In an era where digital trust is quantified by code and consensus, the reinsurance sector faces mounting pressure to deliver real-time transparency and robust risk management. Blockchain-based reinsurance platforms are rapidly gaining traction, but the linchpin for institutional adoption remains verifiable collateralization. This is where Chainlink Proof of Reserve (PoR) is rewriting the rules of on-chain reinsurance transparency.

Chainlink Proof of Reserve: The Gold Standard for On-Chain Verification

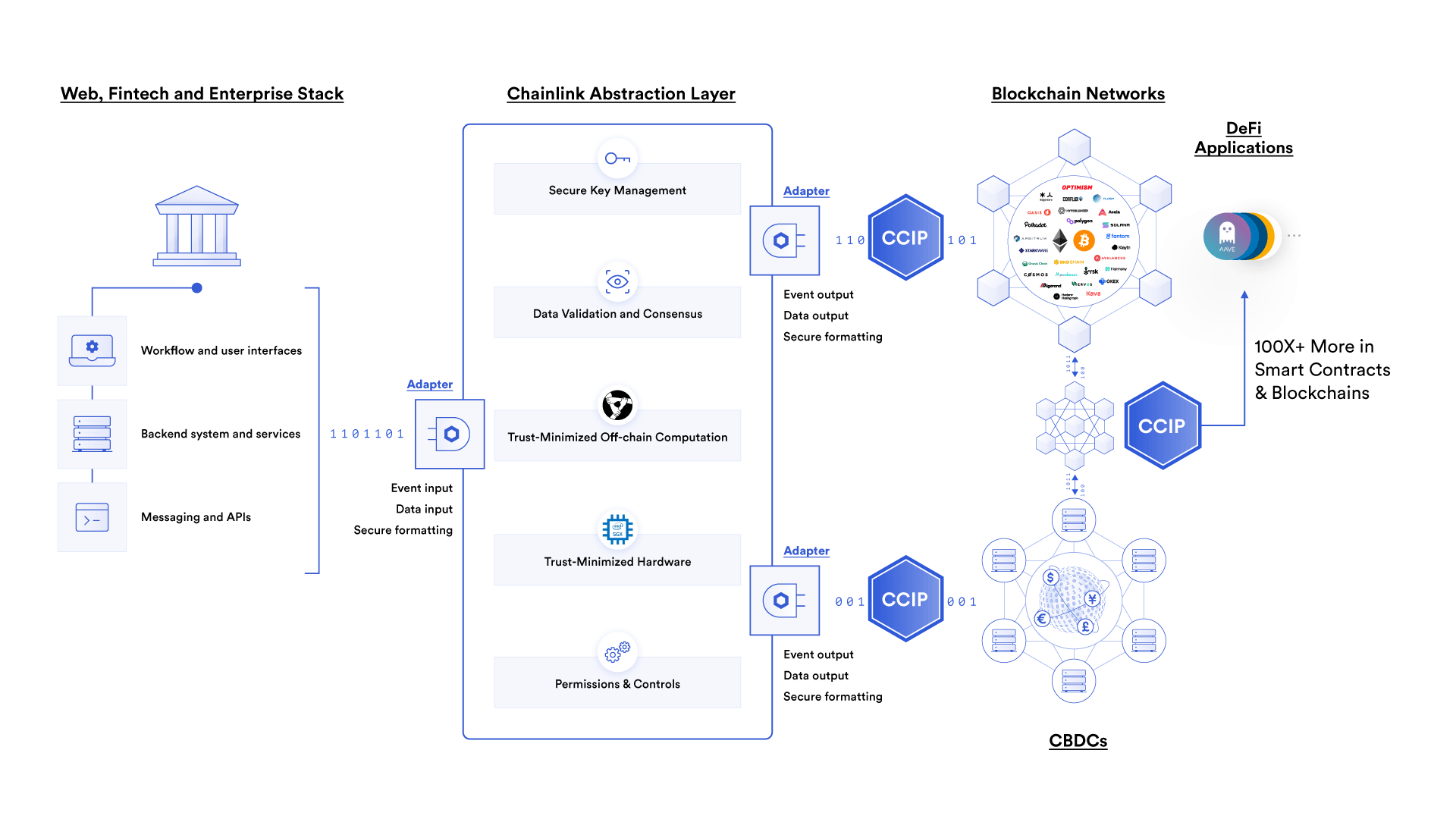

Chainlink PoR is a decentralized oracle solution that delivers automated, tamper-proof verification of off-chain reserves backing on-chain assets. As of October 19,2025, Chainlink (LINK) trades at $16.71, reflecting steady demand for decentralized data infrastructure. PoR’s architecture leverages a network of independent oracles to continuously monitor reserve balances, ensuring that collateralization data is both timely and immune to single points of failure.

The result? Automated reserve monitoring that eliminates the inefficiencies of manual audits and periodic disclosures. For on-chain reinsurance protocols, this means that every policy, every tranche, and every risk transfer can be verified in near real time by any stakeholder, no more opaque trust accounts or delayed reporting cycles.

Transforming On-Chain Reinsurance Transparency

Reinsurance is fundamentally about trust. Traditionally, cedents (primary insurers) relied on annual or quarterly audits to confirm that reinsurers held sufficient reserves to cover catastrophic claims. However, this process is slow, expensive, and often reactive, leaving room for systemic risk to accumulate undetected.

Chainlink PoR introduces a paradigm shift by offering:

- Automated Reserve Verification: Smart contracts automatically check collateralization status at predefined intervals or in response to key events.

- Real-Time Data Availability: All parties, insurers, reinsurers, auditors, can instantly access on-chain reserve data, reducing information asymmetry.

- Risk Mitigation: If reserves dip below required thresholds, PoR-integrated contracts can autonomously pause new policy issuance or restrict claim payouts until collateralization is restored.

This level of transparency not only enhances operational efficiency but also reduces counterparty risk, a critical factor as institutional capital flows into on-chain insurance products.

Industry Adoption: From Stablecoins to Re Protocol

The utility of Chainlink PoR extends well beyond reinsurance. It has already been battle-tested across major DeFi verticals:

- CACHE Gold: Utilizes PoR to provide real-time proof that tokenized gold assets are fully backed by physical gold in vaults.

- 21. co: Employs PoR to ensure that its wrapped Bitcoin (21BTC) on Solana and Ethereum remains transparently collateralized at all times.

Within the reinsurance ecosystem, the integration of Chainlink PoR with platforms like Re protocol marks a significant leap forward. By embedding decentralized oracles into the core of their smart contracts, these protocols enable real-time collateral verification, a stark contrast to the legacy model of periodic black-box attestations. As noted by industry observers, this approach not only reduces operational overhead but also inspires greater investor confidence in the solvency and stability of on-chain insurance vehicles.

To explore the technical underpinnings of how Chainlink PoR is transforming collateral transparency in reinsurance, see our detailed guide: How On-Chain Collateral Transparency Is Transforming Reinsurance With Chainlink Proof of Reserve.

Looking at the current market landscape, the demand for real-time reinsurance auditing and blockchain collateral verification is intensifying. As the Chainlink (LINK) price holds at $16.71, institutional interest is being fueled by the promise of automated, data-driven trust. The integration of Proof of Reserve across protocols like Re is not just a technological upgrade – it is a fundamental shift in how capital adequacy and risk are managed in decentralized insurance networks.

Key Benefits of Chainlink PoR for On-Chain Reinsurance

-

Automated, Tamper-Proof Reserve Verification: Chainlink Proof of Reserve (PoR) delivers continuous, automated verification of reinsurance contract reserves, reducing reliance on manual audits and minimizing the risk of errors or manipulation.

-

Real-Time Transparency for All Stakeholders: PoR provides up-to-date, on-chain reserve data, enabling insurers, reinsurers, and policyholders to instantly verify collateralization status and make informed decisions.

-

Enhanced Risk Mitigation: By integrating with smart contracts, PoR can trigger automated safeguards—such as pausing new policy issuance or limiting payouts—if reserves fall below critical thresholds, helping prevent insolvencies.

-

Increased Investor and Policyholder Confidence: The decentralized oracle network powering Chainlink PoR ensures data integrity, fostering greater trust among investors and policyholders in the transparency and security of reinsurance agreements.

-

Proven Industry Adoption: Major platforms like CACHE Gold and 21.co have successfully implemented PoR to provide real-time collateral verification, demonstrating its effectiveness across asset classes.

Consider the operational impact: reinsurers can now publish verifiable collateral updates directly to the blockchain, providing instant assurance to cedents and regulators alike. This continuous flow of data means that any deviation from required reserve ratios can be detected and addressed before it escalates into a solvency crisis. For investors, this translates into quantifiable risk metrics and greater confidence in underwriting capacity.

The Road Ahead: Challenges and Opportunities

While Chainlink Proof of Reserve sets a new bar for decentralized insurance trust, several challenges remain. Regulatory frameworks are still catching up with on-chain models, particularly around cross-jurisdictional compliance and audit standards. Additionally, the technical complexity of integrating PoR oracles with legacy insurance systems requires careful change management and robust governance protocols.

Despite these hurdles, early adopters are already seeing tangible benefits:

- Reduced Settlement Risk: Automated triggers based on real-time collateral status help prevent undercollateralized positions from endangering policyholders.

- Enhanced Market Liquidity: Transparent reserves make it easier for new capital providers to evaluate risk-adjusted returns, driving greater participation in reinsurance pools.

- Auditability by Design: Every reserve update is immutably recorded on-chain, supporting both internal controls and external regulatory audits.

The competitive landscape is evolving rapidly. Platforms that fail to adopt transparent collateral verification risk being sidelined as institutional allocators prioritize security and compliance. For those embracing Chainlink PoR, the rewards include not only improved operational efficiency but also a reputational edge in an increasingly data-driven market.

A Paradigm Shift for Institutional Investors

The confluence of blockchain technology and decentralized oracle networks like Chainlink is ushering in a new era for reinsurance markets. By delivering real-time, tamper-proof reserve data directly onto public ledgers, PoR bridges the gap between traditional actuarial rigor and digital asset transparency.

This transformation is not theoretical – it’s happening now. As more reinsurance protocols integrate PoR solutions, expect to see increased capital inflows from institutions seeking both yield and verifiable security. The days of opaque trust accounts are numbered; tomorrow’s winners will be those who can prove their solvency every block, not every quarter.

The bottom line? In an environment where trust is measured by code rather than credentials, on-chain reinsurance transparency powered by Chainlink Proof of Reserve isn’t just best practice – it’s becoming table stakes for global insurance innovation.