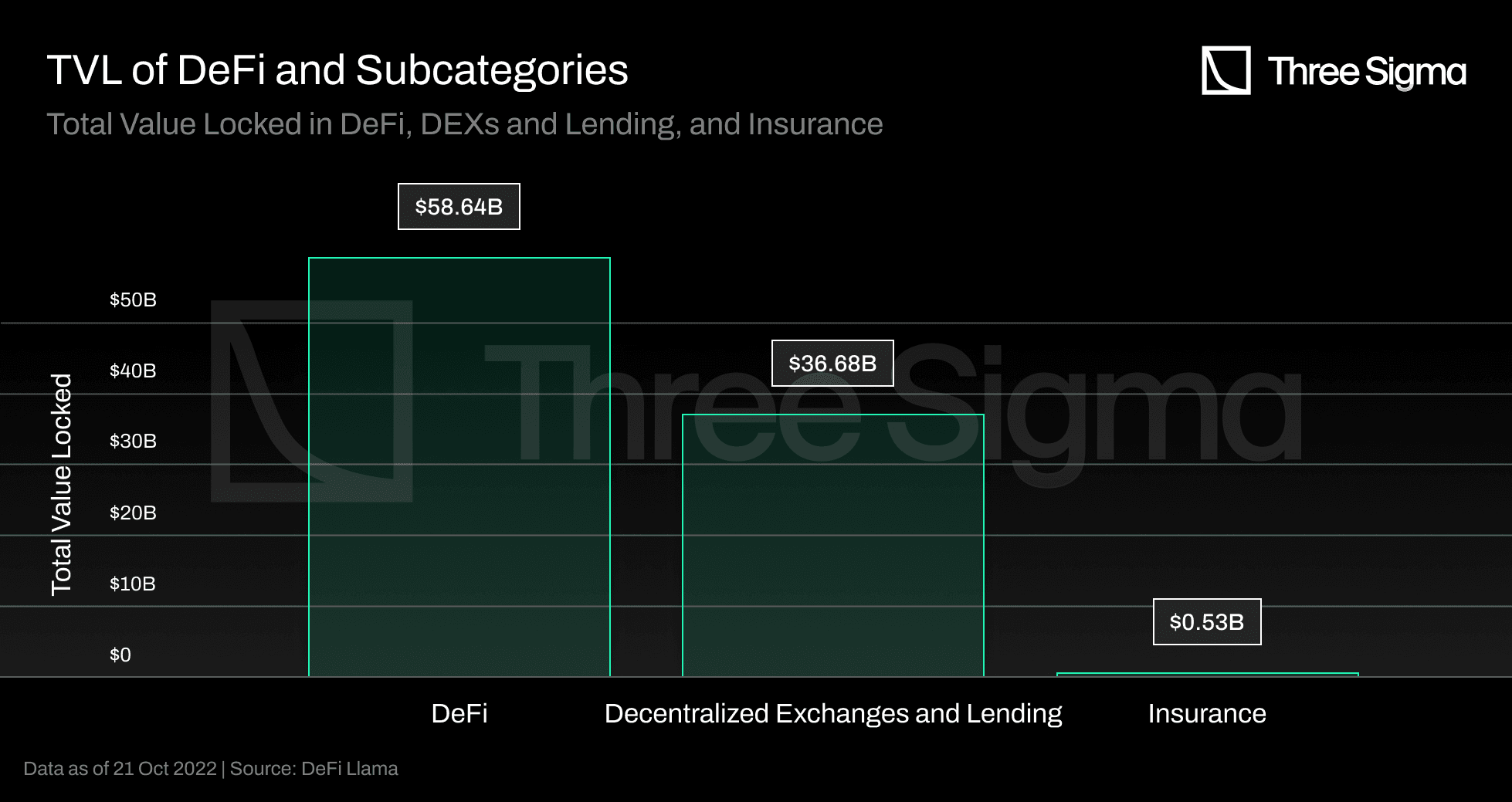

The real-world asset (RWA) narrative exploded with treasuries and private credit, but tokenized reinsurance offers something unique: yields from diversified, catastrophe-mitigated risks. Traditional reinsurers pocket premiums from policies on homes, businesses, and fleets, investing the float conservatively. Catastrophes are rare black swans; most years deliver healthy margins. On-chain versions like Re Protocol’s reUSD and reUSDe bring this to Ethereum and Avalanche, with full transparency via smart contracts.

Take Re Protocol’s reUSDe token, currently priced at $1.23. That premium over $1 reflects accrued yields from U. S. insurance underwriting, proving the model works. Investors deposit stablecoins into the Insurance Capital Layer, receiving tokenized positions that appreciate as premiums roll in. It’s principal-protected yield accrual, sidestepping the impermanent loss pitfalls of AMMs.

Tokenized reinsurance targets the US$2trn future, one structure combines pools with yield-generating stablecoins.

This isn’t speculative; protocols report on-chain metrics, from premiums underwritten ($80M growth for Re) to collateral health. For insurance pros eyeing crypto, it’s validation that legacy models scale on blockchain. Crypto natives get real yield, not ponzi-like incentives.

Spotlight on Pioneers: OnRe’s ONyc and Re Protocol’s Offerings

OnRe bills itself as the world’s on-chain reinsurance company, connecting crypto capital to insurance’s consistent returns. Their new ONyc product flips the script with a multi-collateral model. Stablecoins aren’t idle; they become active collateral for reinsurance underwriting at scale. Base yield? Around 16% from reinsurance performance, boosted by collateral returns. It’s designed for institutions wanting regulated exposure without KYC headaches.

Re Protocol, built on smart contracts, pairs with heavyweights like Ethena. Their partnership lets USDe and sUSDe holders dive into risk pools, chasing up to 23% APY. Re’s reUSD offers principal protection, while reUSDe accrues yield aggressively. Both thrive on Avalanche’s speed, with transparent reporting that grew premiums from modest starts to multimillions.

These aren’t isolated; RockawayX highlights how flexible regs let tokenized reinsurers hold yield-bearing stablecoins or money-market tokens. It’s a flywheel: more capital means more underwriting, higher premiums, fatter yields.

Unpacking the Yield Engine: Premiums to On-Chain Profits

At its core, on-chain reinsurance yields stem from a simple equation: premiums collected minus claims paid, plus float income. Insurers pay reinsurers upfront for coverage; blockchain protocols tokenize these i/o contracts. Capital providers fund the pool via stablecoins, earning pro-rata shares.

Read more on how these protocols generate real yield from insurance premiums. Smart contracts automate payouts, with oracles feeding claims data. Losses? Diversified across geographies and perils, keeping net yields robust. For example, Re’s structures ensure collateral covers risks, with reUSDe at $1.23 signaling strong performance.

This model shines in low-correlation: while BTC dumps, reinsurance chugs along. I’ve modeled it, expect 10-15% long-term averages, with peaks to 23% in fat years. But it’s opinionated: skip if you fear tail risks; embrace if diversification calls.

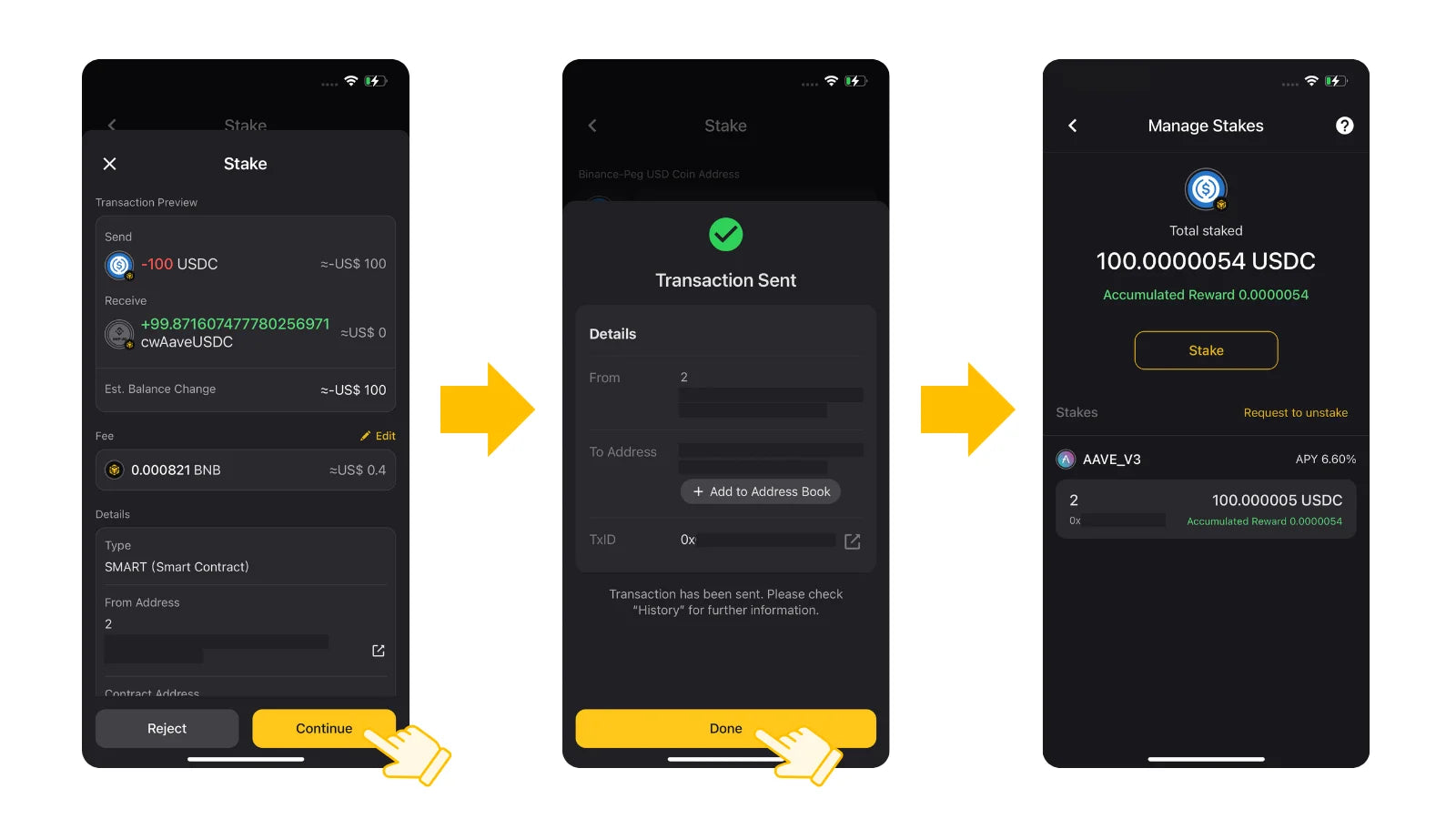

Participating is straightforward for those ready to blend insurance logic with DeFi savvy. Deposit stablecoins into a protocol’s capital layer, receive tokenized receipts like reUSD or ONyc positions, and watch yields compound. Platforms handle the underwriting via licensed partners, so you focus on returns. Re Protocol’s Avalanche deployment keeps gas fees low, making it accessible even for smaller stacks.

Getting Started: Your Path to Reinsurance Yields

First, choose a protocol aligned with your risk appetite. OnRe suits those seeking regulated ties, while Re Protocol appeals to yield chasers via Ethena integration. Connect a wallet to their dApp, approve stablecoins like USDC or USDe, and join the pool. Yields accrue automatically, often rebasing or claimable weekly. I’ve tested similar setups; the key is monitoring TVL growth and premium inflows for sustainability.

Step-by-Step: Deposit for 6-23% Yields

-

1. Choose Your PlatformDecide between OnRe’s ONyc (onre.finance for 16%+ base yield) or Re Protocol (re.xyz for reUSDe/reUSD pools up to 23% APY). Review risks and audits on their sites.

-

2. Visit Official SiteGo to onre.finance for ONyc or re.xyz for Re. Use only verified links to avoid phishing.

-

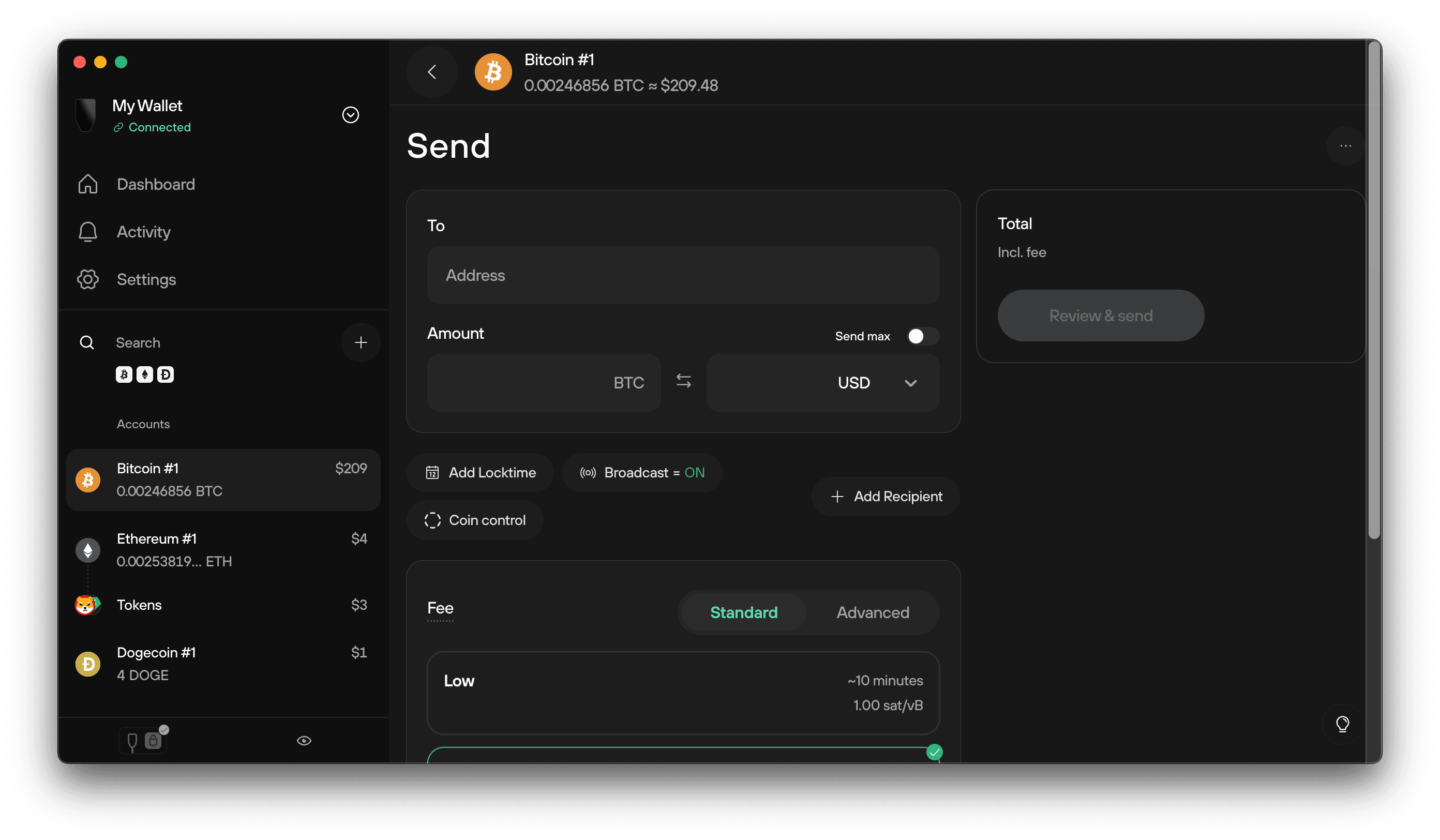

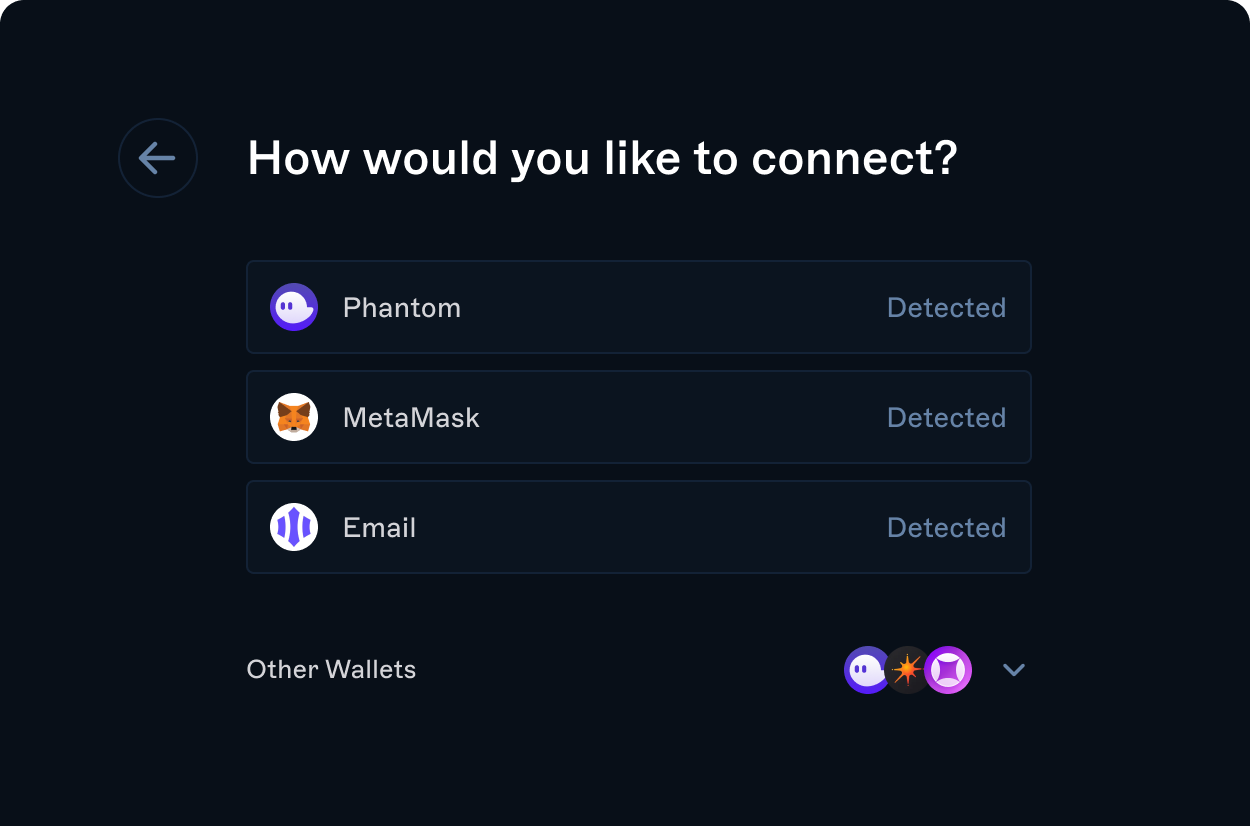

3. Connect WalletClick ‘Connect Wallet’ and link a compatible one like MetaMask or WalletConnect. Ensure it’s on Ethereum or Avalanche network as needed.

-

4. Select Pool & StablecoinNavigate to deposit section. For Re, choose pools accepting USDe/sUSDe (via Ethena partnership) or other stables; ONyc supports multi-collateral stables.

-

5. Approve & DepositApprove stablecoin spend (e.g., USDC/USDT), enter amount, and confirm deposit. Gas fees apply; expect to receive reUSD/reUSDe or ONyc tokens.

-

6. Earn & Monitor YieldsYields accrue automatically from real insurance premiums (6-23% APY). Track via dashboard; withdraw principal + yields anytime with liquidity.

Transparency sets this apart. Every premium dollar and claim hits the blockchain, verifiable by anyone. No black-box funds here; oracles from Chainlink or similar pipe in real-world data. This builds trust, crucial for institutional inflows eyeing the $2trn reinsurance pie.

Yet, yields this juicy come with caveats. Catastrophic events could spike claims, though diversification across perils like hurricanes or cyber attacks tempers blows. Protocols overcollateralize, often 200% and, shielding principal. Still, smart contract risks linger, mitigated by audits and insurance funds. Regulatory shifts? Bermuda and Cayman offer crypto-friendly reinsurance licenses, but U. S. clarity lags.

Reinsurance returns from premiums offset by catastrophe losses, but tokenized versions add stablecoin yield layers.

Opinion: this beats tokenized treasuries for uncorrelated punch. When crypto bleeds, insurance floats steady. Long-term, as TVL scales to billions, expect compressed yields around 10%, but early movers snag the 20% and peaks.

Risks, Rewards, and Real-World Proof

Proof points abound. Re grew premiums from $80M baselines, reUSDe holds firm at $1.23, embodying baked-in gains. OnRe’s ONyc pilots multi-collateral, blending stablecoin yields with reinsurance cuts for hybrid returns. Investors report 15-18% realized APYs in test runs, uncorrelated to ETH or BTC.

Diversification tip: allocate 10-20% of your stablecoin bag here, balancing with lending or staking. For actuaries like me, it’s thrilling to see parametric triggers automate payouts, slashing disputes.

Forward-looking, partnerships like Ethena-Re signal scale. As stablecoin issuers seek real backing, reinsurance pools absorb trillions in idle capital. Blockchain unlocks insurance premiums blockchain flows, turning DeFi from speculation to stewardship. Whether you’re an insurer hedging risks or a yield hunter, onchain reinsurance capital delivers the edge. Dive in, but diligence first; the yields reward the prepared.