For decades, reinsurance has operated behind a veil of complexity and opacity, especially regarding the collateral that underwrites risk transfer. The arrival of blockchain technology – and more specifically, decentralized oracle networks like Chainlink – is changing this paradigm. Today, Chainlink Proof of Reserve (PoR) is powering transparent on-chain reinsurance collateral, making real-time verification not just possible but practical for the first time.

Why Collateral Transparency Matters in Reinsurance

Collateral is the backbone of any reinsurance agreement. Insurers rely on collateral to ensure that claims will be paid even if a reinsurer falters. Traditionally, verifying this collateral has meant periodic audits, manual reconciliations, and reliance on opaque trust structures – processes that are both slow and susceptible to error or manipulation.

This lack of transparency has long been a sticking point for institutional capital looking to enter insurance risk markets. Without timely proof that every dollar of risk is backed by real assets, both investors and policyholders face heightened uncertainty.

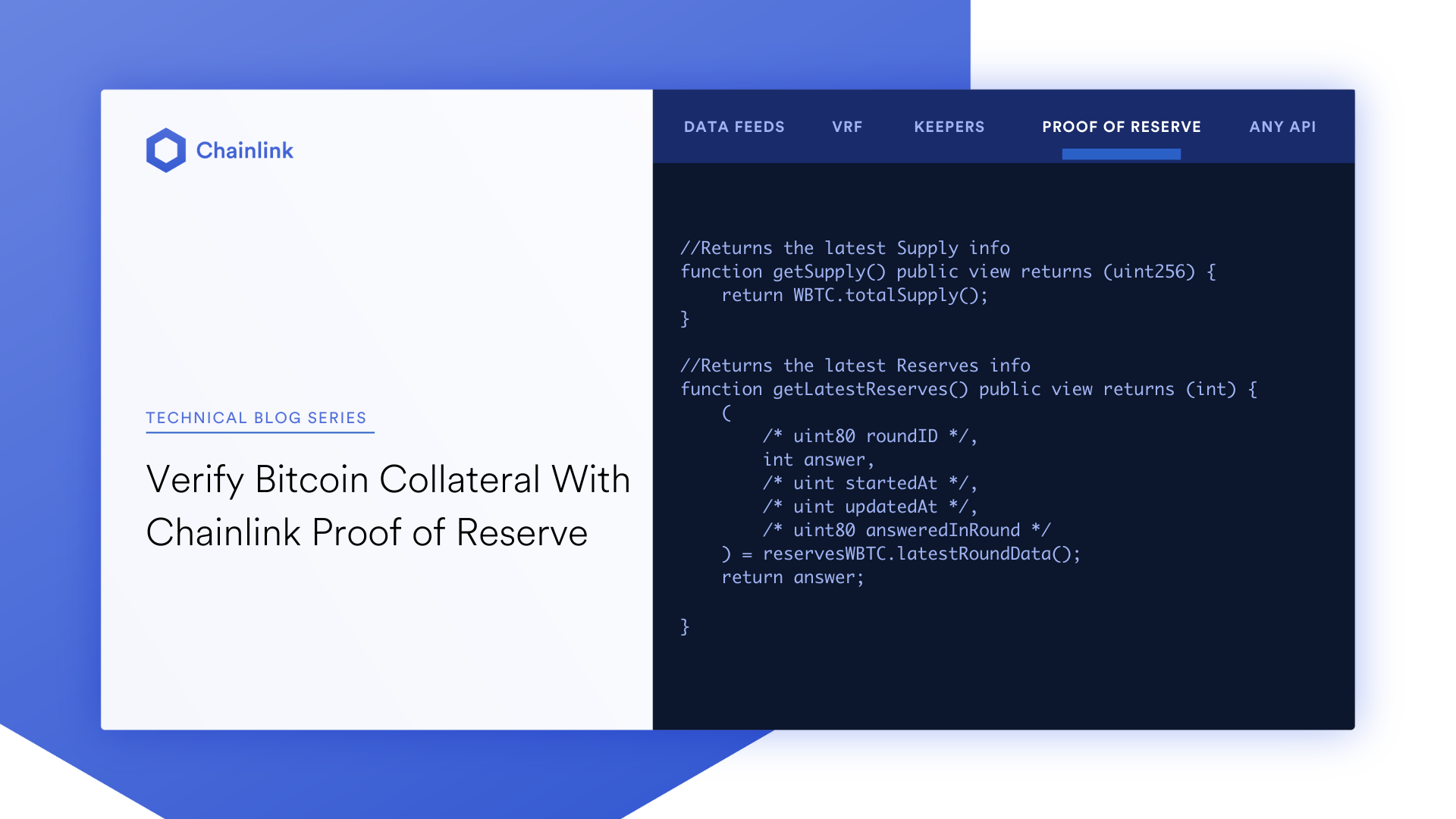

How Chainlink Proof of Reserve Works

Chainlink Proof of Reserve addresses this challenge head-on by serving as a decentralized bridge between off-chain reserves and on-chain smart contracts. Using a network of independent oracles, PoR automatically verifies that reserves backing tokenized or wrapped assets exist in real-world accounts or vaults – and then publishes this data directly onto the blockchain.

This means any protocol or user can independently check reserve sufficiency at any time. For example, when a stablecoin or an insurance-linked token claims to be fully backed by US dollars or other assets, PoR provides cryptographic evidence to support (or refute) those claims in real time.

The significance for on-chain reinsurance is profound. By integrating PoR into their platforms, protocols like Re enable participants to verify collateralization instantly – ensuring that capital pools used for claims payments are always visible and auditable.

The Re Protocol: Real-World Example at $16.53 LINK

The Re Protocol, a pioneer in blockchain-native reinsurance, recently integrated Chainlink PoR to bring unprecedented transparency to its capital reserves. Here’s how it works: users stake stablecoins into the protocol’s smart contracts; these funds are then allocated to back real-world reinsurance treaties. Thanks to PoR’s automated oracle network, every dollar staked is continuously verified against off-chain bank accounts holding the actual collateral.

This isn’t just theoretical transparency – it’s verifiable 24/7 assurance that all obligations are properly funded. And with Chainlink (LINK) currently priced at $16.53, the cost-efficiency and reliability of these decentralized oracle services have never been more accessible for insurers and investors alike.

If you’re interested in exploring how automated reserve audits can transform your approach to insurance risk transfer, see our detailed guide on how Chainlink Proof of Reserve enables real-time collateral verification in on-chain reinsurance.

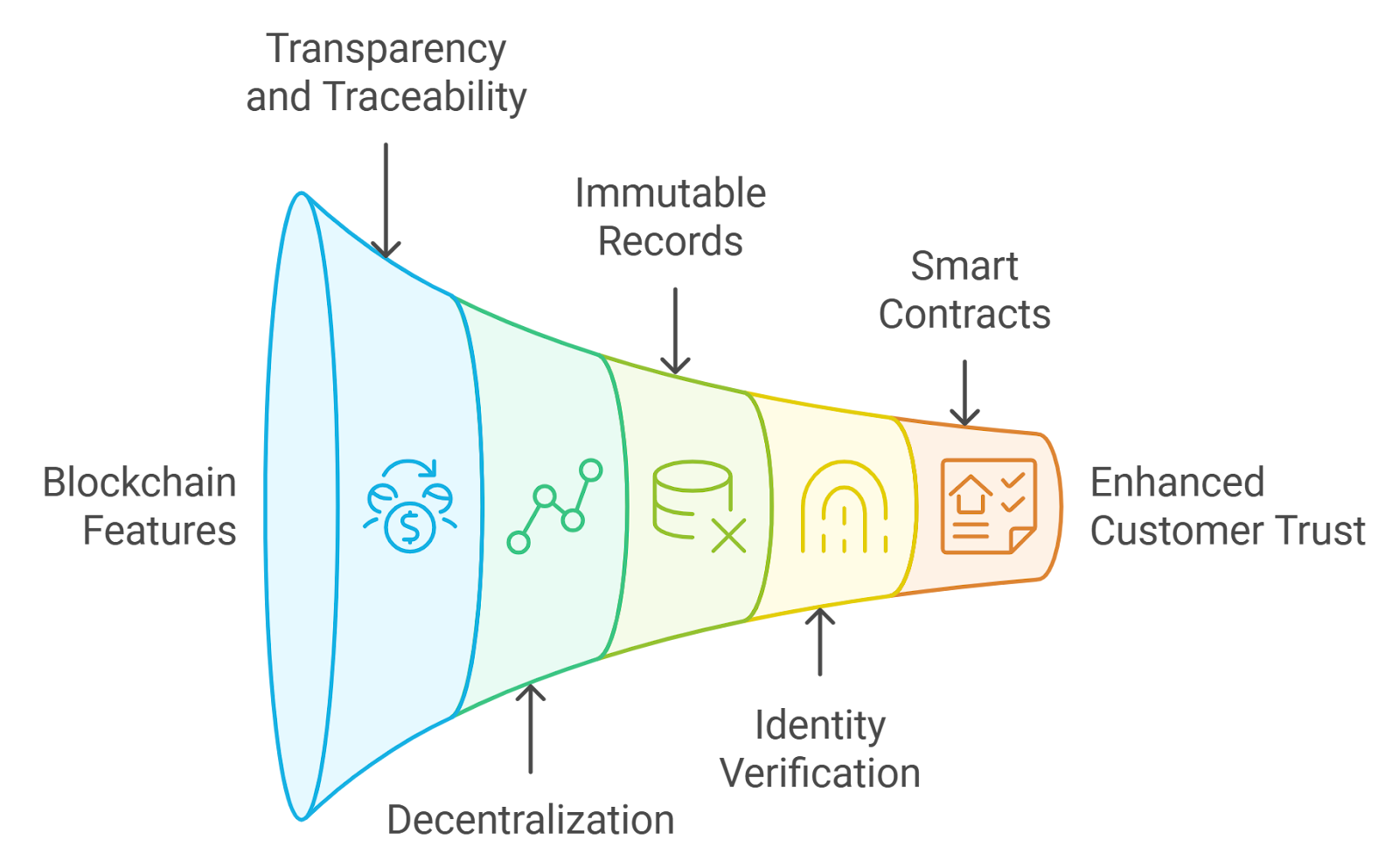

The End of Manual Audits? Automation Meets Trust Minimization

The integration of PoR into reinsurance protocols signals a shift away from trust-based systems toward trust-minimized automation. Instead of relying on quarterly statements or third-party attestations with inherent lag times, stakeholders can now access up-to-the-minute data about collateral status directly from the blockchain itself.

This paradigm shift is especially relevant for institutional investors seeking exposure to insurance risk without the headaches of legacy back-office processes. Real-time, automated collateral verification not only reduces operational costs but also minimizes counterparty risk. By making every dollar visible and auditable at all times, PoR unlocks a new level of confidence for both capital providers and insurers.

Key Benefits of Real-Time On-Chain Collateral Verification

-

Unparalleled Transparency: Real-time on-chain verification—powered by Chainlink Proof of Reserve—ensures that all collateral backing reinsurance agreements is visible and verifiable by anyone, at any time.

-

Automated, Tamper-Proof Audits: Decentralized oracles automate reserve checks, removing manual processes and minimizing human error or manipulation in collateral verification.

-

Enhanced Stakeholder Trust: With every dollar of collateral and premium payment visible on-chain, protocols like Re build confidence among investors, insurers, and reinsurers.

-

Reduced Counterparty Risk: Real-time verification of reserves ensures that reinsurance agreements are always properly collateralized, significantly lowering the risk of defaults.

-

Operational Efficiency: Automated, on-chain verification streamlines compliance and reporting, saving time and resources for reinsurance platforms and their users.

Transparency is more than a buzzword here, it’s a fundamental change in how risk is managed and transferred. For DeFi-native insurance protocols and traditional reinsurers alike, Chainlink Proof of Reserve offers a robust mechanism to demonstrate solvency and build trust with counterparties. This is particularly crucial as the line between on-chain and off-chain assets continues to blur, and as regulators increasingly scrutinize the sufficiency of collateral backing digital financial products.

Step-by-Step: How PoR Powers On-Chain Reinsurance Collateral

To understand how this works in practice, let’s break down the process:

By leveraging these automated steps, protocols like Re can confidently match every staked stablecoin or premium payment to verifiable off-chain reserves, no manual intervention required. This not only streamlines compliance but also sets a new standard for transparency in global risk markets.

What’s Next for Blockchain Reinsurance Transparency?

The adoption of Chainlink PoR by leading protocols signals that on-chain collateral verification is quickly becoming an industry norm rather than an edge case. As the technology matures and more reinsurers embrace blockchain for capital efficiency, we can expect even greater integration between off-chain finance and decentralized infrastructure.

For those looking to stay ahead in this rapidly evolving space, understanding the mechanics, and implications, of real-time insurance oracles like PoR is essential. Whether you’re an insurer seeking capital markets access or an investor searching for transparent yield opportunities, the tools are now available to participate with unprecedented clarity.

If you want a deeper dive into blockchain-native reinsurance models or practical implementation tips, check out our related resource on how on-chain collateral transparency is transforming reinsurance with Chainlink Proof of Reserve.