The insurance industry stands at a pivotal crossroads, as blockchain-enabled on-chain reinsurance rapidly redefines the landscape of collateral management and real-time transparency. Traditional reinsurance agreements are often hampered by fragmented data silos, delayed reporting, and opaque capital flows. By contrast, on-chain reinsurance leverages blockchain’s distributed ledger technology to automate, verify, and visualize every transaction, unlocking new levels of trust and operational efficiency for insurers.

Tokenization: The New Foundation for Insurance Collateral

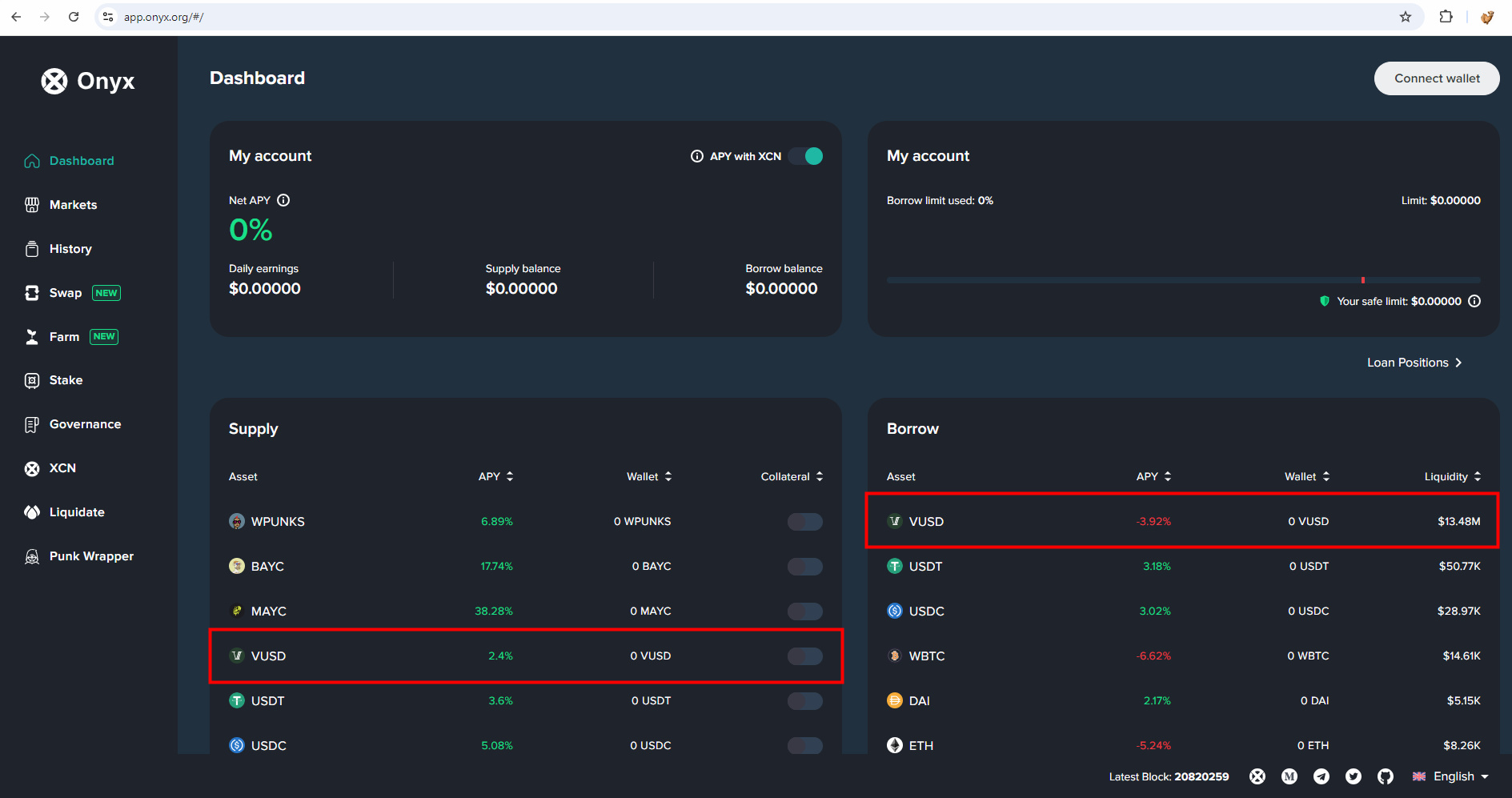

At the heart of on-chain reinsurance lies the tokenization of reinsurance assets. Platforms like OnRe have introduced tokens such as ONyc and sUSDe that not only represent reinsurance pool shares, but also enable seamless composability across decentralized finance (DeFi) protocols. This means that insurers can now use their tokenized reinsurance positions as collateral for lending, staking, or even yield optimization strategies, all while maintaining full visibility into the underlying asset’s performance.

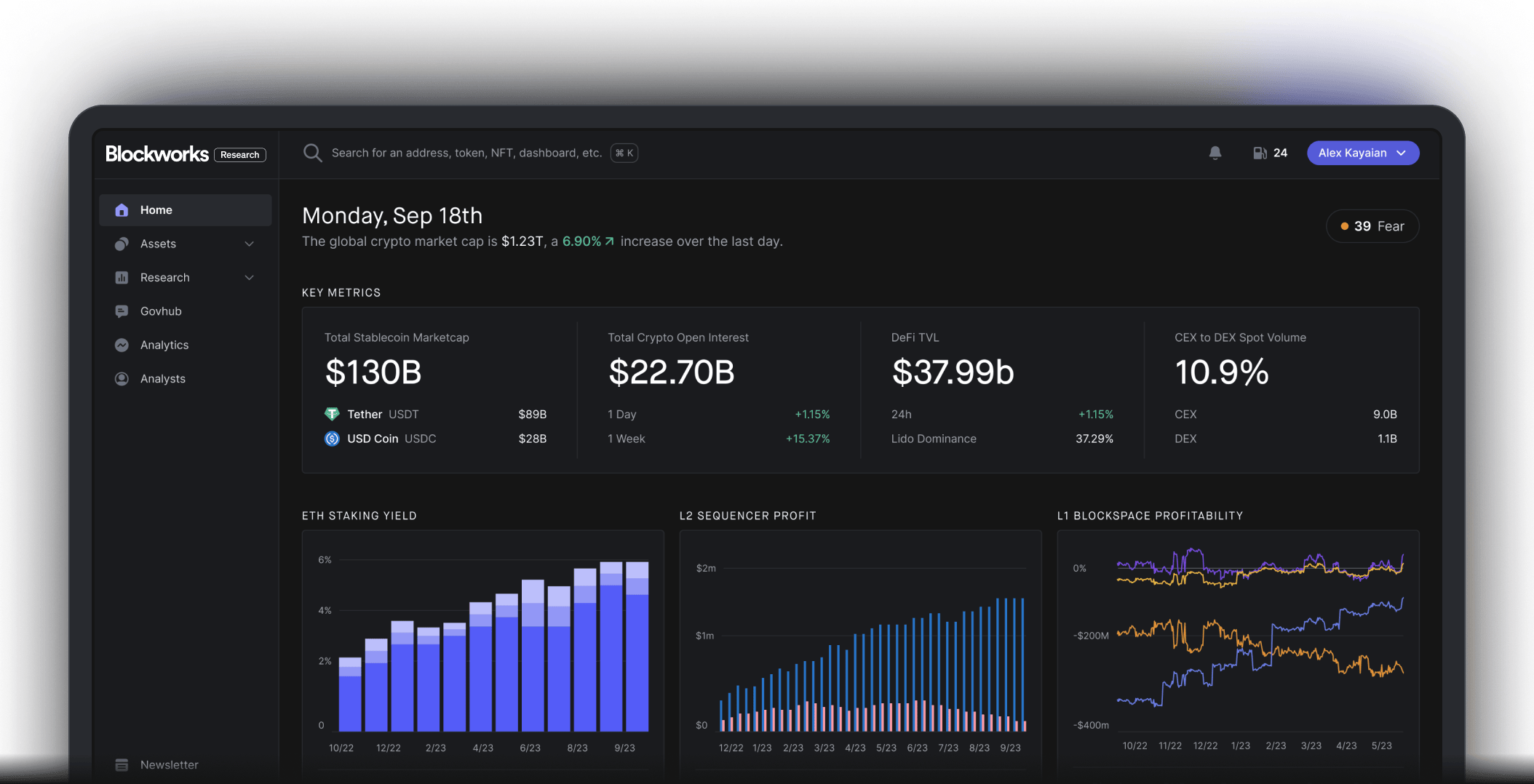

For example, OnRe’s integration with Chainlink’s Onchain NAV solution allows investors and insurers to access real-time net asset value (NAV) data for their reinsurance holdings. This eliminates the traditional lag between capital deployment and reporting, a critical pain point for risk managers and compliance teams. The result is a dynamic, living record of capital adequacy, premium flow, and claim reserves, instantly auditable by all stakeholders. For a deeper dive into how Chainlink’s Proof of Reserve is transforming on-chain reinsurance transparency, see this detailed guide.

Automated Collateral Management: Reducing Friction and Risk

One of the most significant breakthroughs of on-chain reinsurance is the automation of collateral management through smart contracts. By encoding premium collections, claims triggers, and fund distributions directly into blockchain logic, insurers can drastically reduce administrative overhead and minimize the risk of human error or manual fraud. Every collateral movement is cryptographically validated and timestamped, providing an immutable audit trail that regulators and counterparties can trust.

Consider the implications for capital efficiency: instead of tying up excess reserves in static accounts, insurers can programmatically adjust collateral positions in response to real-time risk exposures and claims activity. This agility enables more accurate pricing of risk and unlocks new liquidity for both primary insurers and their reinsurance partners. For those interested in the technical mechanics behind on-chain collateral transparency, our resource on how on-chain collateral transparency is transforming reinsurance offers a comprehensive overview.

Real-Time Transparency: Auditable Capital and Risk Flows

Perhaps the most transformative aspect of on-chain reinsurance is its ability to provide real-time, auditable transparency into capital positions and risk flows. With every transaction recorded on a public or permissioned ledger, insurers, brokers, and regulators can monitor the health of reinsurance pools at any moment. This is a stark contrast to legacy systems, where weeks or months might pass before a true picture of capital adequacy emerges.

The composability of tokens like ONyc further amplifies this effect. Insurers can now collateralize on-chain assets to access yield opportunities or manage liquidity, while maintaining full visibility into their exposure and performance. Industry partnerships, such as the recent collaboration between Re and VIPR Solutions, are already streamlining blockchain-based data management, connecting managing general agents, underwriters, and brokers with on-chain capital for enhanced efficiency and security. For a broader look at how these innovations are reshaping risk management in DeFi protocols, see this analysis.

Beyond just technical upgrades, the shift to on-chain reinsurance is rewriting the rules for insurance capital efficiency. Traditional reinsurance often locks up capital in conservative, low-yield accounts, creating opportunity costs and friction. Tokenized reinsurance pools, by contrast, open the door to programmable capital: collateral can be dynamically reallocated, staked, or even used as liquidity in DeFi markets while maintaining regulatory compliance and full auditability.

Key Benefits of Blockchain Collateral Management for Insurers

-

Real-Time Transparency: Blockchain platforms like OnRe provide continuous, on-chain visibility into collateral positions, enabling insurers to monitor risk exposures and fund flows instantly. This fosters greater trust among stakeholders and supports regulatory compliance.

-

Automated Operations via Smart Contracts: Smart contracts automate premium collection, claims processing, and collateral release, reducing manual intervention and minimizing administrative errors. This streamlines workflows and enhances operational efficiency for insurers.

-

Yield Transparency and Composability: Products like OnRe’s ONyc token and sUSDe offer real-time, on-chain verification of yield and performance. Insurers can use these tokens as collateral across DeFi platforms, maximizing capital efficiency and composability.

-

Enhanced Security and Data Integrity: Blockchain’s immutable ledger ensures that collateral records and transactions are tamper-proof. Partnerships such as Re and VIPR Solutions demonstrate how secure, blockchain-based data management connects underwriters and brokers with on-chain capital.

-

Reduced Counterparty Risk: By removing intermediaries and enabling direct, transparent interactions between insurers and reinsurers, blockchain platforms lower counterparty risk and settlement times, streamlining the reinsurance value chain.

Yield transparency is another frontier. With solutions like sUSDe and ONyc, insurers and investors gain access to real-time yield data verified on-chain. This level of visibility not only supports more informed decision-making but also attracts new classes of capital to the insurance sector, particularly from crypto-native investors seeking transparent, risk-adjusted returns. The ability to see live performance metrics, such as those published via Chainlink’s Onchain NAV, sets a new industry benchmark for trust and accountability.

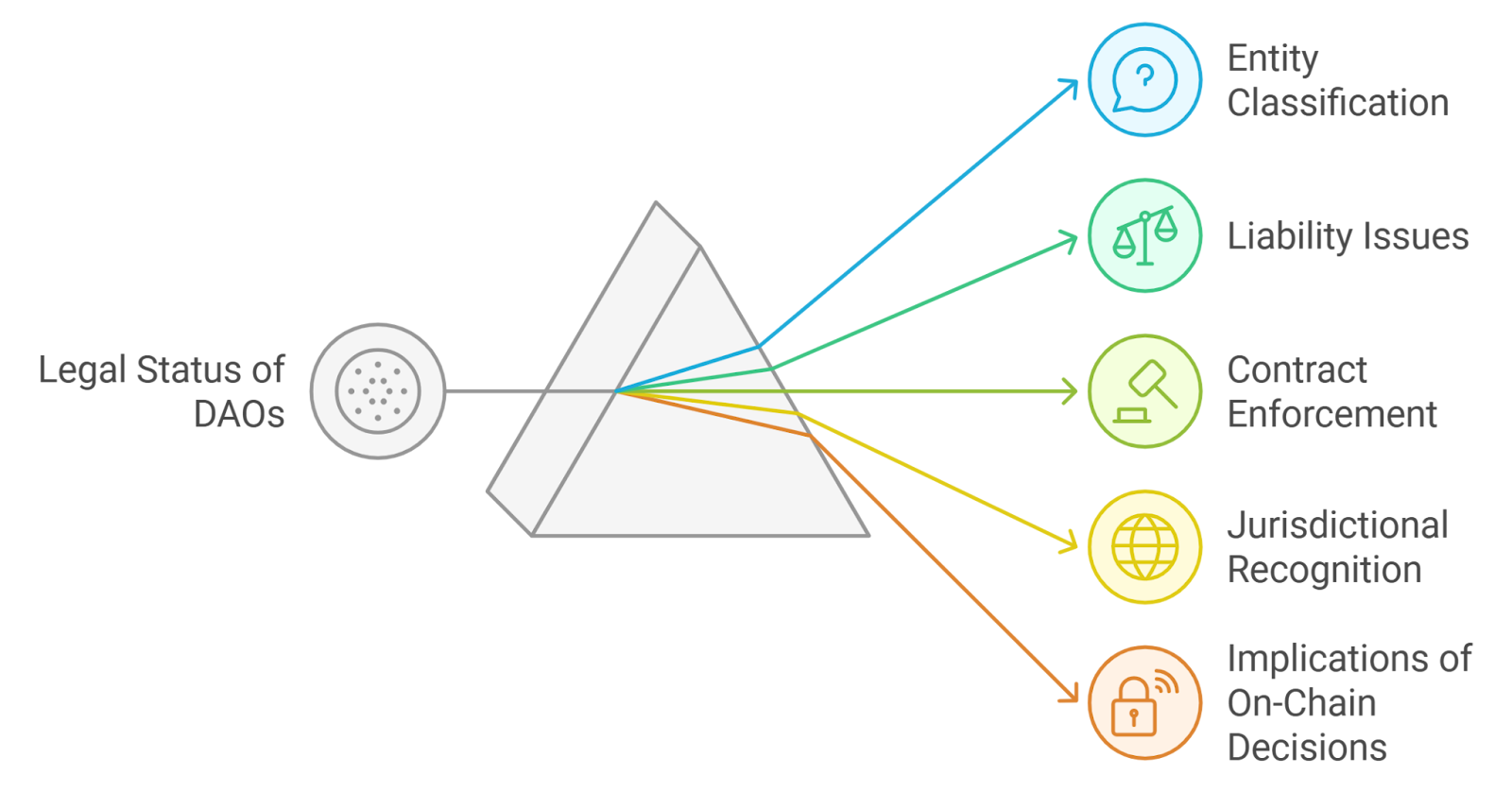

Regulatory compliance is also evolving in tandem. Smart contracts can enforce complex compliance rules, such as KYC/AML checks or jurisdictional restrictions, directly in code, reducing the need for manual oversight and decreasing operational risk. For example, programmable compliance ensures that only approved counterparties can interact with specific insurance pools or collateral assets, all while preserving privacy by avoiding unnecessary on-chain storage of personal data.

Composability and Ecosystem Growth: The Future of Reinsurance Is Open

The composable nature of on-chain reinsurance tokens means that insurers are no longer siloed within a single platform or set of products. ONyc tokens, for instance, are designed to be integrated across a growing ecosystem of DeFi protocols, enabling lending, secondary trading, or even bundling into new insurance-linked investment products. This interoperability not only boosts liquidity but also drives innovation at the intersection of insurance and decentralized finance.

As more industry players adopt these standards, and as partnerships like Re x VIPR Solutions demonstrate, the network effects will accelerate. Data flows become frictionless; capital can move instantly between counterparties; and the entire value chain becomes more resilient to shocks. Real-time insurance audits are no longer an aspiration but an operational reality.

What to Watch Next

The direction is clear: transparent reinsurance agreements, powered by smart contracts and tokenized collateral, are setting new standards for both risk management and investor confidence. The next wave will likely see further integration with AI-driven analytics for risk modeling and even deeper composability with other asset classes.

For those evaluating their next steps in blockchain insurance solutions:

- Assess your current collateral management workflows, where are the bottlenecks?

- Explore tokenization pilots with trusted partners like OnRe

- Prioritize platforms that offer transparent real-time data feeds

- Stay engaged with developments around smart contract regulation and DeFi composability

The future belongs to those who embrace on-chain reinsurance as both a technology upgrade and a strategic shift. As transparency becomes the norm and capital becomes truly programmable, insurers will find themselves better equipped not just to manage risk, but to capture entirely new opportunities in an open financial ecosystem.