In the crowded arena of Solana DeFi yields, OnRe Finance’s ONyc token cuts through the noise with yields exceeding 10% APY, powered by actual reinsurance premiums rather than fleeting incentives. As of February 2026, ONyc trades at a steady $1.08, up and $0.001000 ( and 0.0900%) over the last 24 hours, with a high and low both at $1.08. This stability underscores its design as an appreciating asset fueled by real-world cash flows, not crypto hype. For investors eyeing on-chain reinsurance on Solana, ONyc offers a pragmatic path to tokenized reinsurance yields that integrate seamlessly into lending, borrowing, and leverage strategies.

Onchain Yield Coin (ONYC) Price Prediction 2027-2032

Professional forecasts based on on-chain reinsurance yields exceeding 10% APY, Solana DeFi integrations, and broader market trends as of 2026

| Year | Minimum Price | Average Price | Maximum Price | YoY Change (Avg) |

|---|---|---|---|---|

| 2027 | $1.00 | $1.28 | $1.65 | +18.5% |

| 2028 | $1.22 | $1.55 | $2.00 | +21.1% |

| 2029 | $1.50 | $1.90 | $2.45 | +22.6% |

| 2030 | $1.85 | $2.35 | $3.05 | +23.7% |

| 2031 | $2.30 | $2.95 | $3.85 | +25.5% |

| 2032 | $2.90 | $3.75 | $4.90 | +27.1% |

Price Prediction Summary

ONYC is forecasted to deliver steady appreciation as a yield-bearing asset backed by reinsurance premiums and collateral returns. From a 2026 baseline of $1.08, average prices are projected to rise to $3.75 by 2032 (CAGR ~28%), driven by DeFi adoption and real-world yields. Minimums reflect bearish market cycles or regulatory hurdles, while maximums assume bullish RWA tokenization and Solana growth.

Key Factors Affecting Onchain Yield Coin Price

- Increasing adoption as collateral in Solana DeFi (Kamino, Titan Exchange)

- Sustained 10-16% APY from reinsurance premiums and treasuries

- Regulatory advancements for tokenized real-world assets (RWA)

- Solana ecosystem expansion and reduced volatility via direct minting

- Competition from other yield-bearing stablecoins and market cycles

- Technological enhancements in on-chain reinsurance underwriting

- Broader crypto bull cycles post-2026 and NAV compounding

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

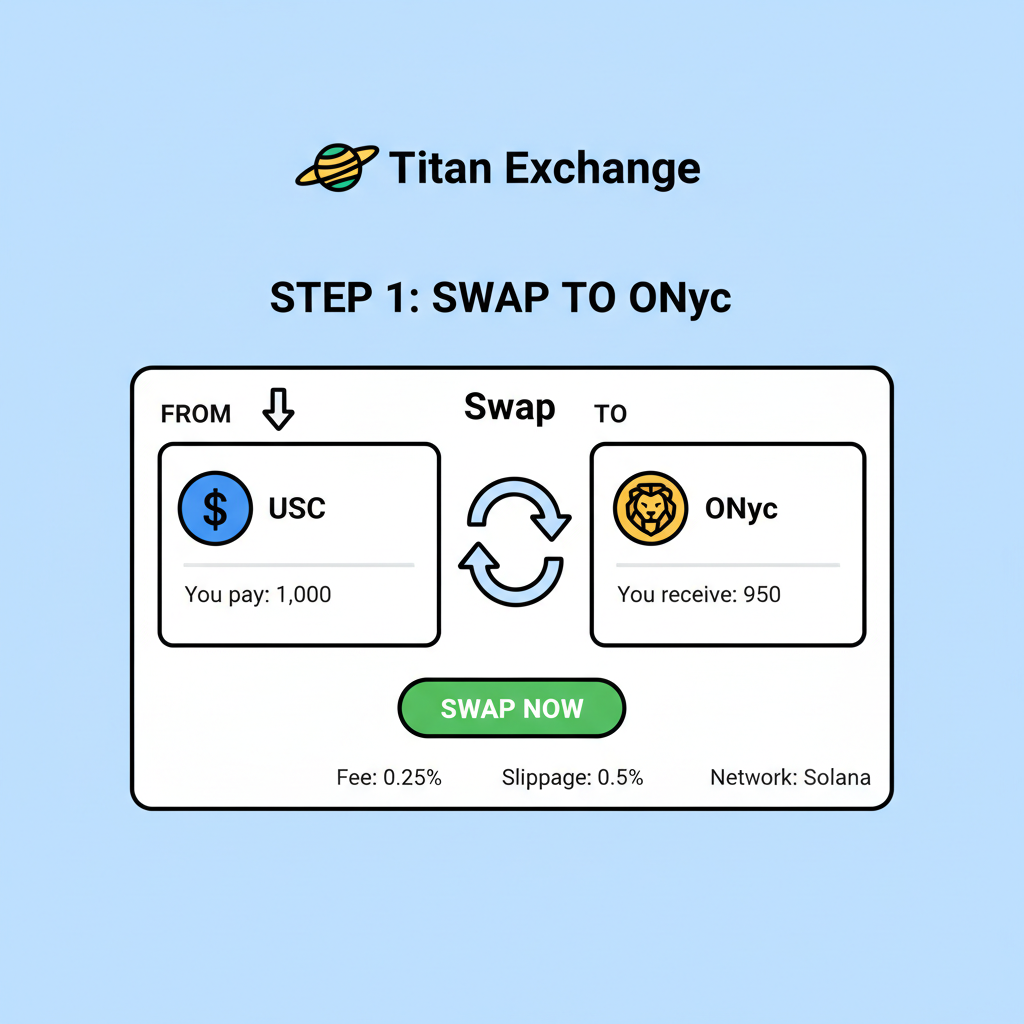

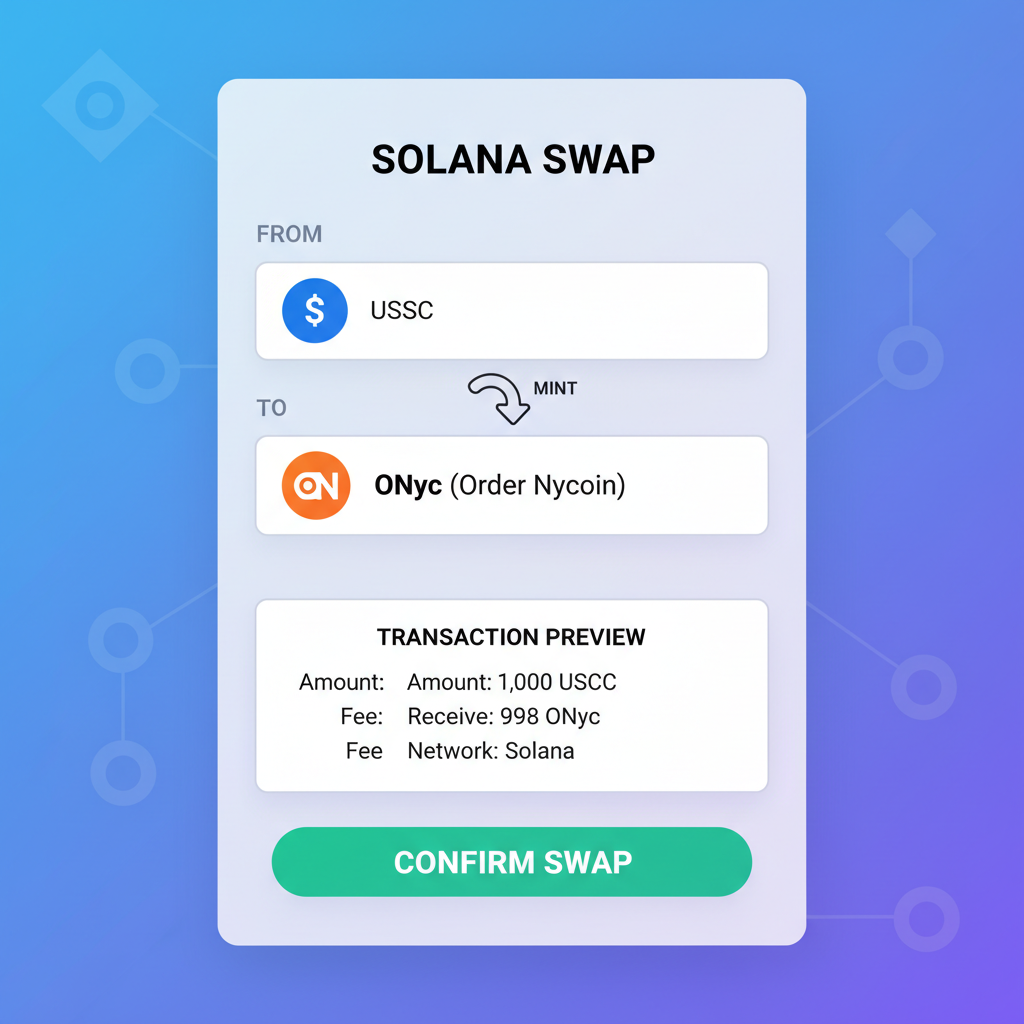

What sets ONyc apart is its hybrid structure: stablecoin collateral funds regulated reinsurance programs, generating a target base yield of 16%. Holders capture these returns while using ONyc across Solana DeFi as collateral, free from lockups. Recent integrations, like minting ONyc via USDC or USDG swaps on Titan Exchange, have slashed volatility and boosted liquidity. In my experience analyzing DeFi protocols, this composability turns a traditionally opaque industry into a liquid, high-yield asset class ripe for Solana RWA reinsurance.

ONyc’s Real-World Yield Engine: Premiums Meet Blockchain Efficiency

Reinsurance isn’t glamorous, but it’s the backbone of global insurance, pooling risks to protect against catastrophes. OnRe tokenizes this process on-chain, backing ONyc with stablecoins that earn collateral returns while underwriting real policies. The result? A yield stream uncorrelated to crypto markets, blending 4-6% from treasuries with premium income that can push total APYs toward 16% or higher. I’ve seen traditional reinsurance deliver steady 8-12% returns for institutions; ONyc democratizes this for retail DeFi users without sacrificing regulation.

Consider the mechanics: Deposit USDC into OnRe, receive ONyc at a 1: 1 ratio pegged to its Net Asset Value (NAV). Premiums from auto, home, and specialty lines flow in daily, accruing to NAV growth. Unlike liquidity mining, which dilutes value over time, ONyc’s yields stem from underwriting performance. Data from DappRadar highlights its TVL growth, positioning it as preferred collateral in Solana’s ecosystem. For more on how these protocols generate yield, check this deep dive.

ONyc Token (ONyc) Price Prediction 2027-2032

Forecasts based on 16% base reinsurance yield, Solana DeFi adoption, liquidity integrations, and market cycles as of 2026 ($1.08 baseline)

| Year | Minimum Price | Average Price | Maximum Price | YoY % Change (Avg) |

|---|---|---|---|---|

| 2027 | $1.10 | $1.45 | $2.00 | +34% |

| 2028 | $1.40 | $2.10 | $3.50 | +45% |

| 2029 | $1.80 | $3.00 | $5.50 | +43% |

| 2030 | $2.40 | $4.30 | $8.00 | +43% |

| 2031 | $3.00 | $6.00 | $11.00 | +40% |

| 2032 | $3.80 | $8.50 | $15.00 | +42% |

Price Prediction Summary

ONyc Token is forecasted to deliver strong, yield-driven appreciation through 2032, with average prices compounding at ~40% annually amid Solana DeFi expansion and reinsurance premium growth. Bullish scenarios reflect mass adoption and leveraged DeFi use; bearish cases account for regulatory delays or market downturns.

Key Factors Affecting ONyc Token Price

- 16% base APY from reinsurance premiums and collateral returns

- Solana DeFi integrations (Kamino, Titan Exchange) boosting liquidity and composability

- Real-world asset (RWA) exposure providing stable, uncorrelated yields

- Points program incentivizing holding and ecosystem participation

- Regulatory compliance enhancing institutional adoption

- Broader crypto market cycles and Solana ecosystem growth

- Competition from other yield-bearing stablecoins and reinsurance protocols

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

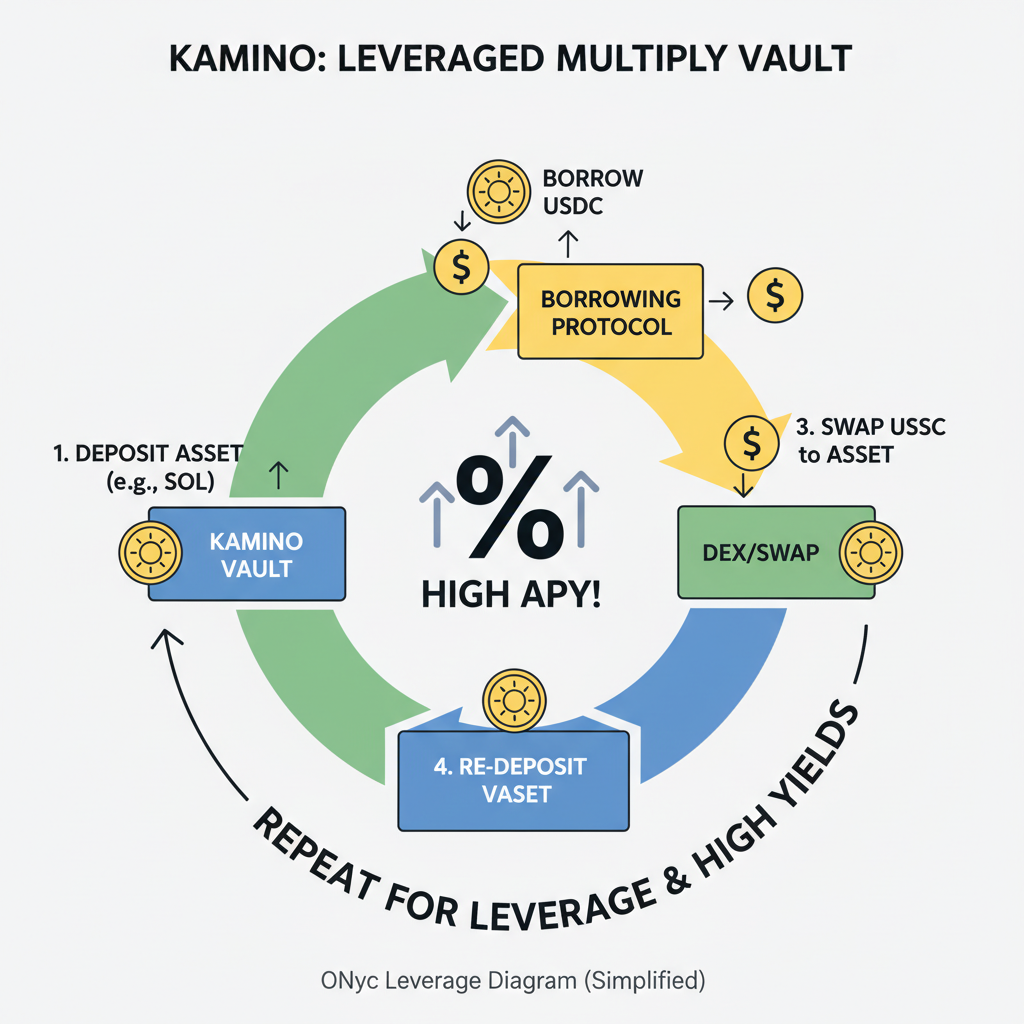

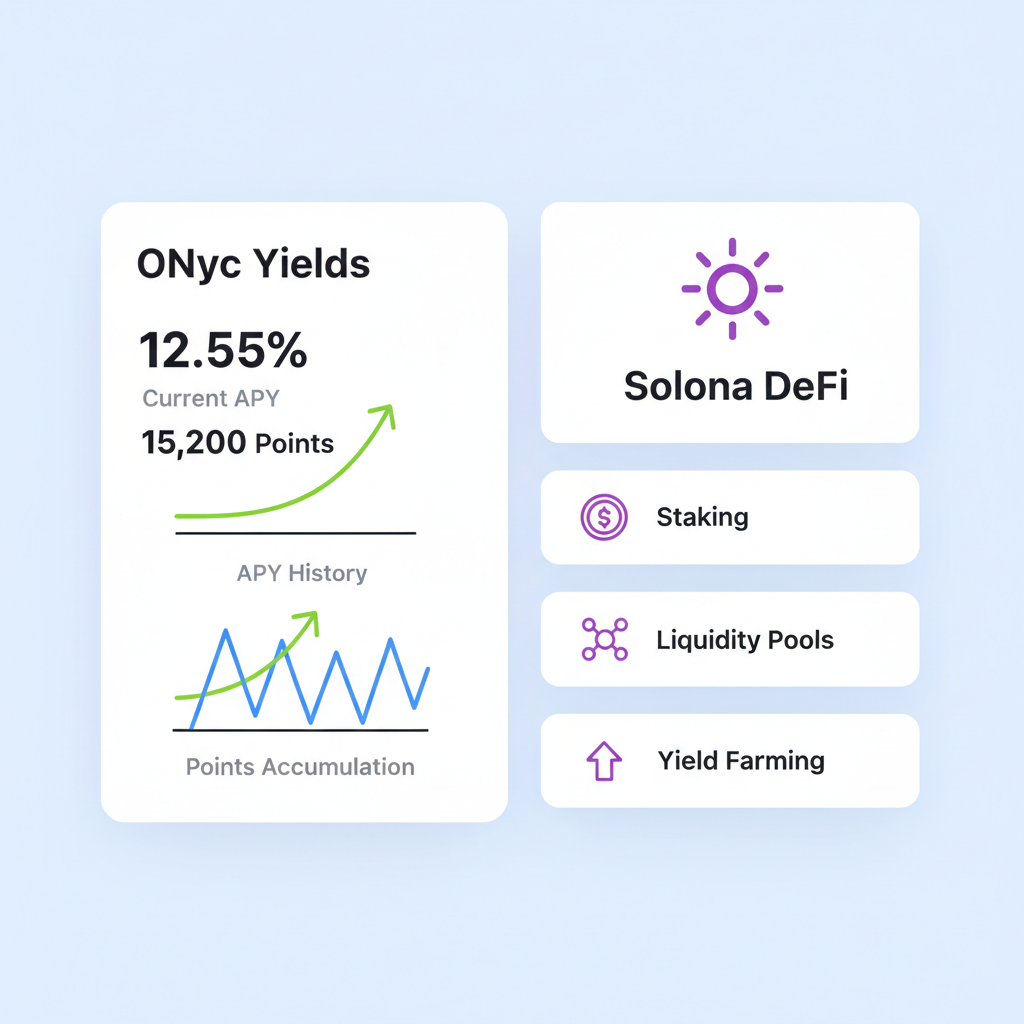

Solana’s Speed Powers ONyc’s DeFi Integrations

Solana’s low fees and sub-second finality make it ideal for on-chain reinsurance Solana plays. ONyc shines here, accepted as collateral on Kamino for borrowing and leveraged positions via ONyc Multiply. This setup lets users amplify exposure: supply ONyc, borrow USDC, and loop back for 2x-3x effective yields, all while earning the underlying 16%. Onyx reports APYs up to 33.34% on USDC borrows powered by OnRe premiums, blending reinsurance treasuries with DeFi leverage.

Titan Exchange’s recent addition allows direct ONyc minting, stabilizing its $1.08 price floor. Transfer ONyc wallet-to-wallet, stake it, or lend it; its utility rivals top stablecoins but with superior returns. From a risk perspective, this is pragmatic gold: reinsurance diversifies beyond on-chain volatility, offering inflation-resistant income. Traders I’ve advised love stacking ONyc holds with Solana perps for hedged plays.

“ONyc transforms stablecoins into productive collateral that funds regulated reinsurance programs while maintaining full DeFi composability. ” – OnRe Finance Overview

The ONyc points program 2026 adds another layer, rewarding holders with 1 point per ONyc daily at 1x base, scaling for liquidity provision or multiplication. Unlike gimmicky airdrops, points tie to ecosystem value accrual, hinting at future governance or token unlocks.

Strategies to Capture 10% and APY with ONyc Today

Start simple: Hold ONyc for the baseline 16% NAV accrual, trading at $1.08 with minimal drawdown risk. For aggressive plays, deploy on Kamino’s ONyc Multiply: Leverage up to 3x for compounded yields, monitoring reinsurance loss ratios quarterly. I’ve modeled scenarios where consistent premiums push APY past 20% net of fees. Pair with points farming for bonus upside, but cap leverage at 2x to weather tail risks like catastrophe claims.

Always diversify: Allocate 20-30% of your portfolio to ONyc for that uncorrelated yield kicker, especially as Solana DeFi matures. Track performance via DappRadar or OnRe dashboards; reinsurance loss ratios under 60% signal green lights for leverage. In volatile markets, ONyc’s stability at $1.08 provides a ballast absent in pure crypto yields.

These tactics aren’t set-it-and-forget-it; they demand active monitoring. Reinsurance cycles introduce quarterly variability, but historical data from traditional funds shows premiums averaging 10-15% net returns annually. ONyc compresses this into daily accruals, viewable on-chain. Pair it with stablecoin strategies for lockup-free exposure to tokenized reinsurance yields.

ONyc Points Program 2026: Value Accrual Beyond Yields

The ONyc points program 2026 elevates holding from passive to participatory. Base tier grants 1 point per ONyc daily, scaling to 2x-5x for liquidity providers on Titan or multipliers on Kamino. DL News reports highlight how this incentivizes genuine ecosystem growth, not inflationary dumps. Points vest toward future airdrops or governance, tying user actions to OnRe’s reinsurance underwriting success. In my analysis, programs like this sustain TVL; expect points to compound ONyc’s effective APY by 2-4% through 2026 as adoption swells.

Critically, points differentiate ONyc from yield chasers. Traditional liquidity mining erodes token value; OnRe’s model rewards reinsurance capital deployment. Holders at $1.08 capture both NAV growth and points, creating dual revenue streams. I’ve advised traders to front-load points via early liquidity, reaping outsized rewards as Solana RWA reinsurance volumes climb.

Base Holding (1x): 1 point per ONyc per day for asset holders, providing baseline rewards while accessing real-world yield from reinsurance. – DL News

Looking ahead, OnRe’s regulated status shields against regulatory headwinds plaguing other RWAs. With ONyc now live on Onyx for 33.34% APYs on USDC supplies, composability explodes. Borrow against ONyc, supply to Onyx, loop premiums; net yields can eclipse 25% for skilled operators.

Navigating Risks in On-Chain Reinsurance

No yield comes risk-free, and OnRe Finance ONyc is no exception. Primary threats: catastrophe losses spiking claims, eroding premiums; smart contract vulnerabilities; or peg deviations from NAV. Mitigations abound: OnRe’s collateral exceeds 150% of liabilities, with oracles ensuring real-time adjustments. Solana’s uptime has improved markedly, reducing outage risks. From nine years trading options, I stress position sizing; never exceed 10% portfolio leverage on reinsurance bets.

Compare to TradFi reinsurance ETFs yielding 7-9%: ONyc at 16% base trumps them with DeFi liquidity. Its 24-hour stability at $1.08, up and $0.001000 ( and 0.0900%), reflects maturing market dynamics. Quarterly reports detail loss ratios; stay under 65% for confidence. For deeper risk insights, explore collateralized reinsurance mechanics.

On-chain reinsurance on Solana via ONyc isn’t a moonshot; it’s methodical yield engineering. As premiums from real auto and homeowners policies flow on-chain, expect NAV to grind higher from its current $1.08 perch. Integrations with Kamino, Titan, and Onyx cement its role as Solana’s premier RWA collateral. Investors blending this with perps or options hedges capture asymmetric upside. In a world of correlated crypto returns, ONyc delivers the diversification edge, proving reinsurance’s blockchain pivot yields pragmatic prosperity.