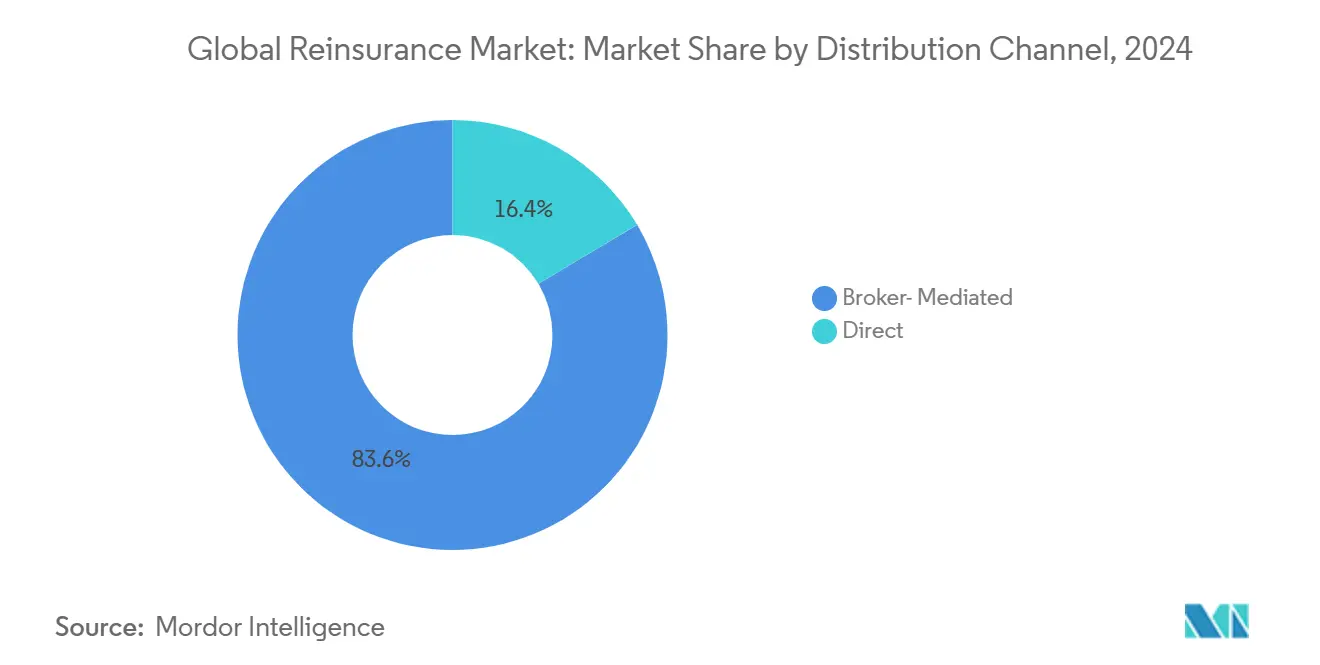

Decentralized finance (DeFi) is evolving beyond speculative yield farming and into the territory of real-world, stable returns. The catalyst? On-chain reinsurance protocols like OnRe and Re, which are bringing the $750 billion global reinsurance market onto blockchain rails. For DeFi investors seeking uncorrelated, sustainable yield, this is a pivotal moment that could redefine risk and reward in crypto portfolios.

Tokenized Reinsurance Yield: A New Asset Class for DeFi

The core innovation here is simple but profound: by tokenizing exposure to reinsurance premiums, protocols like OnRe and Re allow digital asset holders to access genuine cash flows from global insurance markets. Unlike traditional DeFi yields, which are often circular or dependent on volatile token incentives, these platforms generate returns directly from insuring real-world risks, think property, aviation, trucking, and workers’ compensation.

OnRe’s ONe token, for example, offers liquidity providers projected returns of up to 40.35%. These returns are sourced from a blend of reinsurance performance (actual premium income less claims), collateral yield on stablecoins like sUSDe, and targeted token incentives. By partnering with Ethena and leveraging Solana’s high throughput chain, OnRe enables users to deposit sUSDe into diversified pools of reinsurance contracts. The result: yields that remain steady regardless of crypto or equity market turbulence.

Similarly, Re Protocol’s tokenized fund on Avalanche raised $15 million in its initial round from institutional players such as Nexus Mutual and Ava Labs’ Vista fund. Targeting an annualized yield up to 23%, Re focuses on low-volatility insurance lines, delivering consistent income even during bear cycles. Access is available for U. S. accredited investors and global participants who complete KYC checks.

Why Real-World Yield Matters in DeFi Portfolios

The promise of uncorrelated yield is not just marketing spin, it addresses a fundamental weakness in most DeFi strategies: overexposure to crypto market cycles. Traditional yield farming depends on native token emissions or leveraged trading fees, both highly sensitive to risk sentiment and price volatility. When the market turns bearish, yields dry up rapidly.

On-chain reinsurance protocols, by contrast, source their returns from actual economic activity, specifically the premiums paid by insurers transferring risk off their books. This means:

Key Benefits of Tokenized Reinsurance Yield in DeFi Portfolios

-

Stable, Uncorrelated Returns: On-chain reinsurance protocols like OnRe and Re provide yields derived from the global reinsurance market, which are historically uncorrelated with traditional crypto and equity markets. This helps insulate DeFi portfolios from broader market volatility.

-

Attractive Yield Opportunities: OnRe’s ONe token offers liquidity providers projected returns of up to 40.35%, while Re’s tokenized reinsurance fund targets annualized yields up to 23%. These returns are powered by real-world insurance premiums and collateral yield.

-

Portfolio Diversification: Tokenized reinsurance assets allow DeFi investors to diversify their holdings beyond crypto-native products, allocating capital to a $750 billion global industry with historically stable returns.

-

Composability and Liquidity: Protocols like Re issue fully fungible ERC-20 tokens (e.g., reUSD, reUSDe), enabling seamless integration with DeFi platforms for lending, borrowing, staking, and yield farming.

-

Transparency and On-Chain Security: Both OnRe and Re leverage blockchain smart contracts for transparent management of reinsurance pools, collateralization, and yield distribution, enhancing investor trust and security.

-

Access to Real-World Assets (RWA): By tokenizing reinsurance risk, these protocols bridge the gap between digital capital and tangible, regulated insurance products, opening new channels for DeFi capital to access real-world yield.

This structural independence makes on-chain reinsurance an attractive diversifier for sophisticated investors seeking resilience during downturns as well as scalable upside during bull runs.

Composability Meets Institutional-Grade Risk Management

A major advantage of these new protocols is their seamless integration with existing DeFi infrastructure. Both OnRe and Re have engineered ERC-20 compatible tokens (such as reUSD or ONyc) that can be freely traded or used as collateral across lending platforms, DEXs, or structured products ecosystems.

This composability unlocks further utility for holders:

- Lending: Use tokenized reinsurance assets as collateral for stablecoin loans without liquidating your position.

- Staking: Earn additional protocol rewards by staking your tokens within partner pools.

- Yield Aggregation: Combine insurance-backed tokens with other DeFi primitives for layered strategies.

The result is an ecosystem where sophisticated capital allocators can construct robust portfolios combining real-world insurance risk with blockchain-native flexibility, and do so with full transparency into underlying exposures via smart contracts.

Transparency is not just a buzzword here. Every reinsurance contract, premium flow, and claim event is immutably recorded on-chain, providing investors with granular auditability that simply does not exist in traditional insurance markets. This level of visibility minimizes information asymmetry and enables real-time monitoring of risk-adjusted returns.

Another critical factor is the regulatory alignment these protocols are pursuing. Re Protocol’s tokenized fund, for instance, is accessible only to U. S. accredited and KYC-verified global investors, adhering to strict compliance standards. OnRe’s approach similarly prioritizes fully collateralized pools and robust risk selection criteria, which reduces counterparty risk and enhances trust for institutional participants. The move toward regulated, permissioned access points marks a maturation phase for DeFi insurance protocols and paves the way for mainstream adoption.

Risks and Considerations for DeFi Investors

While the promise of stable, uncorrelated yield is compelling, it’s essential to recognize that reinsurance, on-chain or off, is not without risk. Catastrophic loss events can impact returns; smart contract vulnerabilities remain an ever-present consideration; and regulatory frameworks are still evolving globally. Prudent investors should scrutinize protocol audits, collateralization ratios, loss history data, and governance mechanisms before allocating significant capital.

Additionally, liquidity considerations are different from those in pure crypto markets. While ERC-20 compatibility enables composability, the underlying reinsurance contracts may have lock-up periods or delayed settlement cycles compared to instant DeFi withdrawals.

The Road Ahead: Scaling Real-World Yield in DeFi

The convergence of blockchain technology with the $750 billion reinsurance sector is still in its early innings, but momentum is accelerating fast. As more on-chain protocols like OnRe and Re prove their ability to deliver sustainable real-world yield at scale, expect increased participation from both crypto-native funds and traditional institutions seeking diversification away from correlated market risks.

For forward-thinking DeFi investors willing to do their due diligence, tokenized reinsurance stands out as a rare opportunity: exposure to genuine economic activity with built-in downside protection during crypto bear markets and scalable upside when premiums surge in bull cycles.

To learn more about how these innovative models actually capture insurance premium flows as yield, and what it means for your portfolio, see our deep dive at How On-Chain Reinsurance Protocols Generate Real Yield from Insurance Premiums.